Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 10, 2021

US Sector PMI shows improvement in consumer confidence

- Consumer Services climb to the top performing sector in May

- Supply constraints limits output for basic material and consumer good sectors

- Broadly positive economic conditions point to further closing in on the removal of accommodative policy

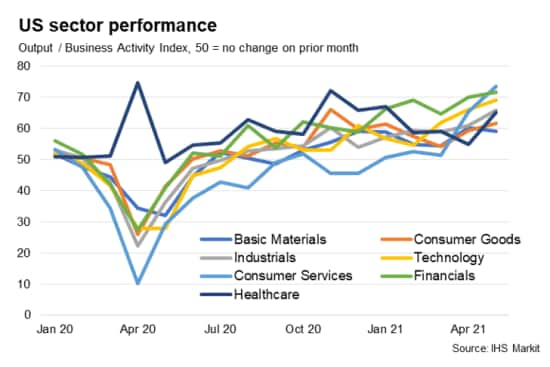

The IHS Markit US Sector PMI™ reflected continued improvement in business activity across all seven broad categories surveyed, in line with the US composite PMI, which signalled record growth in the month.

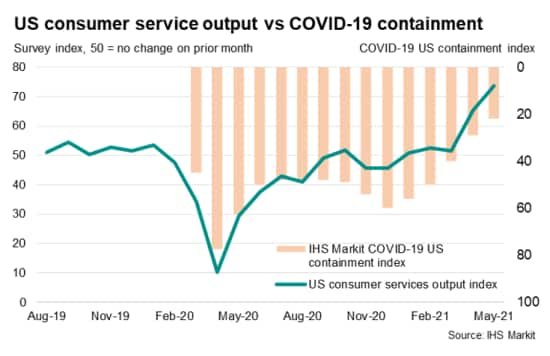

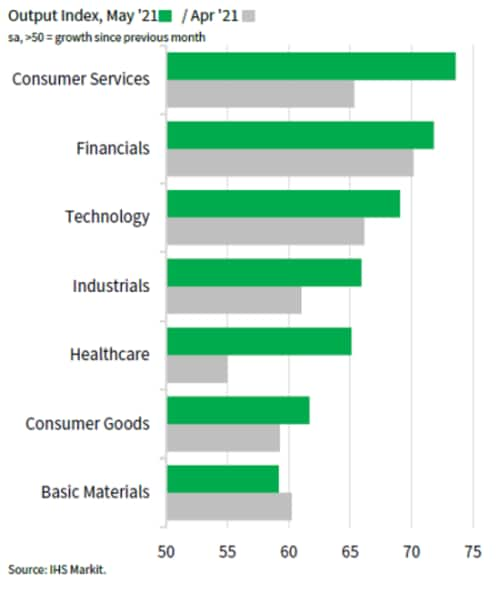

Among the sectors, Consumer Services charged ahead with an output index reading of 73.6 to overtake Financials as the best performer. One would recall that it had only been March when Consumer Services lagged the rest of the categories in terms of the rate of expansion. This was also the first time since September 2019 (pre-COVID), where Consumer Services emerged as the best-performing category to reflect the surge in activity here.

This perhaps comes as no surprise as well given the gradual easing of COVID-19 containment measures as shown by the IHS Markit COVID-19 US containment index. Ongoing vaccination progress in the US is also contributing to the improvement in consumer confidence.

Slower output growth in some sectors attributed to supply chain constraints

On the other end of the spectrum had been Basic Materials and Consumer Goods categories in May. Both of which recorded relatively slower growth in output compared to other monitored sectors.

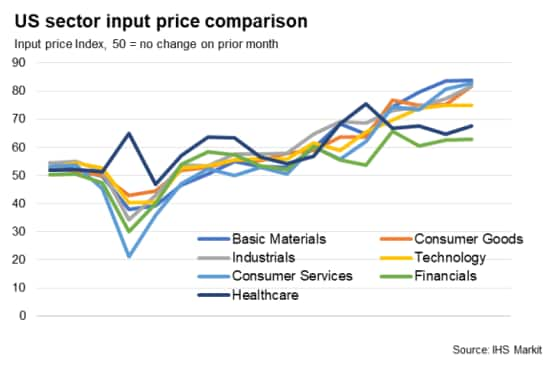

Manufacturers in these categories indicated that supply chain constraints limited production even as demand remained robust, an important point to take note of.

Certainly, comparing input price data across the different segments, one would also find Basic Materials and Consumer Goods among segments facing the steepest price pressures in May, highlighting the demand-supply gap.

While it remains a wait-and-see situation with how long it would take for the bottlenecks to ease for this widespread phenomenon, output growth may well remain limited in the short to medium term. This is not to say that pent-up demand will not keep growth in motion for longer, and firms are generally highly upbeat about future output expectations.

Rising output and input prices point the US economy in the direction of tightening monetary policy conditions

More importantly, the May US Sector PMI continues to point to an improvement in overall business activity and confidence in the US economy. Coupled with the trend of rising price pressures, this does not help with keeping the discussions of Fed tapering at bay, nor risk sentiment from taking off once again.

Reviewing the comments by Fed officials more recently, the tapering of asset purchases has started to look increasingly likely as well. There has also been greater scrutiny of labour market and prices data among market watchers, who are once again adopting a 'when bad news is good news' nature, and sighed with relief when non-farm payroll numbers were positive but below-consensus for May.

The June 15-16 Federal Open Market Committee (FOMC) meeting will be closely followed for hints to any shifting of the stance by the Fed. As far as the PMI survey is concerned, the wheels carting the economy on the road towards further tightening have not stopped turning.

Jingyi Pan, Economics Associate Director, IHS Markit

jingyi.pan@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-shows-improvement-in-consumer-confidence-June21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-shows-improvement-in-consumer-confidence-June21.html&text=US+Sector+PMI+shows+improvement+in+consumer+confidence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-shows-improvement-in-consumer-confidence-June21.html","enabled":true},{"name":"email","url":"?subject=US Sector PMI shows improvement in consumer confidence | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-shows-improvement-in-consumer-confidence-June21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Sector+PMI+shows+improvement+in+consumer+confidence+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sector-pmi-shows-improvement-in-consumer-confidence-June21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}