Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 28, 2025

Week Ahead Economic Preview: Week of 31 March 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide PMI and US payrolls in focus amid tariff updates

Markets will be busy in the coming week assessing new tariff announcements from the US as well as worldwide PMI survey data covering both manufacturing and services, as well as the monthly US jobs report.

The major news event of the week is scheduled for 2 April, which will see the US outline the tariffs it will impose on trading partners in addition to those already announced. While President Donald Trump's so-called 'Liberation Day' is expected see a significant increase in the overall tariff burden, many are hoping that it will at least add some clarity to the US administration's trade policy to help business planning and forecasting. Insights into the degree to which trading partners respond will also be eagerly awaited.

In terms of economic data, the worldwide PMI surveys will give up-to-date feedback from businesses about the impact of recent developments. As well as updates to actual business levels, including output, employment and pricing, a key area of interest will be business confidence via the PMI's forward-looking business expectations indices.

A review of the preliminary 'flash' PMI data from the US, Europe and Japan is available here. While these early surveys showed output growth ticking higher across the major developed economies in March, growth was uneven and has remained modest so far this year. Business sentiment about prospects has meanwhile sunk to its lowest since late 2022.

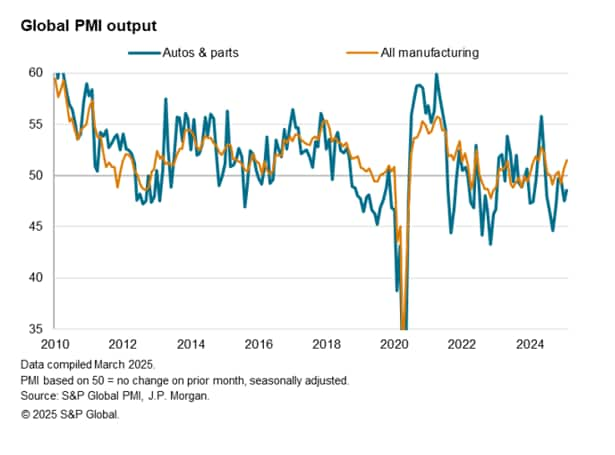

The final global PMI data will add colour in particular via the extension of survey coverage to mainland China, Canada, Mexico and other key APAC economies, as well as the sector details. February, for example, saw the global autos and parts sector already contracting sharply, even before new 25% tariffs had been announced by the US, bucking a broader manufacturing upturn.

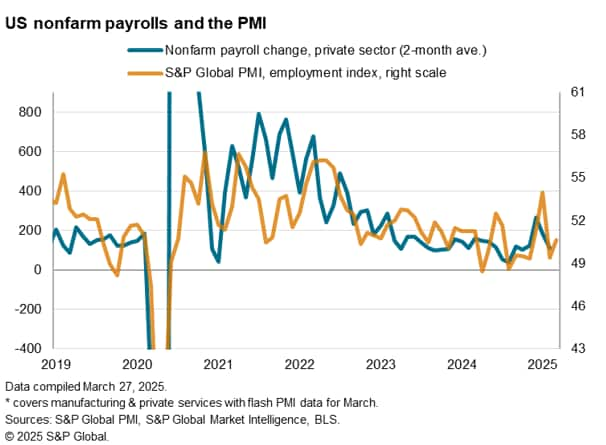

The week will by no means get less exciting as it goes on, however, as Friday is non-farm payroll day. February's payroll count disappointed with a 151k rise, and some government job cuts could depress March's reading. But we note that private sector payrolls rose by just 110k on average in the first two months of 2025, with the PMI data available so far pointing to a further sluggish rise in March. The unemployment rate meanwhile edged up from 4.0% to 4.1% in February and wage growth ticked up from 3.9% to 4.0%.

