Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2025

Japan flash PMI signals steepest output fall for three years as confidence hits lowest since August 2020

Japan's private sector output fell in March for the first time since last October, according to the flash PMI, dropping at the sharpest rate for three years. Sector data revealed that, while the manufacturing sector's downturn continued to be driven by worsening demand, labour constraints partly contributed to a renewed fall in services activity.

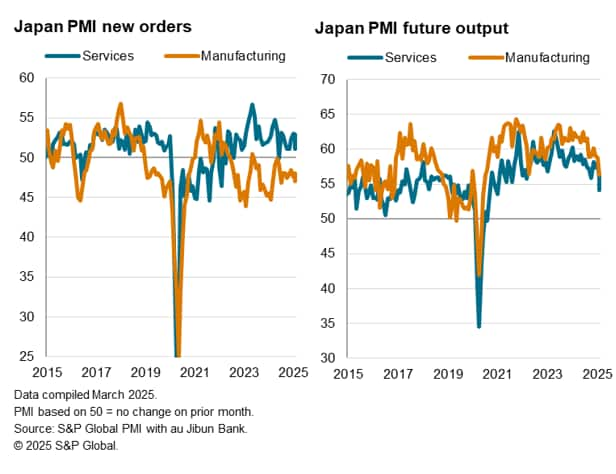

Forward-looking indicators painted a subdued picture for output in the coming months. Overall new orders fell for the first time in nine months while the Future Output Index slipped to the lowest since August 2020, altogether signalling the likelihood of reduced business activity in the near-term.

Sales in March were notably also dampened by elevated prices. Output (selling) prices rose at a solid pace at the end of the first quarter despite Japanese firms partially absorbing a steep increase in costs.

Japan's flash PMI signals first contraction in five months

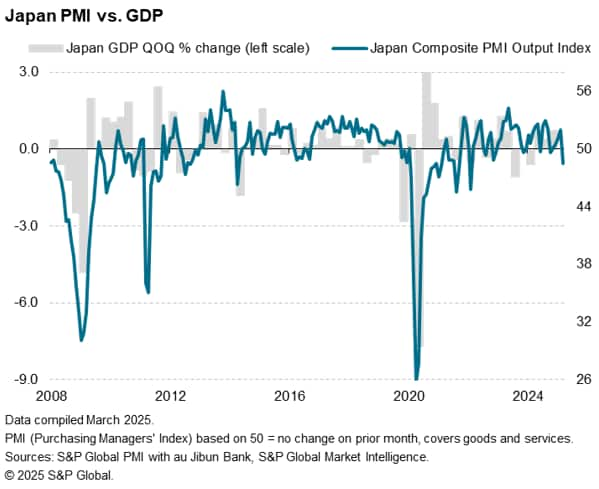

The au Jibun Bank Flash Japan Composite PMI, compiled by S&P Global, posted 48.5 in March, down from 52.0 in February. Falling past the 50.0 neutral mark, the latest reading signalled that Japan's private sector contracted for the first time since last October. Moreover, the rate of contraction was the most pronounced in just over three years.

At current levels, the latest PMI reading is indicative of GDP contracting at a quarterly rate of around 0.5% in March.

Broad-based decline in Japan's private sector output in March

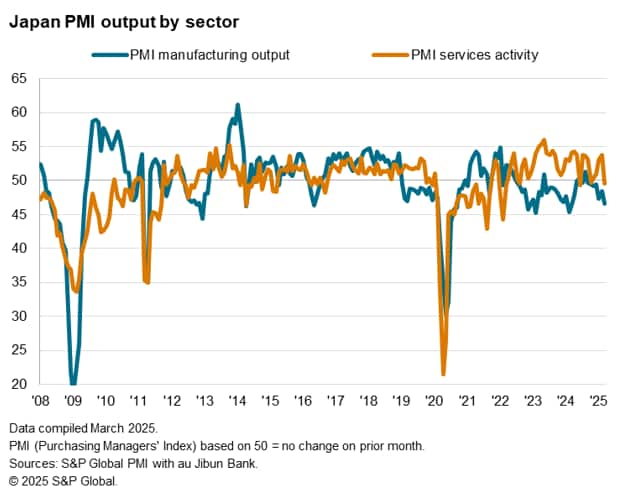

The latest contraction in private sector output was driven by falling services activity. Business activity in the service sector slipped into contraction after expanding in the past four months. While marginal, the rate of decline was the fastest in nine months. Anecdotal evidence revealed that slower new business growth curbed activity, though labour constraints also contributed to the decline. This was despite services firms having raised staffing levels continuously since October 2023.

