Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2025

Flash UK PMI rises to six-month high in March amid stronger service sector expansion

An upturn in business activity in March brings some good news for the government ahead of the Chancellor's Spring Statement, offering a respite from the recent flow of predominantly downbeat economic data. However, just as one swallow does not a summer make, one good PMI doesn't signal a recovery.

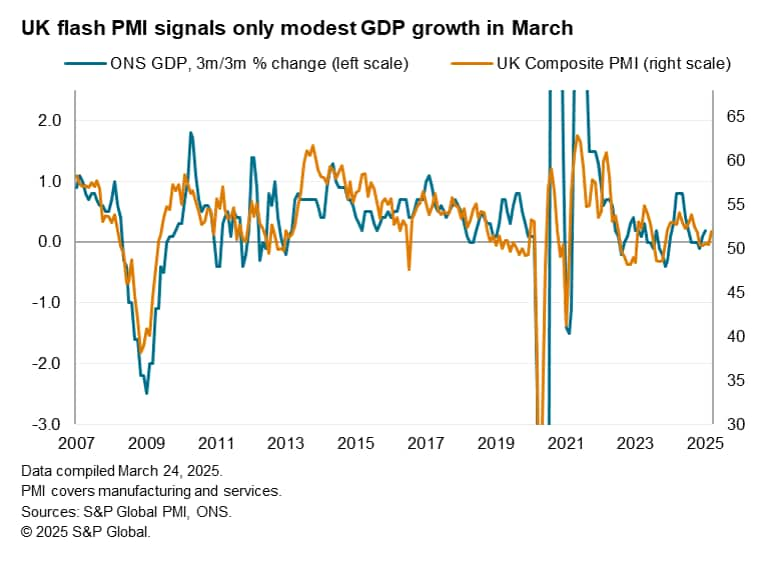

The signal from the flash PMI is an economy eking out a modest expansion in March, consistent with quarterly GDP growth of just 0.1%, but with employment continuing to be cut thanks to concerns over costs and the uncertain outlook. Confidence is still running close to January's two-year low.

The improvement is also being driven by only small pockets of growth, notably in financial services, with consumer-facing business and manufacturers continuing to struggle against headwinds both at home and abroad.

These headwinds include the additional costs imposed on businesses in the Budget, low confidence among businesses and households, and sluggish demand at home and abroad, the latter linked to heightened geopolitical uncertainty resulting from US tariff policies.

Worryingly, these headwinds are likely to grow in force as higher National Insurance contributions come into effect in April, coinciding with the anticipated review of US tariff policy on 2nd April, the latter having the potential to further subdue global economic growth and dampen UK trade.

Economy perks up amid boost from services

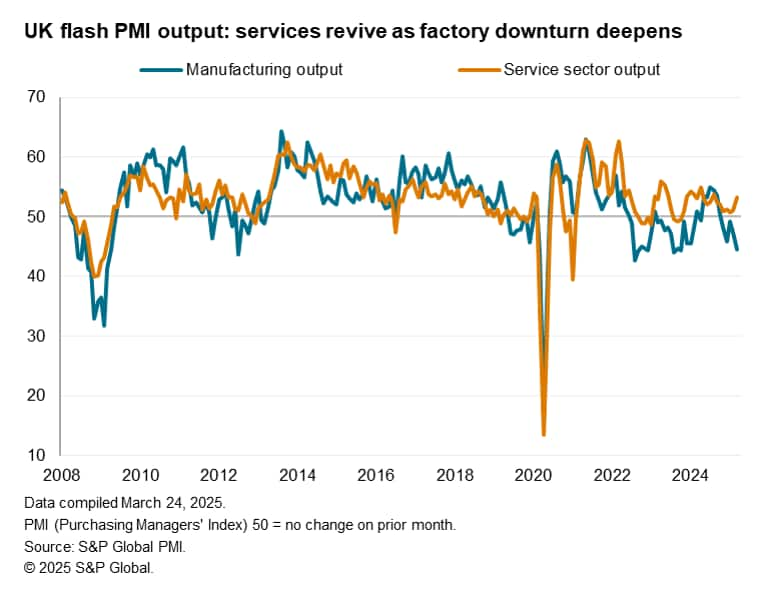

A rise in the flash PMI's headline Output Index, from 50.5 in February to a six-month high of 52.0 in March, indicates that UK business activity grew at the fastest rate since last September. Driving the upturn was the sharpest increase in service sector activity since last August. However, the overall services expansion was subdued by ongoing malaise in consumer-facing businesses, and was largely concentrated on tech and financial services. Better weather also likely helped boost some aspects of services activity.

