Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 19, 2025

Week Ahead Economic Preview: Week of 22 September 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys to provide insights into growth, jobs and inflation

Flash PMI survey data will provide a key focus for the markets in the coming week, though Friday's release of the US core PCE price index will also be eagerly awaited. Other releases of note include revised US GDP numbers, consumer confidence data for the US and Europe, plus US, home sales, durable goods orders and inventories.

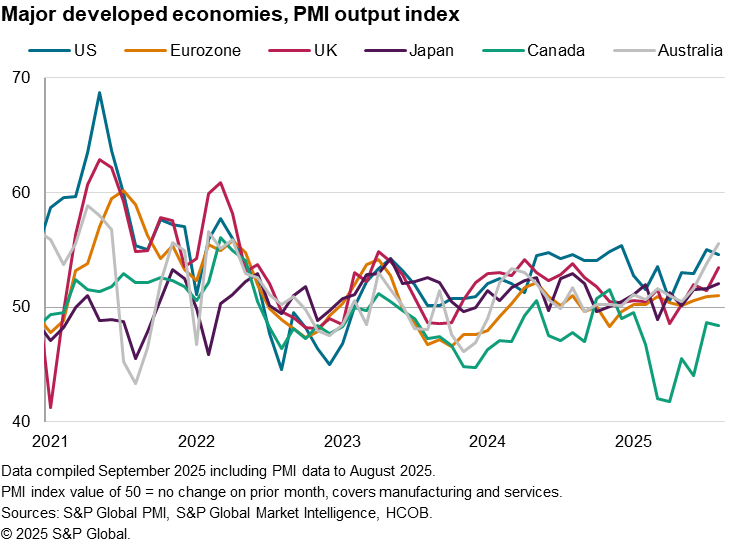

Early 'flash' PMI data will provide the first major snapshots of economic trends in September. Prior data showed especially strong growth in India accompanied by robust expansions in the US and Australia. More modest but strengthening upturns were meanwhile reported in the UK, Japan and - to a lesser extent - the eurozone.

A concern, however, is that some of the recent improvement in manufacturing growth globally has been fueled by the front-loading of shipments ahead of US tariffs. September's factory PMIs will therefore be eyed to see if this boost is fading, and the extent to which rising domestic demand in economies such as Germany may be helping offset US trade issues. In France, the survey data will be eyed for the impact of political upheaval after the fall of the government, but in the UK the survey data will be important to gauge any ongoing impact of policy changes on both inflation and jobs. Higher employer tax and Minimum Wages have recently pushed up inflation and led to widespread UK job losses.

In the US, although the recent strength of the PMI's current output index has bolstered the likelihood of the economy growing at a solid pace again in the third quarter, business confidence about the outlook has taken a knock, suggesting that that companies are becoming increasingly nervous about the outlook.

US PMI price data will also be eagerly awaited to assess tariff impacts. However, a further steer on the future path of US interest rates will also be provided on Friday by updated official inflation data. The publication of the Fed's preferred measure of core PCE inflation follows mixed signals on recent price trends. While consumer price inflation picked up from 2.7% to 2.9% in August, wholesale prices showed a surprise 0.1% decline during the month. Softer inflation will likely be needed to open the door for further rate cuts in the months ahead. The last FOMC meeting, which saw the fed funds rate cut for the first time since December, showed policymakers were generally anticipating another two rate cuts by the end of the year, representing a more dovish stance than previously signalled.

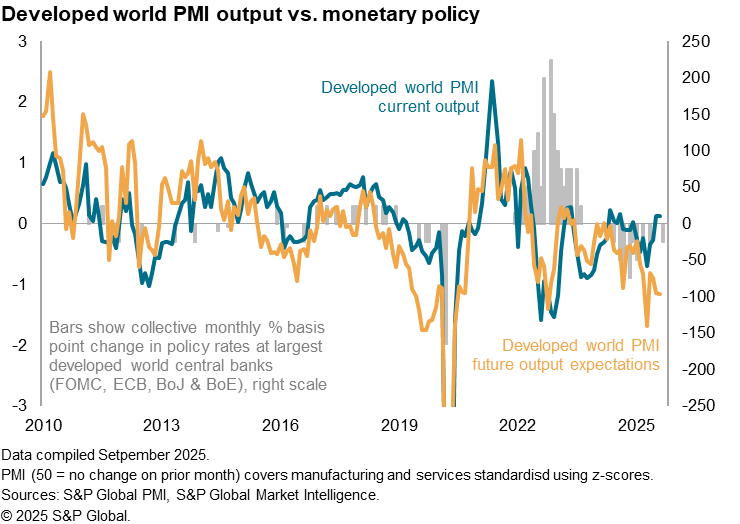

Flash PMI surveys will be important to assess after recent data showed current output growth accelerating but confidence about future output deteriorating. Such a divergence is unusual, and the loss of optimism poses downside risks to the economic outlook.

Monday 22 Sep

Americas

- Canada PPI (Aug)

- US Chicago Fed National Activity Index (Aug)

EMEA

- Eurozone Consumer Confidence (Sep, flash)

APAC

- Hong Kong SAR Inflation (Aug)

Tuesday 23 Sep

Australia S&P Global Flash PMI, Manufacturing &

Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI* Manufacturing & Services*

Americas

- Canada New Housing Price Index (Aug)

- US Current Account (Q2)

- US Existing Home Sales (Aug)

EMEA

- Spain Balance of Trade (Jul)

APAC

Japan Market Holiday

- Malaysia Inflation (Aug)

- Singapore Inflation (Aug)

- Taiwan Export Orders (Aug)

Wednesday 24 Sep

Japan S&P Global Flash PMI, Manufacturing & Services*

Americas

- US New Home Sales (Aug)

EMEA

South Africa Market Holiday

- Germany Ifo Business Climate (Sep)

APAC

- South Korea Consumer Confidence (Sep)

- Australia Monthly CPI Indicator (Aug)

- Taiwan Industrial Production (Aug)

Thursday 25 Sep

Americas

- US Durable Goods Orders

- US GDP Growth (Q2, final)

- US Initial Jobless Claims

- US Wholesale Inventories (Aug)

EMEA

- Germany GfK Consumer Confidence (Oct)

- France Consumer Confidence (Sep)

- Switzerland SNB Interest Rate Decision

APAC

- Japan BOJ Monetary Policy Meeting Minutes (Jul)

- Thailand Balance of Trade (Aug)

- Taiwan Retail Sales (Aug)

- Hong Kong SAR Balance of Trade (Aug)

Friday 26 Sep

Americas

- Mexico Banxico Interest Rate Decision

- Mexico Balance of Trade (Aug

- Canada GDP (Aug, prelim)

- US Core PCE Price Index (Aug)

- US Personal Income, Spending and Prices (Aug)

- US University of Michigan Consumer Sentiment (Sep, final)

EMEA

- Spain GDP (Q2, final)

- Italy Business Confidence (Sep)

APAC

- South Korea Business Confidence (Sep)

- Singapore Industrial Production (Aug)

- Thailand Industrial Production (Aug)

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-september-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-september-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+22+September+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-september-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 22 September 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-september-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+22+September+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-september-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}