Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 06, 2025

Tech and financial services power stronger US output growth in July

A jump in US business activity was witnessed via the S&P Global PMI data for July. Growth hit the highest seen so far this year. However, the upturn was uneven, being fueled largely by tech and financial services, with large swathes of the economy struggling to grow amid heightened uncertainty. Business confidence in the year ahead has sunk to one of the lowest levels seen over the past three years amid concerns over government policy and the impact of tariffs, the latter of concern in particular in relation to inflation. Average prices charged for goods and services rose in July at the sharpest rate for three years.

Strong start to third quarter

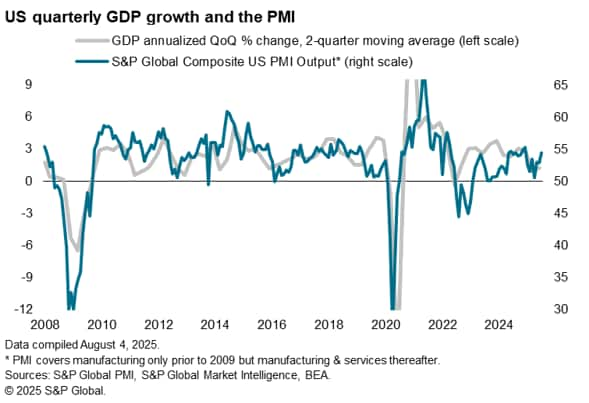

A strong rise in service sector business activity helped offset a slowdown in the manufacturing sector in July, signaling encouragingly robust economic growth at the start of the third quarter. The S&P Global US PMI Composite Output Index rose from 52.9 in June to 55.1 in July. The latest reading signalled the fastest rate of growth recorded so far this year, with output having now grown continually for 30 months.

While GDP has risen at an average 1.25% pace over the first half of 2025, July's PMI is indicative of growth doubling to about 2.5%.

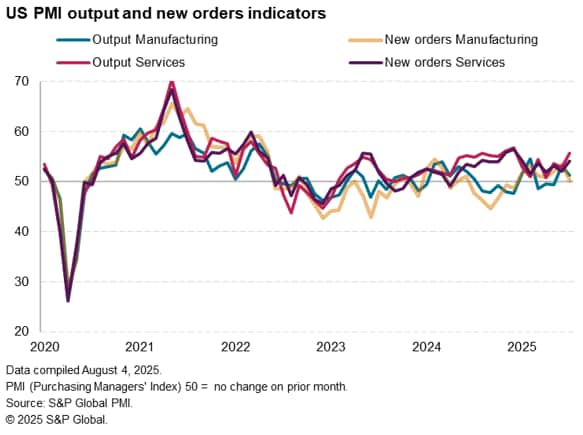

Service sector drives expansion

While service sector growth accelerated sharply to the fastest since last December, buoyed by the largest rise in new business since January, manufacturing output growth slowed as new orders growth almost stalled. The marginal rise in new orders placed at factories was the smallest recorded so far this year.

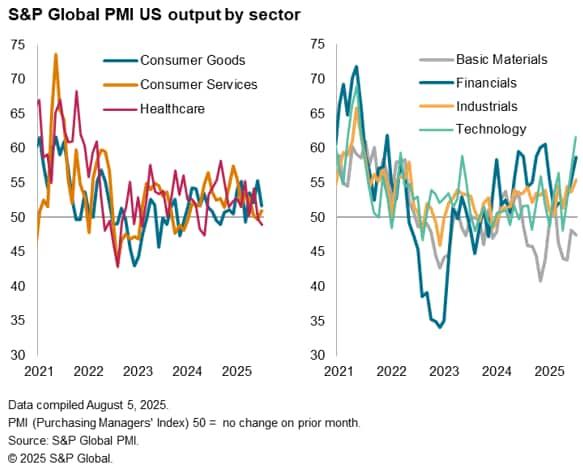

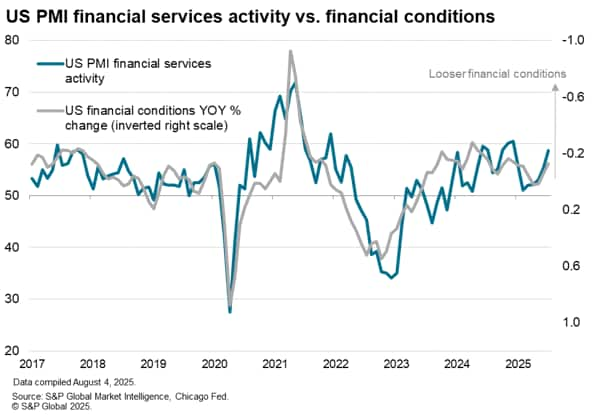

Digging into further detail, July's expansion was driven by surging demand in the tech sector alongside rising financial services activity. Tech sector activity rose at the fastest rate recorded since June 2021, while financial services activity grew at the sharpest rate seen so far this year to register one of the best gains since the pandemic.

