Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 22, 2025

PMI output and prices indices provide insights into 10-year benchmark bond yields

- S&P Global PMI data provide insights into a range of economic indicators including growth, inflation and business confidence, which are among the key drivers for sovereign bond yield movements.

- PMI subindices can be used in combination and weighted to best determine the trajectory for benchmark bond yields.

Purchasing Managers' Index (PMI) survey data produced around the world by S&P Global have a strong reputation for providing advance insights into changing economic conditions, being widely used by policymakers, governments, investors and businesses to anticipate changes in official macroeconomic data such as GDP, industrial production, inflation and employment. As a result of the wide range of economic conditions the PMI track, the data can also provide valuable, unique guidance on financial market trends, including for benchmark sovereign 10-year bond yields.

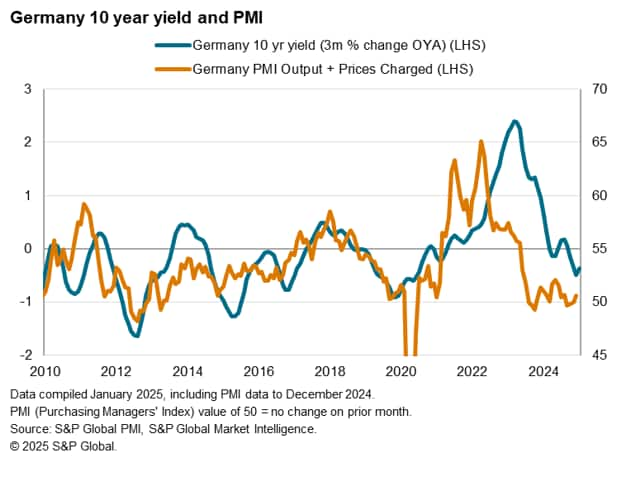

To illustrate, our charts below plot the composite PMIs from S&P Global (covering both the manufacturing and service sectors) against 10-year sovereign bond yields from the US, UK and Germany. As movements across the 10-year yield are influenced by factors including growth and inflation, the PMI output and output prices indices provide valuable insights into the trends. Furthermore, as the PMI similarly provide early signals for conditions tracked by central bankers who determine interest rates, the data can therefore provide advance indication for bond market trends.

US 10-year Treasury yield and the PMI

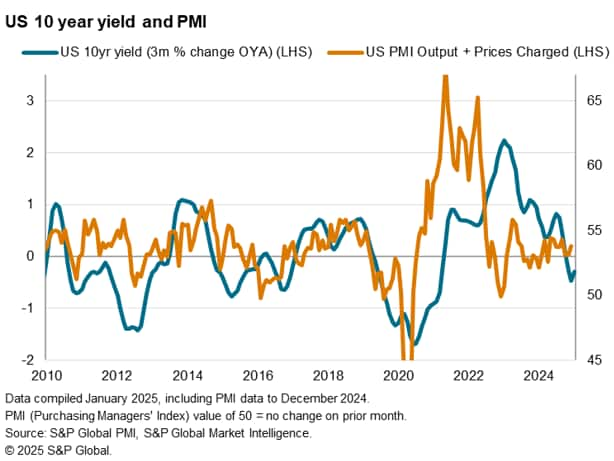

A PMI-based indicator based on a simple average of the S&P Global PMI output and prices charged indices shows a positive historical correlation with the changes in 10-year Treasury yield, as illustrated in the chart below. Bond yields will rise when inflation is expected to rise, or when faster economic growth may stimulate inflation or higher policy interest rates. As the PMI-based indicator captures important information regarding these economic conditions, it can therefore provide valuable insights into whether Treasury bonds may be over- or undervalued relative to economic fundamentals.

For example, as observed in the post-pandemic period, the PMI-based indicator alluded to the rise in bond yields well ahead of the actual move as central bankers "delayed" the tightening of financial conditions, prioritising growth over the impetus for raising interest rates amid rapidly rising inflation. The subsequent waning of the year-on-year change in yields was also well captured by the PMI ahead of time, which provided an advance signal of softer inflation.

