Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 18, 2025

Week Ahead Economic Preview: Week of 21 July 2025

Economic updates via flash PMIs accompanied by ECB meeting

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The release of flash PMI data for the world's largest developed economies will provide an updated assessment of the economic environment in a month of ongoing heightened uncertainty surrounding US tariff policy. The European Central Bank also meets to set monetary policy.

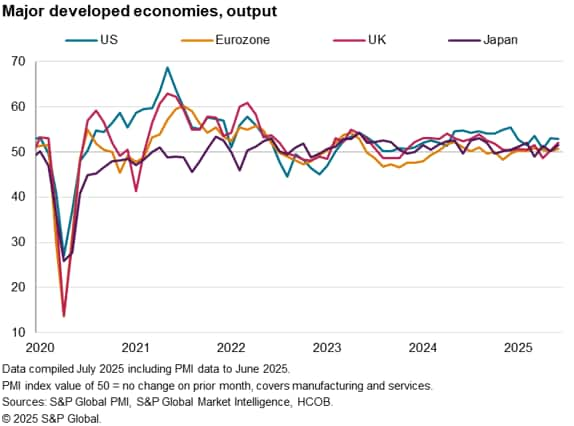

We look to the flash PMI survey data for July, published 24th July, to provide an updated assessment of the economic growth trajectories for the US, Eurozone, Japan and the UK. Back in June, the US had reported the fastest output growth of the major economies, but its rate of expansion remained slow compared to the end of last year. While growth lifted higher in the UK and Japan, it remained somewhat sluggish in both cases alongside a near-stalled eurozone. The latter's expansion nonetheless edged up to a three-month high in part due to Germany's manufacturing sector enjoying its best spell for three years.

The PMIs also brought indications that these modest performances may worsen. Warning signs included a likely upcoming inventory adjustment after US stockpiles rose sharply as firms front-ran tariffs, low consumer demand, deteriorating business confidence amid persistent geopolitical uncertainty, and disappointing signals on capex.

However, July has so far seen some calming of tensions in the Middle East as well as a further postponement of tariff hikes from the US. The US has now given trading partners until 1st August for new deals to be made. This new deadline is seen by many as a preference for the US to strike deals instead of imposing the higher rate tariffs, and has lifted financial markets. Although the geopolitical landscape clearly remains fluid, especially in relation to tariff policies, this lift to financial markets provides an important ray of hope to watch in the flash PMIs, whereby improving financial conditions could feed through to stronger global services growth, helping offset some of the tariff-related headwinds.

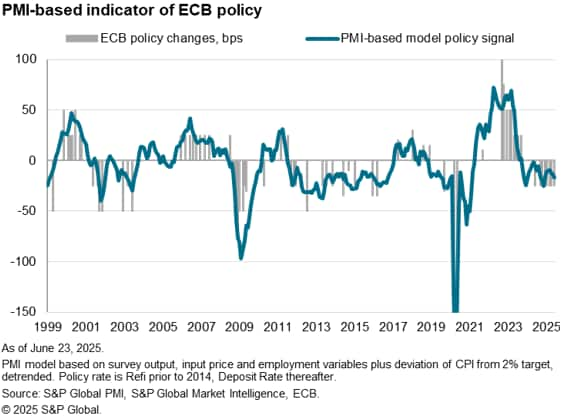

The flash PMIs will be especially closely watched in the eurozone, as the ECB announces its policy decision on the same day. A rate cut is not anticipated but markets will be eager to see the door being left open for a rate cut in September. Although inflation in the eurozone is running at the ECB's 2% target, and policymakers are concerned about the fragility of growth, the ECB's Deposit Rate has already been trimmed to what is considered to be a broadly "neutral" level of 2%, setting a high bar for further policy easing.

Flash PMIs are updated after tentative uplifts were seen in the UK, Japan and eurozone in June, albeit still underperforming the US.

