Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 16, 2025

Assessing outlook risks as PMI surveys send warning signals

S&P Global's PMI surveys indicated that worldwide output growth picked up for a second successive month in June, but there are several indications to suggest that this improvement will prove short-lived. Warning signs include a likely upcoming inventory adjustment, low demand from consumers, deteriorating confidence and disappointing signals on capex.

On the other hand, July has so far seen some calming of geopolitical risks and tariff worries, and buoying financial markets providing a tailwind to financial services activity.

July's flash PMI data will provide a timely insight into how these factors affected economic growth momentum as we move into the second half of the year.

Subdued second quarter

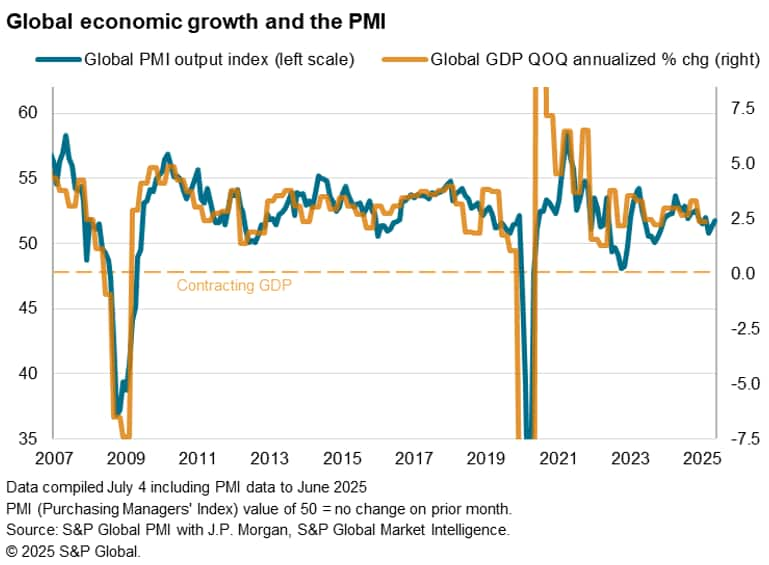

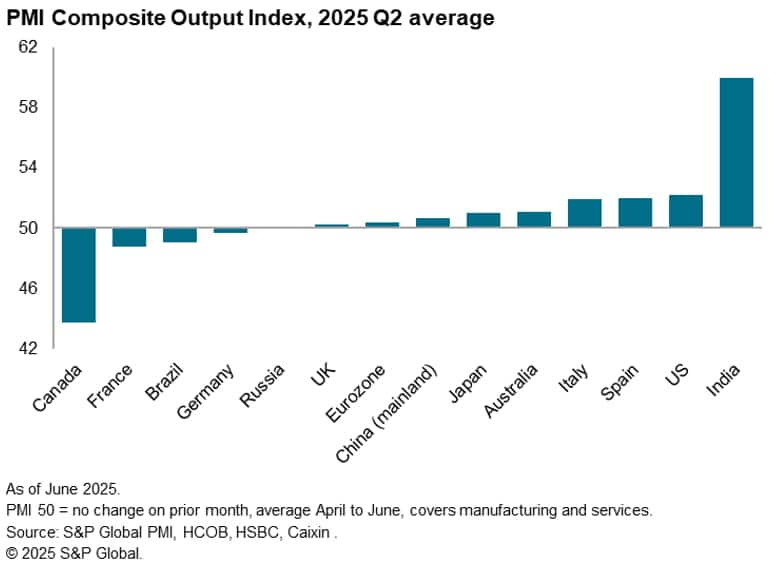

The headline Global PMI, covering output in manufacturing and services across over 40 economies and compiled for J.P. Morgan by S&P Global, rose from 51.2 in May to 51.7 in June. The rise signalled the fastest pace of expansion since March. However, despite the further upturn, the average expansion signalled by the PMI over the second quarter has been the weakest since the fourth quarter of 2023.

Historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.0% in the second quarter. This looks sluggish when compared with an average GDP growth rate of 3.1% in the decade prior to the pandemic. Moreover, growth looks more likely to decelerate than revive further as we head into the second half of the year.

