Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 01, 2025

Top five economic takeaways from March's manufacturing PMI data as tariff worries intensify

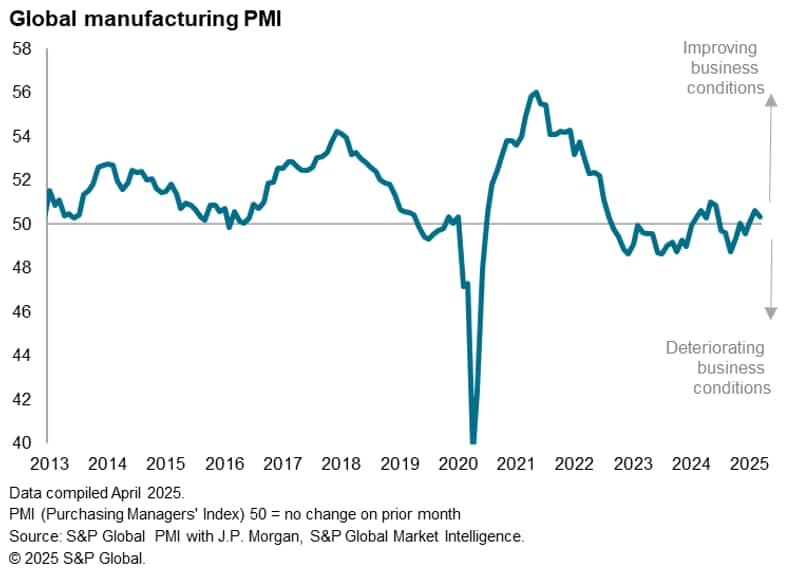

The global manufacturing sector remained only just in expansion territory in March. While signalling improved economic conditions for a third successive month, at 50.3, down from 50.6 in February, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, indicated only a very modest rate of improvement to point to a largely moribund global factory sector.

Here are our top five takeaways from March's manufacturing PMI survey sub-indices, which provide a deeper insight into business conditions.

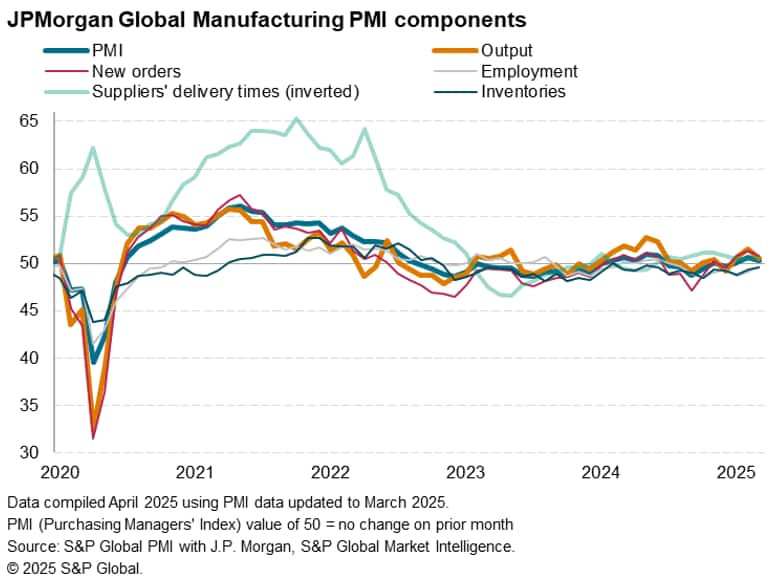

1. PMI held back by all five components

All five components on the PMI either acted as reduced growth drivers or as drags on the PMI.

Growth of production and new orders, which carry the highest weights in the PMI, moderated to register only slight expansions in March. Supplier delivery times also provided a reduced positive contribution to the PMI. Employment and inventories (of purchases inputs) meanwhile fell, albeit at only marginal rates.

