Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 17, 2025

Flash PMI to show if the UK economy has recovered some poise after stumble

- The UK economy experienced a good start to 2025, but more recent official data and PMI surveys have brought signs of a slowdown in the second quarter.

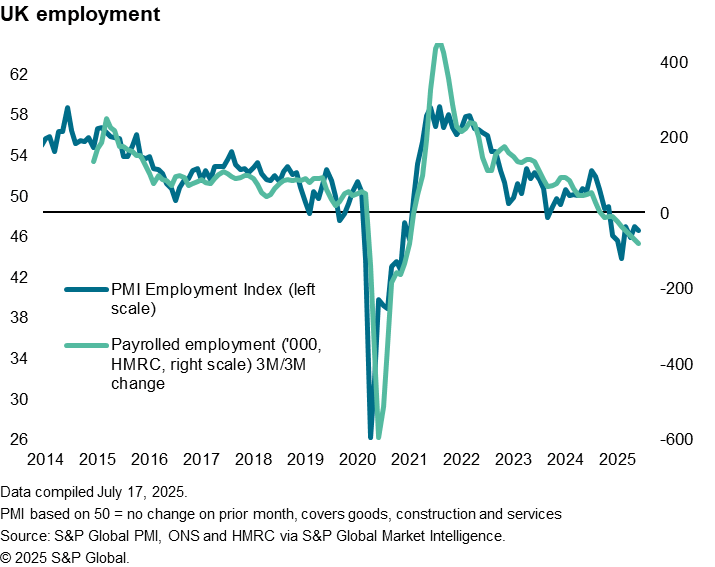

- Job cuts have surged, with recent months having seen the highest rate of job losses since the 2008-9 financial crisis.

- The deterioration in the economy is linked to last autumn's Budget, alongside geopolitical tensions, but PMI sentiment indicators suggest that concerns over tariffs appear to be easing.

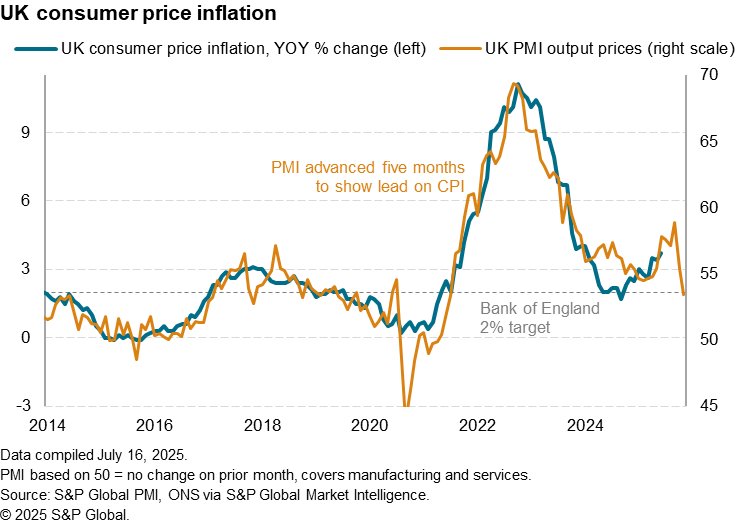

- Inflation is also showing signs of cooling, with PMI indicators suggesting that the worst inflationary pressures may soon be over.

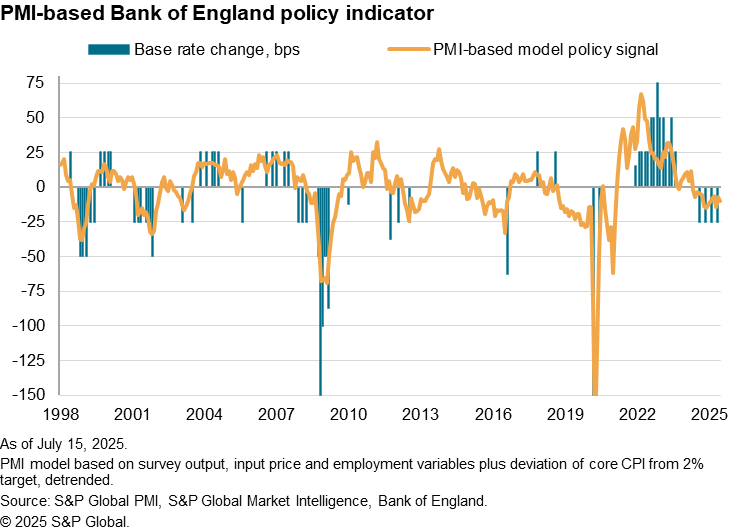

- The Bank of England is expected to continue reducing interest rates, which could help strengthen the economy as it moves through the latter half of the year.

False start

The UK economy is looking like the relay runner who got out of the blocks quickly but stumbles and drops the baton at the first changeover.

News that the economy grew by a surprisingly strong 0.7% in the first quarter of the year has been followed by some worrying signs of economic stress, meaning the second quarter is not looking anything like as good. More encouragingly, there are signs that the worst may be over and the economy could pick up pace again.

The first point to note is that there was something of a false start to the year, in that the first quarter growth was not a true reading of the economy's health. Business activity looks to have been buoyed by temporary factors, notably a boost to manufacturing and exports as firms shipped goods to customers ahead of new US tariffs. There was also evidence that some activity was also pulled forward ahead of increased Stamp Duty and vehicle tax rates in April.

