Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 11, 2025

UK economy set for disappointing second quarter as GDP follows PMI lower

Official data showed the UK economy contracting 0.1% in May after a 0.3% decline in April. Despite the two successive monthly falls, the data put the economy on course for 0.1% GDP growth in the second quarter, assuming a flat picture is seen in June. However, even this modest growth is a far cry from the 0.7% GDP expansion which had been reported in the first quarter, and brings the official data into line with recent gloomier PMI survey data.

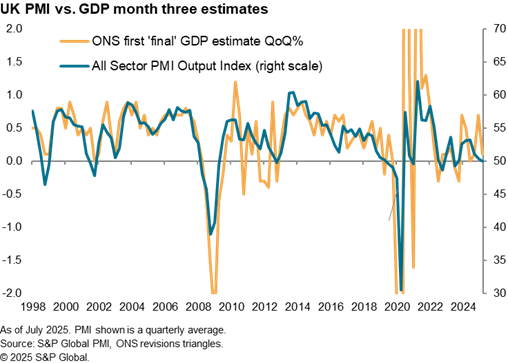

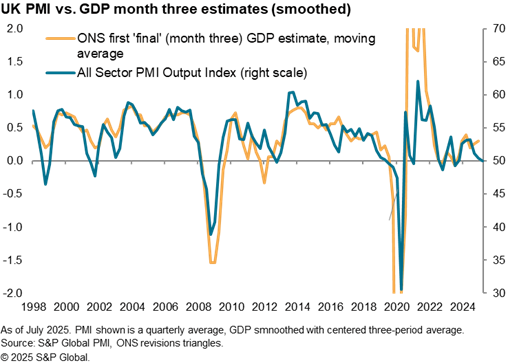

The average all-sector PMI output index reading of 50.0 in the second quarter (based on the output of manufacturing, services and construction sectors) was also consistent with just 0.1% GDP growth.

The survey signals of an economy which is struggling against various headwinds have therefore arguably painted a more accurate picture of the underlying health of the UK economy so far this year than had been hoped from the strong growth estimated by the official GDP data in the first quarter.

GDP revisions

Some caution in terms of the strong growth seen in the first three months of 2025 is also warranted given the potential for GDP data to be revised. Since 1998, the absolute 'error' in first estimates of GDP (as measured by the extent to which initial estimates have been revised compared to the latest estimate of GDP in each period) has been 0.3%. Some revisions have been remarkably large.

Several spells of weak growth in the decade prior to the global financial crisis have been revised away to now show periods of solid, and in some cases accelerating, growth, such that the entire picture of growth trends over this decade has been rewritten.

Two periods of falling GDP after the global financial crisis, which led to newspaper headlines of the feared "triple dip" recession have now also been removed from the ledger with marked upward revisions to both of these downturns.

An initial estimate of a -0.5% GDP decline in the final quarter of 2010 is now estimated at growth of +0.1%. Similarly, a -0.2% drop in GDP in the first quarter of 2012 has been revised to now show very strong growth of +0.9%.

More recently, initial estimates of growth in each quarter of 2017 have been revised higher to indicate a far stronger year of economic growth (+2.7%) than first thought (+1.7%), and a downturn in 2019 has been revised away. Particularly strong revisions were meanwhile evident in the pandemic years, peaking with a +2.5% revision to growth in the second quarter of 2021.

Revisions to the data are still likely to be seen in more recent years, as we note that the average absolute revision to GDP in the past three years has already been 0.2% against the long run average of 0.3%.

A large element of these revisions takes a while to work through: the average absolute revision between initial (month one) estimates and those estimates made in the third month after each quarter is just 0.1%.

This indicates that much of the revisions stem from the reconciliation in the three methods of calculating GDP. Early estimates (up to month three after each quarter) are derived primarily from output data, such as industrial production data. But these output data are then supplemented with data on expenditure and income, the data collection of which can often take far longer than that of output. These three sources of data - output, expenditure and income - should in theory all produce the same GDP numbers. However, in practice they tend to vary considerably at times. Hence the early output data need to be revised to reconcile with the expenditure and income data.

PMI comparisons

This raises an issue when comparing GDP data with other sources, such as the PMI survey, which primarily measure output (rather than income or expenditure). It also helps explain why the PMI's output index has a closer relationship with early output-based GDP estimates than with later (revised) GDP estimates which include income and expenditure data1.

The standard error for an OLS regression using the all sector PMI output index as the sole determinant of GDP between 1998 and 20192 is 0.38 but this falls to 0.29 when first final estimates of GDP are used.

Smoothing the volatile GDP data using a centered moving average can further help improve the fit of the two data sets, especially visually when the PMI is plotted against the month three GDP estimates. This reduces the standard error to 0.26. The bad news is that this regression signals flat GDP in the second quarter of 2025.

Different GDP measures

It is not clear why the different GDP output, income and expenditure measures may vary so much, and diverge with the PMI, but it is notable that some of the major GDP revisions and divergences with the PMI occur in times of output decline (or marked growth weakening), for which the income and expenditure based GDP data subsequently suggest were stronger than first thought.

This may be because, for many firms and public sector activities, a given level of employment (and wages - hence income) is required for different levels of output. For example, a bank will still need the same number of staff to be available to process mortgage or account applications and queries even if the volume of sales fall sharply in any given period. Similarly, a factory will still employ the same number of staff, requiring the same wages, even if production levels are cut in the short term (though protracted output falls may later lead to layoffs).

Hence it is the output-based data that provide the best guide to changing business conditions and demand, thereby better matching the signals from the surveys.

1 Often as included in the publication of the Blue Book, some of this data may take years to eventually be included.

2 Pandemic years are excluded due to the high volatility and 2012 Queen's Jubilee and Olympics have been adjusted for while more recent data are ignored due to scope for GDP revision.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-set-for-disappointing-second-quarter-as-gdp-follows-pmi-lowerjul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-set-for-disappointing-second-quarter-as-gdp-follows-pmi-lowerjul25.html&text=UK+economy+set+for+disappointing+second+quarter+as+GDP+follows+PMI+lower+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-set-for-disappointing-second-quarter-as-gdp-follows-pmi-lowerjul25.html","enabled":true},{"name":"email","url":"?subject=UK economy set for disappointing second quarter as GDP follows PMI lower | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-set-for-disappointing-second-quarter-as-gdp-follows-pmi-lowerjul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+set+for+disappointing+second+quarter+as+GDP+follows+PMI+lower+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-economy-set-for-disappointing-second-quarter-as-gdp-follows-pmi-lowerjul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}