Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 06, 2025

US leads global PMI selling price inflation to 26-month high in July

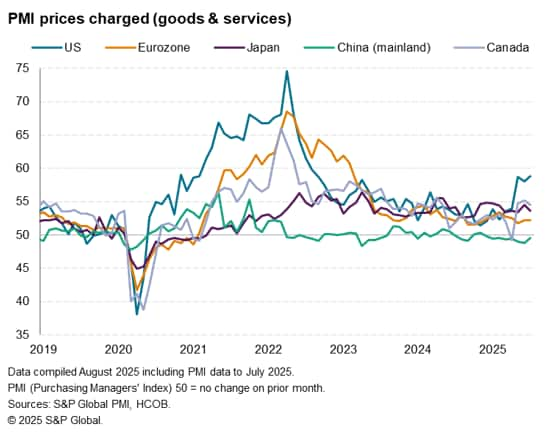

The worldwide PMI surveys - produced by S&P Global in association with ISM and IFPSM for J.P.Morgan - showed global selling price inflation rising to its highest for over two years in July, led by rising charges for goods and services in the US. The elevated US price growth was widely linked by companies to US tariffs. The steep rise in US prices recorded by the PMI over the past three months contrasts with an easing price trend in the rest of the world.

Global PMI signals rising price pressure

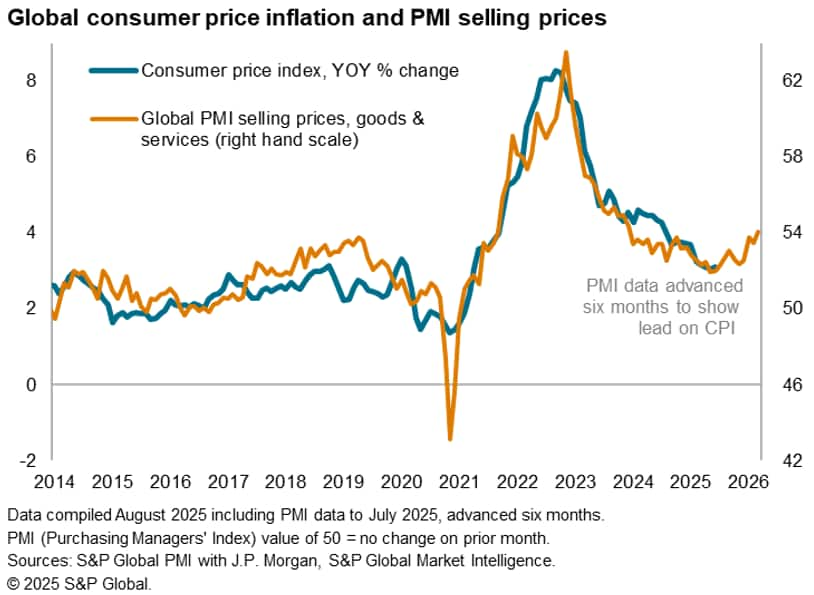

S&P Global Market Intelligence's PMI surveys indicated rising global price pressures in July. The headline J.P. Morgan PMI Global Prices Charged Index rose from 53.5 in June to 54.1 to signal the steepest rise in prices since May 2023.

Historical comparisons indicate that the index is broadly consistent with global consumer price inflation running at 4% in the coming months, up from the 3.0-3.1% rate currently being indicated by recent official data.

