Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 04, 2025

Global Manufacturing PMI declines in May but confidence lifts from April's low

Worldwide manufacturing business conditions deteriorated for a second successive month in May, according to the latest PMI survey data, but with some marked variations in performance. Canada and Mexico reported the steepest output declines amid disruptions caused by US tariffs, with production and exports also falling solidly in mainland China. In contrast, eurozone producers reported a further increase in output.

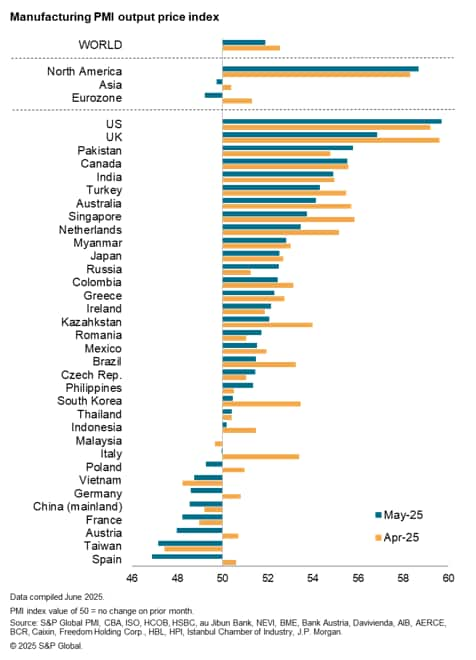

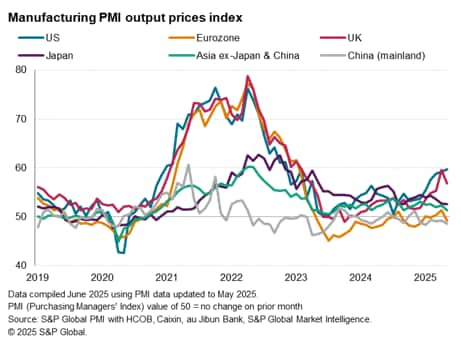

Some of the output gains are likely linked to the US reporting the largest accumulation of inventory recorded by the survey so far, as companies sought to safeguard against mounting tariff-linked supply issues and price hikes. US producers reported the steepest rise in selling prices of all economies surveyed in May, contrasting with prices falling on average in Asia and the eurozone, with US supply delays also running high by international standards.

The extent to which coming months see production and trade volumes suffer amid pay-back from this tariff front-running is a key risk to the near-term outlook. However, it was encouraging to see manufacturers become more upbeat about their year-ahead outlooks in May, with future expectations improving across the board, and most notably in the eurozone, suggesting that business uncertainty and pessimism - while still elevated - may have peaked back in April.

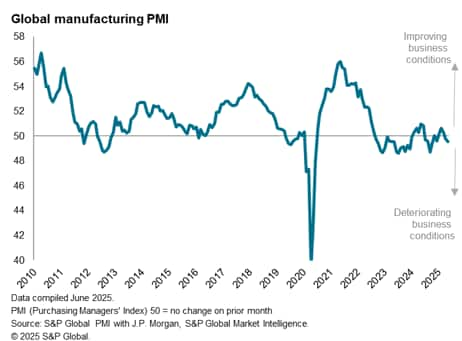

PMI dips further into contraction territory

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, fell from 49.8 in April to 49.6 in May, dropping further below the 50 'no change' level to indicate a worsening of overall business conditions for a second successive month. Although the overall rate of deterioration remained only very modest, there were marked variations in performance amongst the major economies, notably in relation to the impact of tariffs.

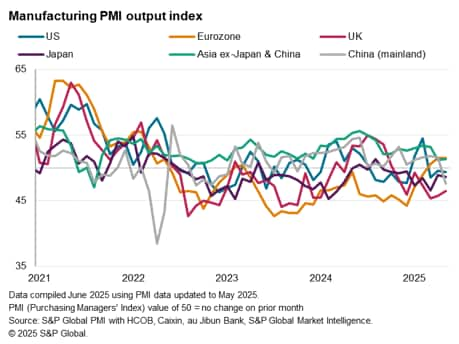

Global output fall led by Mexico and Canada, plus renewed decline in mainland China

The PMI's Output Index, which measures monthly changes in factory production volumes, signaled the first decline recorded since December. The rate of reduction was the joint-fastest in 19 months, after having expanded at the quickest pace for eight months in February.