Inventory adjustment

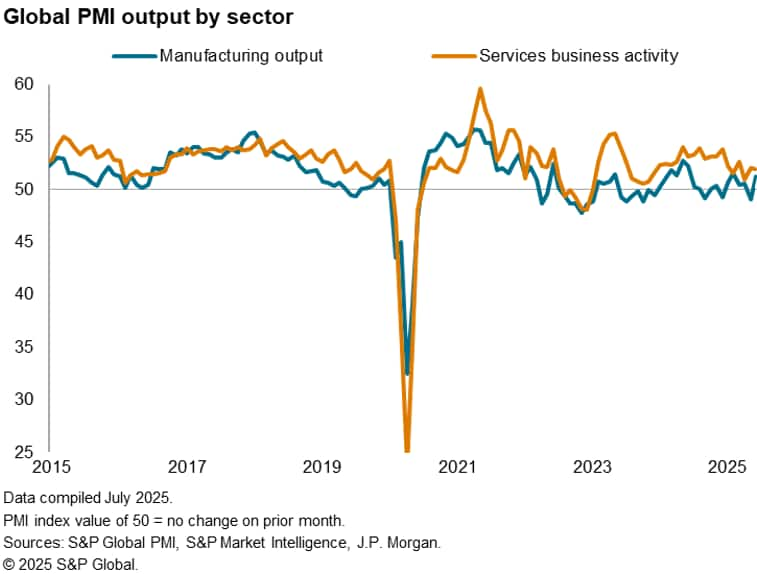

The first warning sign comes from the improved rate of expansion in June being driven by an acceleration of global manufacturing output growth to the highest since February.

Although encouraging at first glance, survey respondents note that this higher factory growth was in part buoyed by the front-running of US tariffs. Seeking to get ahead of the 9th July tariff deadline, greater exports were shipped to the US, a consequence of which was a second month of intense inventory building by US firms. Stocks of inputs held by US manufacturing rose by an unprecedented degree in May, followed by another month of strong growth in June. Global manufacturing output growth looks set to weaken when this trade reverses: US factories (and likely retailers, too) will now be holding excess stock, reducing their imports.

Consumer industries stall

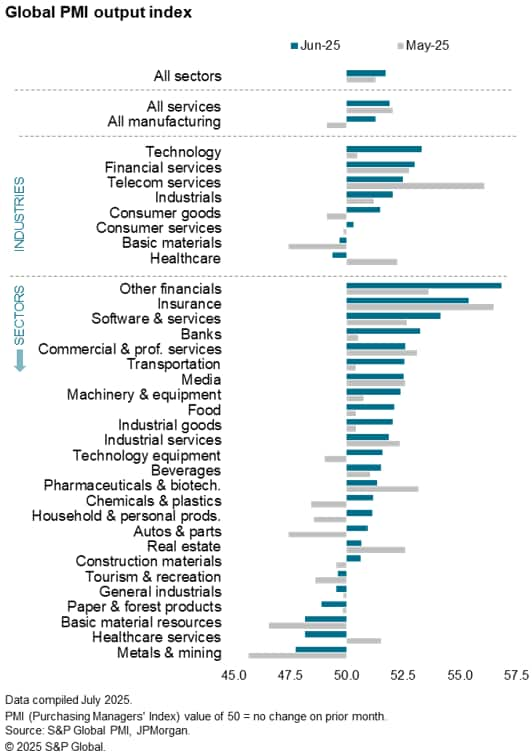

Second, service sector growth moderated worldwide in June, and is running well below levels seen late last year. Best performing were technology firms and financial services providers, the latter buoyed by looser financial conditions. But consumer-facing industries remained especially subdued, notably in terms of tourism & recreation.

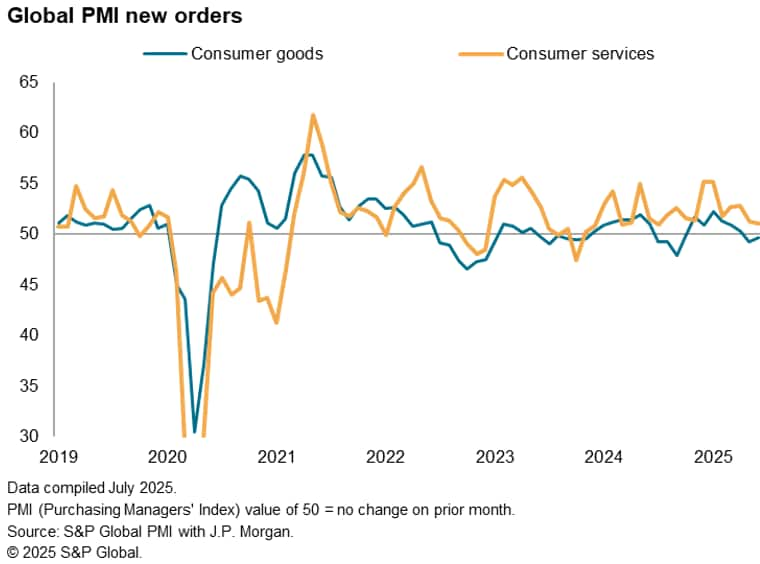

Measured globally, consumer services activity in the past two months has been the weakest since late 2023, contracting marginally in both the US and Europe in June, on the back of weaker demand growth. New orders for consumer goods have meanwhile fallen over the past two months, dropping in Asia and Europe to offset a rise in the US.

