Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 06, 2020

Week Ahead Economic Preview: Week of 9 March 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- European Central Bank meeting

- US consumer sentiment and inflation

- UK Budget and GDP update

- German industrial health update

- IHS Markit Global Business Outlook Survey

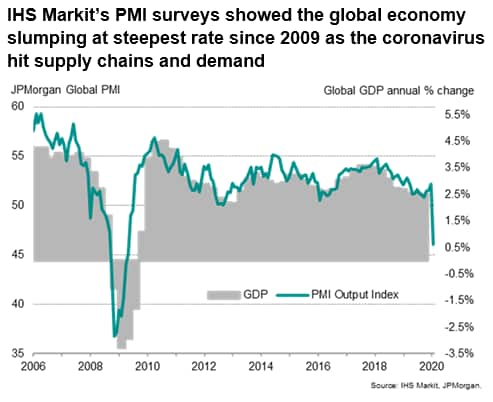

After worldwide PMI surveys showed the global economy contracting at the steepest rate since 2009 as the coronavirus disrupted supply chains and hit sectors such as travel, tourism and transport, markets will be watching keenly for remedial (or insurance) policy action from central banks and governments, either via fiscal or monetary stimulus.

With the US Fed cutting rates by 50 basis points in response to the developing outbreak, the coming week sees eyes turn to the European Central Bank's policy meeting. Room for policy manoeuvre is more limited in Europe than the US, but we expect an enhancement of liquidity provision, a 10bp deposit facility rate cut and a modest increase in the monthly pace of net asset purchases to be announced. There's a risk, however, that the Governing Council may struggle to agree on such a comprehensive package of measures.

Europe also sees some key data out of Germany which will add insight into the health of the eurozone's largest industrial sector at the start of the year, while in the UK the government sets out its post-Brexit spending and tax plans in its Spring Budget.

In the US, consumer confidence data are the pick of the bunch, highlighting the degree to which the coronavirus has affected households' willingness to spend. Inflation numbers are also updated, and should show price pressures easing.

In Asia, investors will seek to gauge the potential of production recovery in China by assessing the speed to which firms restart work. Data highlights include Taiwan's trade statistics, industrial output in India and Malaysia, inflation figures in mainland China and India, plus Japan's machinery orders.

IHS Markit's triannual Global Business Outlook Survey will meanwhile provide insights into firms' expectations for the year ahead. Data were collected in late-February and will be published on Monday.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

Recent week ahead economic previews

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-march-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-march-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+9+March+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-march-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 9 March 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-march-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+9+March+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-9-march-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}