Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 29, 2020

Midyear factor review amid the COVID-19 pandemic

Research Signals - July 2020

While coronavirus-induced volatility plagued equity markets in March, we closely monitored daily factor and style model performance with weekly performance reviews of daily style exposures. Volatility has since settled down, though still in excess of levels at the start of the year. Given these unusual times, with the COVID-19 pandemic wreaking havoc from a health and financial perspective, we extend our review from both a macro and factor view during the first six months of this year.

- Large caps were favored over small caps through June, while the prolonged growth cycle over value strategies benefited further from a sharp bounce since March

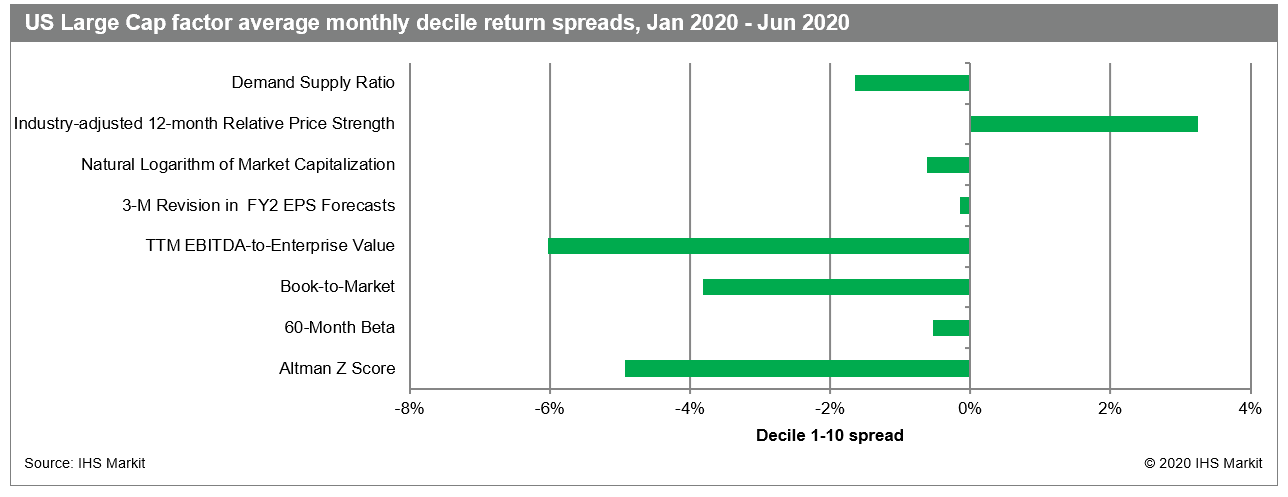

- Price Momentum and Historical Growth factors, such as 24-Month Active Return with 1-Month Lag and 1-yr Change in Sales, respectively, were consistent outperformers, while Deep Value measures suffered, particularly those based on analyst estimates, with Leading 12 Month EBITDA/EV the weakest of the group

- The Historical Growth Model topped all other style models, though the Price Momentum model has been making a comeback since March, while the Deep Value Model sat at the opposite extreme

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmidyear-factor-review-amid-the-covid19-pandemic.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmidyear-factor-review-amid-the-covid19-pandemic.html&text=Midyear+factor+review+amid+the+COVID-19+pandemic+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmidyear-factor-review-amid-the-covid19-pandemic.html","enabled":true},{"name":"email","url":"?subject=Midyear factor review amid the COVID-19 pandemic | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmidyear-factor-review-amid-the-covid19-pandemic.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Midyear+factor+review+amid+the+COVID-19+pandemic+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmidyear-factor-review-amid-the-covid19-pandemic.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}