Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2025

Global manufacturing PMI signals slower global factory expansion in September

Worldwide manufacturing business conditions improved in September, though upturns in new orders and production were insufficient to encourage a net increase in staffing levels. Sluggish demand was also linked to increased price discounting.

However, trends varied around the world, ranging from strong expansions in India, Thailand and some eurozone economies to especially sharp downturns in Taiwan, Russia, Brazil and the UK.

At least some of the variations in recent performances can be linked to US tariffs, which have likely buoyed US production and exports to the US temporarily. We anticipate some payback from these gains as we head towards the end of the year.

PMI in growth territory but employment edges lower

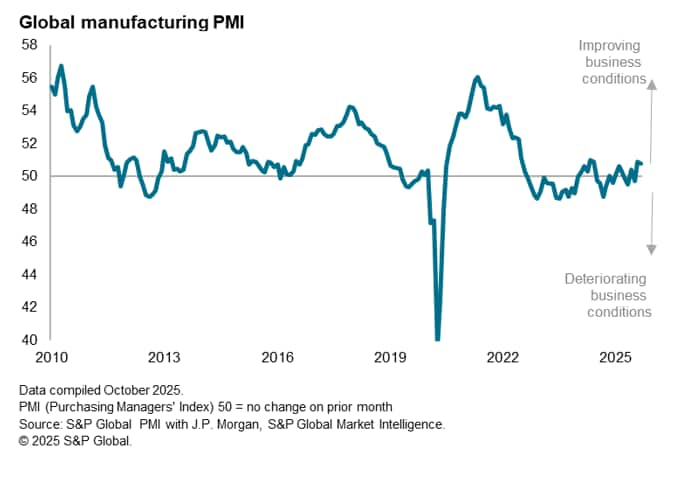

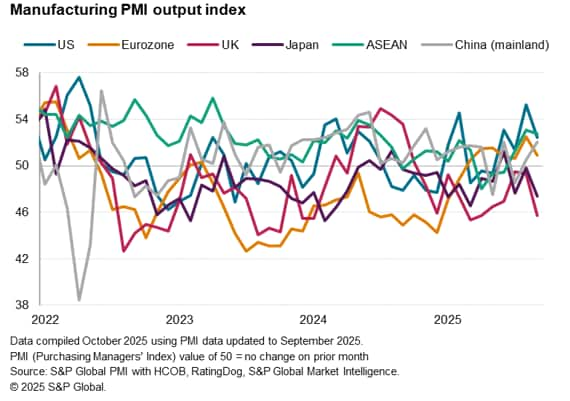

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, registered 50.8 in September from 50.9 in August. Although dipping slightly at the end of the third quarter, the past two months have seen the highest back-to-back PMI readings since June 2024 to indicate one of the best spells for the sector since the pandemic.

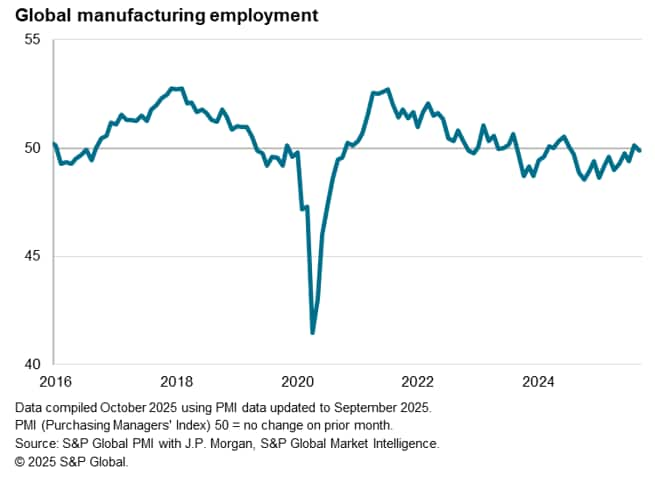

Global production rose for the third time in the past four months, buoyed by a further modest increase in new orders. However, the overall pace of production growth remains relatively lacklustre, and the upturn in demand was insufficient to drive global factory staffing levels higher. Employment consequently dropped marginally in September amid a further fall in global backlogs of work, the latter having now fallen for 39 successive months to indicate the persistence of excess capacity relative to demand.

