Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 30, 2025

PMIs and monetary policy: South Africa

In this paper, we use South Africa Purchasing Managers' IndexTM (PMI®) data from S&P Global to calculate a signal for the likelihood of changes in monetary policy at the South African Reserve Bank (SARB).

PMI data serve as a valuable resource for central banks, offering frequent and timely macroeconomic information that is not revised, unlike official data like Gross Domestic Product (GDP) and the Consumer Price Index (CPI), which are published with a significant delay and are frequently revised.

This paper explores how likely monetary policymakers in South Africa are to loosen or tighten interest rates at certain PMI thresholds based on historical data from 2011 to 2025. The methodology is derived from previous research which has demonstrated how PMI survey data can be a valuable tool for predicting monetary policy decisions in the US, euro area and UK. Using a multinomial logistic regression model, we calculate probabilities of interest rates being cut, hiked or left unchanged at each SARB policy meeting.

PMIs role in monetary policy decisions

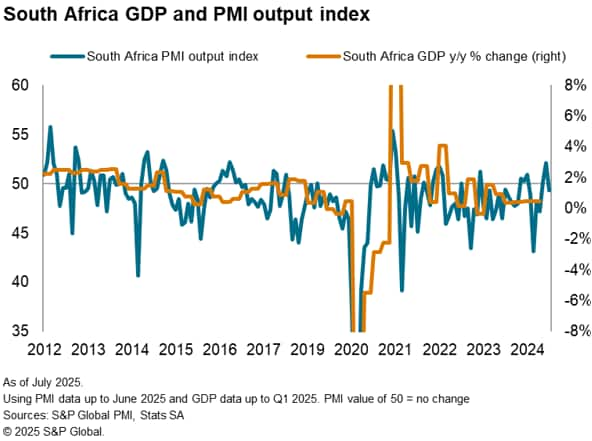

The PMI has earned a strong reputation as a leading indicator of the business cycle at both the national and global level, and can be used to accurately anticipate official economic data such as GDP or inflation. For instance, the South Africa PMI is released on the third working day following the end of the reference month, whilst first estimates of quarterly GDP statistics are typically only released over two months after the end of the reference quarter. This means that PMI users can get an initial steer on economic activity from the first month of PMI data in a particular quarter approximately four months prior to first estimate GDP releases.

As such, monetary policymakers can use the data to support real-time decisions by getting timely indications on business output, employment, price pressures, supply chain conditions and other key factors. This suggests PMI data should also be used by central bank watchers as changes in PMI data can give advanced signals of changes in monetary policy, which will have ramifications for business and financial decisions.

South Africa's participation in the Common Monetary Area - a monetary union comprising of South Africa, Namibia, Lesotho and Eswatini, in which the South Africa rand serves as the anchor currency and all other currencies are pegged at a 1:1 exchange rate - means that PMI data can be additionally useful in predicting monetary policy decisions in these additional countries.

Methodology

The goal of price stability for a central bank is closely connected to the business cycle, necessitating that central banks evaluate the current and anticipated trajectories of economic activity and prices when formulating monetary policy. Based on this evaluation, a central bank will decide among three options during its rate-setting meetings: to tighten, loosen, or maintain the current rate.

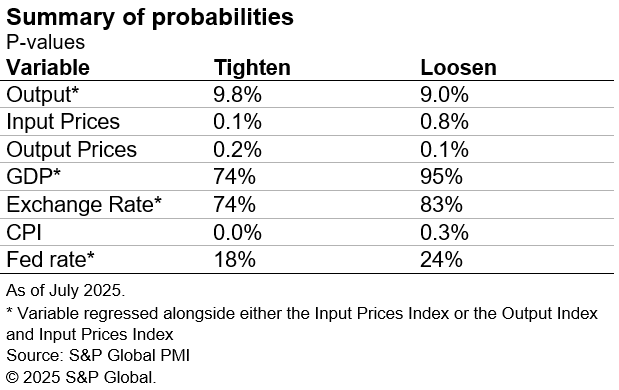

The likelihood of a decision falling into one of these three categories can be modelled using a multinomial logistic regression. With this specification, we use PMI data for activity, input prices and output prices to calculate the implied probability of tightening, loosening or no change by the SARB at each central bank meeting. We also tested the predictive power of a handful of non-PMI data series that were deemed to be potentially influential on interest rate decisions, including CPI, GDP, the South African rand/US dollar exchange rate and Federal Reserve interest rate decisions. For simplicity, we modelled only the probability of a change in interest rates rather than the magnitude of that change.