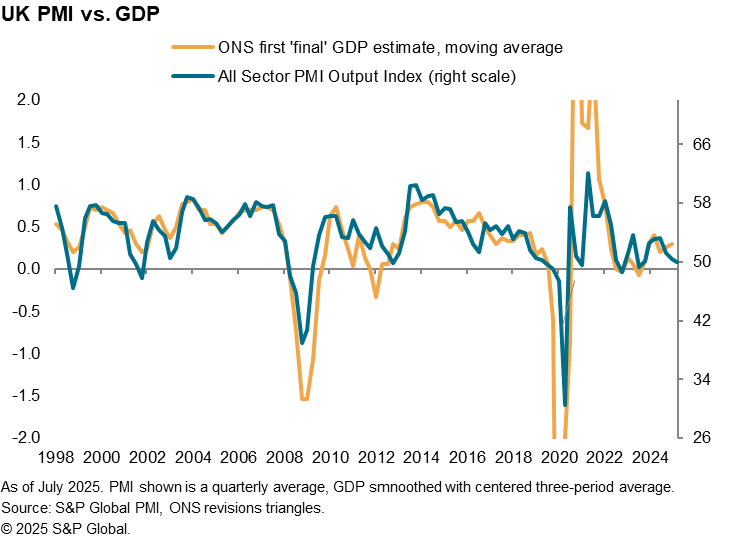

The fading of these effects has dampened growth in the second quarter. The UK PMI surveys have hinted at a near stalling of GDP in the second quarter, and early estimates from the Office for National Statistics (ONS) seem to be also hinting at a sharp second quarter slowdown.

Job cuts

The jobs market has also crumbled. PMI data have shown jobs being cut in recent months at a rate not seen since the 2008-9 global financial crisis barring only the pandemic. The weakness in the PMI's employment index has been followed by similar alarming job market news from HMRC payroll data. These data show that, since private sector employment peaked last June, 281,000 jobs have been cut (1.3% of the private sector workforce).

Budget woes aggravated by tariffs

The economic deterioration can be linked to several factors, according to companies participating in the PMI survey. Last autumn's Budget, which among other measures saw employers' National Insurance contributions rise alongside a hike in the Minimum Wage, has featured especially heavily when companies have cited causes of lost sales and the need to cut jobs. Note that companies are telling us that the impact of the Budget measures is far from over, with pressure to raise prices and cut jobs set to persist in the near term, according to the tri-annual Business Outlook Survey. Households, worried by job insecurity alongside a still high cost of living, have also been spending cautiously (read more here).

Then there is the broader geopolitical climate, which has been dominated by changes to US trade policy and tensions in both the Middle East and Ukraine.

However, April appears to have represented 'peak tariff concern' globally, according to the PMI's sentiment-based indicators of business uncertainty, with the US seemingly stepping back repeatedly from actually imposing sharply higher tariffs. We await August 1st as the next deadline for new tariffs to potentially apply, though the UK is set to be excluded here.

Inflation set to cool (after the summer)

There is also some good news in that, although the Budget measures such as the National Insurance hike appear to have driven official inflation higher up to June, the impact is already showing some signs of wearing off, at least in terms of its intensity. In fact, the PMI gauge of selling prices for goods and services has come back down to a level that is broadly consistent with the Bank of England's 2% inflation target. It will take a few months before this appears in the official data, and it could get worse before it gets better (see chart), but interest rate-setters will be encouraged by this suggestion that the worst of the inflation impact of the Budget has passed.

Turning the corner

Trying to forecast the economic outlook in this environment is clearly unusually difficult. The Bank of England seems to be erring on the gloomy side. At its last (June 18th) policy meeting, it indicated that it hopes to keep reducing interest rates given the weakness of economic growth and headwinds facing the economy. You can read the minutes of the last Bank of England policy meeting here, in which you will see numerous references to the PMI.

We can in fact combine the PMI gauges of output, prices and employment to get an overall indication of what the Bank of England ought to be doing with interest rates, according to the PMI survey panel. Not surprisingly, given the attention the Bank pays to the PMI, there is a close relationship between this PMI indicator and actual policy changes. When growth is strong, hiring is good and inflation high, the Bank tends to raise interest rates, and vice versa. The current prescription from the PMI is to err towards lower rates.

To recap, since August 2024, the Bank of England has reduced its Bank Rate four times, with the recent May meeting seeing the rate fall to 4.25%.

Our forecasters here at S&P Global Market Intelligence also see the UK economy struggling to the extent that we anticipate two more rate cuts in 2025 at the August and November policy meetings.

These rate cuts should help strengthen the economy. Barring any new shocks to the system after the second quarter stumble, we should therefore see the UK running at a better speed as we go through the second half of the year and into 2026. The next major 'time-check' will come from the flash PMI on 24th July, in which we want to see the survey prices gauge stay low, while the output and employment gauges show further signs of the Budget and tariff shocks fading. This will set the scene for a better second half of the year.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-to-show-if-the-uk-economy-has-recovered-some-poiseJ25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-to-show-if-the-uk-economy-has-recovered-some-poiseJ25.html&text=Flash+PMI+to+show+if+the+UK+economy+has+recovered+some+poise+after+stumble+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-to-show-if-the-uk-economy-has-recovered-some-poiseJ25.html","enabled":true},{"name":"email","url":"?subject=Flash PMI to show if the UK economy has recovered some poise after stumble | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-to-show-if-the-uk-economy-has-recovered-some-poiseJ25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+to+show+if+the+UK+economy+has+recovered+some+poise+after+stumble+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-to-show-if-the-uk-economy-has-recovered-some-poiseJ25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}