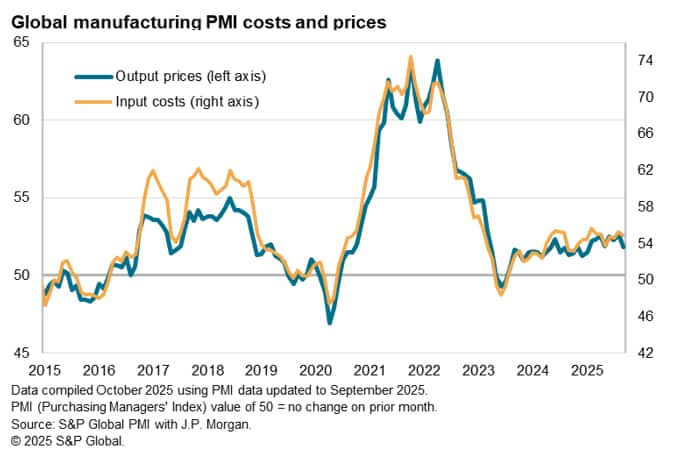

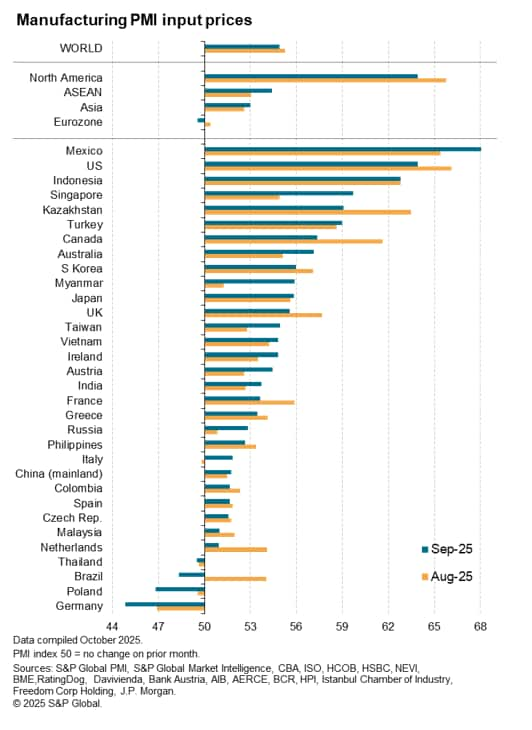

Price pressures meanwhile moderated globally as more discounting was evident. Average prices charged for goods at the factory gate rose globally at the slowest rate since January.

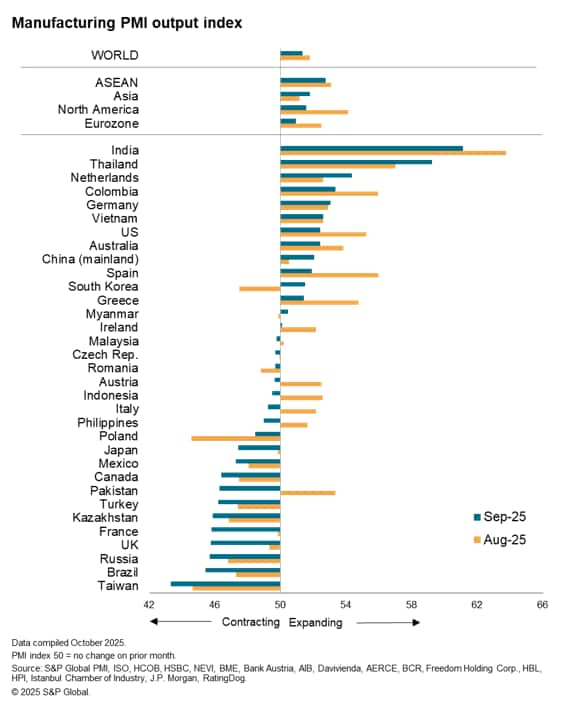

Trends were, however, mixed around the world, led by variations in production. Of the 33 countries for which PMI data are available, output rose in only 14 but fell in the remaining 19.