Since March 2012, SARB policy meetings have generally occurred every two months, so we have modelled interest rate decisions based on the latest data that has been released. For instance, implied probabilities of interest rate changes in meetings that occurred in January have been calculated with December PMI data and November CPI data, although the SARB may receive up-to-date inflation data before it is published.

PMI data and interest rate decisions

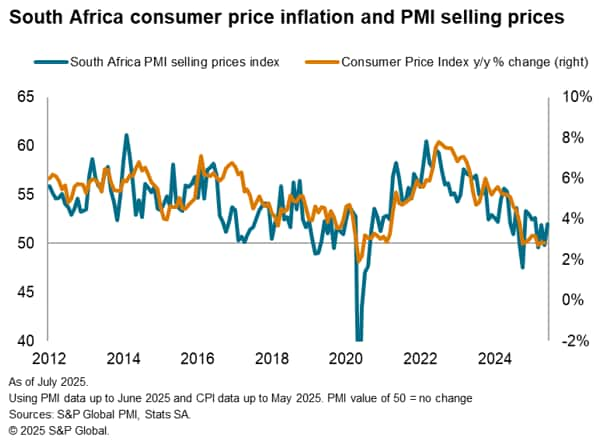

The SARB states on its website that its primary mandate is to "protect the value of the currency in the interest of balanced and sustainable economic growth". Currency stability is closely linked to price stability, which in South Africa is defined as maintaining inflation within the target range of 3-6%. Heightened inflation will tend to diminish the value of the currency and lead to investment outflows, prompting the central bank to raise lending rates in order to restore the currency's appeal.

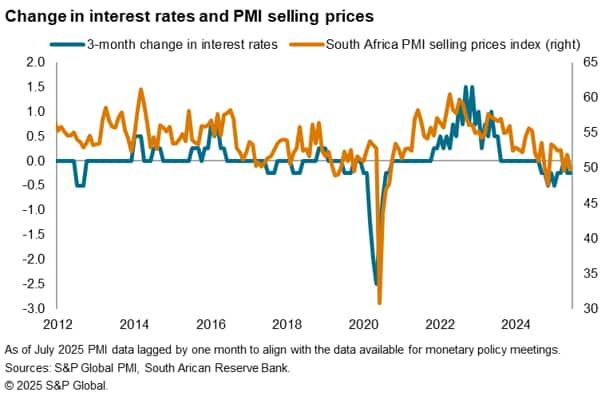

This suggests that the central bank closely monitors indicators that can give an advance signal of inflation, such as the PMI Output Prices Index, which measures selling price inflation at private sector businesses. This index has a 65% correlation with the rolling 3-month change in interest rates since the series began in 2011, which suggests that it is a strong predictor of policy decisions.

Price pressures can also be tracked by the PMI Input Prices Index which measures changes in overall business input costs - this index has a 57% correlation with the rolling 3-month change in interest rates.

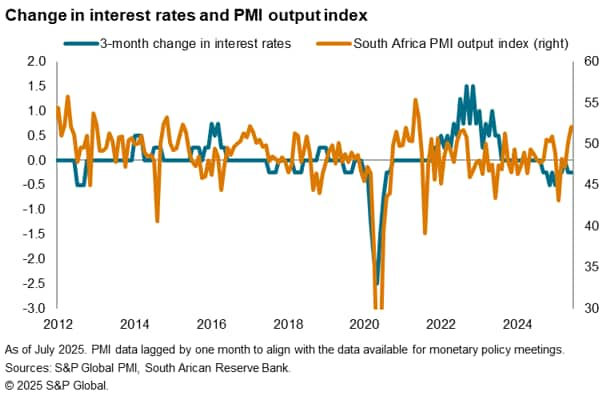

Monetary policy will also be determined by the pace of economic activity, as demand growth in particular will drive pricing power. The PMI output index allows us to monitor private sector business activity and has demonstrated a robust correlation (52%) with changes in interest rates. This relationship was particularly strong at the beginning of the COVID-19 pandemic when a steep contraction in economic activity precipitated several interest rate cuts in South Africa.

