Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 03, 2025

Week Ahead Economic Preview: Week of 6 October 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The outlook for US interest rates comes under the radar with the publication of the minutes from the last FOMC meeting and a speech by Jerome Powell. UK and eurozone economic prospects will also be eyed via jobs data and retail sales, and a new head at New Zealand's central bank takes the helm amid growing concerns over the economy.

Policymakers' views on the health of the US economy and the inflation outlook will come under increased scrutiny as the coming week not only brings the minutes from the last FOMC meeting but also a speech by Fed Chair Jerome Powell.

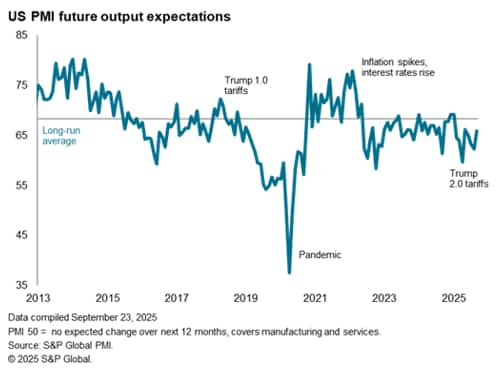

The FOMC cut the fed funds rate for the first time this year at its September meeting, but policymakers are clearly split on the rates path going forward. While nine policymakers pencilled in two more rate cuts in 2025 in the so-called 'dot plot' projections, one (new voter Stephen Miran) sees even more cuts, two see just one cut and seven see either no rate cuts or even higher rates. The central bank is juggling a weakening jobs market against the possibility of sticky tariff-related inflation. Powell himself has warned against counting on more rate cuts in the coming months. As far as data goes, trade, inventories and consumer confidence data will be adding to the picture of an economy which appears to be showing resilience but with caution dominating the outlook, and dampening jobs growth amid policy uncertainty.

In Europe, construction PMIs for the UK and Eurozone are accompanied by Halifax house price data and recruitment industry survey in the former, while the eurozone also sees retail sales and German trade data published. The UK government will be eager to see some better economic news, especially on the labour market, after early PMI data showed the economy losing momentum amid further steep job losses. Eurozone policymakers will meanwhile be hoping for further signs of domestic demand reviving, notably via the retail sales data, to confirm the tentative indications of economic recovery seen in the PMI data.

In APAC, central bank decisions are due in New Zealand, Thailand and the Philippines. The former is especially interesting as the Reserve Bank of New Zealand has a new head, Anna Breman, who takes the helm as the country faces a double-dip recession risk after GDP fell on a year ago in the second quarter. The central bank cut rates to 3.0% at its last meeting.

Key diary events

Monday 6 Oct

Americas

- Mexico Consumer Confidence (Sep)

- Brazil Balance of Trade (Sep)

EMEA

- Switzerland Unemployment Rate (Sep)

- Eurozone, France, Germany, Italy HCOB Construction PMI* (Sep)

- UK S&P Global Construction PMI* (Sep)

- Eurozone Retail Sales (Aug)

APAC

China (Mainland), South Korea, Taiwan Market Holiday

- Hong Kong SAR S&P Global PMI* (Sep)

- Thailand Inflation (Sep)

- India HSBC Services PMI* (Sep)

Tuesday 7 Oct

Americas

- Canada Trade (Aug)

- US Trade (Aug)

EMEA

- Germany Factory Orders (Aug)

- UK Halifax House Price Index* (Sep)

- France Trade (Aug)

APAC

China (Mainland), Hong Kong SAR, South Korea Market Holiday

- Japan Household Spending (Aug)

- Philippines Inflation (Sep)

Wedneday 8 Oct

Americas

- US EIA Crude Oil Stock Change

- US Fed FOMC Minutes (Sep)

EMEA

- Germany Industrial Production (Aug)

- Sweden Inflation (Sep, prelim)

APAC

China (Mainland), South Korea Market Holiday

- Japan Current Account (Aug)

- Philippines Unemployment Rate (Aug)

- New Zealand RBNZ Interest Rate Decision

- Thailand BoT Interest Rate Decision

- Taiwan Inflation (Sep)

Thursday 9 Oct

Americas

- Brazil Inflation (Sep)

- Mexico Inflation (Sep)

- US Fed Powell Speech

- US initial Jobless Claims

- US Wholesale Inventories (Aug)

EMEA

- UK RICS House Price Balance (Sep)

- Germany Trade (Aug)

- Türkiye Industrial Production (Aug)

APAC

South Korea Market Holiday

- Philippines BSP Interest Rate Decision

- Taiwan Trade (Sep)

Friday 10 Oct

Global GEP Supply Chain Volatility Index* (Sep)

Americas

- Mexico Industrial Production (Aug)

- Canada Unemployment Rate and Employment Change (Sep)

- US University of Michigan Consumer Sentiment (Oct, prelim)

EMEA

- UK & English Regions KPMG/REC Report on Jobs* (Sep)

- Norway Inflation (Sep)

- Sweden GDP (Aug)

- Switzerland Consumer Confidence (Sep)

- Italy Industrial Production (Aug)

APAC

Taiwan Market Holiday

- Malaysia Industrial Production (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-october-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-october-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+6+October+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-october-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 6 October 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-october-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+6+October+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-6-october-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}