Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2025

US Manufacturing PMI rises in May, buoyed by unprecedented inventory build-up amid tariff worries

The S&P Global US Manufacturing PMI rose from 50.2 in April to 52.0 in May, its highest since February. However, the survey sub-indices hint that May's improvement was linked to a temporary surge in demand, as manufacturers and their customers sought to accumulate inventory at an unprecedented rate amid signs of growing supply issues and rising prices, often linked to tariffs.

Headline PMI masks underlying weakness in production sub-index

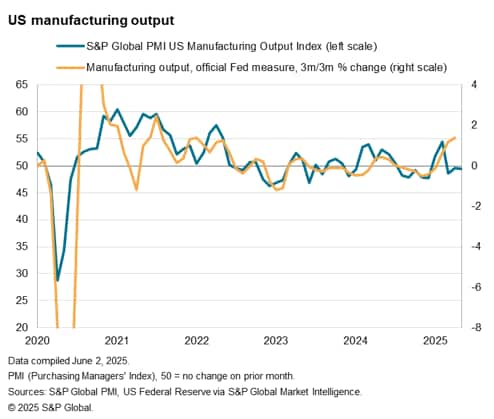

A first hint that the headline PMI's rise to 52.0 in May might mask some underlying problems comes from the Output Index. This measures monthly changes in production volumes at US factories, and signaled a small drop in output for a third successive month, paying back some sizeable gains seen in the opening two months of the year.

Further caution is warranted by factories not showing enthusiasm for taking on more workers. The PMI's Employment Index registered only a marginal rise in payroll numbers in May, and on average has indicated a slight drop in employment over the second quarter so far. However, we recognize that employment is often a lagging indicator.

Price hikes and supply worries become more widespread

There was better news from the New Orders Index, which registered the largest upturn in demand for US goods seen for three months. However, these higher orders were often reported to have been due to customers seeking to buy goods ahead of potential tariff-related price hikes or supply issues, most notably in the consumer goods markets, so this upturn in demand could well prove short-lived.

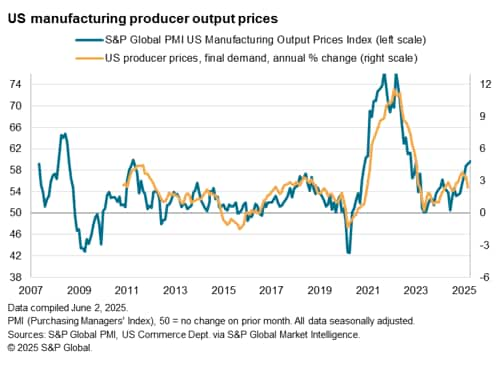

These fears are not without some basis. US manufacturers are already reporting widespread price hikes and supply shortages. Reports of increased prices charged by factories hit the highest since November 2022.

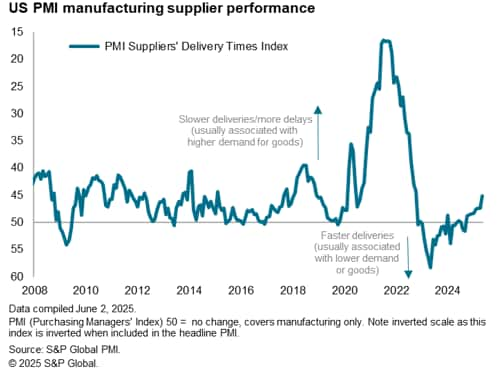

Meanwhile supply delays were the most widespread since October 2022, as recorded by the PMI's Suppliers' Delivery Times Index.

