Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2025

Eurozone’s sluggish recovery continues as flash PMI edges up to 16-month high in September

Eurozone businesses reported the fastest output growth for 16 months in September, though the overall rate of expansion remained only modest in a sign that the region's upturn is struggling to gain momentum. Sluggish service sector growth was accompanied by a slowdown in manufacturing, where companies reported an increased loss of export sales thanks partly to the fading effect of tariff front-running. Business optimism also waned, led by reduced expectations of growth in the manufacturing sector. Staffing levels were unchanged, underscoring the lack of meaningful growth momentum.

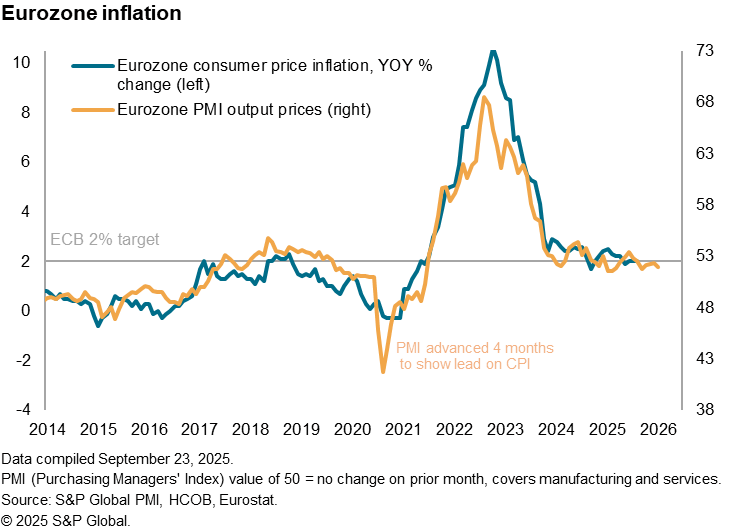

Weak demand meanwhile helped to keep a lid on inflationary pressures, keeping the door open for further interest rate cuts from the ECB should the region's recovery falter.

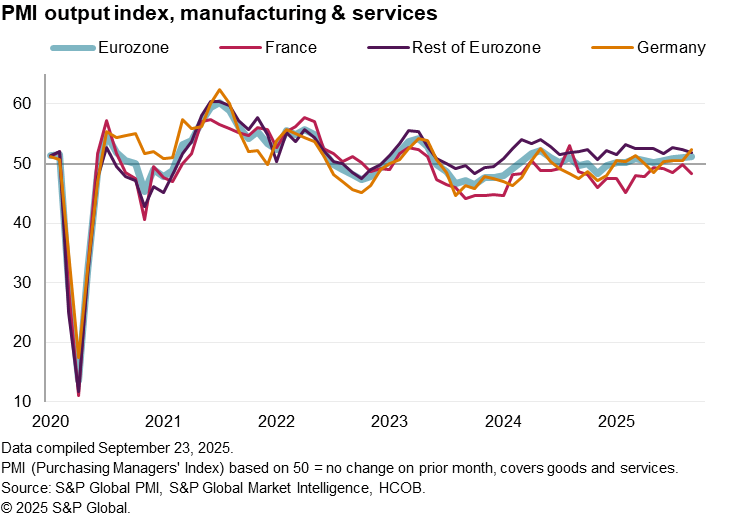

Within the region, conditions contrasted in the eurozone's two largest economies. While growth accelerated in Germany to a pace unbeaten since early 2023, France's downturn deepened amid intensifying political uncertainty.

Eurozone growth at 16-month high

Modest growth was again recorded in the eurozone in September, the pace of expansion edging higher for a fourth month in a row. At 51.2, up from 51.0 in August, the HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, signalled an expansion of activity for a ninth successive month.

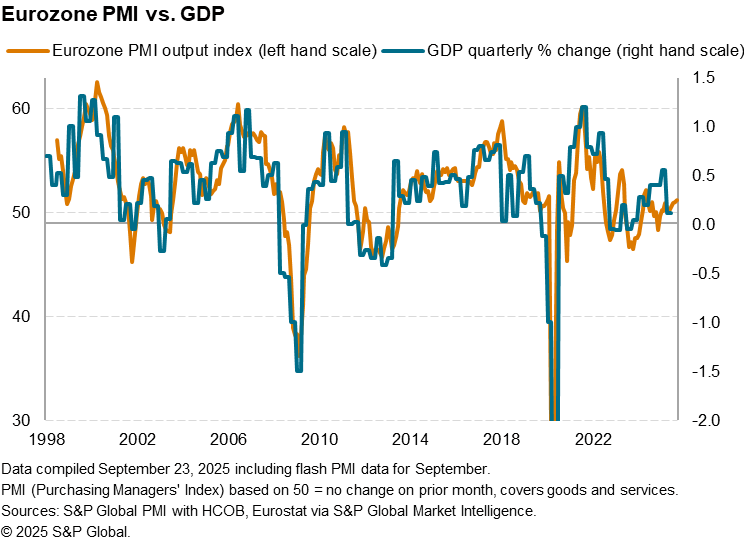

The good news that the rate of growth has steadily edged higher to a 16-month high is tempered by the fact that comparisons with official data indicate that the current PMI reading is consistent with just 0.2% growth in both September and the third quarter as a whole. While this represents an improvement after the 0.1% GDP increase in the second quarter, it remains a disappointingly sluggish expansion.