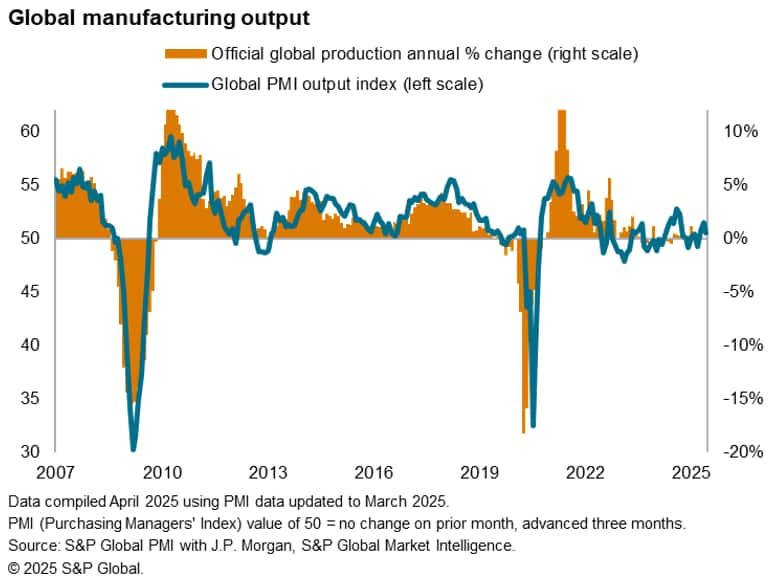

2. Global production growth loses momentum into March

The PMI survey's sub-index of production, which tracks reported month-on-month changes in factory output, signalled a third successive monthly rise in output in March. Although rounding off the best quarter since the second quarter of last year, the latest rise was only modest, and below that seen in the prior two months.

The overall rate of expansion hence remains lacklustre, and equivalent to global production having grown at a modest annual rate of just below 1% in the first quarter, losing momentum into March.

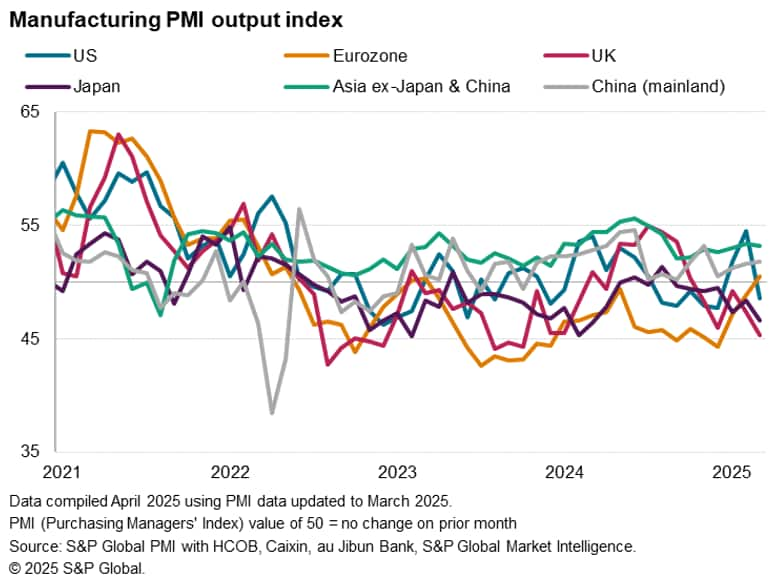

3. Asian production rises on export gains but US falls into decline

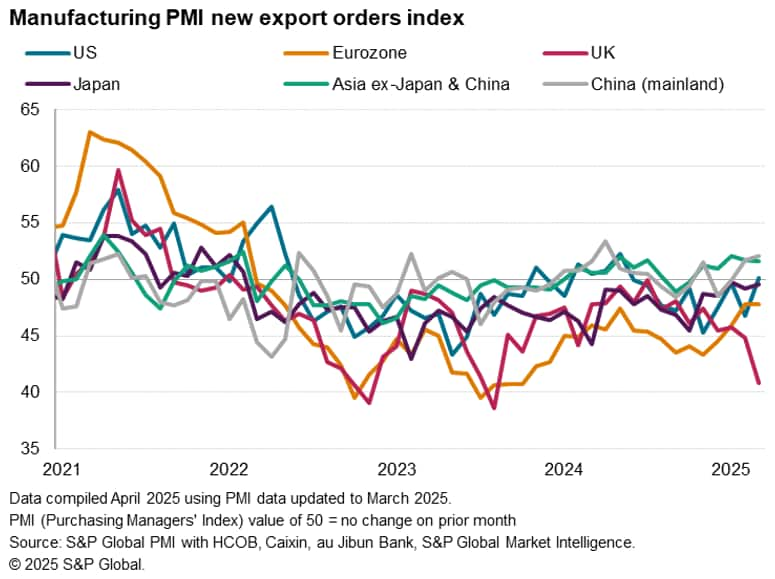

Trends varied markedly among the major economies. Especially steep - and deepening - downturns were seen in both Japan and the UK, where production declines were the largest recorded for 12 and 17 months respectively as companies commonly citing deteriorating demand environments both at home and abroad. UK exports notably fell at a pace not seen for over one-and-a-half years.

Output also fell into decline in the US after two months of expansion at the start of the year, with producers reporting a waning impact from the front-running of tariffs earlier in the year, as well as a weakening of domestic demand.

Output in Canada meanwhile fell at the sharpest rate for 15 months as export orders slumped at a rate not seen since May 2020. Mexican factory output showed the largest slump since July 2022 as producers reported the sharpest export orders decline since March 2021.