Note that the Suppliers' Delivery Times Index is inverted in the calculation of the PMI, hence our chart uses an inverted X axis. This reflects the belief that more delays (or slower deliveries) are usually considered a positive sign for the health of the manufacturing economy, as more delays usually reflect stronger demand. This is in turn usually met with higher production in the coming months. However, at times of supply shocks, as in the pandemic, longer delivery times are not a positive development, and can therefore bias the PMI into signaling a better performing manufacturing economy than is really the case. It is possible that the current lengthening of delivery times is also not a positive development, as the recent delays have been widely linked either to the temporary front-running of tariffs or simply to a lack of inputs as suppliers halted shipments due to tariffs.

Delays were most widely indicated by smaller producers, who also reported the greater incidence of prices having risen for these inputs.

Unprecedented inventory rise

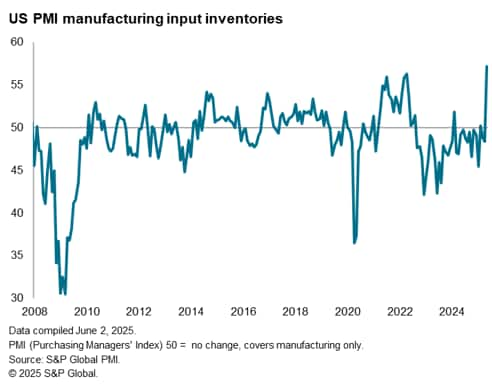

The front-running of tariffs and building of safety stocks to protect against tariff-related supply problems is clearly demonstrated by the PMI Inventory of Purchases Index. This index, which is the fifth component of the headline PMI, surged in May to the highest ever recorded in the S&P Global's 18-year survey history. This signals an unprecedented accumulation of inventory, with the increase most marked in consumer goods producing companies.

A worrying corollary from this rise in inventories is that the survey's orders-to-inventory index, which is widely used as a short-term leading indicator of changes in production, has fallen to one of the lowest levels seen since the global financial crisis. Only the early pandemic months and last September (in the lead up to the Presidential Election) saw lower readings.

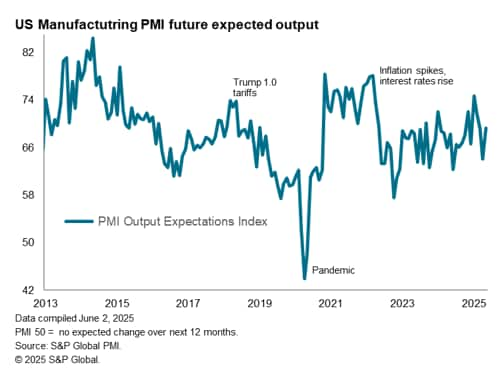

Volatile expectations

There was, however, some brighter news from one of the survey sub-indices which is not included in the headline PMI. The Future Output Index, which monitors factories' expected production volumes in the year ahead, rose sharply in May. This positive development needs to be qualified though by the rise merely taking the index more or less back to where it was in March.

Whereas future optimism had been hit hard in April by the announcement of higher tariffs, May's improvement had been linked to the temporary rowing-back of some of these additional tariffs. With President Trump having merely paused these tariffs, and having announced new 50% tariffs on the European Union to be applied in July, it remains to be seen how confidence will change in the months ahead.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-rises-in-may-buoyed-by-unprecedented-inventory-buildup-tariff-worries-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-rises-in-may-buoyed-by-unprecedented-inventory-buildup-tariff-worries-Jun25.html&text=US+Manufacturing+PMI+rises+in+May%2c+buoyed+by+unprecedented+inventory+build-up+amid+tariff+worries+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-rises-in-may-buoyed-by-unprecedented-inventory-buildup-tariff-worries-Jun25.html","enabled":true},{"name":"email","url":"?subject=US Manufacturing PMI rises in May, buoyed by unprecedented inventory build-up amid tariff worries | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-rises-in-may-buoyed-by-unprecedented-inventory-buildup-tariff-worries-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Manufacturing+PMI+rises+in+May%2c+buoyed+by+unprecedented+inventory+build-up+amid+tariff+worries+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-rises-in-may-buoyed-by-unprecedented-inventory-buildup-tariff-worries-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}