The official eurozone GDP data so far this year has been distorted by volatile growth in Ireland and US tariff shipments, making the underlying trend hard to discern. The strong first quarter GDP gain of 0.6% was followed by a meagre 0.1% expansion. The PMI has instead signalled a steadier but sluggish improvement in the underlying economic growth trend in recent months.

Services report higher demand, but manufacturing suffers steeper export decline

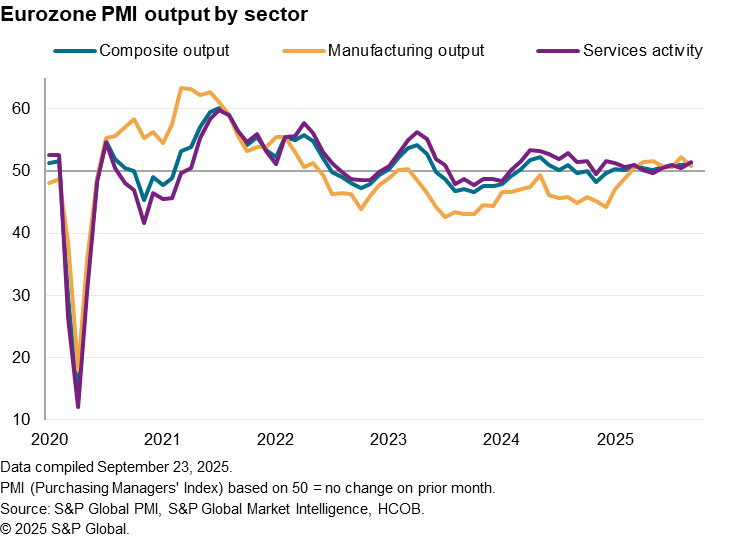

By sector, the accelerated growth in business activity in September was due to the service sector reporting its fastest expansion so far in 2025. Although only sluggish, the increased service sector output, which was buoyed by one of the largest (though still fractional) influxes of new orders seen over the past year, adds to tentative signs of domestic demand picking up slowly in the region.

Manufacturing production also rose, but here the rate of expansion slowed from the near three-and-a-half year high registered in August to result in only a very modest gain.

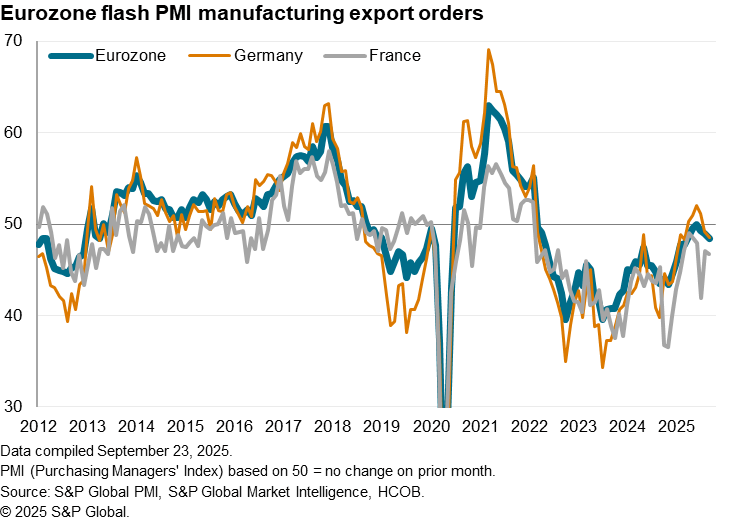

In manufacturing, trends have been distorted lately by the front-running of US tariffs. Having stabilized in May for the first time in 40 months, aided by shipments to the US ahead of US tariffs, eurozone goods exports have fallen back into decline in a sign of this front-running effect waning. September's export decline was the sharpest since March. The further anticipated unwinding of this tariff front-loading poses downside risks to production in the coming months.

Further suggestions that manufacturing growth could come under increased pressure came from companies' own expectations. Business sentiment about output in the year ahead dipped to a four-month low in September to fall further below the series long-run average. The waning in confidence was centered on the manufacturing sector, where optimism was the weakest in the year-to-date. More encouragingly, services sentiment was broadly unchanged from August, though even here optimism remained among the lowest seen so far this year.