The accelerating growth of financial services was linked to improving financial conditions, fueled in turn partly by recent stock market gains. Equity indices such as the S&P 500 have been hitting all-time highs in recent sessions, and measures of the financial environment, such as those compiled by the Federal Reserve of Chicago, have been indicating some of the most supportive conditions seen over the past three years.

Industrials have also picked up, reporting the largest jump in activity for just over three years in July, though these firms reported only a modest upturn in customer demand to suggest some of this upturn may lose momentum.

Meanwhile, falling exports of services, which includes spending in the US by tourists and corporates, acted as a drag on growth alongside subdued demand from consumers more broadly. Consumer services activity consequently barely rose in July, rounding off the worst three months for this sector recorded over the past year and a half.

In the manufacturing sector, output of consumer goods grew at a reduced rate amid a combined effect of low consumer confidence and inventory adjustment, the latter also having an especially notably impact on the basic materials sector, where output fell for a fifth straight month.

Optimism sinks lower

The upturn therefore seems to be largely driven by financial market gains and tech sector investment, with other large parts of the economy struggling, often linked to heightened uncertainty and the adverse impact on demand caused by recent government policy changes.

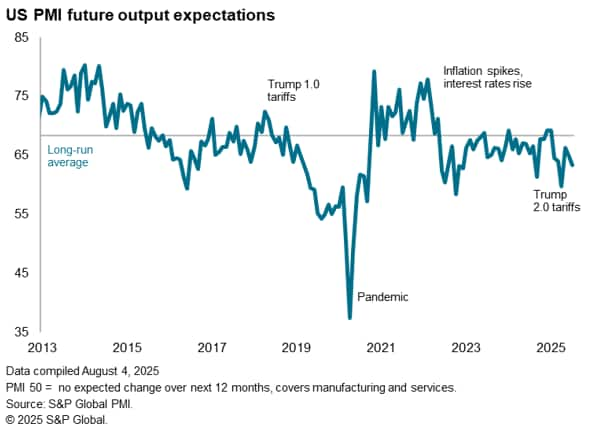

Measured overall, the survey's future output expectations index remained above April's recent low but registered the second-lowest level of optimism recorded since the lead up to the presidential Election last September. Prior to that, this level of relative gloom has not been seen since July 2022.

By sector, by far the darkest outlook is evident for consumer services firms, where sentiment is now at its lowest since the early months of the pandemic, while tech firms are the most optimistic. The steepest falls in sentiment in July were meanwhile recorded in the consumer goods and basic materials sectors.

Price hikes dampen optimism, stoke inflation worries

An additional factor dampening optimism in July was the inflation environment, with firms concerned about the impact of rising input prices on margins and demand.

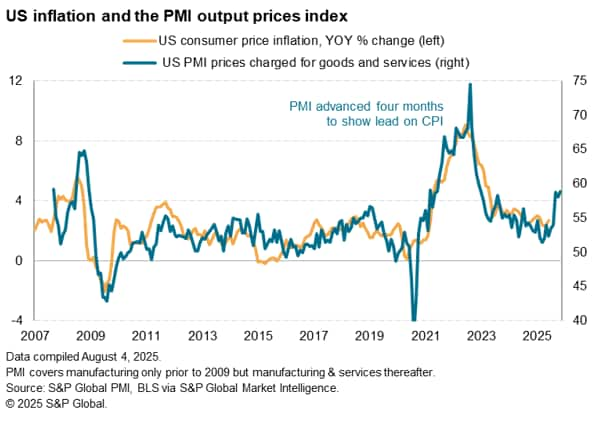

Across goods and services, input costs rose sharply in July, posting one of the largest increases recorded over the past two-and-a-half years, which fed through to the largest jump in average selling prices recorded since August 2022. At recent levels, the PMI selling price index is broadly indicative of consumer price inflation rising at an annual rate of over 4%, and certainly well above levels consistent the central bank's 2% target.

Steep price growth was recorded across goods and services, widely linked first and foremost to higher import price associated with tariffs, as well as the inflationary impact of the weakened exchange rate and rising labor costs.

Access the latest services press release here and the sector PMI release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftech-and-financial-services-power-stronger-us-output-growth-in-july-aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftech-and-financial-services-power-stronger-us-output-growth-in-july-aug25.html&text=Tech+and+financial+services+power+stronger+US+output+growth+in+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftech-and-financial-services-power-stronger-us-output-growth-in-july-aug25.html","enabled":true},{"name":"email","url":"?subject=Tech and financial services power stronger US output growth in July | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftech-and-financial-services-power-stronger-us-output-growth-in-july-aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tech+and+financial+services+power+stronger+US+output+growth+in+July+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftech-and-financial-services-power-stronger-us-output-growth-in-july-aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}