Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 26, 2021

Supply delays and commodity price hikes stoke inflation concerns

Near-record supply chain disruption has led to fastest rise in global input prices since August 2008

Higher costs were passed through to clients at sharpest pace for over a decade in March

Shipping delays, elevated transport costs and higher commodity prices likely to feed through to household inflationary pressures during second half of 2021

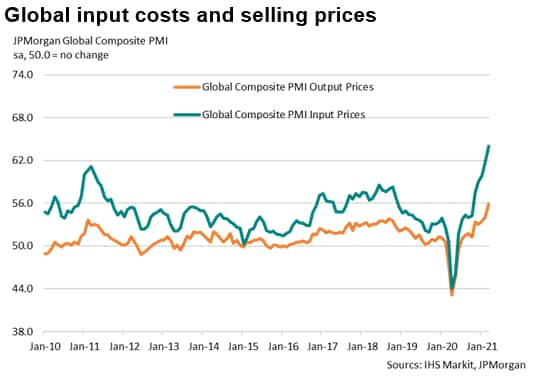

Supply chain constraints and shortages of critical materials have accompanied the recovery in global demand for goods and services, according to IHS Markit's PMI surveys. Manufacturers and service providers indicated an increased willingness to pass on steep rises in commodity prices and transport costs during the first quarter of 2021. These are early signs that elevated purchasing prices are being passed on to end consumers, which adds to concerns about global inflationary pressures in the coming months.

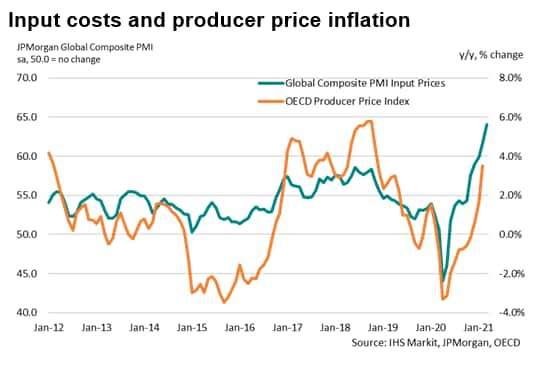

March PMI data signalled the fastest rise in worldwide input costs since August 2008, while prices charged for goods and services rose at the steepest pace since this index began more than ten years' ago.

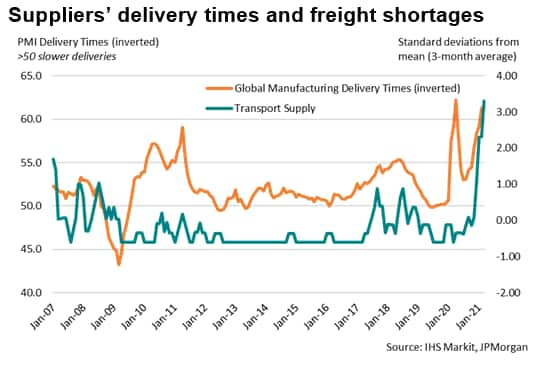

Restrictions introduced to stop the spread of the coronavirus disease 2019 (COVID-19) pandemic temporarily closed economies and severely disrupted global supply chains in the first half of last year. More recently, ongoing pandemic restrictions have been exacerbated by supplier shortages - both for raw materials and logistics capacity. On a worldwide basis, the number of manufacturers reporting shortages of transport supply was the highest since this index began in 2007. Limited freight availability and a lack of capacity to meet demand meant that supplier lead times deteriorated in March to an extent only exceeded at the peak of the pandemic in April 2020.

Commodity prices rise sharply

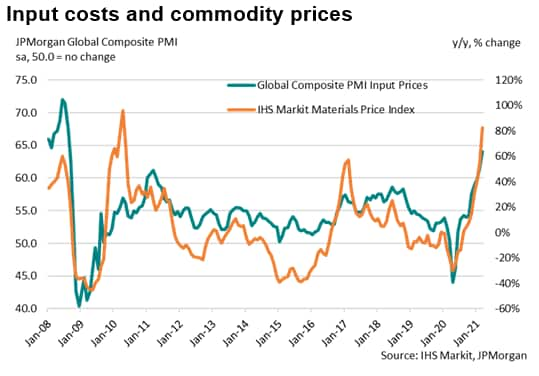

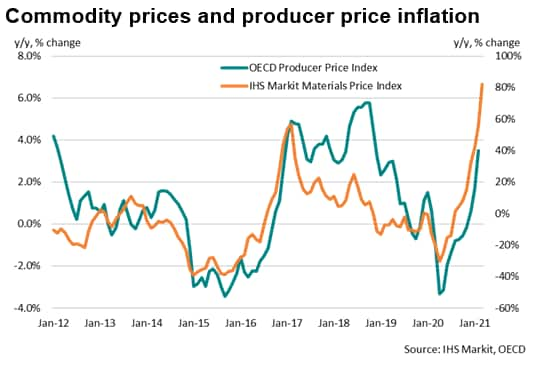

Supply shortages were rife in raw materials markets, which contributed to a further rise in commodity prices in March, as measured by the IHS Markit Materials Prices Index (MPI), a composite figure of global commodity prices. The latest increase was the eleventh in as many months and pushed the overall Index to the highest reading since January 2014.

