Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 20, 2025

Loss of confidence in January adds to UK economic outlook risks

Consumer confidence soured further at the start of 2025, according to S&P Global's Consumer Sentiment Index (CSI). Employment worries, stalling income growth and reduced savings all contributed to increased gloom among households about their current and future financial situations, leading to increased caution with regard to spending.

Accompanied by a similar recent slump in business expectations for the year ahead, the deterioration of consumer confidence adds to downside risks to the UK economy at a time when growth has already stalled.

Upcoming official labour market data and the flash PMI numbers for January will add important clarity about recession risks for the UK, and thereby also provide a valuable steer as to the next moves in monetary policy from the Bank of England.

Economy flat-lining

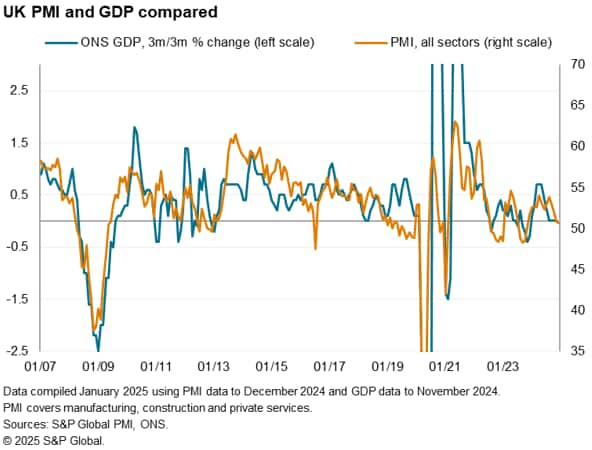

The latest official data corroborates survey findings of a UK economy which was broadly flat-lining late last year. GDP was up 0.1% in November after two months of 0.1% declines. On a three-month-on-three-month basis (the equivalent of quarterly growth) the economy has now seen zero growth for four straight months.

We await December GDP, but the PMI output index covering goods, services and construction came in at just 50.6 in the closing month of 2024, signalling another flat month in terms of GDP.

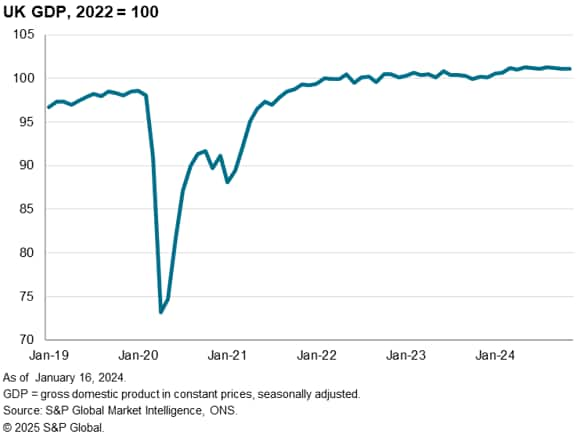

So a recession was likely avoided in 2024, but by the thinnest of margins. Whether a downturn can be avoided in 2025 remains uncertain, as recent survey data relating to business and consumer confidence point to some downside risks in the near-term.

Loss of confidence

It's clear that the UK's economic performance has been disappointing for some time now. GDP over the first 11 months of 2024 was just 0.7% larger than the average seen in 2023 and only 1.1% larger than the average seen in 2022.

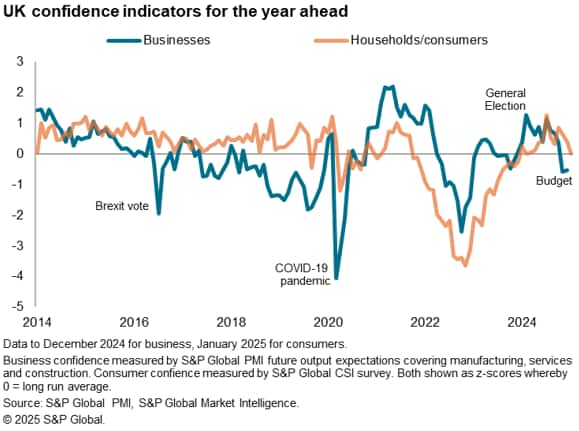

This anemic growth trend has not been without its brighter moments, however. One such bright spot was the summer of 2024, which saw output growth as measured by both GDP and the PMI accelerate as businesses and households reported rising optimism about the outlook amid the election of a new government.

Business confidence, as measured by the PMI survey gauge of companies' expectation of their output over the coming year (covering manufacturing, services and construction), hit a two-year high on the announcement of the General Election in early 2024, and peaked again on the actual Labour election win in July. Companies reported growing optimism on a new era of domestic political stability, according to the anecdotal evidence collected via the survey.

Sentiment among consumers likewise surged higher on the General Election result. As measured by S&P Global Consumer Sentiment Index (CSI), consumers' views on their expected household finances over the coming year hit an all-time high in July 2024 (from a survey history which extends back to early-2009).

