Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2025

Japan's private sector growth accelerates amid deepening sector divergence

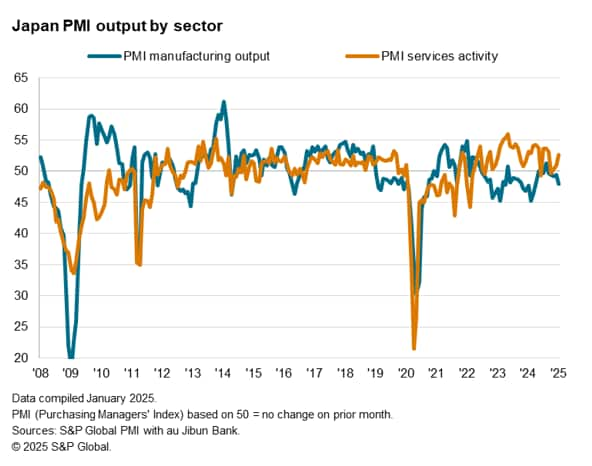

Japan's private sector growth accelerated for a second successive month at the start of 2025. That said, the improvement masked a deepening sector divergence whereby faster service sector growth contrasted with a worsening manufacturing sector performance. Moreover, forward-looking indicators again outlined the likelihood for growth to remain reliant on rising services activity in the coming months.

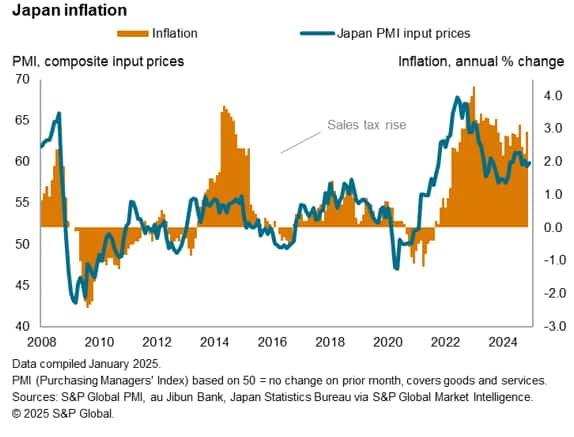

Elevated inflation was where the manufacturing and service sectors found common ground, though with service providers experiencing a particular intensification of cost pressures at the start of the year. The price trends showed by the PMI gauges were therefore supportive of the Bank of Japan's latest January move to raise rates, with concerns circling a weak yen - as captured by anecdotal evidence supporting the fall of the future output index - highlighting the need for further vigilance in relation to rising prices in 2025.

Japan's flash PMI signals fastest growth in four months

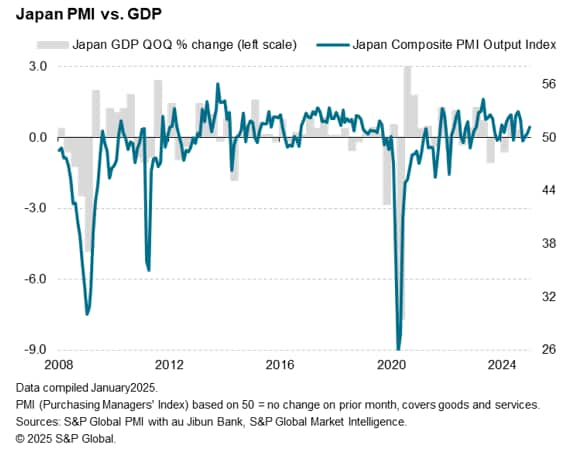

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, rose to 51.1 in January, up from a final reading of 50.5 at the end of last year. Posting above the 50.0 neutral mark, the latest reading signalled that Japan's private sector expanded for a third successive month. Whilst modest, the flash reading for January was the highest in four months. Additionally, the latest PMI reading is indicative of quarterly GDP growth at around 0.5% in the opening month of 2025.

Japan's private sector growth remain services driven

The acceleration in private sector growth was driven mainly by rising services activity in January. Services activity expanded at a rate that was solid and the quickest since September 2024. This was underpinned by quicker inflows of new business according to panellists, with export business notably returning to growth for the first time in four months. Anecdotal evidence highlighted improvements in tourism activity at the start of the year, supporting the uptick in overall activity.

There was also a knock-on effect on hiring as services employment increased for the sixteenth successive month, growing at the fastest pace since last July. Although increased hiring contributed to rising wage pressure, according to panellists, services companies were better able to fulfil orders, further clearing their outstanding business for the first time in three months.

Sentiment in the service sector remained positive, with the level of business confidence little changed since December and above-average. Services firms generally anticipate increased events in 2025, such as the World Expo in Osaka, and greater business development efforts to drive sales in the new year.

The elevated future output index and acceleration in new business growth also suggest that services activity will remain in expansion in the coming months.

Manufacturing sector weakness expected to prevail in near-term

In contrast to services, manufacturing output shrank at a quicker rate headed into 2025. The pace of manufacturing output contraction was the fastest in nine months amid a clear lack of orders, according to manufacturers.

The forward-looking New Orders Index meanwhile outlined the potential for the manufacturing-services divergence to further deepen in the coming months. While services new business was buoyed by rising tourism activity, as highlighted above, manufacturing new orders shrank at an accelerated rate at the start of 2025 amidst lower export demand. The difference between the services and manufacturing new business indices is at the widest in six months.

Additionally, business optimism among goods producers fell back below the long-run average after sinking to a 33-month low in January. Among the concerns raised by firms indicating a pessimistic outlook for production in the next 12 months were uncertainties regarding the outlook for sales amid trade uncertainties and rising prices.

Selling price inflation at joint-highest in eight months

Price pressures remained elevated for Japanese businesses at the start of 2025 according to PMI data, which tend to prelude the trend for consumer price inflation (CPI). The rate of input price inflation accelerated to the fastest since August 2024 and remained well above the series average in January. Higher raw material, transport and wage costs, partially underscored by weakness of the domestic currency, were again the main contributors to the acceleration of cost increases.

Despite rising cost pressures, selling price inflation remained unchanged from December, albeit staying the joint-highest since May of last year. Although still elevated by historical standards, the stagnation of the rate of output price inflation reflected firms' willingness to partially absorb price increases to support sales. This was most evident in the manufacturing sector, where selling prices continued to increase at a rate well below input cost inflation. However, service providers also raised selling prices at only a fractionally quicker rate in January despite a more significant acceleration in the rate of cost increases, likewise hinting at some margin squeeze.

Policy outlook

Overall, the latest PMI price gauges are indicative of inflation remaining at around the 2.0% mark in the coming months, which is supportive of the January Bank of Japan (BoJ) meeting decision to raise rates. The PMI prices data will remain an area to monitor for inflation trends in Japan the coming months. With the current elevated inflation trend and potential for sustained inflation amid yen weakness (as highlighted by PMI survey respondents) the likelihood for further monetary policy moves should not be ruled out for the rest of 2025. That said, the divergence in sector performance, specifically weakness in the manufacturing sector, remains a lingering concern and hints at some downside growth risks.

Access the PMI press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-amid-deepening-sector-divergence-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-amid-deepening-sector-divergence-Jan25.html&text=Japan%27s+private+sector+growth+accelerates+amid+deepening+sector+divergence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-amid-deepening-sector-divergence-Jan25.html","enabled":true},{"name":"email","url":"?subject=Japan's private sector growth accelerates amid deepening sector divergence | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-amid-deepening-sector-divergence-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+private+sector+growth+accelerates+amid+deepening+sector+divergence+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapans-private-sector-growth-accelerates-amid-deepening-sector-divergence-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}