Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2025

UK flash PMI points to sharp growth slowdown amid ongoing job cuts in September

September's flash UK PMI survey brought a litany of worrying news including weakening growth, slumping overseas trade, worsening business confidence and further steep job losses.

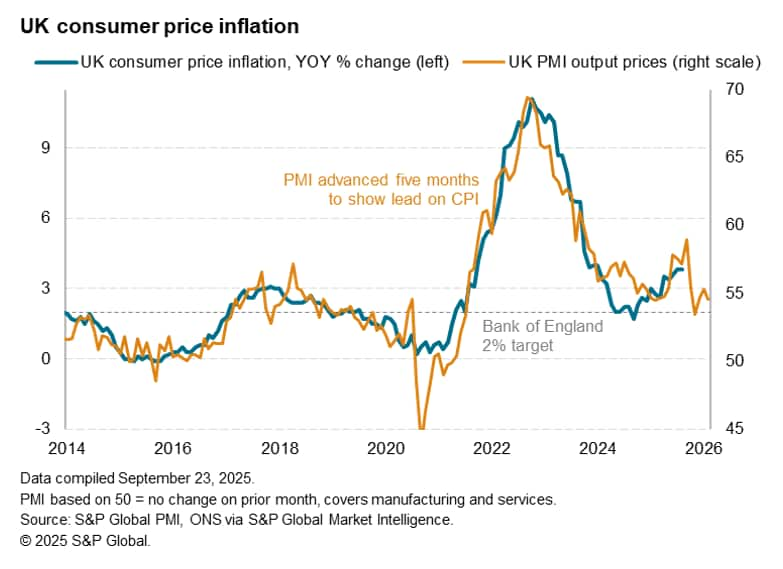

The only good news is perhaps that, just as the Bank of England grows increasingly worried about persistently elevated inflation, the PMI indicated that price pressures have moderated in September. Companies reported one of the smallest increases in prices charged for goods and services seen since the pandemic.

With the weakening of business activity growth to a rate consistent with the economy almost stalling, and around 50,000 job losses being signalled by the PMI again in the three months to September, alarm bells should be ringing that the economy is faltering, which could help shift the policy debate at the Bank of England back towards a more dovish stance.

However, amid talk of further tax rises being needed in the Budget later this year, it's not surprising to see that business expectations have worsened again in September, and in the absence of an improvement in confidence, it's unlikely that the economy will make any strong gains in the months ahead irrespective of the outlook for interest rates.

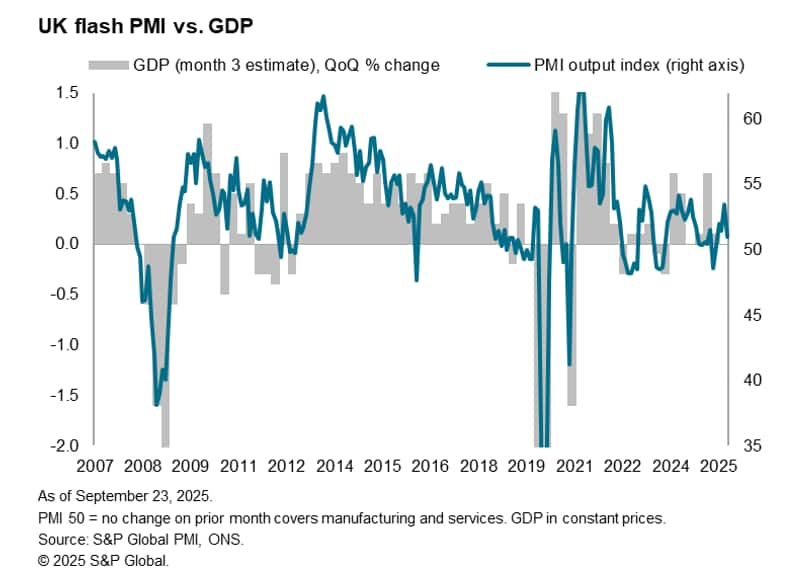

Business growth slows amid deepening factory decline

UK business activity slowed sharply in September. At 51.0, a four-month low and down from 53.5 in August, the September flash PMI headline composite output index signalled a marked step-down in the pace of economic growth at the end of the third quarter. The PMI is broadly consistent with GDP almost stalling in September, but quarterly growth of almost 0.2% is indicated for the third quarter as a whole.

