Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 09, 2020

Record falls in output seen in eight of 23 sectors, led by slump in auto making

- Global PMI hits lowest since 2009 as some eight out of 23 sectors see record falls in output

- Global investment spending in steep downturn, but demand for consumer services also slides

- Autos lead downturn with record decline in output

- Pharmaceuticals and biotech outperform

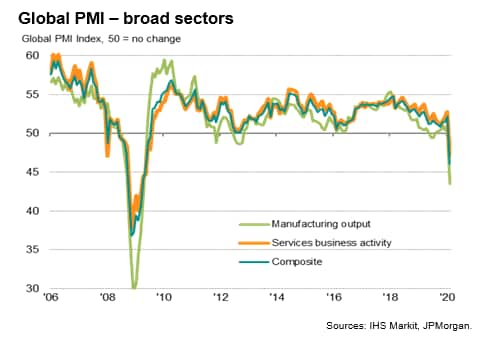

Worldwide growth plunged by a record extent in February, the pace of expansion slowing to the weakest since May 2009, according to the latest PMI surveys. The JPMorgan Global PMI™ (compiled by IHS Markit) fell from 52.2 in January to 46.1.

Worldwide factory production dropped at the steepest rate since April 2009 as companies reported falling demand and a reduced supply of inputs: February saw the second-longest lengthening of suppliers' delivery times since global production growth boomed in 2004, linked in the majority of cases to extended factory closures in China. However, it was not just supply chain disruptions to blame: service sector activity plunged to a degree not seen since May 2009 amid signs of demand slumping for many travel and consumer-related activities.

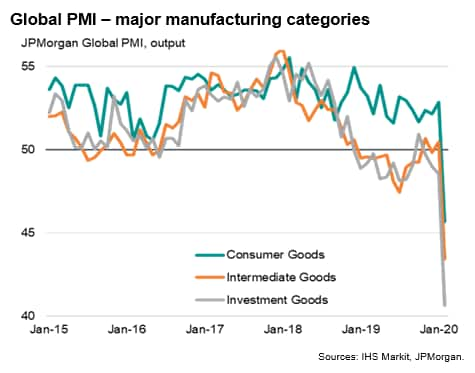

Broad manufacturing downturn led by sliding demand for investment goods

The global survey data also revealed a broad-based drop in factory output by main product groups. Worldwide output fell at the sharpest rates seen since comparable data were first available in late-2009 for consumer goods, intermediate goods (inputs supplied to other companies) and investment goods.

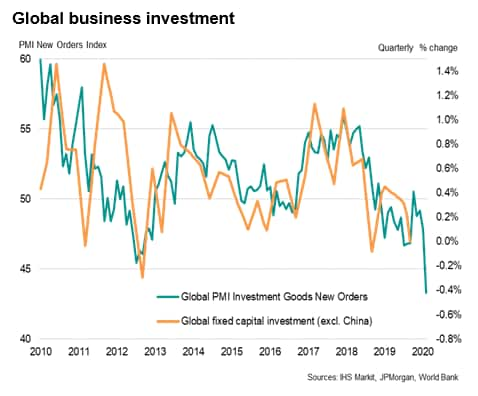

The drop in investment goods output is especially noteworthy, reflecting in turn a marked drop in new orders from businesses worldwide for plant, machinery and other capital equipment. As such, the deterioration in orders for new investment goods points to a renewed downturn in global capex arising from the heightened uncertainty surrounding the spread of COVID-19. The recent slump indicates a disappointing set-back after signs of capex spending recovering at the start of the year amid an easing of US-China trade war tensions.

