Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 17, 2025

Week Ahead Economic Preview: Week of 20 January 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI data to provide New Year snapshots

In a week leading up to the inauguration of Donald Trump as the new US President, we will publish the January flash PMI data to help shed light on how companies around the world are faring amid the heightened political and economic uncertainty.

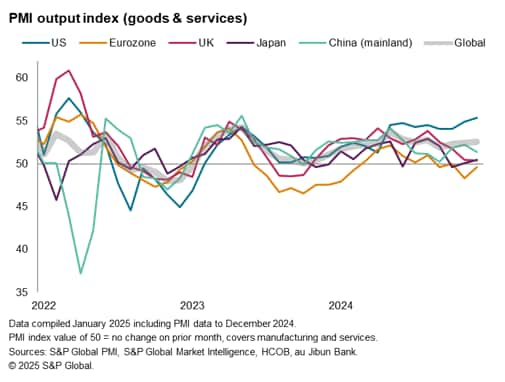

Prior PMI data showed the US has widened its lead among the developed economies at the end of last year, with growth accelerating to the fastest since April 2022. In contrast, business activity contracted slightly in the eurozone and both the UK and Japan reported near-stalled growth. India meanwhile led the major emerging economies, as mainland China notably lost growth momentum.

These diverging growth trends, if sustained, could have meaningful implications for monetary policy. The robust expansion evident in the US has added to speculation that the Fed could see just two rate cuts in 2025, and recent data showing reviving business confidence, or 'animal spirits', among expectations of a pro-growth agenda from the new administration and loosening financial conditions in the US add to some upside risks to business activity in January. Conversely, pressure could meanwhile mount on the Bank of England and European Central Bank to help support growth if the UK and eurozone PMIs disappoint. Forward-looking confidence indicators have been subdued for both, in part reflecting worries over the potential impact of mooted US policies on trade in particular.

Policy decisions will, however, naturally also depend on inflation trends, which the PMI surveys will also help assess. Recent official (CPI) inflation brought welcome news of downward pressure on core inflation in the US and UK, but the recent survey data have hinted that price pressures could revive again. PMI selling price gauges rose in the US, eurozone, Japan and the UK in December, the latter seeing a particularly elevated rate of inflation.

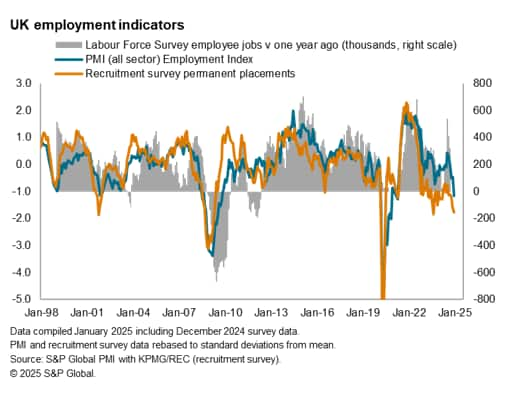

The UK also seen updated official UK labour market statistics. These follow recent survey data (and another aspect of the January flash PMIs to watch) showing a pull-back in hiring due in part to recent government policy changes, which will add to staffing costs from April.

Other key events in the economic diary include the Bank of Japan's first monetary policy meeting of 2025, which follows mounting speculation that interest rates could be hiked, as well as policy meetings in Norway, Turkey and Malaysia.

Key diary events

Monday 20 Jan

United States Market Holiday

Japan Machinery Orders (Nov)

China (Mainland) Loan Prime Rate (Jan)

Malaysia Trade (Dec)

Japan Industrial Production (Nov, final)

Germany PPI (Dec)

Canada BoC Business Outlook Survey

Tuesday 21 Jan

United Kingdom Labour Market Report (Nov)

Taiwan Export Orders (Dec)

Hong Kong SAR Inflation Rate (Dec)

Germany ZEW Economic Sentiment (Jan)

Canada Inflation Rate (Dec)

Wednesday 22 Jan

New Zealand Inflation (Q4)

Malaysia Inflation Rate (Dec)

Malaysia BNM Interest Rate Decision

South Africa Inflation (Dec)

Thursday 23 Jan

South Korea Business Confidence (Jan)

South Korea GDP (Q3, advance)

Japan Trade (Dec)

Australia NAB Business Confidence (Dec)

Singapore Inflation (Dec)

France Business Confidence (Jan)

Taiwan Industrial Production (Dec)

Norway Norges Bank Interest Rate Decision

Turkey TCB Interest Rate Decision

Canada Retail Sales (Nov, final)

United States Initial Jobless Claims

Eurozone Consumer Confidence (Jan, flash)

Friday 24 Jan

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Inflation (Dec)

United Kingdom Gfk Consumer Confidence (Jan)

Japan BoJ Interest Rate Decision

Singapore Industrial Production (Dec)

Taiwan GDP (Q4, advance)

Canada New Housing Price Index (Dec)

United States Existing Home Sales (Dec)

United States UoM Sentiment (Jan, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI for January

The first set of flash PMI data for 2025 will be released on Friday, January 24, for insights into economic conditions across major developed economies such as the US, UK, eurozone, Japan and Australia, as well as India, which has led emerging market growth through 2024. The flash data perfectly captures economic conditions just prior the change of US government, and will be assessed for growth, price and sentiment trends at the start of 2025.

Americas: US home sales; Canada inflation, retail sales

Key US releases in the new week include existing home sales figures and final January University of Michigan sentiment releases.

Meanwhile Canada updates inflation and retail sales figures for December. According to the latest S&P Global Canada PMI data, price pressures intensified slightly at the end of the year, attributed mainly to higher services inflation (selling price inflation in the goods producing sector eased). This was while services activity declined for the first time in three months, hinting at softening retail demand.

EMEA: UK labour market report; German ZEW survey, PPI data; Norway, Turkey central bank meetings

Labour market data will be anticipated from the UK, with the latest KPMG / REC UK Report on Jobs having indicated that permanent placements and vacancies declined at accelerated rates in December amidst employment cost concerns following the November Budget. The earlier S&P Global UK PMI release also showed UK employment falling at the sharpest pace since January 2021 in December.

Additionally, the German ZEW economic sentiment index will be published on Tuesday for insights into investor confidence. January's S&P Global Investment Manager Index (IMI) has already shown that money managers are much less optimistic regarding European as compared to the US and Asia-ex China equities at the start of 2025.

APAC: BoJ meeting, Japan inflation and trade data; China Loan Prime Rate; New Zealand, Singapore, Malaysia inflation data, South Korea, Taiwan GDP

The Bank of Japan (BoJ) convenes for their first meeting of 2025 with central bankers having hinted at the potential for interest rates to be lifted. Additionally, key inflation and trade data will also be due in the week, and the au Jibun Bank Japan PMI data earlier showed that December's selling price inflation remained elevated above the 2024 average, supporting the BoJ in shifting rates.

Besides Japanese data, tier-1 releases will also be anticipated from the APAC region including inflation numbers out of New Zealand, Singapore and Malaysia. South Korea and Taiwan also update fourth quarter GDP.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-january-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-january-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+20+January+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-january-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 20 January 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-january-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+20+January+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-20-january-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}