PMI data also suggest that consumer demand in South Africa can be swiftly subdued by increasing selling prices, leading to lower activity levels. As a result, there are frequently situations where interest rates have increased in response to high prices despite the output index and GDP growth remaining relatively low.

When we modelled SARB decisions using the 2011-2025 sample, we therefore found changes in output and prices can both trigger changes in interest rates, but prices typically take precedence. Moreover, the PMI Output Index was only significant at the 10% level, and when modelling using a sample cut of 2017-2025, the PMI Output Index was no longer significant. However, employing a dummy variable that accounts for periods of heightened recession risk (calculated as when the output index was more than 1 standard deviation below its mean) helped to improve the modelling of interest rate cuts. This chimes with our previous research that explored the use of PMI data in predicting monetary policy in major developed markets, which found that output was often a key driver of interest rate decisions, particularly when interest rates are loosened.

Results

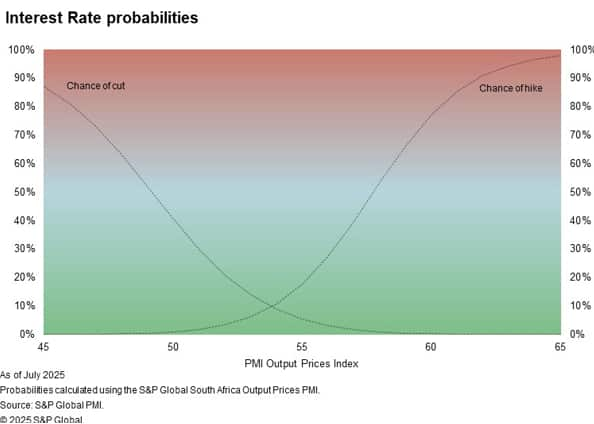

Model suitability can be measured using the Akaike information criterion. This measure signalled that, of the prices metrics used, the PMI Output Prices Index is better than the PMI Input Prices Index for modelling interest rate decisions. It is also slightly better than consumer price inflation (CPI), assuming that CPI data is not yet available for the most recent month. Applying a two- or three-month average of the PMI Output Prices Index was shown to further improve the suitability of the model.