Labour constraints also caused the level of unfinished business to rise at the fastest pace in four months. Whether services activity can deal with backlogs of work and return to growth in the coming months may well depend on service providers' ability to acquire skilled labour, especially when faced with challenges including labour shortages and an aging population.

Meanwhile the manufacturing sector also contributed to the fall in overall activity by reporting the fastest decline in production in a year. March also marked the seventh consecutive month in which manufacturing output contracted in Japan. According to panellists, reductions in goods new orders dampened output at the end of the first quarter. The latest fall in new work inflows was the fastest in eight months, plagued by economic uncertainties and elevated prices.

Forward-looking indicators outline risks for further downsides

Forward-looking indicators pointed at the likelihood for further downsides for near-term performance.

In particular, overall new orders declined for the first time in nine-months, albeit only marginally. As mentioned, the reduction in new work was limited to the goods producing sector, though services new business growth softened for a second successive month to rise at only a marginal pace. Altogether, the latest data showed an overall worsening in demand conditions for the first time in nine months.

Additionally, the survey's only sentiment-based indicator - the Future Output Index - revealed that business optimism among Japanese private sector firms fell to the lowest since August 2020, which was when we last saw an extended period of output contraction in Japan. Among the reasons provided for pessimism regarding output in the next 12 months were mentions of economic and tariff uncertainty, elevated prices, and labour supply issues, the latter observed especially in the services sector. As such, the likelihood of services activity returning to growth in the coming months appear to be less certain.

Margin pressures rise for Japanese private sector firms

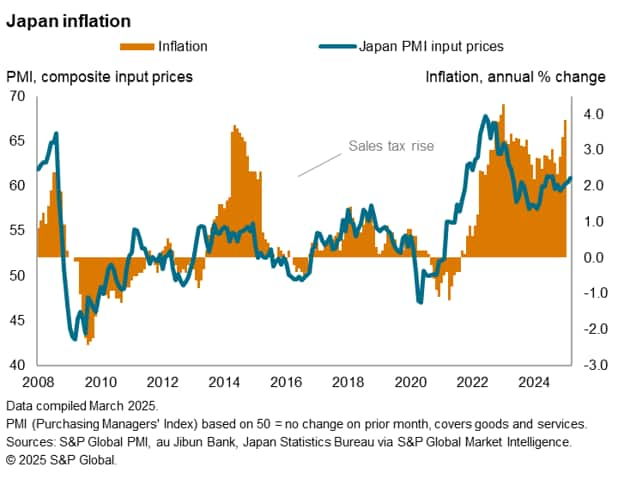

Finally, elevated prices also played a part in dampening demand for Japanese goods and services in March, and PMI prices data suggest that there may not be any reprieve in the pipeline in the near-term.

Average selling prices in Japan rose at a solid rate according to the flash March data. Despite the rate of output price inflation moderating for a third successive month to the lowest since last October, firms continued to report that elevated prices eroded sales. This was even after Japanese private sector firms opted to partially absorb cost increases in order to slow the pace at which they raised charges. Input cost inflation notably climbed to the highest since the third quarter of last year, attributed to higher input material, fuel and wage costs. Amid service sector labour shortages, the prospect for higher wage pressures have also risen. The steady intensification of cost pressures therefore pointed to the likelihood that firms may have to continue raising selling prices in the coming months.

Overall, the latest PMI price gauges are indicative of inflation running above the 2.0% mark in the coming months, supporting the Bank of Japan's (BoJ) tightening bias. That said, with private sector output shifting into contraction in March and the outlook for business activity growth dimming, especially amidst rising protectionism policy changes, uncertainty has greatly risen regarding the timing in which the BoJ may next tightening monetary policy.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-steepest-output-fall-for-three-years-as-confidence-lowest-since-2020-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-steepest-output-fall-for-three-years-as-confidence-lowest-since-2020-Mar25.html&text=Japan+flash+PMI+signals+steepest+output+fall+for+three+years+as+confidence+hits+lowest+since+August+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-steepest-output-fall-for-three-years-as-confidence-lowest-since-2020-Mar25.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals steepest output fall for three years as confidence hits lowest since August 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-steepest-output-fall-for-three-years-as-confidence-lowest-since-2020-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+steepest+output+fall+for+three+years+as+confidence+hits+lowest+since+August+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fjapan-flash-pmi-signals-steepest-output-fall-for-three-years-as-confidence-lowest-since-2020-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}