Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 18, 2023

Previewing the April PMI surveys after global growth accelerated in March

Ahead of the flash PMI releases for the US, Eurozone, UK, Japan and Australia, released on 21st April, we recap on the latest survey findings from the March S&P Global's PMI surveys and look ahead to market expectations for April.

Although the surveys surprised to the upside in March, allaying worries of imminent recessions in the world's major economies, nagging doubts about the resilience of the upturn persist. In particular, a deeper dive into the PMI survey data underscores how the current growth revival could prove short-lived and therefore highlights which data to watch in the upcoming releases.

Robust global GDP growth

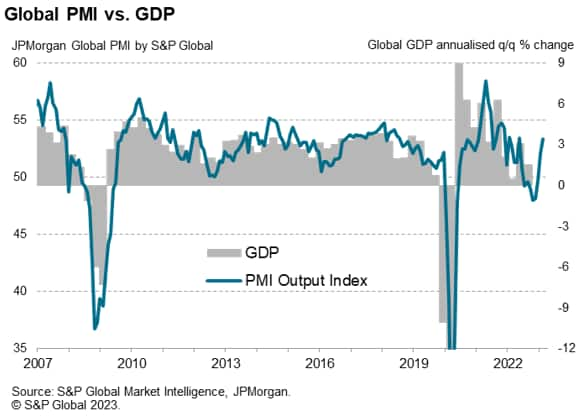

At first sight, the news from the PMI surveys looks promising. With the headline JPMorgan Global PMI - compiled by S&P Global - rising from 52.1 in February to 53.4 in March, the survey data are indicative of worldwide GDP rising at a robust quarterly annualized rate of approximately 3%.

This marks a major reversal of the situation seen late last year, when the PMI had sunk into contraction territory. If the initial pandemic lockdown months of early 2020 are excluded, the downturn recorded late last year had been the steepest since the global financial crisis.

However, delve deeper into the recent data and cracks soon start to appear, most notably in the reliance on the service sector, which looks vulnerable to weakening demand in the months ahead.

Manufacturing buoyed by improving supply

Looking first at manufacturing, the sector has stabilised since sliding into a downturn late last year, providing welcome support to the global economy. But this improvement has been fueled by improving supply chains rather than an upturn in demand. Supplier delays, which plagued manufacturing and led to an unprecedented backlog of uncompleted work since the pandemic, have eased to the extent that March saw the greatest improvement in supplier performance since 2009. Factories are hence now able to reduce these accumulated backlogs of work.

Unfortunately, inflows of new orders into factories continued to fall globally in March. Unless these order inflows pick up, existing backlogs of work will soon become depleted, meaning current production volumes will prove unsustainable.

Service sector reliance amid policy headwind

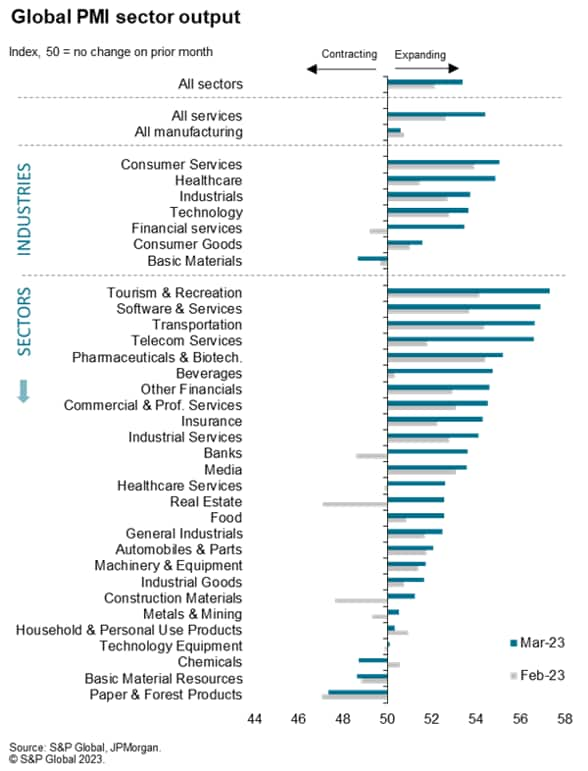

Turning to services, the news is better, in that the rate of growth hit the highest since December 2021, with the sector reviving substantially from the downturn of late 2022 on the back of rising inflows of new business.

Looking further into the detail, the services expansion was driven first and foremost by resurgent tourism & recreation and travel, reflecting a broader improvement in spending by consumers. A further key development was a surprising revival of activity and demand in the financial services sector.

