Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 25, 2025

Week Ahead Economic Preview: Week of 28 July 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Payrolls, GDP, inflation and PMIs accompanied by key policy meetings

The coming week sees top tier data releases in the form of GDP and inflation numbers from the US and Eurozone, plus US non-farm payrolls and the worldwide manufacturing PMIs. Central bank meetings include the FOMC, Bank of Japan and Bank of Canada.

Although monetary policy setters in the US and Canada are expected to retain an easing bias, while a hiking bias is more likely to be evident in Japan, policymakers from all three camps are likely to follow the ECB in stressing a 'wait and see' approach to interest rates. In all cases, more clues are probably needed before rates change, both in terms of assessing the resilience of their economies to the disruptions caused by US tariff policy, as well as the impact of these tariffs on inflation in the US.

Some help from an economic growth perspective will be provided by the second quarter GDP data for the US and Eurozone. However, trends have been hard to read lately due to tariffs. While the front-loading of imports ahead of tariffs caused a net trade drag in the US in the first quarter, resulting in a drop in GDP, the eurozone saw a corresponding export bounce, boosting GDP. No doubt tariffs will have therefore created more noise in the second quarter GDP numbers. Markets are expecting a 2.5% rate in the US with a flat reading in the eurozone, but PMI data - which tend to give a reliable reading in underlying growth trends - point to resilient 1.3% annualized GDP growth in the US and a 0.1% quarterly rise in the eurozone.

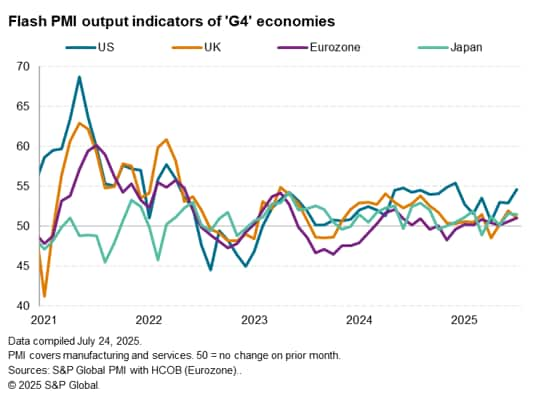

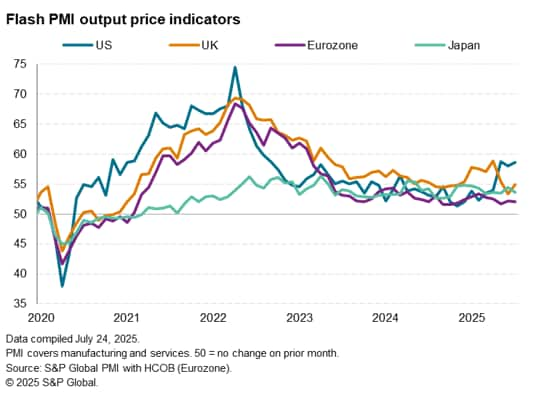

More recent flash PMI data indicated US economic outperformance gaining ground in July, albeit with the eurozone also picking up momentum to record the strongest output gain for nearly a year. The PMIs also point to strong job gains and above-target inflation in the US, with the latter starting to creep into the official CPI numbers. PCE data will therefore be eagerly awaited for more inflation signals, as are non-farm payroll data. Consensus currently points to a jobs gain of just over 100k after a 147k rise in June.

The manufacturing PMI data from both S&P Global and ISM will also provide up to date steers on industrial trends in the US and around the world as producers grapple with the rapidly changing tariff environment. The focus will be initially drawn to Asia, and in particular mainland China where analysts will be eager to see the play off between US tariff policy and increased domestic stimulus.

Flash PMIs not only indicated the US outperformance gaining further ground in July, but also showed the US continuing to report markedly higher price pressures than the other major developed economies.

