Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2025

US manufacturing PMI: five key takeaways as production growth slows amid tariff disruptions

US manufacturing rose for a fourth successive month in September, but the upturn lost momentum as companies reported a drop in order book growth alongside a buildup of unsold finished goods inventories.

Despite a slowing in demand, many factories have elected to produce more goods in order to use up raw materials that had been stockpiled ahead of tariff implementation. This poses a downside risk to future production in the absence of a pickup in demand, though also hints at some alleviation of price pressures: there is already evidence of companies offering excess stock to customers at reduced rates.

A growing uncertainty, however, relates to supply chains, with September seeing an increase in tariff-related supplier delays, which threaten to curb production and push up prices if these delays persist or intensify.

We examine these developments through five key charts.

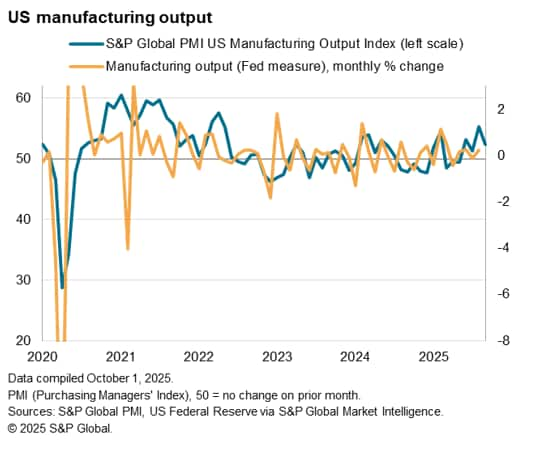

1. Production rises for fourth month, but at a reduced rate of growth

The September PMI survey showed manufacturing output rising for a fourth successive month, following declines in the three months to May, albeit with the rate of expansion slowing from August's 39-month high.

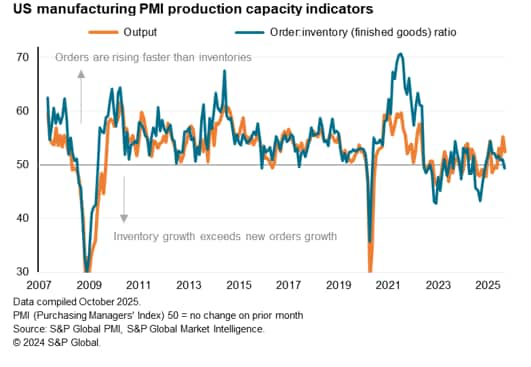

2. Orders-to-inventory ratio at ten-month low

Whether further production gains can be sustained is uncertain. New orders growth slowed, linked partly to falling exports, while backlogs of work dropped in September at the sharpest rate since April.

This weakening order book situation hints at production slowing in October unless demand growth revives. The forward-looking orders-to-inventory ratio has fallen to its lowest since last November, down to a level indicative of falling output.

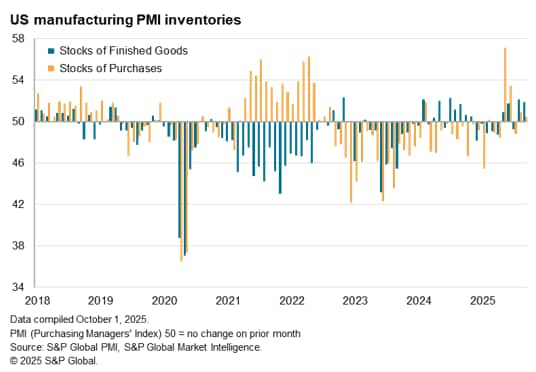

3. Finished goods stock accumulates as companies use up raw material stockpiles

Importantly, the orders-to-inventory ratio has fallen not just because new orders growth has weakened, but also because of higher inventory levels. September saw inventories of finished goods rise sharply by historical standards for a second month, in part reflecting the need to use up raw material stock holdings. Raw material inventories had jumped to the greatest extent recorded in the survey's 18-year history back in May, with a further marked rise in June and subsequent smaller rises, as companies stepped up their purchases of imported inputs ahead of tariff-related price rises. The combined rise in finished goods stock in August and September has consequently been the joint-highest in the survey history.