The manufacturing sector meanwhile slipped deeper in severe contraction, the rate of output loss accelerating to the sharpest recorded for nearly one-and-a-half years.

The resulting signal is one of the UK economy scratching out only modest growth in March (a quarterly GDP growth rate of just 0.1% being signalled), leaving the first quarter as a whole largely flat.

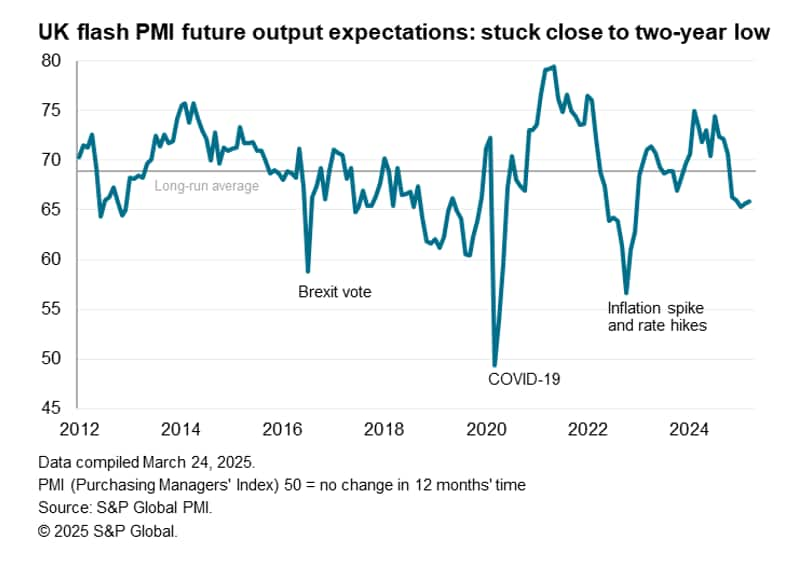

Sentiment stuck near two-year low

The survey's forward-looking indicators moved higher, though remained subdued to suggest that economic conditions will remain tough in the near term.

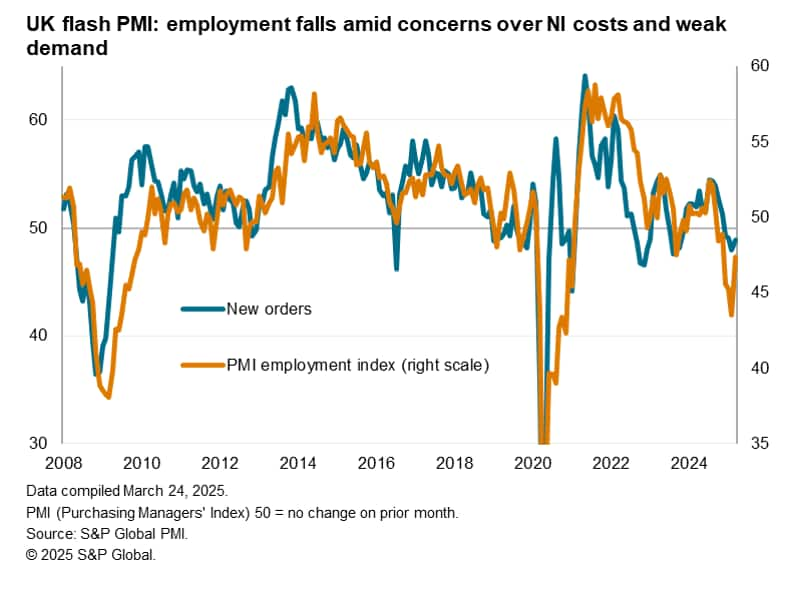

First, inflows of new business contracted for a fourth successive month and, although some encouragement can be gleaned from the rate of decline moderating compared to February, the data suggest that demand is continuing to fall (just at a reduced rate).

