Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 24, 2025

Flash eurozone PMI signals return to growth for manufacturing in March

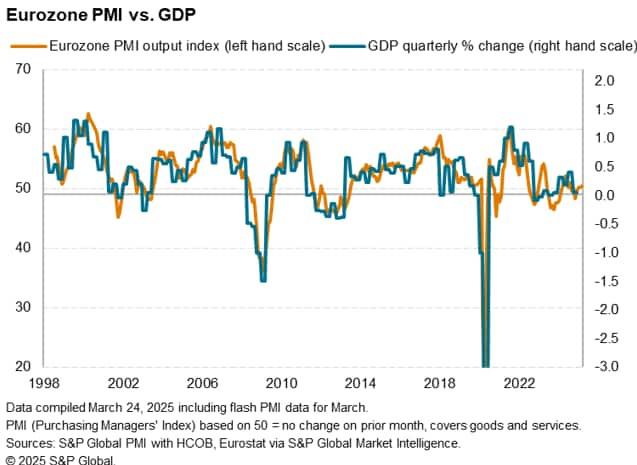

The flash PMI® survey data showed the eurozone economy expanding marginally at the end of the first quarter, putting the region on course for positive but sluggish 0.1% GDP growth.

However, the headline data masked varying sector performances, and in particular signs of a revival in eurozone manufacturing, led by Germany. While in part driven by pre-tariff shipments to the US, the production upturn also reflected indications of domestic demand picking up in the region, albeit limited to the goods-producing sector.

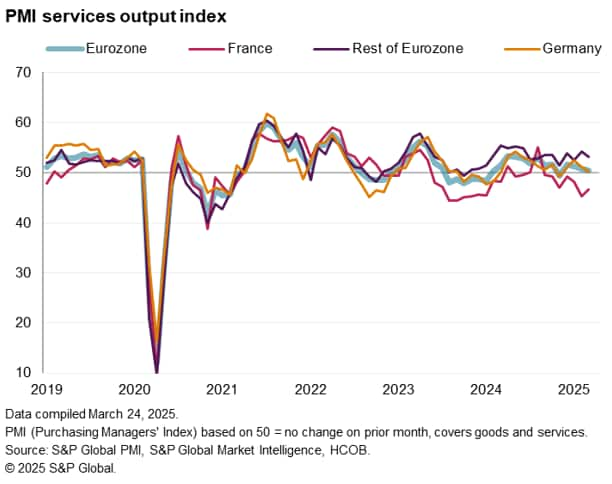

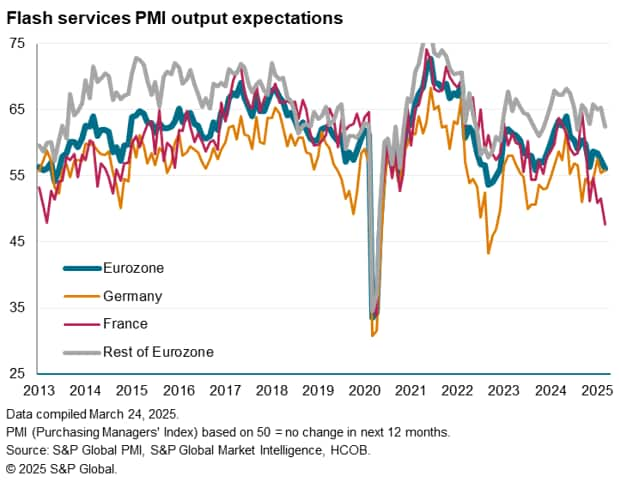

Business conditions meanwhile continued to deteriorate in the services economy, though - and with inflation signals remaining benign - the ongoing contraction of this major part of the region's economy will fuel hopes of a further imminent interest rate cut by the ECB.

Eurozone business activity edges higher

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, ticked up to 50.4 in March from 50.2 in February, signalling a third successive marginal monthly expansion in business activity across the euro area. Although only slight, the latest rise was the fastest since last August and indicative of GDP rising at a quarterly rate of just over 0.1%. While clearly only very modest, this represents a further improvement on the marginal contraction signalled at the survey's recent low point last November.

Manufacturing returns to growth

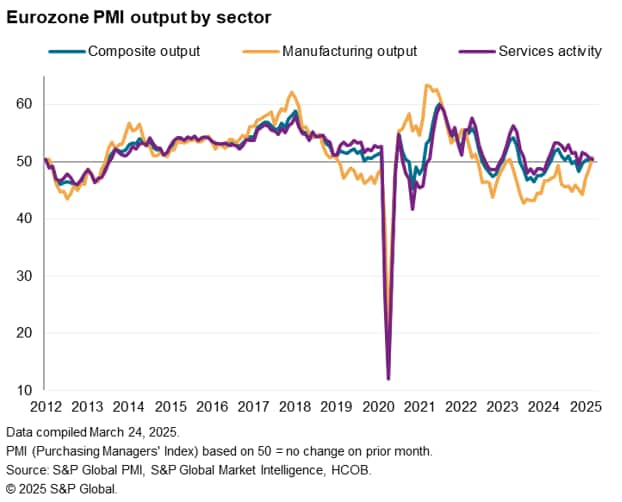

The sluggish increases in output recorded over recent months have, however, masked a significant change in the performance of the region's manufacturing economy.