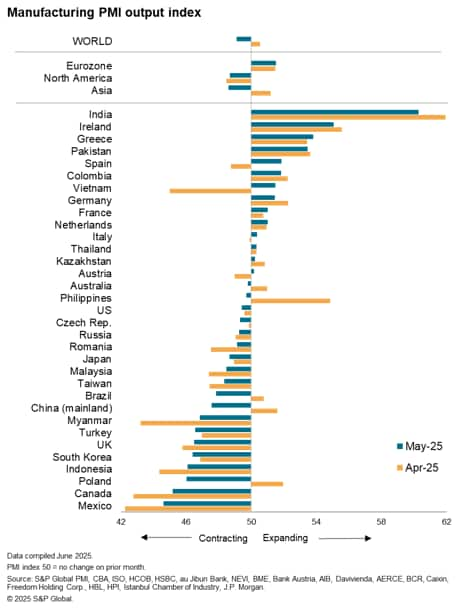

Only 14 of the 33 economies tracked by S&P Global's manufacturing PMI surveys reported higher production in May, with India continuing to report by far the strongest performance. However, an improved eurozone performance over the past two months, in which output has grown at a rate not seen for three years, has been an important development. Within the eurozone, robust increases were seen in Ireland, Greece and Spain, accompanied by smaller but still noteworthy gains in Germany, France and the Netherlands. In total, eurozone member states accounted for seven of the top 11 economies as far as production growth was concerned in May.

At the other end of the scale, the steepest declines were reported in Mexico and Canada, despite rates of contraction moderating compared to April in both cases, reflecting widespread reports of the ongoing impact of US tariffs. A further small drop in US production rounded off a month in which production fell across North America as a whole for a third straight month.

Output also fell across Asia as a whole, dropping for the first time in just over one-and-a-half years. The fall was also the steepest since November 2022. A key driver of the renewed Asian decline was a marked drop in production in mainland China, where output fell for the first time since October 2023, and at the sharpest rate since November 2022, in a sign of an intensifying impact from US tariffs (exports also fell sharply). Marked output falls were also reported in Indonesia, South Korea, Taiwan, Malaysia and Japan.

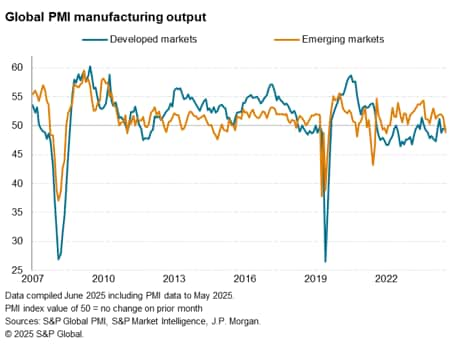

As a result, emerging markets collectively reported the first fall in manufacturing output since November 2022, the rate of decline slightly exceeding that seen in the developed markets, where a modest drop in production was reported for a third successive month.

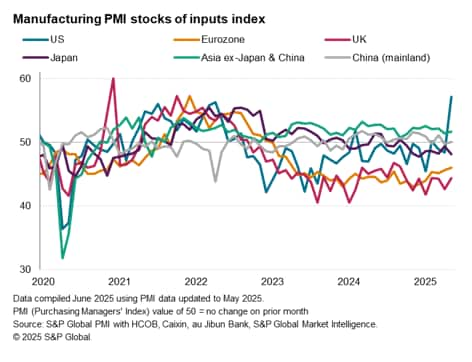

US reports unprecedented inventory surge

A further sign of the impact of tariffs was evident in terms of inventories. US factories reported the largest accumulation of stocks of inputs ever recorded in over 18 years of comparable US survey data history. That contrasted with falling inventories in Japan and Europe and largely unchanged stock holdings in mainland China. The rise in US inventories was largely attributed by survey respondents to the need to safeguard against potential tariff-related supply shortages or to beat tariff-related price hikes.

This inventory accumulation raises some concerns that at least some of the recent output and export growth, notably in economies which are poised to face potentially higher US tariff rates, may be temporary, reflecting the front-running of these tariffs.