Second, backlogs of work were also depleted at a reduced rate, falling at the softest pace since last October, but the signal is one of current output levels only being achievable by companies eating into orders placed in prior months.

Third, business optimism about the outlook also ticked higher, rising to the brightest recorded so far this year. However, the overall level of sentiment remains well below its long-run average, having barely risen from January's two-year low.

The tale of two divergent sectors was replicated in these forward-looking data. Service sector new business inflows rose marginally after two months of decline, while expectations of activity levels in the coming year revived to their highest since last October. In contrast, manufacturers reported the sharpest drop in new orders since August 2023, the rate of decline accelerating to a worryingly sharp degree. Business confidence also slumped sharply in the factory sector, now sitting at its lowest since November 2022, encouraging producers to slash their purchases of inputs to an extent not seen for 15 months.

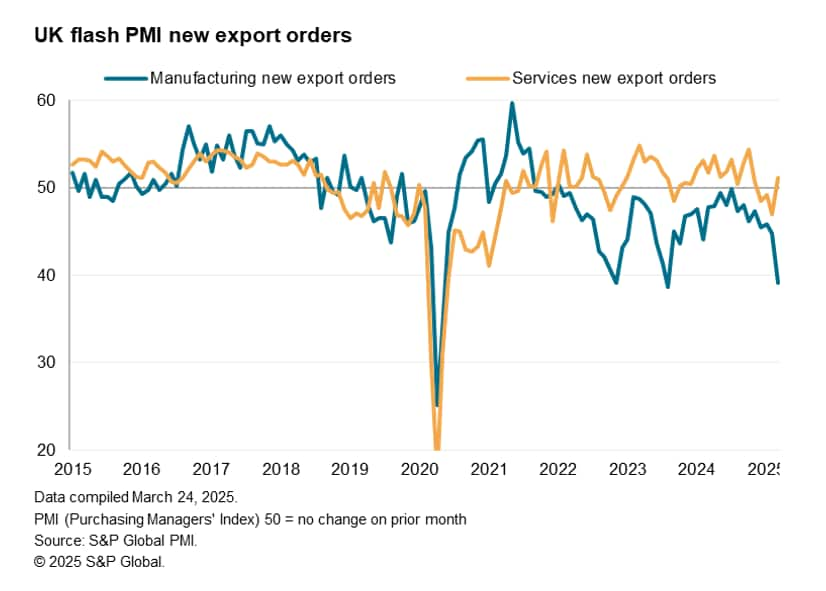

Shifting global demand conditions likely also played a role in driving the sectoral divergence: as exports of services rose after three months of decline, goods exports fell in March to the greatest extent since August 2023.

Companies in both sectors commonly blamed low business and consumer confidence for weak demand, with many surveyed firms also citing recent government policy changes - notably on National Insurance - for rising costs and for stymieing business expansion. However, manufacturers also blamed tariff worries, trade uncertainty and weakening international demand as an increasing drag on export sales.