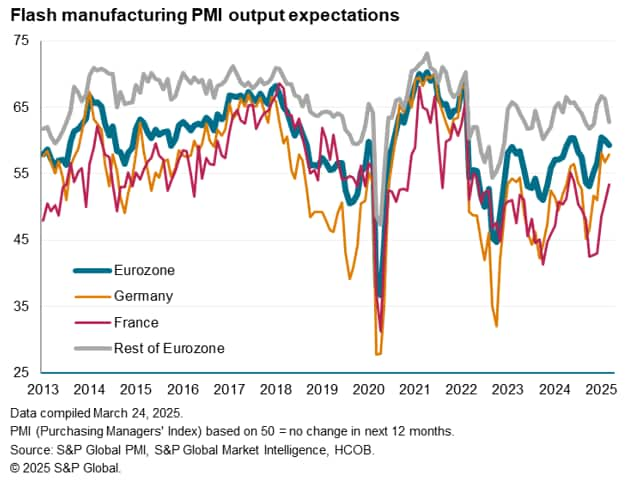

Manufacturing production returned to growth in the eurozone during March, rising for the first time in two years and to the greatest extent since May 2022. The rise represents a sharp contrast to the severe rate of decline recorded by the survey as recently as last December, the rate of deterioration having eased markedly in the first two months of 2025 before edging back into growth at the end of the first quarter.

While new orders for goods continued to fall, down for a thirty-fifth successive month, the decline was only marginal and the smallest yet recorded over this near-three-year period. Goods export orders also continued to fall, albeit at the slowest rate for nearly three years.

While service providers likewise reported a rise in activity for the fourth month running, the pace of expansion cooled to the weakest so far over this period to hint at a near-stalling of activity in the services economy. New business placed at service providers fell slightly for a second successive month.

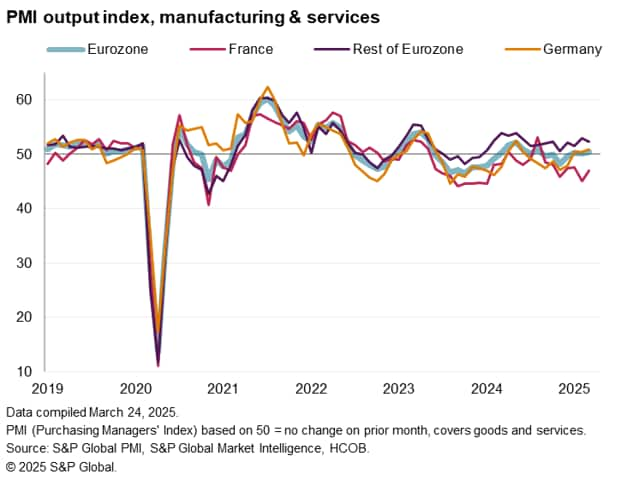

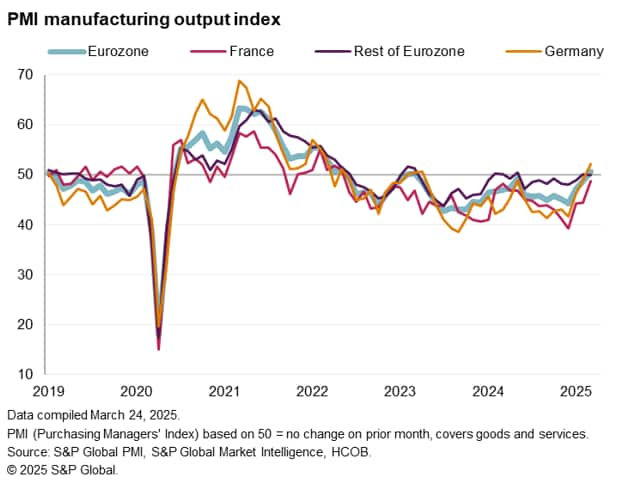

Eurozone buoyed by fastest German factory expansion for three years

By country, key to the eurozone's expansion was a third month of sustained output growth in Germany during March, which remained only modest but nonetheless reached a ten-month high, in part thanks to a renewed expansion in manufacturing output. German factory output in fact grew at the sharpest rate for three years, helping offset a near-stalled service sector, thanks to the first rise in new orders for German-produced goods in three years. Of note, export orders for goods from Germany fell at a slightly increased rate, though the past two months have seen the smallest declines recorded over the last three years.

While business activity in France decreased for a seventh month running, the pace of contraction moderated from that seen in February, likewise reflecting signs of change in the manufacturing economy. Although factory output fell in France for a thirty-fourth successive month, March's decline was only modest and the shallowest seen over this period. While a further sharp service sector decline was meanwhile recorded in France, this downturn also lost some intensity.