While some of these finished goods inventories are awaiting shipment to customers, just over three quarters of those reporting higher inventory levels indicated that these goods were unsold. This suggest that, absent a rise in demand, lower production will be likely in coming months to prevent a further build up on unwanted stock. However, such high inventory levels also tend to be associated with price discounting.

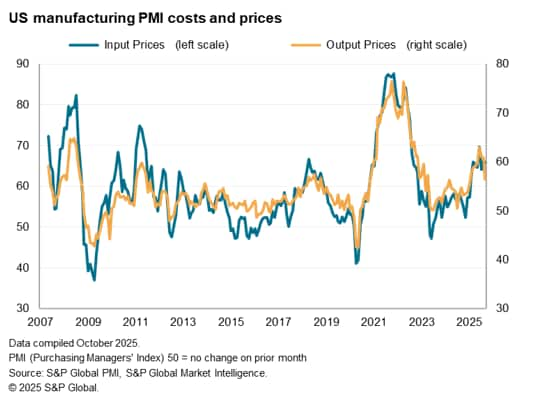

4. Price inflation cools, but tariff impact remains uncertain

Inflation signals were mixed. While tariffs were widely blamed on a further steep increase in costs, as input prices rose sharply again in September, with an especially elevated rate having been signalled throughout much of the year to date. That said, the latest rise was the weakest recorded since February.

Similarly, average selling price inflation for goods leaving the factory gate remained historically elevated, though cooled sharply to its lowest since January, in part reflecting price discounting to move stock in the face of either stiff competition or weak demand.

As such, the data suggest that some of the early tariff price impact has started to moderate, in part as producers offer discounts. However, it is widely anticipated that further tariff levies implemented in August which could lead to a further kick-up in the PMI price indices in coming months: note that all goods sent prior to the enactment of new tariffs on August 7 that arrive to the US prior to October 5 will be allowed to enter under the former tariff rate. (S&P customers can read more about US tariffs here.)

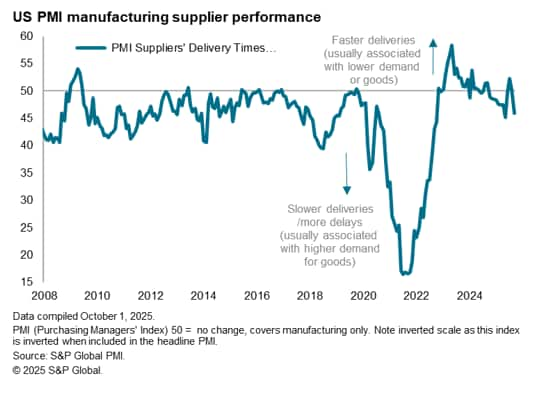

5. Supply chain delays on the rise again

A further consequence of the tariffs to note is the effect on supply chains. Although well down on the levels seen in the pandemic, the incidence of supply chain delays in September hit the highest since October 2022 barring only the recent spike in May following the April tariff announcements. As seen in May, the latest rise in supply delays was widely linked to disruptions to imports arising from tariffs.

Supply chain delays are a cause of concern for two reasons: first, supply shortages can disruption production; second, shortages can lead to higher prices, irrespective of tariff rates, as demand exceeds supply, which may offset some of the cooling pressure on prices noted in the September survey.

Access the latest press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-Sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-Sep25.html&text=US+manufacturing+PMI%3a+five+key+takeaways+as+production+growth+slows+amid+tariff+disruptions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-Sep25.html","enabled":true},{"name":"email","url":"?subject=US manufacturing PMI: five key takeaways as production growth slows amid tariff disruptions | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-Sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+manufacturing+PMI%3a+five+key+takeaways+as+production+growth+slows+amid+tariff+disruptions+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-manufacturing-pmi-five-key-takeaways-as-production-growth-slows-amid-tariff-disruptions-Sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}