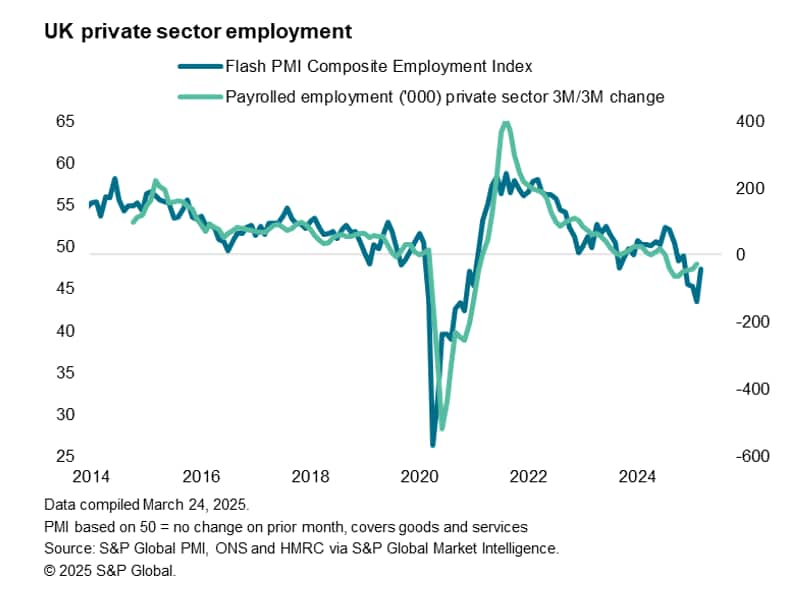

Further job cuts

Jobs were cut on average for a sixth straight month, with companies citing the weak demand environment, uncertainty about the outlook and impending additional payroll costs associated with the new policies announced in the Autumn Budget. However, rates of job shedding moderated in both sectors compared to the steep cuts recorded in February, cooling notably in the service sector. The resulting overall drop in employment signalled by the March flash survey was the smallest since November.

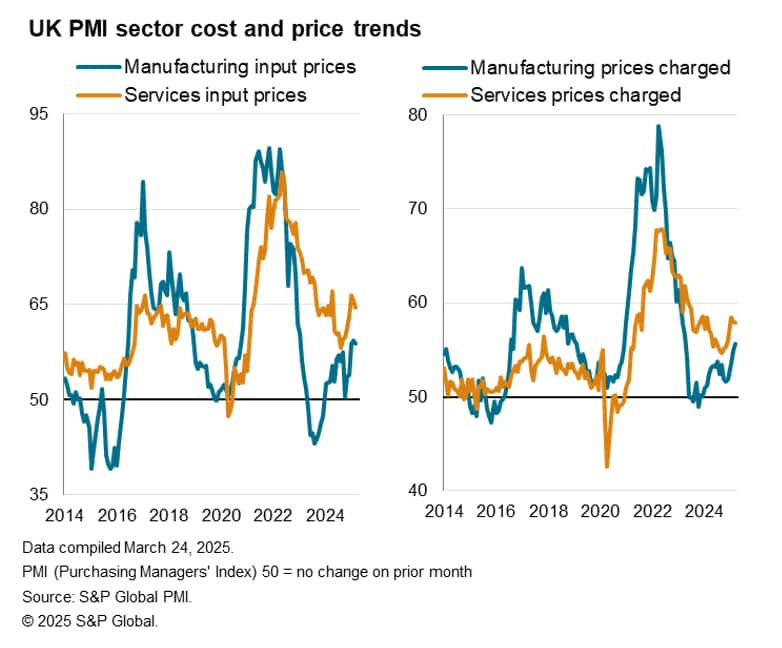

Higher costs

Higher employee costs were also widely linked to a further steep rise in average input prices in both manufacturing and services, albeit with rates of increase cooling slightly in both sectors. Although the overall rate of input cost inflation consequently slowed slightly for a second month, the rate of inflation remained the third-sharpest recorded over the past 19 months.