However, both confidence gauges have fallen sharply in recent months.

The PMI's future output expectations index slumped to a near-two-year low in November as companies digested new government policies announced in the Budget in an environment of growing geopolitical uncertainty, and remained close to that two-year low in December.

Household sentiment about future finances has meanwhile also weakened materially. January saw sentiment measured by the CSI suffering a further deterioration after weakness seen late last year to now sit at a ten-month low.

Curbed spending

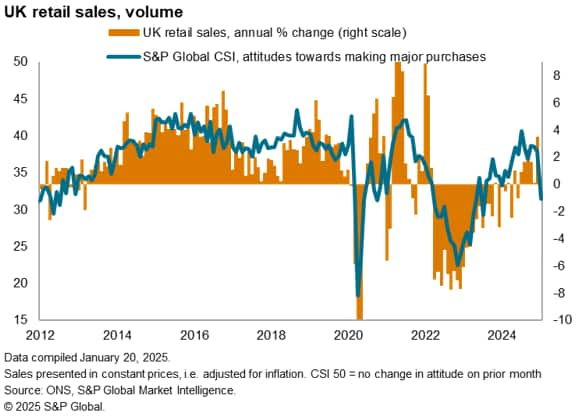

Worryingly, the CSI survey also found consumers' attitudes towards making major purchases fell especially sharply in January; now riding at their lowest since July 2023. If pandemic months are excluded, consumer appetite to make major purchases is now among the lowest recorded since July 2012, during the height of austerity and the European debt crisis.

With retail sales having already fallen in December, the slumping sentiment data pose further risks to retail sales and wider consumer spending metrics at the start of 2025.

Job market woes amid falling employment

Other survey variables help understand the pullback in spending signalled by the CSI, notably in relation to the labour market.

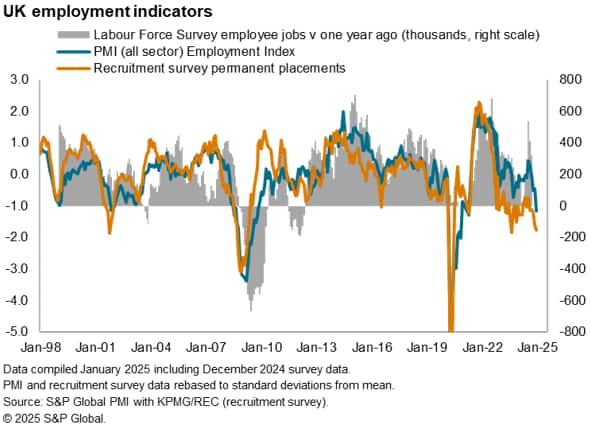

December saw the PMI respondents report a fall in private sector employment for a third month running, with the rate of job losses rising to the highest since January 2021 (excluding the pandemic, the PMI's December fall in employment was the largest since the global financial crisis).

The REC/KPMG recruitment industry surveys meanwhile also reported one of the largest drops in hiring of permanent employees since 2009 late last year.

Survey responses from both PMI and the recruitment industry have linked falling employment to the higher taxation of employees announced in the autumn Budget.

In this environment, households have become increasingly concerned about job security. January saw more survey respondents insecure about their jobs outnumber than those secure in their positions for the first time for nearly a year.

Workplace activity growth consequently also slowed sharply in January according to the consumer sentiment survey, in turn causing take-home pay growth to slow to a near standstill - its weakest in one and a half years - and the amount of cash available to spend to fall at a pace not seen since last March. Debt levels meanwhile rose and savings fell.

Hence, as we go into 2025 the near-term risks to the economy seem tilted to the downside, with confidence among both business and consumers falling.

Interest rate pressure

One final aspect of the January consumer survey worth noting was the households grew more hawkish in respect to interest rates. On balance, households expected the next move in rates by the Bank of England to be a hike rather than a cut, and to a greater extent than recorded in December.

However, subsequent inflation data have come in lower than expected, and have led to increased financial market speculation that rates will be cut soon by the central bank. Any such cut could therefore help allay households' concerns over higher borrowing costs and lift consumer sentiment higher.

The upcoming flash PMI and labour market data will therefore help further assess the growth, inflation and policy outlooks.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2floss-of-confidence-in-january-adds-to-uk-economic-outlook-risks-jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2floss-of-confidence-in-january-adds-to-uk-economic-outlook-risks-jan25.html&text=Loss+of+confidence+in+January+adds+to+UK+economic+outlook+risks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2floss-of-confidence-in-january-adds-to-uk-economic-outlook-risks-jan25.html","enabled":true},{"name":"email","url":"?subject=Loss of confidence in January adds to UK economic outlook risks | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2floss-of-confidence-in-january-adds-to-uk-economic-outlook-risks-jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Loss+of+confidence+in+January+adds+to+UK+economic+outlook+risks+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2floss-of-confidence-in-january-adds-to-uk-economic-outlook-risks-jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}