There are of course factors that have helped boost services growth: consumers and businesses are benefitting from a peaking of policy rates being in sight, labour markets remain robust, and there remains a tailwind from the travel and spending curbs seen during the pandemic, notably in recent weeks from the reopening of the Chinese mainland.

However, given the banking sector stress witnessed in March, as well as the further recent tightening of monetary policy in the US and Europe, it would be a surprise to see the consumer and the financial services sector retain their roles as such prominent growth drivers of the global economy in the coming months.

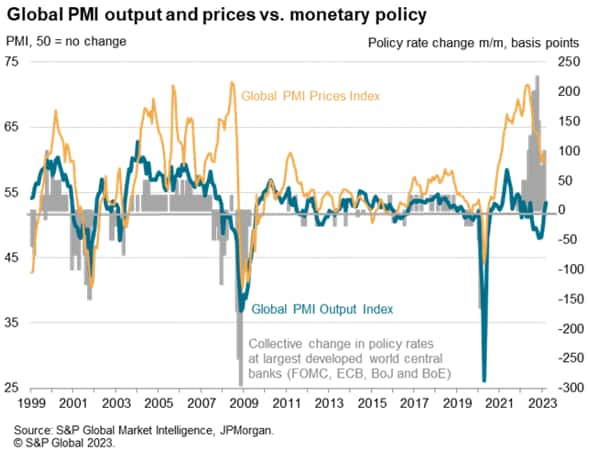

As our chart illustrates, the recent upturn in global output has been surprising in the context of recent policy hikes, and with the full impact of policy changes widely thought to occur with a significant delay, there should be more headwinds from interest rates evident in the months ahead.

India and Spain lead global expansion, Australia, Brazil and UK lag

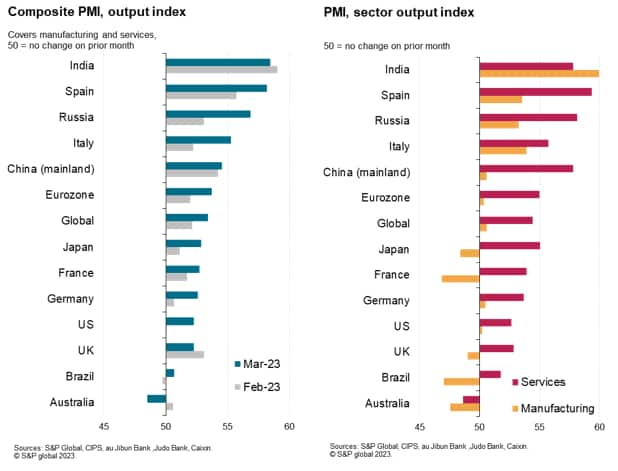

Looking at the world's largest economies, India once again reported the fastest expansion and is continuing to enjoy its strongest growth spell for over a decade. Spain, and to a lesser degree Italy, also reported well-above average growth in March, with buoyant service sector activity accompanied by solid manufacturing performances in both cases. Russia also saw notably strong and accelerating growth as domestic firms compensated for a further steep downturn in trade flows arising from sanctions.

Growth in mainland China likewise accelerated, rising to a nine-month high on the back of resurgent service sector activity following the recent easing of COVID-19 containment measures.

Japan also enjoyed the strongest upturn in activity for nine months. Although below average growth was recorded in France, Germany and the US, in all cases the rate of expansion accelerated compared to February, in each case driven by reviving service sector activity.

Growth meanwhile slowed in the UK, though remained in positive territory for a second month running thanks to a solid expansion of activity in the service sector.

Brazil reported rising output for the first time in five months, as a recovery in (yes, once again) service sector activity helped offset a steepening manufacturing decline.

That left Australia as the only major economy (for which composite PMI data are available) in decline.

