Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 26, 2025

Week Ahead Economic Preview: Week of 29 September 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Payrolls and PMIs to provide new policy path clues

US nonfarm payrolls provide the crescendo to a busy week for economy watchers which includes worldwide manufacturing PMI surveys, flash eurozone inflation numbers and monetary policy decisions in India and Australia.

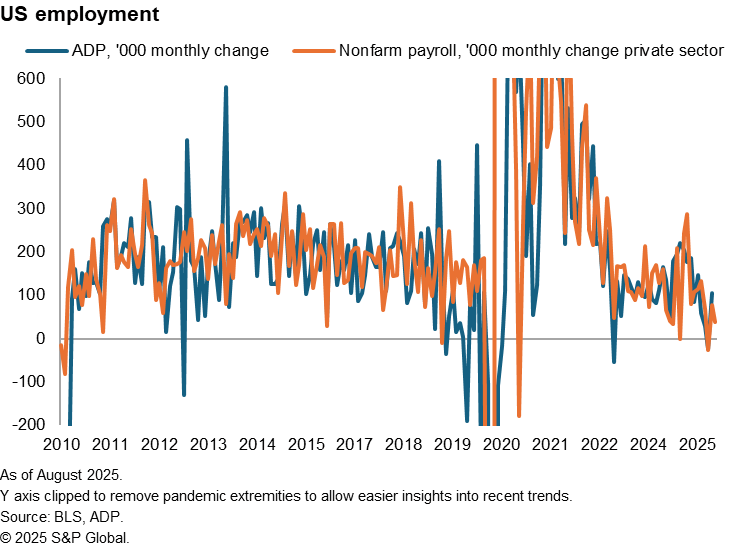

The monthly US employment report will provide guidance on the likelihood of further rate cuts this year. The Fed not only cut interest rates for the first time this year at its September FOMC meeting, but also revealed a general expectation among policymakers that rates could be cut another two times this year. However, officials including Fed Chair Powell have since sought to stress that the path to lower rates is by no means certain. Further signs of a weakening jobs market will therefore be important in maintaining a dovish stance. Markets are expecting just 39,000 jobs to have been added in September after the 22,000 gain reported in August. Such low numbers are thought to be consistent with rising unemployment, though there's an expectation among analysts that the jobless rate will hold at 4.3% for now. The payroll report will be preceded by job openings (JOLTS) data, jobless claims and the ADP private sector job count to give some additional clues as to the labour market's health.

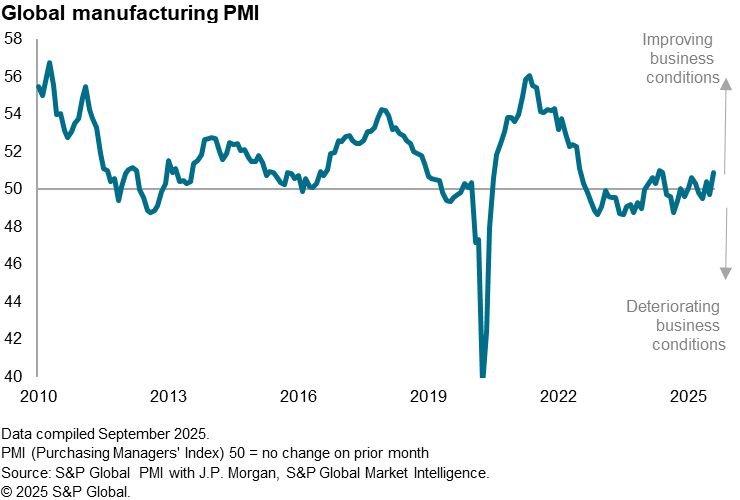

Insights into the global manufacturing economy's health will meanwhile be provided by the worldwide PMI surveys. After August's global PMI had hit a 14-month high, more recent flash PMI data have hinted at this performance losing steam as the boost to production and trade from the front-running of US tariffs fades. Besides these broader growth trends, developments on US factory prices will be key data to watch: September's flash PMI numbers showed US input cost inflation remaining elevated due to tariffs, but selling price inflation moderated in one of the first signs from the survey that producers were struggling to pass these higher costs on to customers.

In Europe, the PMIs will be assessed alongside flash eurozone CPI inflation numbers for September, but both are likely to suggest inflation is still running at or close to the ECB's 2% target. Also look out for eurozone unemployment data and UK mortgage approvals.

In APAC, central bank decisions in India and Australia are expected to see rates held steady as the former eyes faster than expected economic growth and the latter weighs up hotter than anticipated inflation.

Key diary events

Monday 29 Sep

Americas

- Mexico Unemployment Rate (Aug)

- US Pending Home Sales (Aug)

- US Dallas Fed Manufacturing Index (Sep)

EMEA

- Spain Inflation (Sep, prelim)

- UK Mortgage Lending and Approvals (Aug)

- Eurozone Economic Sentiment (Sep)

- Spain Business Confidence (Sep)

APAC

- Taiwan Consumer Confidence (Sep)

- Pakistan GDP (Q2)

- India Industrial Production (Aug)

Tuesday 30 Sep

Americas

- Brazil Unemployment Rate (Aug)

- US S&P/Case-Shiller Home Price (Jul)

- US JOLTS Job Openings (Aug)

- US CB Consumer Confidence (Sep)

EMEA

- Germany Retail Sales (Aug)

- UK Current Account (Q2)

- France, Italy, Germany Inflation (Sep, prelim)

- Germany Unemployment (Sep)

APAC

- South Korea Industrial Production (Aug)

- Japan BoJ Summary of Opinions (Sep)

- Japan Industrial Production and Retail Sales (Aug)

- China (Mainland) NBS PMI (Sep)

- China (Mainland) RatingDog PMI* (Sep)

- Australia RBA Interest Rate Decision

Wednesday 1 Oct

Worldwide Manufacturing PMIs, incl. global PMI* (Sep)

Americas

- US ADP Employment Change (Sep)

- US ISM Manufacturing PMI (Sep)

EMEA

- UK Nationwide Housing Prices (Sep)

- Eurozone Inflation (Sep, flash)

APAC

China (Mainland), Hong Kong SAR Market Holiday

- Japan Tankan Index (Sep)

- South Korea Trade (Sep)

- Indonesia Inflation (Sep)

- India RBI Interest Rate Decision

Thursday 2 Oct

Americas

- US Initial Jobless Claims

- US Factory Orders (Aug)

EMEA

- Switzerland Inflation (Sep)

- Spain Unemployment Rate (Sep)

- Italy Unemployment Rate (Aug)

- Eurozone Unemployment Rate (Aug)

APAC

China (Mainland), India Market Holiday

- South Korea Inflation (Sep)

- Australia Trade (Aug)

- Japan Consumer Confidence (Sep)

Friday 3 Oct

Worldwide Services, Composite PMIs, inc. global PMI* (Sep)

Global Sector PMI* (Sep)

Americas

- Brazil Industrial Production (Aug)

- US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings

(Sep)

- US ISM Services PMI (Sep)

EMEA

- France Industrial Production (Aug)

- Turkey Inflation (Sep)

- Italy Retail Sales (Aug)

APAC

China (Mainland), South Korea Market Holiday

- Japan Unemployment Rate (Aug)

- Singapore Retail Sales (Aug)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-september-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-september-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+29+September+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-september-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 29 September 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-september-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+29+September+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-29-september-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}