Key diary events

Monday 28 Jul

Thailand Market Holiday

India Industrial Production (Jun)

Tuesday 29 July

Sweden GDP (Q2, flash)

Spain GDP (Q2, flash)

United Kingdom Mortgage Lending and Approval (Jun)

United States Goods Trade Balance (Jun, adv)

United States Wholesale Inventories (Jun, adv)

United States S&P/Case-Shiller Home Price (May)

United States JOLTs Job Openings (Jun)

United States CB Consumer Confidence (Jul)

Wednesday 30 July

Australia Inflation (Q2)

Australia Monthly CPI Indicator (Jun)

France GDP (Q2, prelim)

Germany Retail Sales (Jun)

Spain Inflation (Jul, prelim)

Germany GDP (Q2, flash)

Italy GDP (Q2, adv)

Eurozone GDP (Q2, flash)

Mexico GDP (Q2, prelim)

United States ADP Employment Change (Jul)

United States GDP (Q2, adv)

Canada BoC Interest Rate Decision

United States Pending Home Sales (Jun)

United States FOMC Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 31 July

South Korea Industrial Production (Jun)

Japan Industrial Production and Retail Sales (Jun)

Australia Retail Sales and Building Permits (Jun)

China (Mainland) NBS PMI (Jul)

Japan BoJ Interest Rate Decision

Japan Consumer Confidence (Jul)

France Inflation (Jul, prelim)

Germany Unemployment Rate (Jul)

Taiwan GDP (Q2, adv)

Hong Kong SAR GDP (Q2, adv)

Italy Inflation (Jul, prelim)

Eurozone Unemployment Rate (Jun)

Germany Inflation (Jul, prelim)

Canada GDP (Jun, prelim)

United States Core PCE Price Index (Jun)

United States Personal Income and Spending (Jun)

Friday 1 Aug

Switzerland Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Dec)

Indonesia Trade and Inflation (Jun/Jul)

Eurozone Inflation (Jul, flash)

Brazil Industrial Production (Jun)

United States Non-Farm Payrolls, Unemployment and Average Hourly

Earnings (Jul)

United States ISM Manufacturing PMI (Jul)

United States UoM Sentiment (Jul, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing PMI for July

Following the release of flash PMI data for July, worldwide manufacturing PMI for July will be made available on Friday, August 1, for more detailed insights into conditions across the goods producing sector around the world. In particular, after the announcement of the tariff deadline delay from July 9th and other trade updates, changes in demand, output, supply chain and business sentiment will be made available with the timely release of July's global manufacturing PMI.

Americas: FOMC, BoC meetings; US GDP, labour market, core PCE and ISM PMI data; Canada GDP

Central bank meetings in the US and Canada unfold in the new week, though no changes in interest rates are expected. Uncertainty regarding the outlook for inflation in the US on the back of tariffs is expected to delay the next rate cut by the US Federal Open Market Committee (FOMC) till later in the year. Meanwhile the Bank of Canada (BoC) is likely to also hold steady following recent inflation news. PMI data further outlined the likelihood for inflation to stay relatively elevated in Canada and may therefore hold the BoC back from lowering rates for the time being despite subdued output conditions.

The data highlight in the new week will be the advance second quarter GDP out of the US, as well as the labour market report for July. A positive second quarter growth is expected after the import-related dip in the first quarter. Meanwhile official payrolls data will be in focus following indications of a solid rise in employment in July according to early US PMI data. Major releases in the week also include core PCE data for June and the ISM Manufacturing PMI data, alongside the final reading for the July S&P Global US Manufacturing PMI on Friday.

EMEA: Eurozone GDP and inflation data

The key updates due from the eurozone include flash Q2 GDP and July's inflation numbers. Subdued growth is expected for the eurozone in line with indications from the HCOB Eurozone PMI data, consolidated by S&P Global Market Intelligence. Additionally, according to the latest HCOB Flash Eurozone PMI, July's selling price inflation was unchanged from June, hinting at inflation running at levels broadly consistent with 2% inflation in the coming months.

APAC: BoJ meeting; China NBS PMI; Australia CPI

The Bank of Japan convenes for their July meeting with no changes in monetary policy settings expected, not at least until December according to our forecasts. On the data docket, both the National Bureau of Statistics (NBS) and the S&P Global China General Manufacturing PMI will be in focus, alongside CPI data out of Australia.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-july-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-july-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+28+July+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-july-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 28 July 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-july-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+28+July+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-28-july-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}