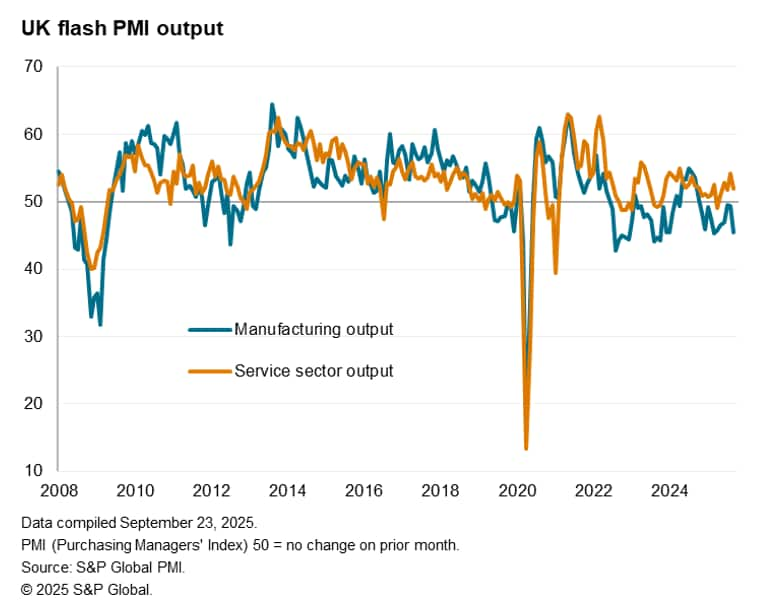

As has been the case over the past year, growth was again led by the service sector in September, though its rate of expansion slowed from August's 16-month high. Manufacturing meanwhile acted as an increased drag on the economy, with output falling at the steepest rate since March, suffering one of the sharpest declines seen over the past year and a half.

Growth dependency on financial services and IT

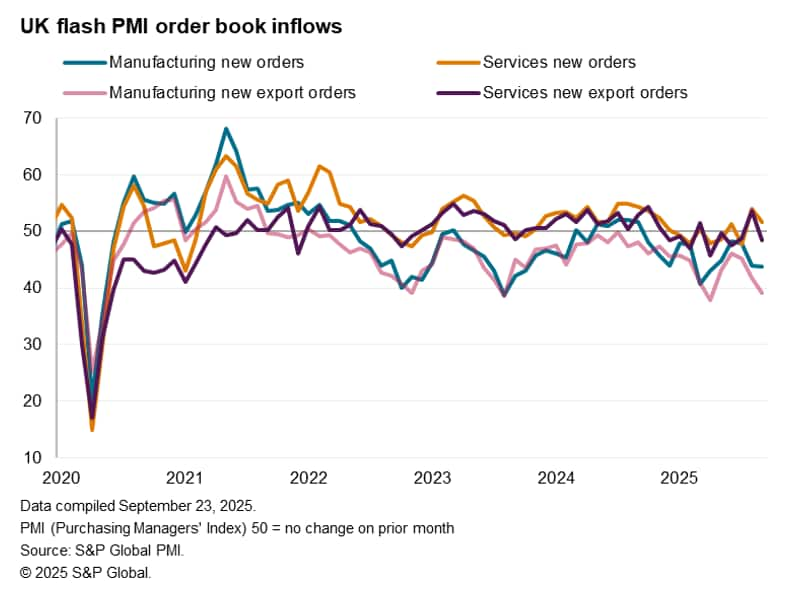

Although in part linked to the temporary halting of auto production at JLR, the worsening picture in manufacturing is a disappointment after the signs of near-stabilization seen in July and August. This partly represents worsening factory export trends, in turn often linked to US tariff policies. New orders placed at manufacturers fell at an especially steep rate for a second successive month, led by an increasingly severe drop in export sales.

However, September saw service sector exports also fall, dropping back into contraction after briefly returning to growth in August. The drop in exports contributed to a slowing in overall service sector new business inflows.

Within services, growth of output and new orders in September was almost entirely accounted for by financial services and IT, with other major consumer- or business-facing service sectors reporting largely stalled or falling business levels.