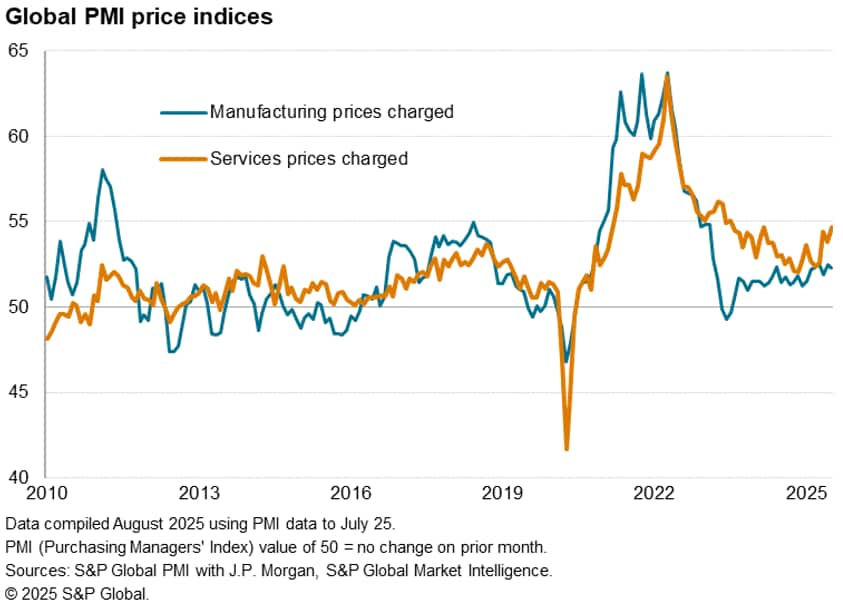

The service sector continued to be main driver of global inflation, with prices levied for services rising on average at a rate not seen since July 2023 as firms passed on higher costs to customers.

Global manufacturing price growth meanwhile remained relatively muted, with the rate of inflation easing slightly in June but remaining among the highest seen over the past two years.