Key diary events

Monday 31 Mar

Egypt, India, Indonesia, Malaysia, Pakistan, Philippines,

Qatar, Saudi Arabia, Singapore, Türkiye, UAE Market

Holiday

South Korea Industrial Production (Feb)

Japan Industrial Production and Retail Sales (Feb)

China (Mainland) NBS PMI (Mar)

Germany Retail Sales (Feb)

United Kingdom Mortgage Lending and Approvals (Feb)

Italy Inflation (Mar, prelim)

Germany Inflation (Mar, prelim)

India Current Account (Q4)

United States Dallas Fed Manufacturing Index (Mar)

Tuesday 1 Apr

Egypt, Indonesia, Kuwait, Malaysia, Pakistan, Qatar, Saudi

Arabia Türkiye, UAE Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Mar)

Japan Unemployment Rate (Feb)

Japan Tankan Survey (Q1)

South Korea Exports (Mar)

Australia Retail Sales (Feb)

Australia RBA Interest Rate Decision

United Kingdom Nationwide Housing Prices (Mar)

Eurozone Inflation (Mar, flash)

Eurozone Unemployment Rate (Feb)

United States ISM Manufacturing PMI (Mar)

United States JOLTs Job Openings (Feb)

Wednesday 2 Apr

Indonesia, Kuwait, Pakistan, Qatar, Saudi Arabia Market

Holiday

South Korea Inflation (Mar)

ASEAN Manufacturing PMI* (Mar)

India HSBC Manufacturing PMI* (Mar)

Brazil Industrial Production (Feb)

United States ADP Employment Change (Mar)

United States Factory Orders (Feb)

Thursday 3 Apr

Indonesia, Taiwan Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* (Mar)

S&P Global Sector PMI* (Mar)

Australia Trade Balance (Feb)

Switzerland Inflation (Mar)

Philippines BSP Interest Rate Decision

Türkiye Inflation (Mar)

Canada Trade (Feb)

United States Trade (Feb)

United States ISM Services PMI (Mar)

Friday 4 Apr

China (Mainland), Hong Kong SAR, Indonesia, Taiwan Market

Holiday

India HSBC Services PMI* (Mar)

Germany Factory Orders (Feb)

Eurozone HCOB Construction PMI* (Mar)

United Kingdom S&P Global Construction PMI* (Mar)

Canada Unemployment Rate (Mar)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly

Earnings (Mar)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing and services PMI

Global manufacturing PMI will be updated on 1 April, while services and composite numbers will be due 3 April. Additionally to the national PMIs, detailed sector data will provide insights into the key drivers of changes to economic conditions. Growth, confidence and inflation metrics will be closely watched after developed economies' flash PMI revealed opposing trends in March.

Americas: US labour market report, ISM PMI, plus trade data; Canada trade and employment figures

March US non-farm payrolls, wages and unemployment data will be released on Friday for official signals of labour market conditions after US Flash PMI revealed that employment returned to growth after falling in February. Final S&P Global PMI figures will also be due alongside the ISM readings for assessment growth and inflation trends at the end of the first quarter of the year. This comes after the flash data indicated a notable impact of tariffs on US goods prices in March.

Separately, Canada will also publish trade and employment figures, with trade uncertainty reported to have negatively affected production in Canada via February's PMI.

EMEA: Eurozone inflation; Germany factory orders and retail sales; UK mortgage data and housing prices

In addition to final PMI readings (including construction PMIs), the key data to watch in Europe will be eurozone inflation. According to flash figures, the PMI's main selling price index declined in March to a level broadly consistent with inflation running close to the ECB's target. If confirmed, markets will see increased scope for the ECB to lower rates further as insurance against downside risks to growth caused by tariff worries.

Germany factory orders and retail sales data will also be due with more up-to-date March HCOB Flash Germany PMI showing growth to have been buoyed by an upturn in manufacturing production.

APAC: RBA meeting, Australia trade; China NBS PMI; Japan Tankan survey, industrial production, retail sales

The Reserve Bank of Australia (RBA) convenes for their April policy meeting with the possibility of a rate cut not entirely ruled out according to latest market views. March's S&P Global Flash Australia PMI showed business activity growth at a seven-month high while inflation eased, providing little impetus for an imminent move.

On the data release front, besides the series of March APAC PMI releases, the focus will be with PMI figures from mainland China's National Bureau of Statistics and Japan's Tankan survey.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-31-march-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-31-march-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+31+March+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-31-march-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 31 March 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-31-march-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+31+March+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-31-march-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}