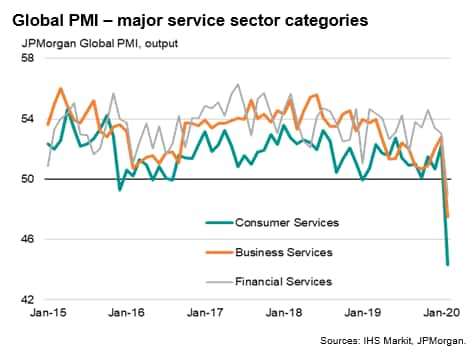

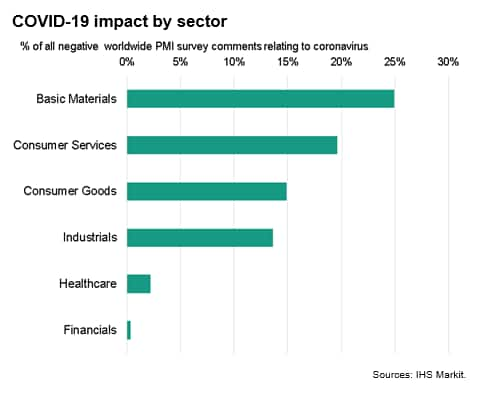

Consumer services hit by virus fears

In addition to supply-side disruptions to business activity from supply shortages, the PMI surveys also indicated weakened demand for many consumer services. This was often blamed on travel and tourism in particular being affected by the coronavirus outbreak. Consumer services saw the highest incidence of companies reporting some negative impact from the COVD-19 outbreak with the exception of basic materials manufacturing, where the supply disruptions were among the greatest recorded during the month.

Measured overall, global consumer services activity fell at a survey record pace in February (data were first collected in late-2009). However, other services sectors also saw sharply reduced activity, with financial services and business services output likewise falling at the steepest rates since 2009.

Autos lead downturn with record decline in output

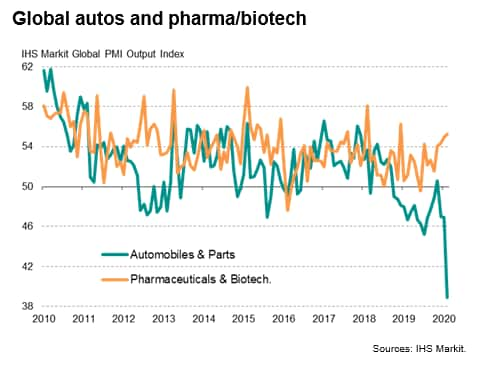

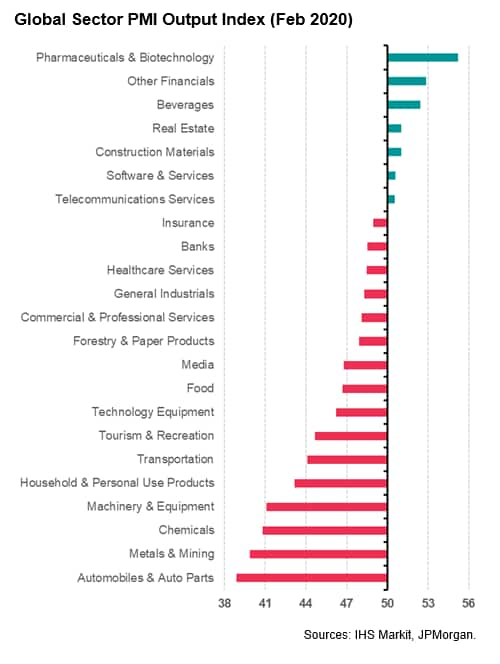

IHS Markit's more detailed PMI data neatly encapsulated the impact of the COVID-19 outbreak in February. Only seven of the 23 sectors reported growth globally, led by pharmaceuticals and biotech, reflecting efforts to deal with the epidemic.

Some eight of the 23 sectors saw record falls in output. The steepest decline was reported in the auto industry, which saw by far the steepest drop in production on record (since late-2009). Existing malaise due to weak car demand was exacerbated by the impact of factory closures and supply chain disruptions from China.

Other sectors seeing record declines in activity included food production, transportation, commercial & professional services, chemicals, metals & mining, machinery & equipment, and household products.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecord-falls-in-output-in-eight-of-23-sectors-mar20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecord-falls-in-output-in-eight-of-23-sectors-mar20.html&text=Record+falls+in+output+seen+in+eight+of+23+sectors%2c+led+by+slump+in+auto+making+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecord-falls-in-output-in-eight-of-23-sectors-mar20.html","enabled":true},{"name":"email","url":"?subject=Record falls in output seen in eight of 23 sectors, led by slump in auto making | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecord-falls-in-output-in-eight-of-23-sectors-mar20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Record+falls+in+output+seen+in+eight+of+23+sectors%2c+led+by+slump+in+auto+making+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2frecord-falls-in-output-in-eight-of-23-sectors-mar20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}