US inflation spike contrasts with disinflationary trend in rest of world

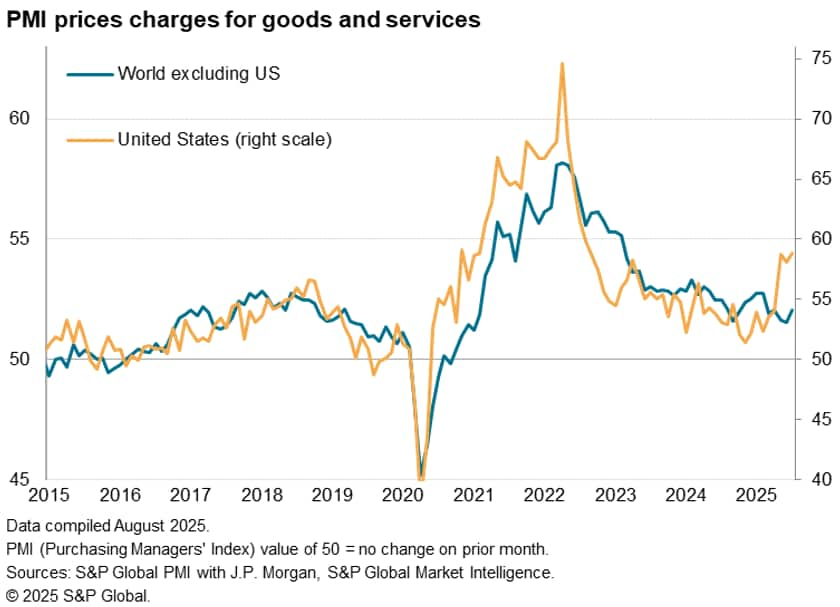

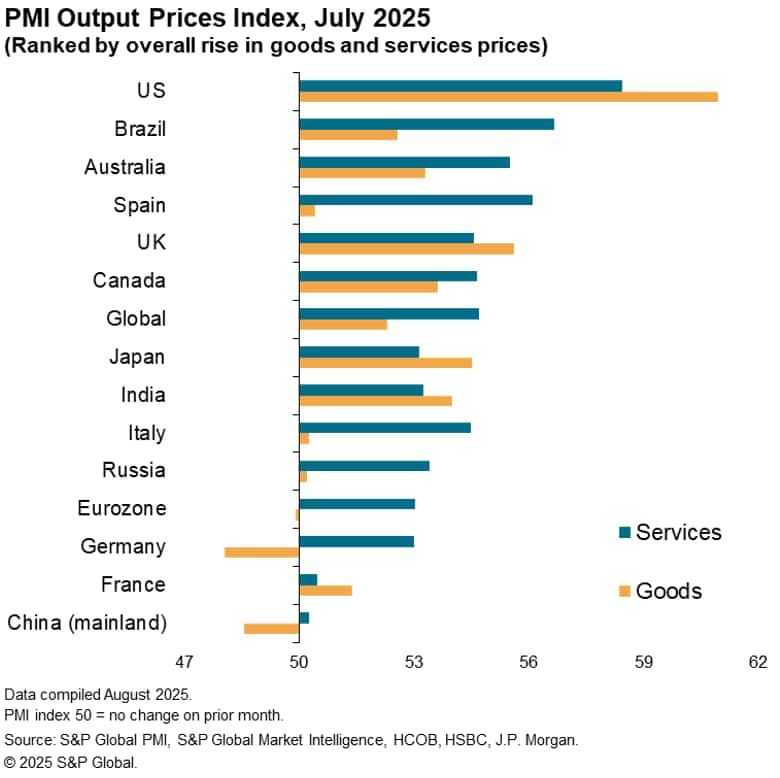

For a third month, the US stood out in reporting an especially steep rise in prices during July. Selling price inflation for goods and services in the US hit the highest since August 2022.

Measured across the rest of the world, prices rose only modestly. Whereas the average US prices charged index reading of 58.5 over the latest three months represents a large uplift in price pressures from an average of 53.6 over the prior year and a half, the rest of world latest three-month average of 51.7 is below the prior 18-month average of 52.5.

These price differential between the US and the rest of the world are even greater for manufacturing. US good prices rose especially sharply in July, the rate of inflation outpacing that of all other economies tracked by the PMI, and notably contrasting with falling goods prices in Germany and mainland China. Although below that seen in June, the July rise in US goods prices was the second-largest over the past 32 months.

However, prices charged for services also rose at a much faster rate in the US than other major economies, the rate of US inflation up to its second-highest in 27 months.

US tariff boost - to prices

Rising US prices were again widely blamed on rising costs of imports associated with tariffs, which were widely passed on to customers either partially or in full, according to the anecdotal reporting by PMI respondents. A weakened US dollar also contributed to rising costs, as did higher wage costs amid staff shortages in some areas.

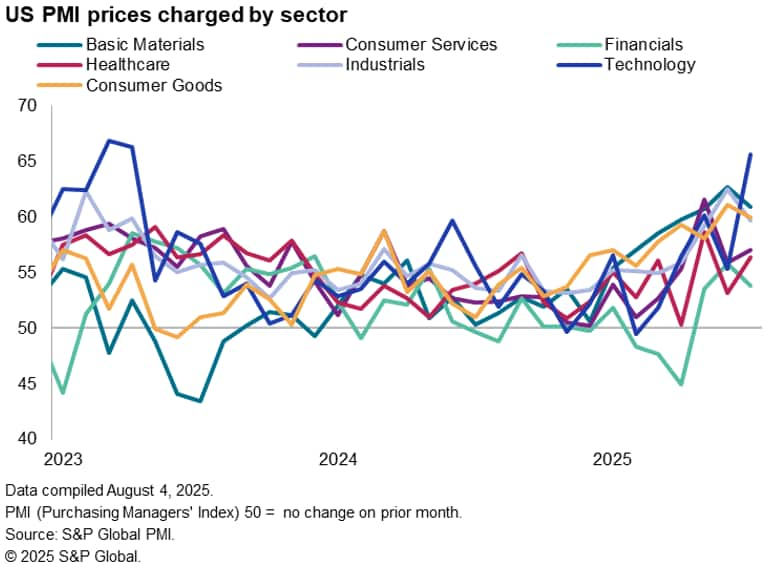

The steepest rise in prices was reported in the technology sector, where a surge in demand allowed increased pricing power. Strong rises were also reported in basic materials, consumer goods and industrials, often reflecting the pass-through of tariffs, albeit with the rate of inflation easing compared to June's recent peaks.

While the weakest price growth was recorded in financial services, July's rise was still the second-largest seen for over a year.