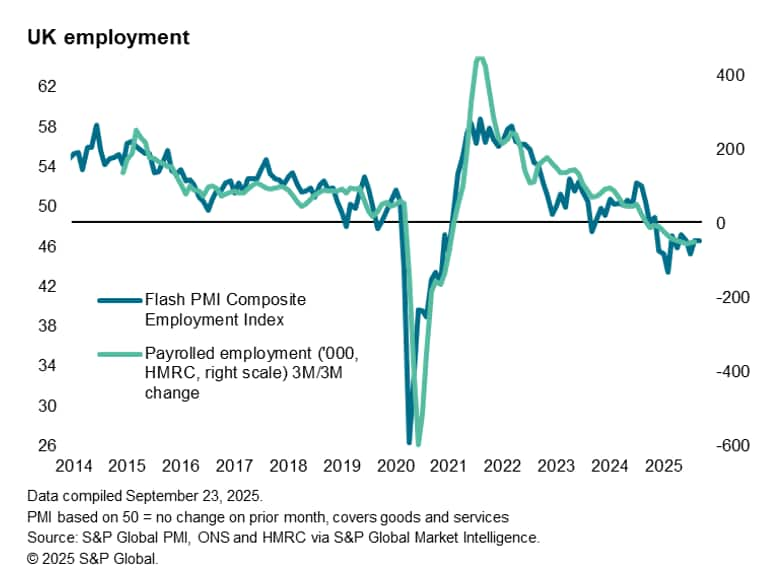

Job losses reported for twelfth straight month

A key area of concern in the PMI survey in recent months has been the deteriorating employment situation, which persisted into September. A further steep drop in staffing numbers in September means the survey has signalled 12 successive months of job cutting, initiated by last autumn's Budget. The latest survey signals about 50,000 private sector jobs being cut in the three month to September. This past year has therefore been the worst spell for employment since the global financial crisis of 2008-9 bar only the pandemic.

Lower employment was signalled in both manufacturing and services in September, with only the tech sector reporting any jobs growth.

While many companies reported lower employment due to the non-replacement of leavers, the survey saw a number of companies reporting redundancies. Higher costs associated with National Insurance and minimum Wage increases were widely cited as the driver of lower staffing levels, aggravating pressure on headcounts from the current weak demand environment.

Confidence eroded by policy worries

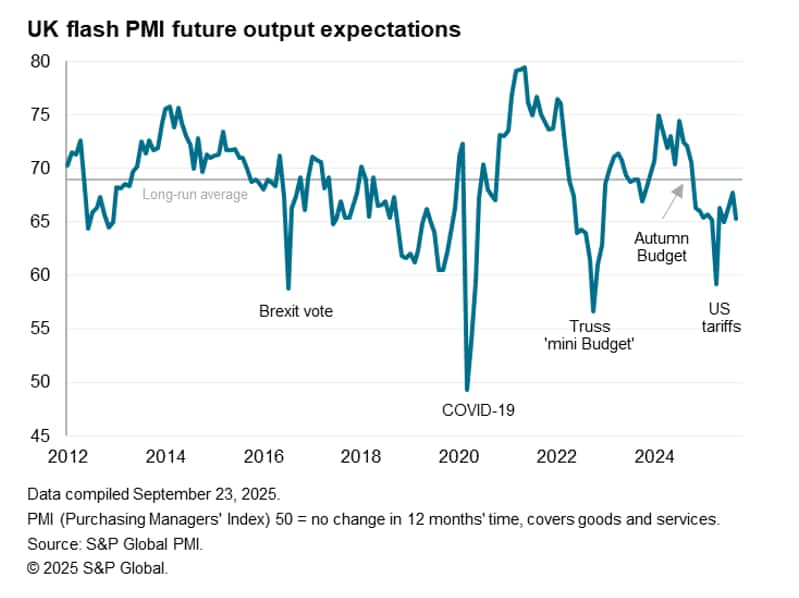

The ongoing job cutting was also accompanied by a deterioration in business confidence about the year ahead, which dropped to its lowest since June to slide further below the survey's long-run average.

Business sentiment about future prospects have darkened since last year's Budget and, although up compared to the shock suffered earlier in the year amid US tariff announcements, the overall level of confidence remains worryingly weak, with many continuing to express concerns about government policy and competitiveness.

