Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 11, 2025

Week Ahead Economic Preview: Week of 14 July 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Tariff impact on inflation and growth under scrutiny

A raft of top tier economic data plus the start of the earnings season will provide important indications of the health of the US economy in the week ahead. GDP data will also give a timely update on the resilience of the mainland Chinese economy while UK inflation numbers will be assessed for policy implications.

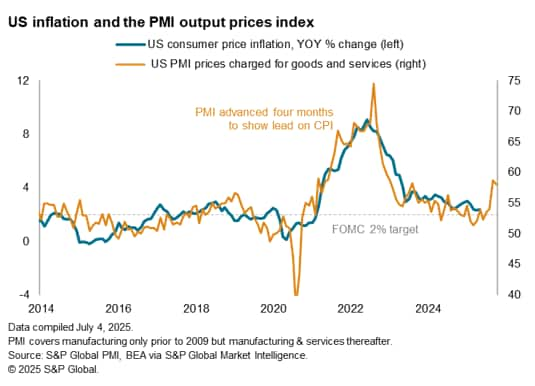

Markets are expecting US inflation to have accelerated in June on the back of tariff-related price rises. Headline and core consumer price inflation rose just 0.1% in May, but these rates are anticipated to have lifted to 0.3% in June according to Reuters consensus. Producer prices are likewise expected to show a pick up, reflecting rising cost trends evident in the business survey data over the past two months. Higher inflation will encourage FOMC policymakers to hold off cutting interest rates, though two rate cuts are widely anticipated by the end of the year as the initial uplift in inflation from tariffs fades and the economy slows. However, lower than expected readings will pile pressure on the FOMC to deliver earlier rate cuts.

The health of the US economy will also be gauged via retail sales, industrial production and inventory data. Sales are likely to have risen after a sharp (0.9%) fall in May, and industrial output to have steadied after having also fallen 0.3% in May. Inventories meanwhile likely rose as firms stockpiled goods ahead of tariff-related price concerns.

The pace of economic growth in mainland China over the second quarter, a period typified by heightened tariff uncertainty, will meanwhile come under scrutiny. Markets are expecting GDP growth to have slowed from an annual pace of 5.4% to 5.2%. Higher frequency monthly industrial production and retail sales data will also be released to give a more detailed insight into how growth drivers in the economy are evolving after government stimulus measures were implemented during June.

Similarly, the impact of recent tariff changes will be sought from eurozone industrial production numbers.

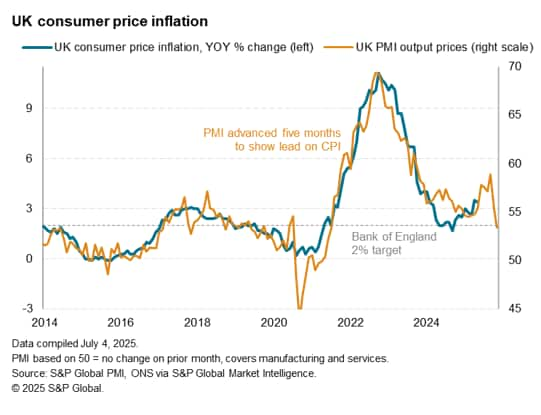

Clues as to the next policy move from the Bank of England will meanwhile be sought from the latest inflation numbers. Consumer price inflation was running at an above target 3.5% in May, with policymakers keen to see if recent hikes in the minimum wage and National Insurance contributions could feed through to stickier inflation. The policy impact on the jobs market will also be highlighted by the latest monthly recruitment survey data in the UK.

Consumer price data are updated for the US and UK in the coming week. Tariff-related price increases mean that inflation pressures have intensified in the US, according to PMI survey data, but moderated in the UK.

Key diary events

Monday 14 July

Japan Machinery Orders (May)

Singapore GDP (Q2, adv)

China (Mainland) New Yuan Loans, M2, Loan Growth (Jun)

Japan Industrial Production (May, final)

India Inflation (Jun)

United Kingdom KPMG/REC Report on Jobs* (Jun)

Tuesday 15 July

Australia Westpac Consumer Confidence (Jul)

China (Mainland) GDP (Q2)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment (Jun)

China (Mainland) Unemployment Rate (Jun)

China (Mainland) House Price Index (Jun)

Indonesia Trade (Jun)

India Trade (Jun)

Spain Inflation (Jun, final)

Eurozone Industrial Production (May)

Eurozone ZEW Economic Sentiment Index (Jul)

Germany ZEW Economic Sentiment Index (Jul)

Canada Inflation (Jun)

United States CPI (Jun)

United States NY Empire State Manufacturing Index (Jul)

Wednesday 16 July

United Kingdom Inflation (Jun)

United Kingdom Bellwether Report* (Jun)

Indonesia BI Interest Rate Decision

Italy Inflation (Jun, final)

Eurozone Balance of Trade (May)

United States PPI (Jun)

United States Industrial Production (Jun)

Thursday 17 July

Japan Balance of Trade (Jun)

Singapore Non-Oil Domestic Exports (Jun)

Australia Employment (Jun)

United Kingdom Labour Market Report (May)

Eurozone Inflation (Jun, final)

United States Retail Sales (Jun)

United States Business Inventories (May)

United States NAHB Housing Market Index (Jul)

Friday 18 July

Japan Inflation (Jun)

Malaysia GDP (Q2, prelim)

Germany PPI (Jun)

Spain Balance of Trade (May)

United States Building Permits (Jun, prelim)

United States UoM Sentiment (Jul, prelim)

Sunday 20 July

China (Mainland) Loan Prime Rate (Jul)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, retail sales, industrial production, building permits and UoM sentiment figures, Fed comments; Canada inflation

The data highlight going into mid-July will be inflation numbers out of the US, with the focus remaining on the impact of tariffs. Latest S&P Global US PMI data revealed that selling price inflation had been especially elevated in May and June, hinting at a higher CPI trend. Additionally, retail sales and industrial production figures will be released for June. The former is expected to reflect a positive reading with a solid rise in services activity, according to PMI data, while the latter may indicate a renewed improvement following a rebound in the S&P Global US Manufacturing PMI output index to signal the highest growth in four months. US building permits and the University of Michigan sentiment data will also be published in a week filled with appearances by Fed members to watch.

Separately, Canada publishes June inflation data. According to S&P Global Canada PMI price data, which preludes the trend for CPI, inflationary pressures heightened at the end of the second quarter to the greatest degree in over a year.

EMEA: UK inflation and labour market report; Germany ZEW index

The UK releases inflation data for June, coming after the latest June S&P Global UK PMI signalled softening price pressures. Average charges, taking into account both manufacturing and service sectors, increased at the softest pace since February 2021 to hint at easing inflationary pressures in the months ahead for the UK. Meanwhile UK labour market data will be published on Thursday via the KPMG/REC Report on Jobs, compiled by S&P Global Market Intelligence and published on Monday. Broad indications from the PMI survey so far indicated a still-subdued labour market situation, with further job shedding observed.

APAC: Mainland China GDP and activity; Japan inflation and trade data; Australia jobs report; BI meeting

In APAC, mainland China's Q2 GDP and June industrial production and retail sales data will be in focus for a check on economic conditions at the end of the quarter. Average growth in the second quarter softened compared to Q1, according to the Caixin China PMI Output data.

Additionally, Japan's inflation and trade numbers plus Australia's employment data will be key updates to track. A central bank meeting also takes place in Indonesia with further rate cuts on the table going into the second half of 2025.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-july-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-july-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+14+July+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-july-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 14 July 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-july-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+14+July+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-july-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}