Comparisons with official data

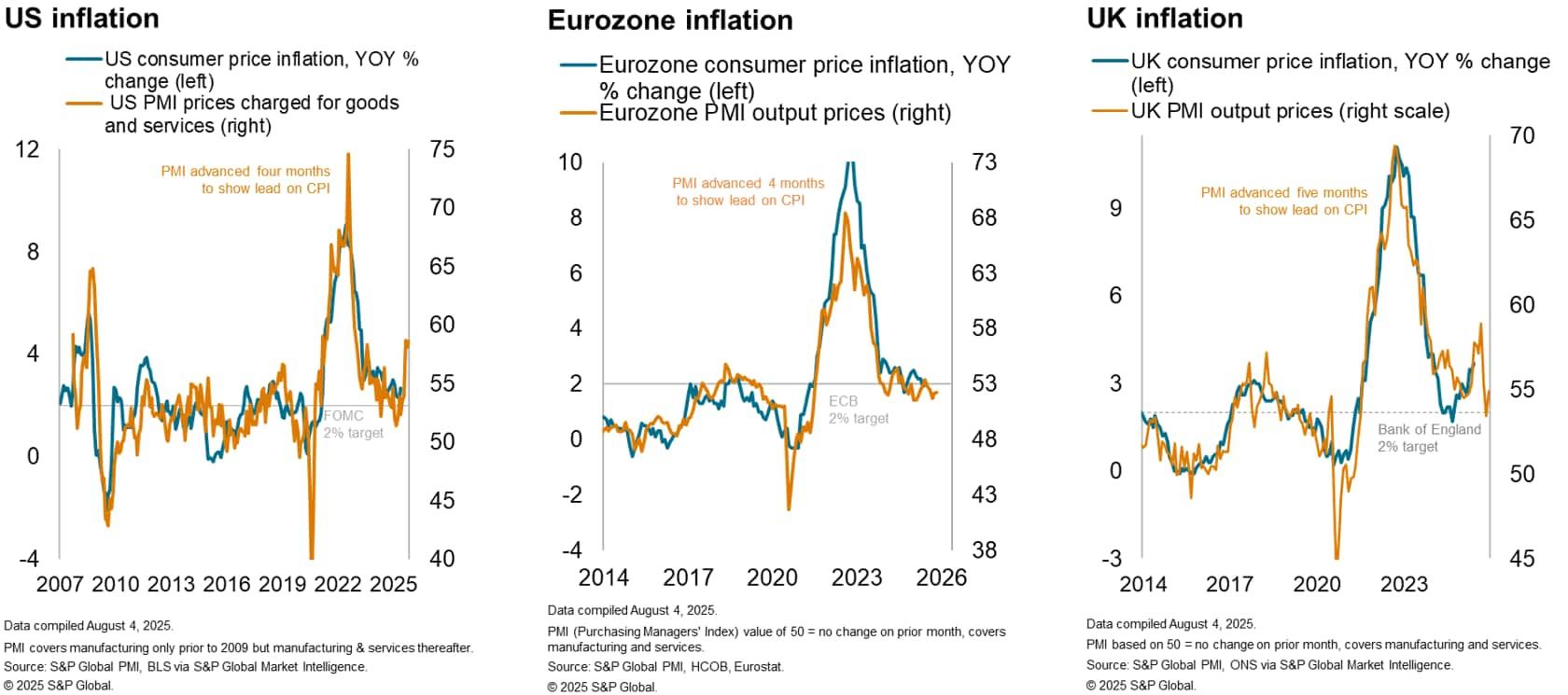

The strength of the price growth reported in the US remains broadly indicative of consumer price inflation running close to 4%, according to historical comparisons, and well above levels consistent with the central bank's 2% target.

In contrast, the equivalent PMI Prices Charged Index for the eurozone has remained relatively subdued in recent months, running at levels broadly consistent with 2% inflation.

While the UK PMI Prices Charged Index has fallen back to a level comparable with 2% consumer price inflation in June, it rose again in July to signal above target price pressures, presenting a dilemma for the Bank of England. Policymakers in the UK have been split between the need to cut interest rates to help support a flagging economy and the need to keep rates restrictive enough to quash upward price pressures associated with higher costs introduced in last autumn's Budget.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-leads-global-pmi-selling-price-inflation-to-26month-high-in-july.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-leads-global-pmi-selling-price-inflation-to-26month-high-in-july.html&text=US+leads+global+PMI+selling+price+inflation+to+26-month+high+in+July+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-leads-global-pmi-selling-price-inflation-to-26month-high-in-july.html","enabled":true},{"name":"email","url":"?subject=US leads global PMI selling price inflation to 26-month high in July | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-leads-global-pmi-selling-price-inflation-to-26month-high-in-july.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+leads+global+PMI+selling+price+inflation+to+26-month+high+in+July+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-leads-global-pmi-selling-price-inflation-to-26month-high-in-july.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}