Cooling inflation

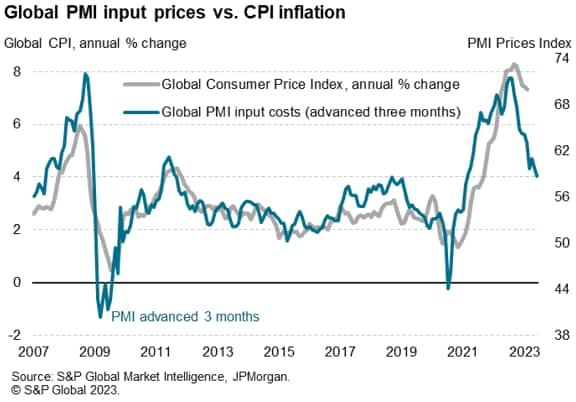

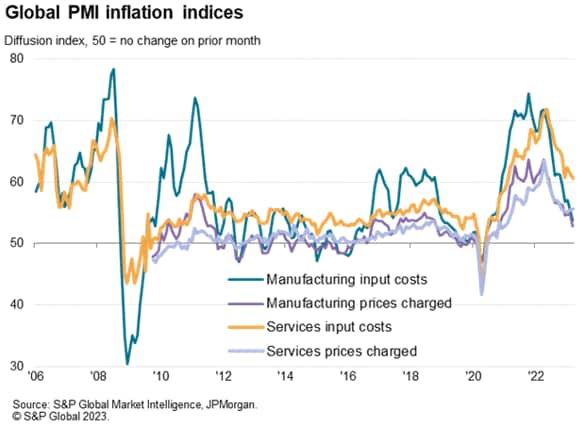

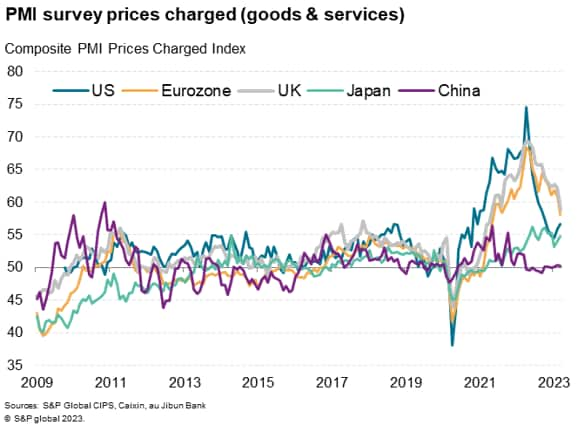

A key factor to consider is the speed with which inflation is likely to cool in the months ahead, given this will determine the future interest rate path. Headline consumer price inflation is showing signs of having peaked globally, and PMI survey data on companies' costs, which acts as a leading indicator of consumer price inflation, suggests price growth should continue to moderate substantially further in the coming months. The rate of inflation of costs has cooled almost continually since hitting a near 14-year peak last May, such that average input costs measured across manufacturing and services rose in March at the slowest rate for 28 months.

One area of concern to watch is wage growth. Although manufacturing input cost inflation has slowed well below its long-run average over the past two months, sinking to a 32-month low in March thanks to the improving supply situation, service sector input cost inflation remains far above its long-run average, with companies citing higher staff costs as a key driver of upward cost pressures.

Selling price inflation has also remained higher in services than manufacturing. Moreover, while selling price inflation in manufacturing has fallen close to its long run average, the equivalent rate of inflation in services continues to run well above its long run average. This could clearly add to some near-term persistence of above-trend global inflation.

Assessing the outlook

Looking ahead, while near-term recession odds have fallen, we retain the view that the PMI sub-indices suggest that the recent upturn is based on poor foundations and a slide back into contraction cannot be ruled out. In particular, the global manufacturing rebound has been buoyed by better supply chains (allowing backlogs of orders to be fulfilled) rather than increasing demand, and rising service sector activity looks vulnerable to the recent tightening of financial conditions. An upside is that inflation looks to be cooling rapidly, albeit with some caution needed in terms of wage growth, meaning peak policy rates are in sight. Any slide into recession could therefore be swiftly met with looser policy.

April flash PMIs

April's flash PMI data, to be published on 21st April, will of course help further assess the developing situation.

According to Refinitiv, the consensus is for the eurozone composite PMI to rise slightly from the 53.7 reading seen in March to 54.0, albeit with the service sector upturn losing some steam. However, the region's manufacturing downturn is anticipated to have moderated. Flash composite PMIs are expected to rise in both Germany and France with a common theme of slower services growth joined by easing manufacturing downturns.

In the UK, growth is likewise expected to strengthen slightly after the composite PMI came in at 52.2 in March, thanks to faster services growth and a reduced pace of decline in manufacturing. The April UK flash PMI is penciled in at 52.6.

In the US, both the manufacturing and services PMIs are expected to soften, pointing to a weakened expansion of services activity (the index set to fall from 52.6 in March to 51.5) and a slightly steeper downturn in the goods producing sector (the manufacturing PMI is expected to dip from 49.2 to 49.0).

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-april-pmi-surveys-after-global-growth-accelerated-in-march.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-april-pmi-surveys-after-global-growth-accelerated-in-march.html&text=Previewing+the+April+PMI+surveys+after+global+growth+accelerated+in+March+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-april-pmi-surveys-after-global-growth-accelerated-in-march.html","enabled":true},{"name":"email","url":"?subject=Previewing the April PMI surveys after global growth accelerated in March | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-april-pmi-surveys-after-global-growth-accelerated-in-march.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Previewing+the+April+PMI+surveys+after+global+growth+accelerated+in+March+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpreviewing-the-april-pmi-surveys-after-global-growth-accelerated-in-march.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}