India and ASEAN lead global upturn

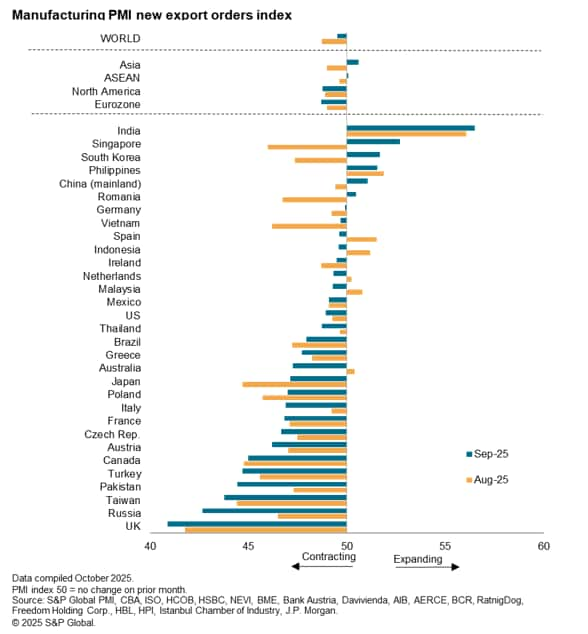

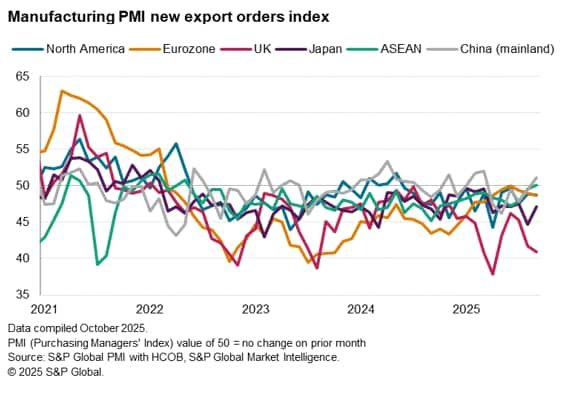

Global factory growth continued to be led by India, but an especially solid production gain was seen in Thailand, where output showed its largest monthly increase since May 2023. Alongside a further robust increase in Vietnam, Thailand's performance helped drive another strong overall ASEAN output rise, a region which in recent months has reported its best output growth since early 2024. ASEAN goods exports rose, albeit only marginally, for the first time since May 2022.

Varied European performance

The Netherlands and Germany also reported notably strong gains, with growth hitting 16- and 42-month highs respectively to help lift overall eurozone factory output for a seventh successive month. However, reduced output gains in Spain and Ireland, alongside falling output in France, and to a lesser extent Italy, meant overall eurozone output growth weakened to remain stubbornly modest.

That said, although sluggish, the upturn reported across the eurozone contrasted with a steep fall in output in the UK, where factory production fell for an eleventh successive month, and at the sharpest pace in six months. The UK also reported the steepest drop in goods exports of all countries tracked by the PMI in September. However, the UK's accelerated decline was in part caused by auto production and related supply chains being disrupted by a cyber-attack.

Taiwan reports sharpest output fall

Even with a major tranche of UK's output being disrupted by cyber attacks, Russia, Brazil and Taiwan all reported even sharper production falls than the UK in September. Recent months have seen output fall in Tawain and Brazil at some of the sharpest rates seen over the past two years, while Russia's decline in recent months has been the strongest for over three years.

Production trends also deteriorated across North America in September, with US output rising at a reduced rate alongside accelerating rates of decline in both Canada and Mexico.

Trends diverge in Japan and mainland China

Production in mainland China meanwhile rose at its fastest rate since June, notching up the second-best performance recorded over the year to date thanks to a return to growth for exports. In contrast, Japan's exports fell, dragging output down for a third straight month and at a steeper rate than August.

