Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 21, 2025

Week Ahead Economic Preview: Week of 24 March 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI data to provide steer on geopolitical economic impact

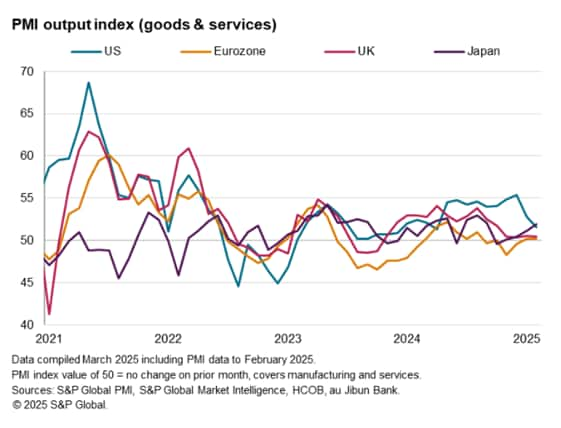

Flash PMI data for March will be released Monday, setting the scene for economic conditions in the major developed economies as businesses react to the changing tariff, fiscal and geopolitical environments, with US and European trends under particular scrutiny.

The flash PMIs are followed by several other key releases to help guide monetary policy, notably the Fed's preferred gauge of inflation - core PCE prices - as well as inflation data in the UK, Spain and France. Business sentiment in Germany will also be eyed for the impact of recent debt brake developments.

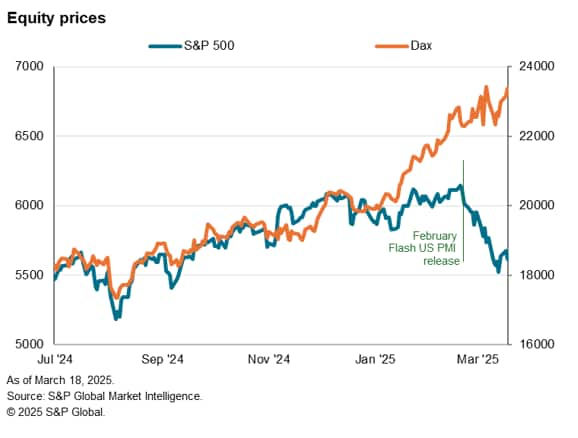

February's flash PMI data, which showed a sudden deterioration of service sector growth in the US after a strong start to the year, was an early catalyst of a sharp subsequent decline in US equity prices. Having hit an all-time high on February 19th, the S&P 500 has since fallen nearly 9%. While investor optimism had surged following President Trump's election, concerns have emerged due to uncertainty around tariff announcements and the uncertainty caused by new policies. The S&P Global Investment Manager Index survey has recently indicated one of the most risk-averse periods for US equity investors in five years.

The flash PMI economic reports released on February 21st were the first to cement these worries. Not only did the S&P Global flash PMI revealed a sharp slowdown in US services business growth, the survey also found rapidly rising costs, suggesting increasing risks of stagflation. That contrasted with more positive PMI reports in Europe and Japan. It remains unclear to what extent growth in these economies (as well as US manufacturing) is being buoyed by the front-running of tariffs, and clarity will be sought here from the March PMIs.

Likewise, the European and US PMIs will be eyed for any contrasting impact of fiscal policy: while the news flow in the US is being dominated by Federal budget cutting, March has seen European news filled with reports of greater government spending on defence and infrastructure.

In the UK, the PMI data have been especially bleak in terms of employment, as Autumn Budget policies raised staffing costs for businesses. How these changes have affected hiring in March and the official February inflation data will be key developments to monitor.

Key diary events

Monday 24 Mar

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Singapore Inflation (Feb)

Switzerland Current Account (Q4)

United States Chicago Fed National Activity Index (Feb)

Tuesday 25 Mar

Japan BoJ Monetary Policy Meeting Minutes (Jan)

Thailand Balance of Trade (Feb)

Taiwan Industrial Production (Feb)

Hong Kong SAR Trade (Feb)

Germany Ifo Business Climate (Mar)

United States S&P/Case-Shiller Home Price (Jan)

United States CB Consumer Confidence (Mar)

United States New Home Sales (Feb)

United States Richmond Fed Manufacturing Index (Mar)

Wednesday 26 Mar

Australia Monthly CPI Indicator (Feb)

Singapore Industrial Production (Feb)

United Kingdom Inflation (Feb)

France Consumer Confidence (Mar)

United States Durable Goods Orders (Feb)

Canada BoC Summary of Deliberations (Mar)

Thursday 27 Mar

China (Mainland) Industrial Profits (Feb)

Eurozone ECB General Council Meeting

Norway Norges Bank Interest Rate Decision

United States GDP (Q4, final)

United States Good Trade Balance (Feb, adv)

United States Wholesale Inventories (Feb, adv)

United States Pending Home Sales (Feb)

Mexico Banxico Interest Rate Decision

Friday 28 Mar

Japan BoJ Summary of Opinions (Mar)

Philippines Trade (Feb)

Japan Housing Starts (Feb)

Germany GfK Consumer Confidence (Apr)

United Kingdom Retail Sales (Feb)

United Kingdom Goods Trade Balance (Jan)

France Inflation (Mar, prelim)

Spain Inflation (Mar, prelim)

Germany Unemployment Rate (Mar)

Eurozone Economic Sentiment (Mar)

Canada GDP (Feb, prelim)

United States Core PCE Price Index (Feb)

United States Personal Income and Spending (Feb)

United States UoM Sentiment (Mar, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

March flash PMI release

Flash PMI will be released for the US, UK, Eurozone, Japan Australia and India on Monday, March 24th, for the earliest insights into economic conditions at the end of the first quarter. Amid fresh US tariff developments in the month, output and price trends will be keenly followed. This is especially so for the manufacturing sector, where questions remain over the sustainability of February's upturn. Additionally, the impact on order books, sentiment and employment will also be closely watched. The flash data follow news that global employment declined in February amidst the fastest fall in developed world staffing levels since July 2020.

Americas: US core PCE, GDP, durable goods orders, new home sales, personal income and spending data

A series of US economic data will be released in addition to flash PMI for March. The highlights include the Fed's preferred inflation gauge, the core PCE index, which will be assessed following the lower-than-expected February CPI release earlier in the month. That said, more up-to-date March flash PMI prices may play a bigger role in providing guidance on the inflation trend in the US, especially with the market eagerly watching the impact of additional tariffs implemented in March.

Other key data releases include a final reading of Q4 GDP, monthly durable goods orders, home sales and personal income and spending data.

EMEA: UK inflation, retail sales, trade data; France and Spain inflation; Germany unemployment, Ifo, GfK surveys; Norges bank meeting

February inflation figures from the UK will be released for an official confirmation of what is likely to be still-elevated price pressures. This is based on early indications from February's S&P Global UK PMI data, which showed output prices in the UK climbing at the second-fastest pace in more than one-and-a-half years, ranked just behind January's increase.

Additionally, France and Spain will publish preliminary March inflation figures. Germany's PMI Future Output data, alongside Ifo and GfK surveys, will also be in focus for sentiment changes following recent tariff and debt brake developments.

APAC: BoJ meeting minutes; Australia monthly CPI; Singapore inflation

A relatively light week for APAC is expected with the Bank of Japan releasing their summary of opinions from their March meeting and meeting minutes from January's. On the inflation front, Australia and Singapore publishes monthly CPI figures in the week.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-march-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-march-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+24+March+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-march-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 24 March 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-march-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+24+March+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-march-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}