Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 03, 2025

US sees highest manufacturing input price inflation worldwide in March, accompanied by falling output across North America

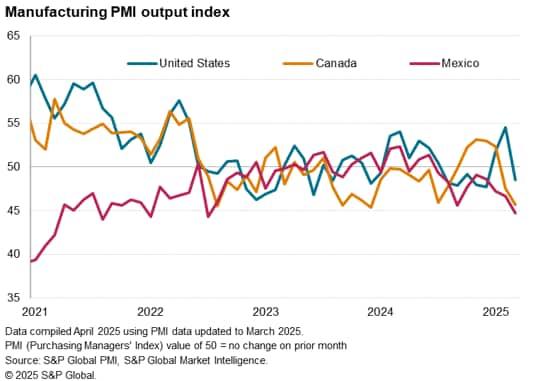

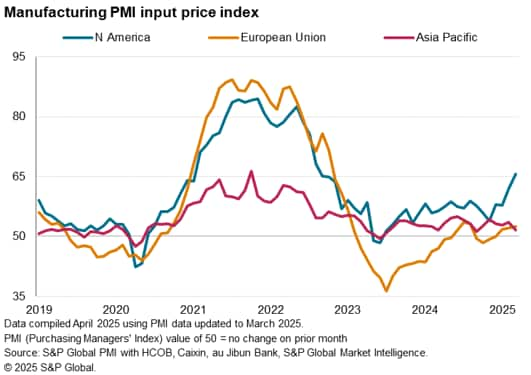

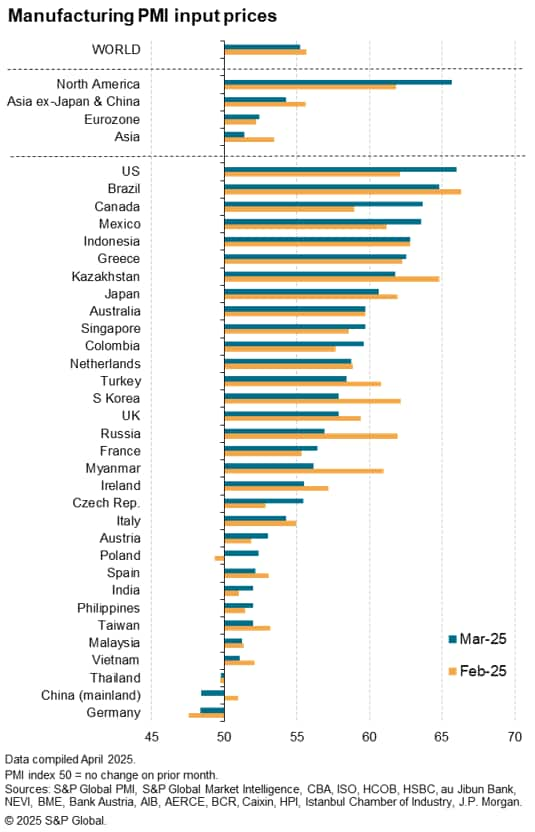

Manufacturing output fell across North America in March at one of the steepest rates seen over the past two years, according to PMI survey data compiled by S&P Global, with broad-based production loses in the US, Canada and Mexico. Prices paid for inputs also rose sharply. US factory input cost inflation in fact exceeded that seen in all 33 economies surveyed by S&P Global for the first time since 2008.

Production falls across North America…

All three North American economies reported lower manufacturing output in March, bucking a broader global expansion of output, with companies widely attributing falling output to tariff-related issues.

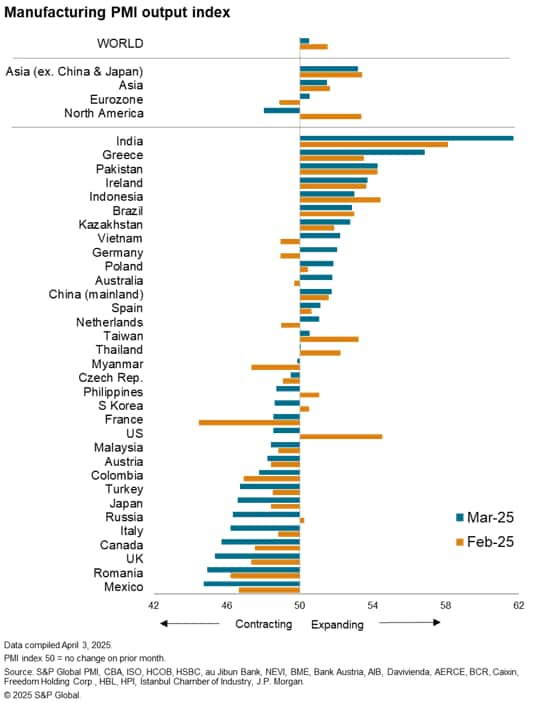

Factory production declined for a ninth successive month in Mexico, with the rate of contraction accelerating to the highest since July 2022. Output meanwhile fell in Canada for a second consecutive month, deteriorating at the sharpest pace since December 2023. Mexico's fall in output was in fact the sharpest of all 33 economies surveyed by S&P Global's PMIs, while Canada's decline was the fourth-largest.