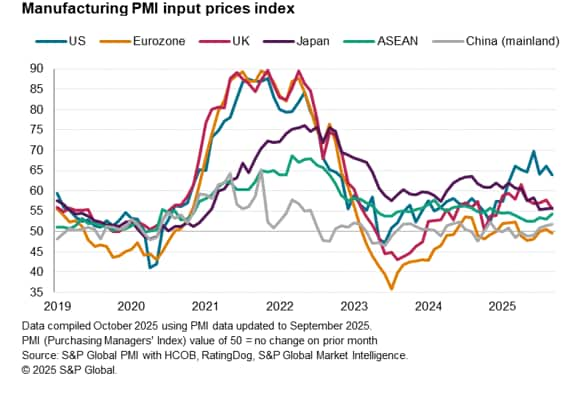

North American input price surge continues

However, perhaps the most striking divergences were seen in terms of prices. Looking at average input prices paid by manufacturers, Mexico displaced the US at the top of the price rankings, but the US still recorded one of the sharpest rises seen over the past three years, widely blamed on tariffs. By contrast, input costs fell in the eurozone, led by a steep fall in Germany, amid greater discounting. Reduced price pressures were also reported in the UK. While increased rates of cost growth were generally recorded across Asia, rates of inflation remained subdued on average.

Tariff impact

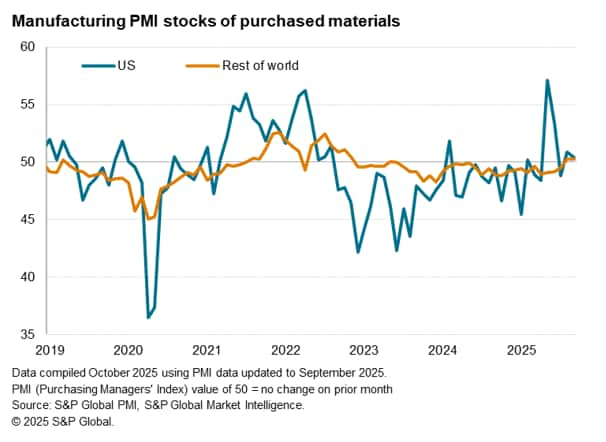

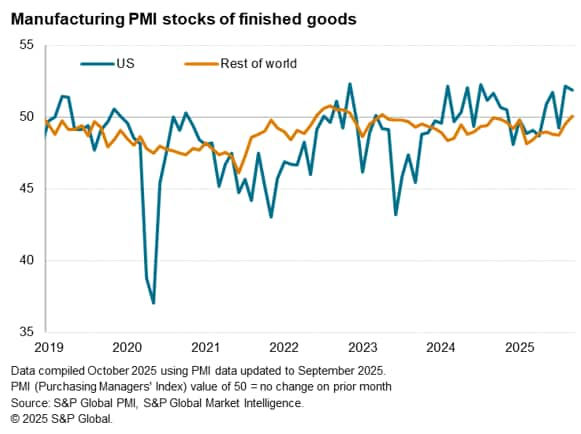

One unknown is the full extent to which tariffs have affected production and exports around the world in recent months. However, it is likely that the announcement of US tariffs back in April has led to a rise in global production and shipments as US importers and global exporters seek to front-run the levies. This boosted US input (and import) buying in the second quarter, which in turn fueled higher US production in the third quarter. It is therefore likely that we will see some pay-back from this tariff-related expansion in the months ahead, cooling US production and dampening exports to the US from European and Asian economies.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-signals-slower-global-factory-expansion-in-september-Oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-signals-slower-global-factory-expansion-in-september-Oct25.html&text=Global+manufacturing+PMI+signals+slower+global+factory+expansion+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-signals-slower-global-factory-expansion-in-september-Oct25.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI signals slower global factory expansion in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-signals-slower-global-factory-expansion-in-september-Oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+signals+slower+global+factory+expansion+in+September+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-pmi-signals-slower-global-factory-expansion-in-september-Oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}