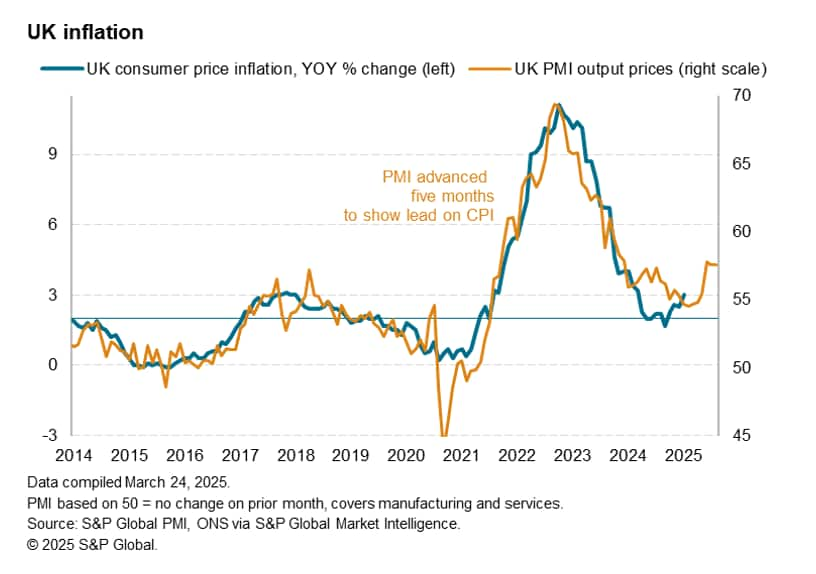

Higher costs fed through to higher selling prices. Average charges for goods and services rose at a rate unchanged on February and only slightly below January's one-and-a-half-year high as companies sought to protect margins to cover increased NI costs. While services inflation cooled slightly, it remained especially elevated relative to its pre-pandemic average. Manufacturing selling prices were meanwhile hiked to a degree not seen for almost two years.

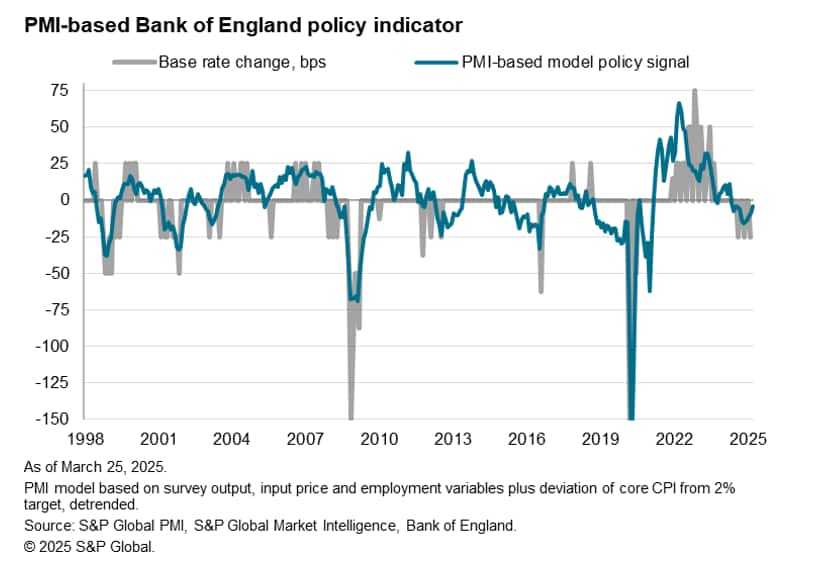

Policy pause

From a policy perspective, the combination of faster output growth, elevated price pressures relative to long-run averages, and reduced job losses, signals a less dovish stance than alluded to by the February PMI data.

The March PMI data are therefore consistent with the Bank of England retaining an easing bias but placing a greater focus on assessing the upcoming data to glean more information on the extent to which higher costs might feed through to inflation, and the degree to which potential headwinds to growth could dampen the nascent upturn in business activity seen in March.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-rises-to-sixmonth-high-in-march-amid-stronger-service-sector-expansion-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-rises-to-sixmonth-high-in-march-amid-stronger-service-sector-expansion-Mar25.html&text=Flash+UK+PMI+rises+to+six-month+high+in+March+amid+stronger+service+sector+expansion+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-rises-to-sixmonth-high-in-march-amid-stronger-service-sector-expansion-Mar25.html","enabled":true},{"name":"email","url":"?subject=Flash UK PMI rises to six-month high in March amid stronger service sector expansion | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-rises-to-sixmonth-high-in-march-amid-stronger-service-sector-expansion-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+UK+PMI+rises+to+six-month+high+in+March+amid+stronger+service+sector+expansion+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-uk-pmi-rises-to-sixmonth-high-in-march-amid-stronger-service-sector-expansion-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}