Inflationary pressures recede

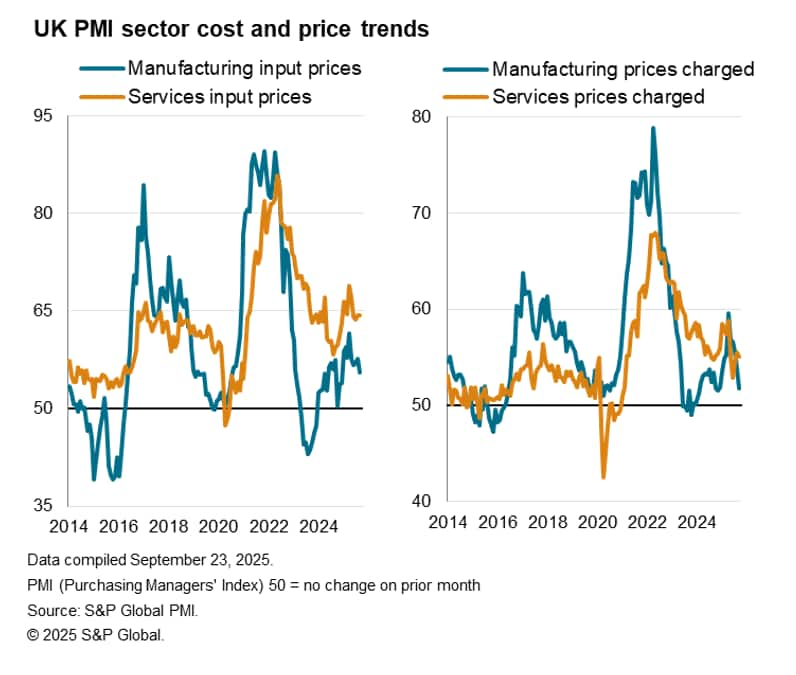

An area of ongoing concern to business has been the increase in staffing costs resulting from the last Budget, these cost increases were again widely cited as having contributed to higher costs and prices in September, notably in the service sector. Service sector inflation consequently remained elevated by historical standards, albeit with selling price inflation moderating slightly during the month. Input costs and selling prices in manufacturing meanwhile rose at the slowest rates seen so far this year, contributing to an overall weakening of inflationary pressures.

While the PMI's composite selling prices index covering goods and services remained above levels historically consistent with the Bank of England's 2% target, the index signals that inflation should start to cool from the current 3.8% rate in the months ahead. September's PMI selling price index reading was the second-lowest seen over the past 11 months, and among the lowest since the pandemic.

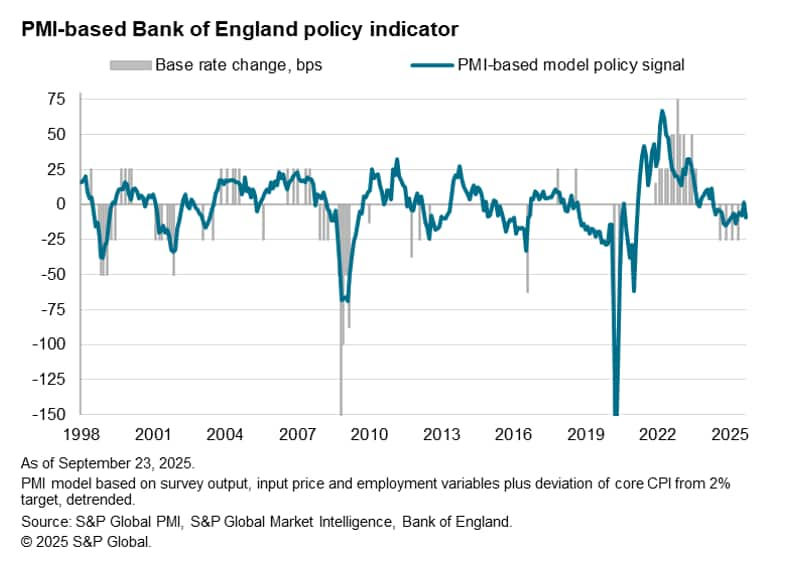

Renewed dovish policy stance signalled

The September flash PMI survey data suggest policymakers could shift to a more dovish stance at upcoming meetings.

Since August 2024, the Bank of England has reduced its Bank Rate five times, with the latest August meeting seeing the Bank Rate drop to a two-year low of 4.00%. The last two meetings have been split decisions, however, reflecting concerns over stubborn inflation on one hand and signs of weak economic growth and falling employment on the other. The flash PMI data for September will therefore play into the hands of the doves and could potentially shift the policy debate back toward cutting interest rates again before the end of the year. However, a further interest rate cut in November, which would follow the quarterly cadence of past rate cuts, will be difficult to see unless headline inflation comes down as quickly as signalled by the PMI, which would likely leave the central expectation for rates to stay on hold until next March.

Read the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-points-to-sharp-growth-slowdown-amid-ongoing-job-cuts-Sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-points-to-sharp-growth-slowdown-amid-ongoing-job-cuts-Sep25.html&text=UK+flash+PMI+points+to+sharp+growth+slowdown+amid+ongoing+job+cuts+in+September+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-points-to-sharp-growth-slowdown-amid-ongoing-job-cuts-Sep25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI points to sharp growth slowdown amid ongoing job cuts in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-points-to-sharp-growth-slowdown-amid-ongoing-job-cuts-Sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+points+to+sharp+growth+slowdown+amid+ongoing+job+cuts+in+September+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-points-to-sharp-growth-slowdown-amid-ongoing-job-cuts-Sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}