Meanwhile, a further solid increase in output was recorded in the rest of the Eurozone, extending the current sequence of growth to 15 months, buoyed in particular by sustained robust service sector growth.

Drivers of change

Key questions surrounding the improvement in the manufacturing data are whether this merely represents a short-term uptick as firms seek to ship deliveries to the US ahead of tariffs, or whether European manufacturers are seeing the signs of a more sustainable-looking domestic recovery. The latter may be buoyed by recent pledges to increase fiscal spending, notably on defense and infrastructure.

Analysis of the anecdotal reasons given by producers reveals only few instances of explicit attribution of cases of higher output, orders or exports to the need to beat tariffs, though higher shipments to the US were often cited to hint strongly that US imports played a role in driving the upturn.

Encouragingly, when looking at firms' expectations of output in the year ahead, there were few cases of producers expecting output to weaken as a temporary pre-tariff-related upturn waned. Instead, optimism was reportedly building on hopes that domestic recoveries will offset a broader trade malaise that might occur once US tariffs are ramped up. Business expectations in the French manufacturing economy hit a nine-month high and improved to the second-highest in three years in Germany.

However, the improvement in sentiment was by no means universal. The factory sector of the rest of the eurozone saw optimism dip to a four-month low. Perhaps more worryingly, service sector optimism across the eurozone sank to a one-and-a-half year low, reflecting across-the-board deteriorations. Of particular concern, service sector expectations in France are now at their lowest since 2008, if the early pandemic months are excluded.

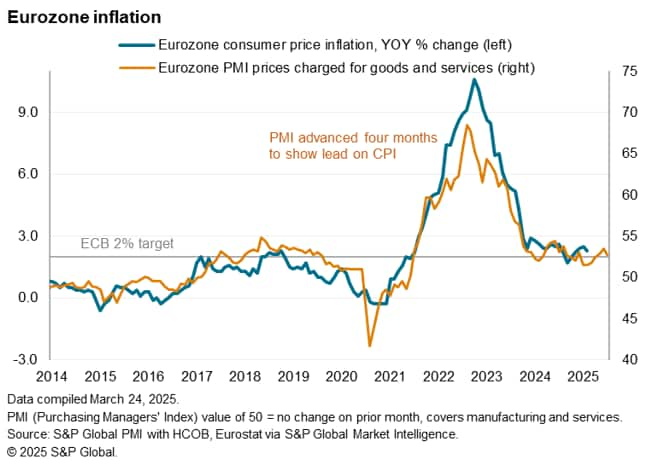

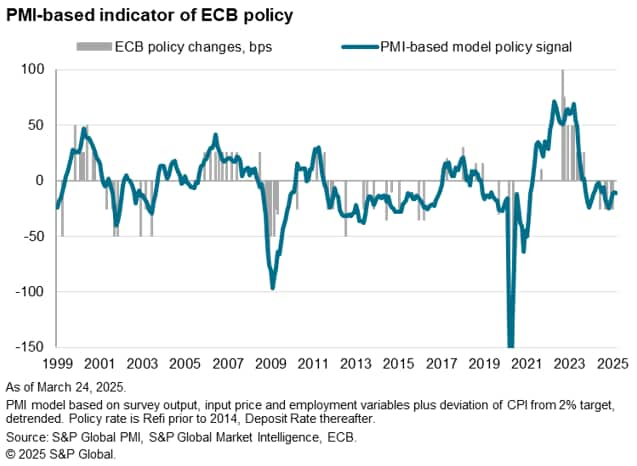

ECB policy

The persistent weakness of the service sector raises the possibility of the ECB cutting rates further to stimulate this domestically-focused aspect of the eurozone economy. The door to further rate cuts is also opened somewhat by the flash eurozone PMI's main selling price index, which tracks changes in prices charged for both goods and services, dropping in March - back to a level broadly consistent with inflation running close to the ECB's target.

A composite indicator of key PMI gauges and the extent to which inflation is deviating from the ECB's 2% target remained firmly in rate-cutting territory in March, reflecting the overall weakness of output growth, the relatively subdued inflation picture, and a sustained broadly-stalled labour market seen in the latest surveys.

Markets are currently fully pricing in another ECB rate cut by June, further to the March cut, which took the deposit rate to 2.5%. A 60% chance is given to a cut as soon as April.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-return-to-growth-for-manufacturing-in-march-Mar25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-return-to-growth-for-manufacturing-in-march-Mar25.html&text=Flash+eurozone+PMI+signals+return+to+growth+for+manufacturing+in+March+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-return-to-growth-for-manufacturing-in-march-Mar25.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI signals return to growth for manufacturing in March | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-return-to-growth-for-manufacturing-in-march-Mar25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+signals+return+to+growth+for+manufacturing+in+March+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-signals-return-to-growth-for-manufacturing-in-march-Mar25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}