Low confidence

A third concern is a deterioration in business expectations about the year ahead, which fell in June to one of the lowest levels seen since the pandemic.

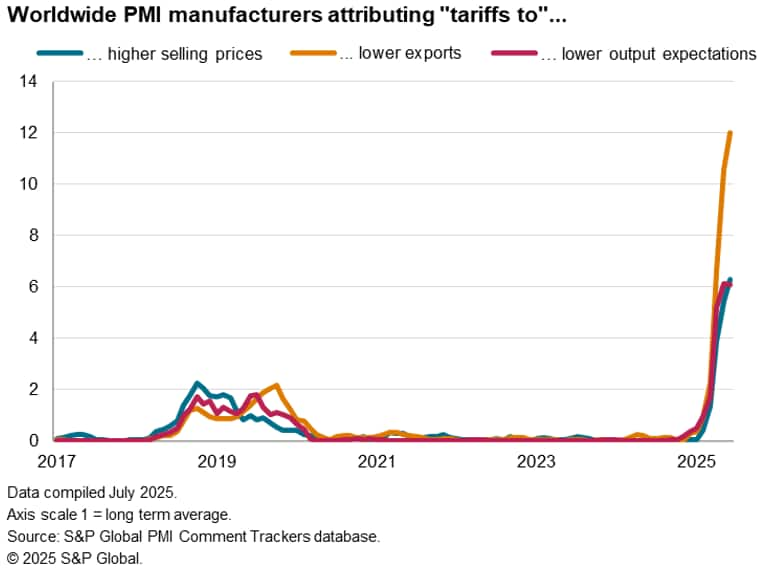

Although reports of the damaging effect of "uncertainty" on businesses have eased since April, they remain elevated by historical standards, and the adverse impact of tariffs was reported to have intensified further in June.

Weakened capex

Fourth, heightened economic uncertainty have meanwhile dampened firms' capex and expansion plans. According to the PMI-based Global Business Outlook Survey, conducted in June, planned spending on capital investments and R&D are running at some of the lowest levels seen since the pandemic.

The monthly PMI surveys also highlight how weak demand conditions have curbed firms' appetites to hire new staff to a degree only usually seen at times of heightened global economic stress.

Another warning sign on investment spending was a deterioration in the number of manufacturers on the global PMI survey reporting that output or employment had risen in response to new capital investment. This investment-led expansion is now running at one of the lowest levels seen in the 20-year history of the data series.

Isolated pockets of growth

An additional concern comes from the weakness of growth evident in much of the world over the second quarter. Globally, growth was again led by India, but growth elsewhere remained modest at best, and in part buoyed by the tariff front-loading. Despite some pockets of growth materialising thanks to firming domestic demand on the back of higher fiscal spending, notably in Germany, trade uncertainties dominated. Trade disruption was most evident in Canada, which signalled the steepest contraction of the major economies over the second quarter.

Looking ahead

We will look to the flash PMI survey data for July, published 24th July, to provide an updated assessment of the economic growth trajectories for the largest developed economies, notably the US, Eurozone, Japan and the UK.

July has so far seen some calming of tensions in the Middle East as well as a further postponement of possible tariff hikes from the US. A 90-day pause on higher rate tariffs (announced back in April) expired on 9th July, but the US has given trading partners until 1st August for new deals to be made. This new schedule is seen by many as a preference for the US to strike deals instead of imposing the higher rate tariffs, and has led not only to some improved sentiment among manufacturers but has also lifted financial markets.

Although the geopolitical landscape clearly remains fluid, especially in relation to tariff policies, this lift to financial markets provides an important ray of hope to watch in the flash PMIs, whereby improving financial conditions could feed through to stronger global services growth, helping offset some of the tariff-related headwinds currently subduing economic growth.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-outlook-risks-as-pmi-surveys-sending-warning-signals-July25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-outlook-risks-as-pmi-surveys-sending-warning-signals-July25.html&text=Assessing+outlook+risks+as+PMI+surveys+send+warning+signals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-outlook-risks-as-pmi-surveys-sending-warning-signals-July25.html","enabled":true},{"name":"email","url":"?subject=Assessing outlook risks as PMI surveys send warning signals | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-outlook-risks-as-pmi-surveys-sending-warning-signals-July25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Assessing+outlook+risks+as+PMI+surveys+send+warning+signals+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-outlook-risks-as-pmi-surveys-sending-warning-signals-July25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}