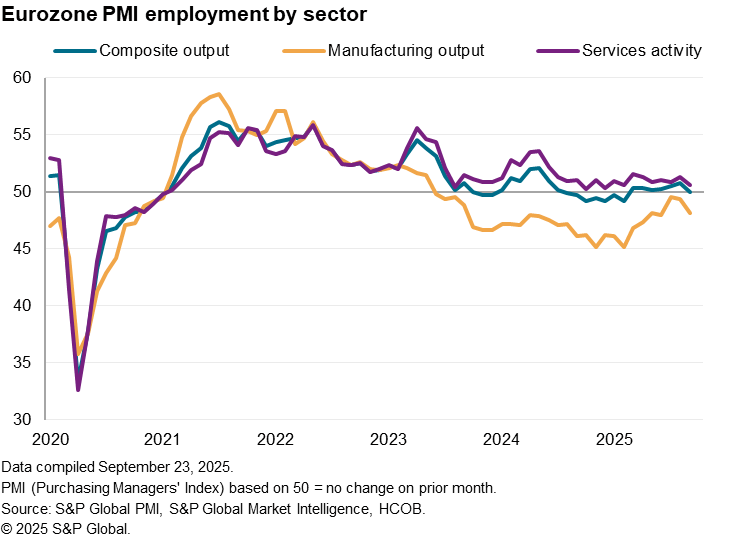

Stalled employment

Further disappointment came from a lack of jobs growth being reported during the month, with a steepening rate of job losses in the manufacturing sector countering a reduced rate of job growth in services.

Inflation at target

Inflation pressures meanwhile moderated, the overall rate of selling price inflation across goods and services down to a four-month low in September and broadly consistent with inflation running just below the ECB's target of 2%, where it has sat in the three months to August.

One remaining area of concern to policymakers has been the ongoing stubbornness of services inflation, but September saw prices levied for services rise at the slowest rate for four months, accompanied by a slightly increased rate of decline in goods prices.

Policy easing bias

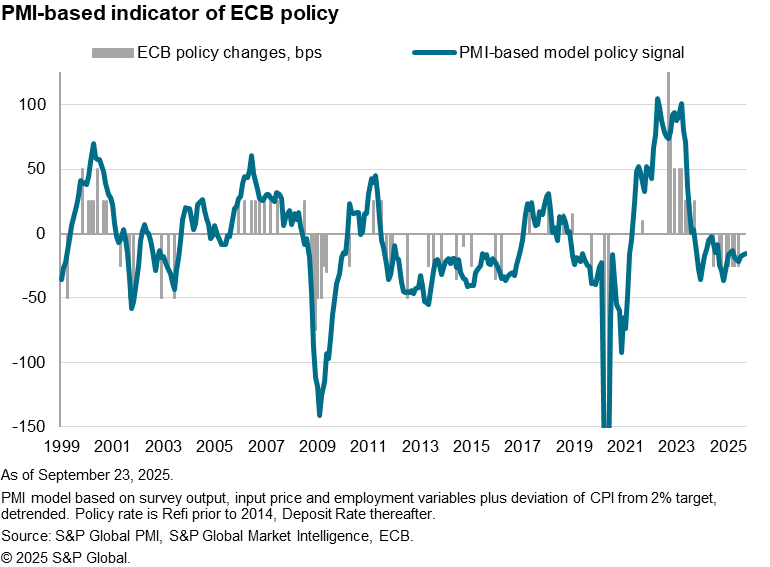

A composite ECB policy indicator, based on key PMI gauges and the extent to which inflation is deviating from the ECB's 2% target, suggest an ongoing easing bias to policymaking. Despite the uptick in output growth in September, the expansion remained only modest and was accompanied by slower cost growth and a stalling of employment.

However, the bar to further imminent rate cuts is likely to be high. The ECB has already cut interest rates by 25 basis points eight times in this cycle, taking the Deposit Rate to 2.00% from a peak of 4.00% in the spring of 2024. It will likely take a more worrying weakness in the demand picture than that signalled by September's PMI to lead the ECB to cut rates again this year, though much will depend on the growth trajectory going forward.

France's downturn drags on the region

Within the eurozone, Germany was a key driver of growth in September, recording a solid increase in output that was unbeaten since May 2023. On the other hand, France saw activity decrease for the thirteenth consecutive month, the rate of decline having worsened to the sharpest pace since April after the near-stabilization seen in August. While Germany reported higher output for both manufacturing and services, the latter enjoying its best gain since January, France reported deeper downturns in both sectors, with some companies reporting heighted political uncertainty as having dampened both spending and confidence.

The rest of the Eurozone reported continued growth of output, but the rate of expansion moderated to one of the slowest seen this year.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-sluggish-recovery-continues-flash-pmi-edges-up-Sep25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-sluggish-recovery-continues-flash-pmi-edges-up-Sep25.html&text=Eurozone%e2%80%99s+sluggish+recovery+continues+as+flash+PMI+edges+up+to+16-month+high+in+September++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-sluggish-recovery-continues-flash-pmi-edges-up-Sep25.html","enabled":true},{"name":"email","url":"?subject=Eurozone’s sluggish recovery continues as flash PMI edges up to 16-month high in September | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-sluggish-recovery-continues-flash-pmi-edges-up-Sep25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone%e2%80%99s+sluggish+recovery+continues+as+flash+PMI+edges+up+to+16-month+high+in+September++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozones-sluggish-recovery-continues-flash-pmi-edges-up-Sep25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}