The ECB is leaning toward another cut to interest rates amid weak growth and uncertainty over inflation, but is likely to wait until September before making a move.

Chris Williamson, Chief Business Economist

Jingyi Pan, Economics Associate Director

S&P Global Market Intelligence

Key diary events

Monday 21 July

Japan Market Holiday

New Zealand Inflation (Q2)

Hong Kong SAR Inflation (Jun)

Canada PPI (Jun)

United States CB Leading Index (Jun)

Canada BoC Business Outlook Survey

Tuesday 22 July

South Korea PPI (Jun)

New Zealand Balance of Trade (Jun)

Australia RBA Meeting Minutes

Malaysia Inflation (Jun)

Taiwan Export Orders (Jun)

Mexico Retail Sales (May)

Wednesday 23 July

South Korea Consumer Confidence (Jul)

Singapore Inflation (Jun)

South Africa Inflation (Jun)

Taiwan Industrial Production (Jun)

Taiwan Retail Sales (Jun)

Canada New Housing Price Index (Jun)

United States Existing Home Sales (Jun)

Thursday 24 July

Australia S&P Global Flash PMI, Manufacturing & Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea Business Confidence (Jul)

South Korea GDP (Q2, adv)

Australia RBA Bulletin

Germany GfK Consumer Confidence (Aug)

France Business Confidence (Jul)

Eurozone ECB Interest Rate Decision

Canada Retail Sales (Jun)

United States Chicago Fed National Activity Index (Jun)

United States New Home Sales (Jun)

Friday 25 July

United Kingdom Gfk Consumer Confidence (Jul)

Japan Tokyo CPI (Jul)

Thailand Balance of Trade (Jun)

Singapore Industrial Production (Jun)

United Kingdom Retail Sales (Jun)

Germany Ifo Business Climate (Jul)

Italy Business Confidence (Jul)

United States Durable Goods Orders (Jun)

Sunday 27 July

China (Mainland) Industrial Profits (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI data release for July

The flash PMI data for July will be released on Thursday July 24th for major developed economies and India. Indications of an inventory-led acceleration in global growth was observed in June ahead of the tariff deadline previously anticipated in early July. With the further delay of the tariff implementation to August 1st, but with higher-than-expected tariffs announced for some countries, July's flash PMI data will be in focus for insights into the changes in economic conditions, especially across measures of demand, output and prices. This is in addition to tracking the Future Output Index for an update on business confidence.

Americas: Fed comments, US existing and new home sales, durable goods orders data; BoC Business Outlook Survey and Canada retail sales figures

A series of appearances by Fed members will be closely watched in the coming week as uncertainty lingers over the outlook for the economy and interest rates. On the data front, US existing and new home sales plus durable goods orders data will shed light on growth momentum in the US.

Bank of Canada's business outlook survey will also be published at the start of the week with the most recent S&P Global Canada PMI data indicating subdued confidence at the end of the second quarter of 2025.

EMEA: ECB meeting; UK retail sales; Germany GfK consumer confidence, Ifo survey

The European Central Bank (ECB) convenes for their July meeting in the new week with the consensus pointing to interest rates on hold. With rates viewed to be close to "neutral", the ECB is expected to lower rates only once more in 2025, most likely at the September meeting. Indications from the HCOB Eurozone PMI, compiled by S&P Global, currently suggest muted inflation in the coming months alongside only modest growth.

Beside flash PMIs, other key releases due from Europe include UK retail sales and German sentiment updates.

APAC: RBA meeting minutes; South Korea GDP; New Zealand, Hong Kong SAR, Singapore, Malaysia inflation

Meeting minutes from the July Reserve Bank of Australia meeting where rates were kept on hold unexpectedly will be scrutinised in the coming week.

A series of tier-1 data will also be published across APAC in the new week, including South Korea's advance Q2 GDP and inflation data from across the region.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-july-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-july-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+21+July+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-july-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 21 July 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-july-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+21+July+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-july-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}