These declines were accompanied by a renewed fall in US factory output, attributed by companies to falling demand and a waning impact from the front-running of tariffs earlier in the year.Manufacturing output fell across North America in March at one of the steepest rates seen over the past two years, according to PMI survey data compiled by S&P Global, with broad-based production loses in the US, Canada and Mexico. Prices paid for inputs also rose sharply. US factory input cost inflation in fact exceeded that seen in all 33 economies surveyed by S&P Global for the first time since 2008.

… contrasting with growth in other regions

Collectively, manufacturing output consequently fell in North America at the fastest rate since last September, and the second-fastest rate since June 2023.

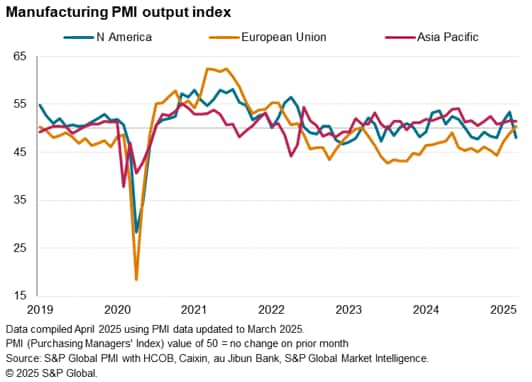

The drop in North American output contrasted with rising output in other major regions.

Asia Pacific (APAC) manufacturers continued to report the strongest regional output gain, led by India, though particularly robust gains were also seen in Pakistan and Indonesia. APAC growth was held back, however, by falling output in Japan, Myanmar, Malaysia, South Korea and the Philippines, keeping the rate of expansion below the average seen throughout 2024.

EU output edged back into growth territory amid a rise in eurozone output, posting the largest increase for nearly three years. Greece and Ireland reported especially notable gains, alongside revived growth in Germany.

US sees steepest price rises

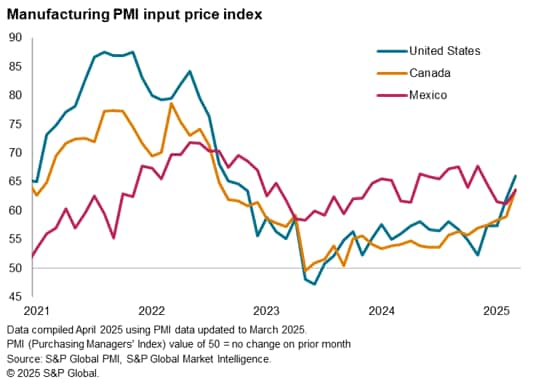

At the same time as reporting lower output, producers across North America also reported higher costs. Manufacturers' input cost inflation accelerated especially sharply in the US, to the highest since August 2022, and also rose in Mexico and Canada to the highest since last December and August 2022 respectively.

The rise in US input costs was the steepest recorded of all 33 economies surveyed by S&P Global in March, while the Canadian and Mexican increases were the third and fourth largest respectively. This is the first time since June 2008 that the US has led the manufacturing input cost rankings in S&P Global's survey history.

Collectively across North America, factory input costs rose at the fastest pace since August 2022, contrasting with only very modest rates of inflation in the EU and APAC.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sees-highest-manufacturing-input-price-inflation-worldwide-in-march-accompanied-by-falling-output-across-north-america-Apr25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sees-highest-manufacturing-input-price-inflation-worldwide-in-march-accompanied-by-falling-output-across-north-america-Apr25.html&text=US+sees+highest+manufacturing+input+price+inflation+worldwide+in+March%2c+accompanied+by+falling+output+across+North+America+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sees-highest-manufacturing-input-price-inflation-worldwide-in-march-accompanied-by-falling-output-across-north-america-Apr25.html","enabled":true},{"name":"email","url":"?subject=US sees highest manufacturing input price inflation worldwide in March, accompanied by falling output across North America | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sees-highest-manufacturing-input-price-inflation-worldwide-in-march-accompanied-by-falling-output-across-north-america-Apr25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+sees+highest+manufacturing+input+price+inflation+worldwide+in+March%2c+accompanied+by+falling+output+across+North+America+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-sees-highest-manufacturing-input-price-inflation-worldwide-in-march-accompanied-by-falling-output-across-north-america-Apr25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}