There was better news from the eurozone and the rest of Asia. Eurozone factory output rose for the first time in two years as companies reported improving domestic demand and some cooling of export losses in recent months compared to that seen through much of the prior three years. Export gains were linked in some cases to firms seeking to beat potential tariffs. Similarly, production growth in mainland China's factories hit a four-month high, with export orders growth at an 11-month high.

Production in the rest of Asia meanwhile continued to expand at a robust pace, losing only a little momentum in March as companies continued to see rising export sales. The rise in export orders from Asia (excluding Japan and mainland China) over the first three months of 2025 has been the strongest quarterly gain since the second quarter of 2021.

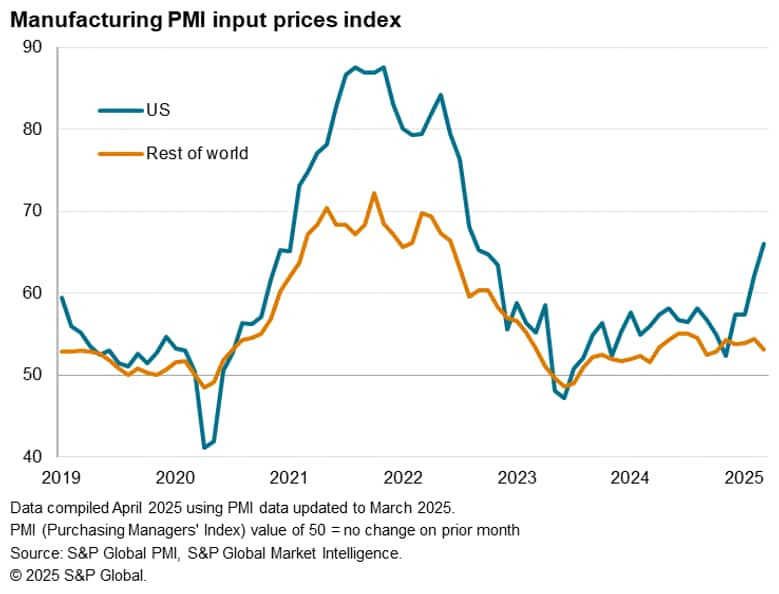

4. US reports especially strong cost growth

While manufacturers outside of the US collectively reported the slowest input cost growth in five months in March, US producers reported the steepest rise since August 2022. Higher raw material and input prices in the US were commonly blamed on suppliers pushing through tariff-related hikes across a broad spectrum of materials, as well as higher wage costs.

Input prices meanwhile rose at reduced rates in all other major economies with the exception of a slightly increased, though still modest rate in the eurozone. Prices paid by producers in mainland China in fact fell slightly, often linked to increased competition amid sluggish demand.

5. Manufacturing sentiment hit by tariffs

The March data were collected prior to the announcement of new auto sector tariffs from the US in late March, and preceded President Trump's so-called "liberation day" announcements of further tariffs due on 2nd April. Sentiment among manufacturers about output growth in the year ahead was nevertheless heavily influenced by concerns over the potential impact of US tariffs and any responses from trading partners. Business expectations consequently fell globally to their lowest since December, though with some marked variations around the world.

Having risen to a near-three-year high at the start of the year, optimism among US manufacturers lost further ground in March as producers cited concern over weakening domestic demand, high prices and tariff uncertainty, albeit with confidence still running slightly above its long-run average. Sentiment also remained above its long-run average in the eurozone, in marked contrast to the worrying weakness seen throughout much of last year, buoyed in part by hopes of economic recovery within the region.

Sentiment meanwhile slipped further below long run averages in mainland China, Asia (excluding Japan and mainland China), and in the UK, the latter now in especially concerning territory. Sentiment also remained weak in Japan. In all cases, concerns over the rise of protectionism and tariffs were key drivers of caution about the year ahead.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-marchs-manufacturing-pmi-data-as-tariff-worries-intensify.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-marchs-manufacturing-pmi-data-as-tariff-worries-intensify.html&text=Top+five+economic+takeaways+from+March%27s+manufacturing+PMI+data+as+tariff+worries+intensify+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-marchs-manufacturing-pmi-data-as-tariff-worries-intensify.html","enabled":true},{"name":"email","url":"?subject=Top five economic takeaways from March's manufacturing PMI data as tariff worries intensify | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-marchs-manufacturing-pmi-data-as-tariff-worries-intensify.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+economic+takeaways+from+March%27s+manufacturing+PMI+data+as+tariff+worries+intensify+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-marchs-manufacturing-pmi-data-as-tariff-worries-intensify.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}