Out of the 12 key commodities featured in IHS Markit's Price & Supply Monitor, nine recorded rising prices, including oil, ferrous and non-ferrous metals and chemicals, along with transport prices. The latest price rises were commonly attributed to widespread supply shortages among the monitored commodity markets. Manufacturers reported supply shortages in eight of the 12 commodity markets in March, and six of these were the sharpest since the survey began in 2007.

When plotted against global input costs, the surge in prices in the second half of 2020 is linked tightly to the rise in commodity prices, the latter of which have increased consistently since a collapse in oil prices at the start of the pandemic led to a sharp contraction in the MPI. Prices charged by manufacturers and service providers saw sustained rises in the same period, which was largely attributed to a spike in the cost of raw materials.

Inflationary pressures intensify in March

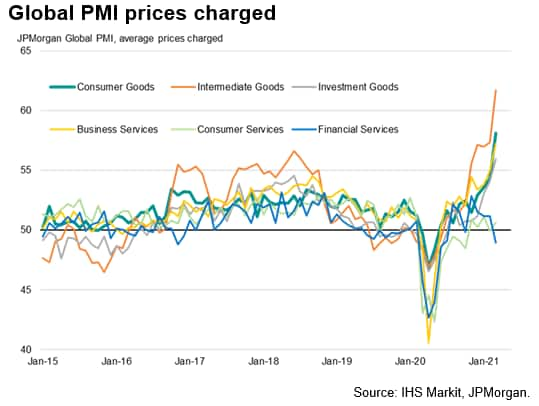

Rising commodity prices have been broad-based across the global economy. Sharp upticks in prices of non-ferrous metals for example, such as aluminium and copper, have been notably strong in the US and Europe, as firms cited delays and difficulties in sourcing raw materials.

Marked increases in the cost of intermediate goods fed into increasing inflationary pressure in the global composite data for input prices, in turn filtering though in particular to higher prices for consumer goods and investments goods, such as machinery.

March PMI data indicated that prices charged inflation for goods and services in the US, UK, Brazil and China were among the steepest on record. Once again, a common link across the various PMI surveys pointed to rising raw material and commodity prices.

Looking at the OECD grouping of advanced economies, latest data relating to producer price inflation closely followed signals from PMI data since the start of the pandemic, with the latter hinting that the former has further to rise in coming months.

Supply constraints remain key to outlook

IHS Markit's base case scenario is that inflationary pressures will start to ease as demand and supply come back into balance after the summer, the US dollar steadies and the pattern of demand shifts from goods to services as the pandemic eases. However, risks appear skewed to the upside. As COVID-19 restrictions are reimposed across much of Europe and parts of Asia, there's a risk that supply chain disruption will continue feeding into purchasing prices. The pace at which cost pressures return to stability will be contingent on how quickly logistics disruptions are resolved and capacity is rebuilt to help resolve supply and demand imbalances.

Manufacturers and service providers around the world remain hopeful that disruptions will ease as the pandemic recedes in the second half of 2021. A key indication for supply chain resilience will be the Global PMI suppliers' delivery times index. Should lengthier wait times persist, this will provide an early signal that manufacturing costs may continue to spike higher and sustain a general rise in global inflationary pressures over the course of 2021.

Usamah Bhatti, Economist, IHS Markit

Tel: +44 1344 328 370

usamah.bhatti@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-and-commodity-price-hikes-stoke-inflation-concerns-Apr21.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-and-commodity-price-hikes-stoke-inflation-concerns-Apr21.html&text=Supply+delays+and+commodity+price+hikes+stoke+inflation+concerns+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-and-commodity-price-hikes-stoke-inflation-concerns-Apr21.html","enabled":true},{"name":"email","url":"?subject=Supply delays and commodity price hikes stoke inflation concerns | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-and-commodity-price-hikes-stoke-inflation-concerns-Apr21.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Supply+delays+and+commodity+price+hikes+stoke+inflation+concerns+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsupply-delays-and-commodity-price-hikes-stoke-inflation-concerns-Apr21.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}