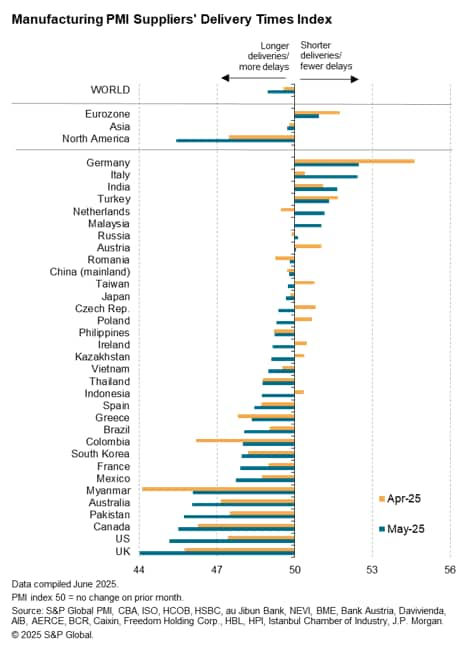

US and UK report highest incidences of supply delays

Concerns over shortages of inputs in the US were fueled in part by reports of supply delays hitting the highest since late-2022, with the incidence of supply issues in the US surpassed only by that seen in the UK.

US sees steepest price pressures

With supply constraints commonly cited as a key driver of higher prices, it's not surprising that - as well as seeing the highest incidence of supply chain delays - the US and UK also reported the sharpest price increases. However, while the rate of selling price inflation abated in the UK (in part linked to April having also seen the introduction of higher payroll costs), prices in the US were raised to the greatest extent since November 2022. As with the supply shortages reported in the US, the price hikes were overwhelmingly attributed to tariffs. In contrast, prices charged by factories fell on average across Asia and the eurozone.

Manufacturing confidence regains some lost ground, led by the eurozone

Having slumped in April to its lowest since October 2022, confidence among manufacturers worldwide about production in the year ahead rose in May. However, confidence remained lower than seen in March and lower than the average recorded over 2024, to hint at still-subdued sentiment. Rebased in order to compare the current level against its long-run average, global sentiment also remains below par.

Looking regionally, manufacturing confidence is the most optimistic relative to its long-run average in the eurozone, having improved to its highest since February 2022. However, US confidence also resurfaced above its long-run average in May and confidence also regained some poise in Japan, the UK, mainland China and the rest of Asia as a whole, albeit in all cases remaining below long-run averages.

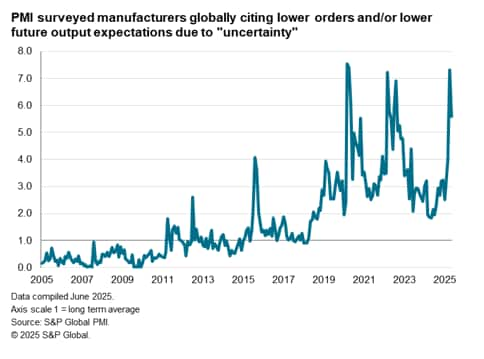

The broad-based uplift in sentiment hints that manufacturers are expecting the worst to now be behind them, a view which is given further credence by reports of uncertainty having adversely affected business. Having risen in April to reach a level close to the all-time high recorded in the initial stage of the COVID-19 pandemic in 2020, reports of "uncertainty" fell in May. That said, uncertainty clearly remained elevated by historical standards, running at over five-and-a-half times the long-run average, underscoring how factories worldwide remain highly unsettled by the changing tariff environment.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-declines-in-may-but-confidence-lifts-from-aprils-low-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-declines-in-may-but-confidence-lifts-from-aprils-low-Jun25.html&text=Global+Manufacturing+PMI+declines+in+May+but+confidence+lifts+from+April%27s+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-declines-in-may-but-confidence-lifts-from-aprils-low-Jun25.html","enabled":true},{"name":"email","url":"?subject=Global Manufacturing PMI declines in May but confidence lifts from April's low | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-declines-in-may-but-confidence-lifts-from-aprils-low-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+Manufacturing+PMI+declines+in+May+but+confidence+lifts+from+April%27s+low+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-declines-in-may-but-confidence-lifts-from-aprils-low-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}