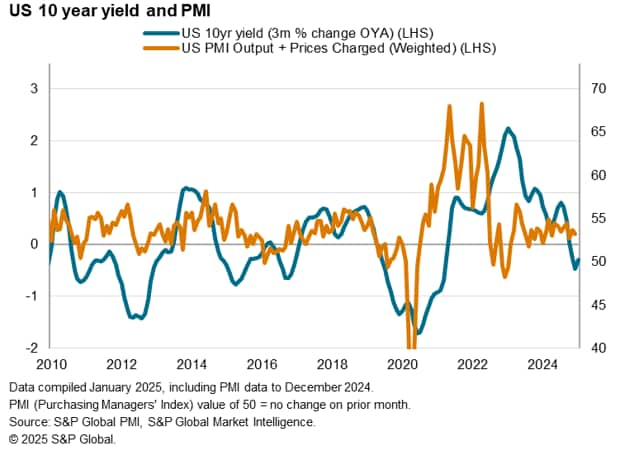

One can further improve the correlation between this simple PMI-based indicator by adding weights to the subindex components. This is to account for greater sway from the factor (either growth or prices) that is seeing higher volatility and thereby importance at different points in history. In the comparison showed below, the subindex with a greater month-on-month change carries twice the weight of the other factor.

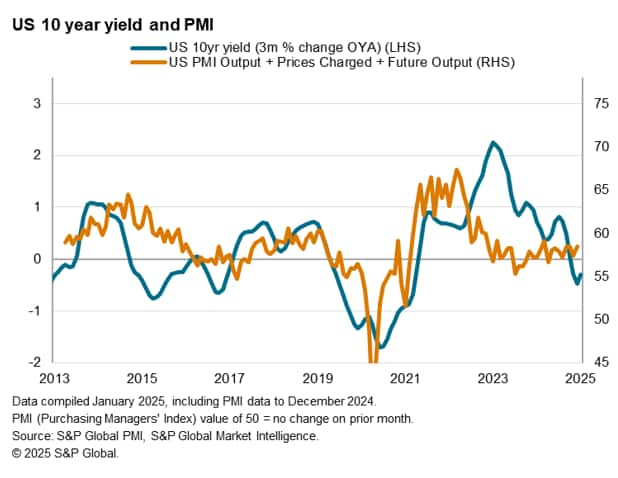

Additionally, the correlation can be further improved with the inclusion of the PMI Future Output Index. As the 10-year Treasury yield often undergo periods where sentiment plays a big part in driving movements, such as during periods of heightened geopolitical uncertainties, including the only sentiment-based PMI subindex - the Future Output Index - can enhance the comparison between the data. In the example below, the correlation between the PMI-based indicator (averaging the output, prices charged and future output indices) and the change in US 10-year Treasury yields was found to be as high as 44% studying the period since early 2013 to December 2024.

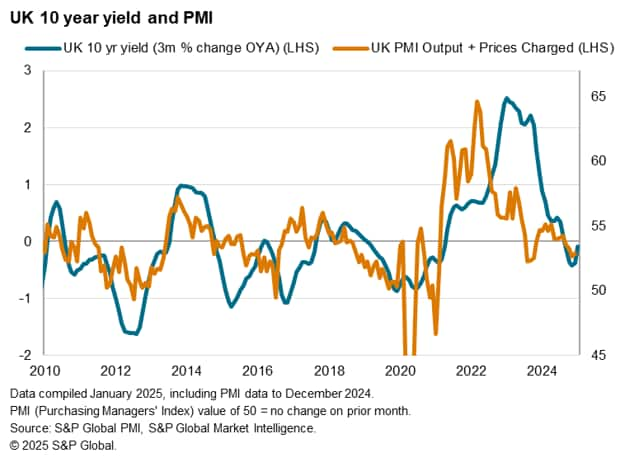

PMI and other benchmark bond yields

Besides the US, PMI data across other parts of the world can similarly be utilised as economic fundamentals-based gauges of bond yield movements. The charts below outlined the simplest example of comparing the PMI output and prices charged indices with changes in 10-year bond yields for the UK and Germany.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-output-and-prices-indices-provide-insights-into-10year-benchmark-bond-yields-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-output-and-prices-indices-provide-insights-into-10year-benchmark-bond-yields-Jan25.html&text=PMI+output+and+prices+indices+provide+insights+into+10-year+benchmark+bond+yields+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-output-and-prices-indices-provide-insights-into-10year-benchmark-bond-yields-Jan25.html","enabled":true},{"name":"email","url":"?subject=PMI output and prices indices provide insights into 10-year benchmark bond yields | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-output-and-prices-indices-provide-insights-into-10year-benchmark-bond-yields-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+output+and+prices+indices+provide+insights+into+10-year+benchmark+bond+yields+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-output-and-prices-indices-provide-insights-into-10year-benchmark-bond-yields-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}