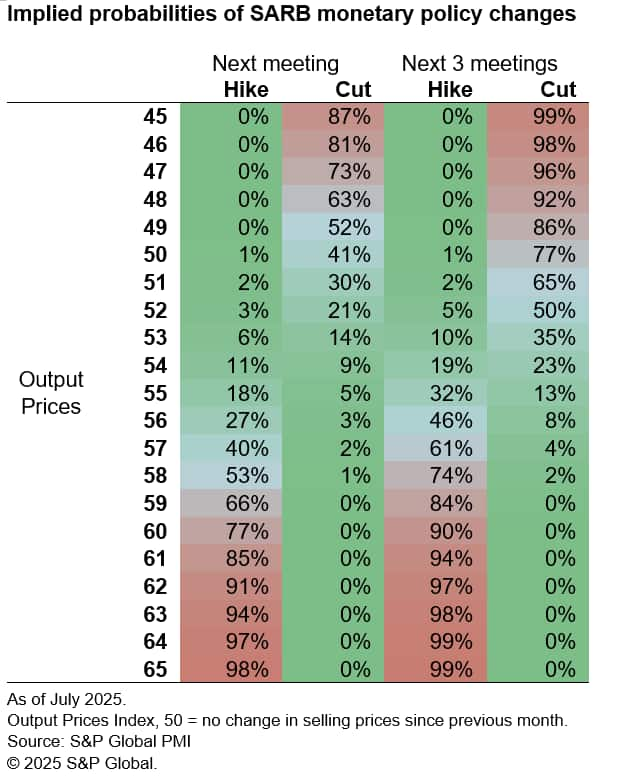

These statistical findings can be demonstrated using the chart below, which shows the likelihood of tightening and loosening at different levels of the Output Prices Index using the 2011-2025 sample. For example, if the Output Prices Index were to record 60.0, which is roughly consistent with South Africa CPI reaching 7% year-on-year, the model implies a 77% chance the SARB will raise interest rates at the next meeting. If the Output Prices Index recorded 48.0, which is below the 50.0 neutral mark and thereby signals falling selling prices at private sector companies, the model implies a 63% chance of interest rates decreasing at the next meeting.

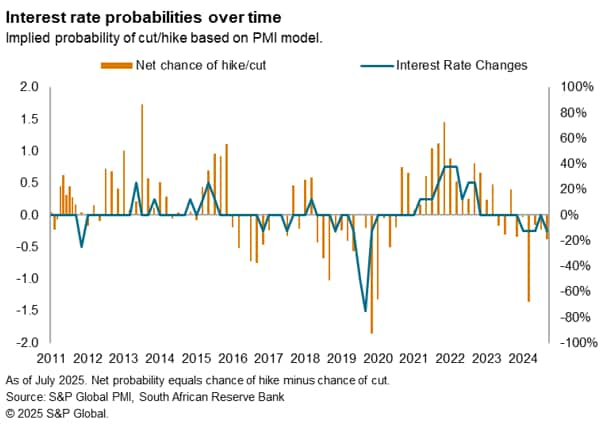

Analysis of the model over the sample period shows that it has often signalled a heightened probability of interest rate changes ahead of decisions being taken. This was especially evident during periods of interest rate hikes in late-2015/early-2016 and late-2021 to early-2023.

Including the PMI Output Index improved the model's ability in predicting the interest rate cuts in early-2020 during the initial stage of the COVID-19 pandemic.

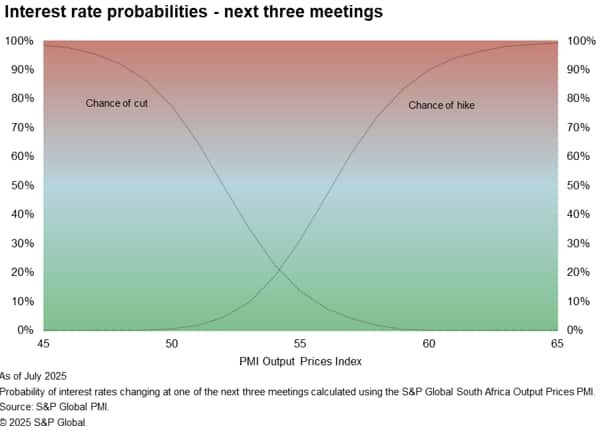

An additional model was also tested which calculated the probability of interest rates being tightened or loosened at one of the next three SARB meetings (i.e. over the next six months). The statistical findings of this model, using the PMI Output Prices Index, can be demonstrated in the chart below. Naturally, the model implied higher probabilities of interest rates being changed at one of the next three meetings (at relatively high or low values of the PMI Output Prices Index) compared with the base model. At an index reading of 60.0, the model implies an 90% chance the SARB will raise interest rates at at least one of the next three meetings. At a reading of 48.0, the model implies a 92% chance the SARB will cut interest rates at at least one of the next three meetings. This model illustrates how central banks will sometimes wait to monitor the emergence of economic trends and make monetary policy decisions at subsequent meetings once these trends become more certain.

David Owen, Senior Economist, S&P Global Market Intelligence

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmis-and-monetary-policy-south-africa-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmis-and-monetary-policy-south-africa-Jul25.html&text=PMIs+and+monetary+policy%3a+South+Africa+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmis-and-monetary-policy-south-africa-Jul25.html","enabled":true},{"name":"email","url":"?subject=PMIs and monetary policy: South Africa | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmis-and-monetary-policy-south-africa-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMIs+and+monetary+policy%3a+South+Africa+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmis-and-monetary-policy-south-africa-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}