Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

PUBLICATION

Jul 21, 2020

Healthcare dividends to remain resilient

Despite Covid-19, we expect a payout of $64bn in 2020

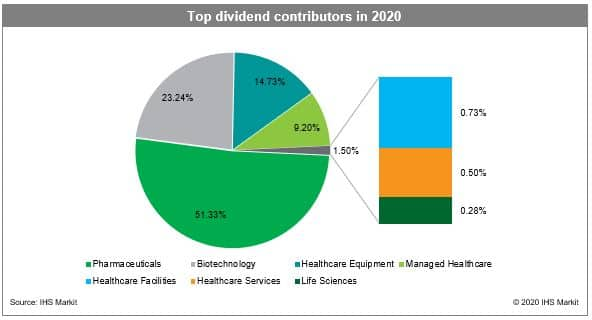

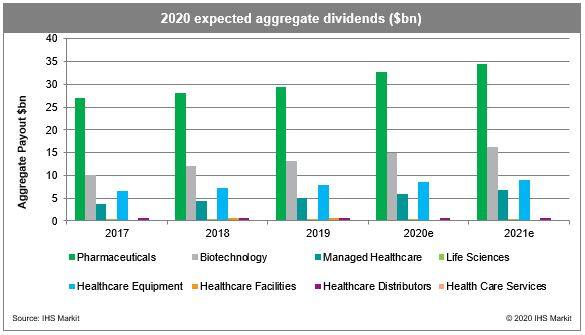

Healthcare is expected to deliver stable returns to shareholders, and we expect the industry to declare aggregate dividends of $64 billion for FY20. The growth in dividends in recent years was mostly attributed to higher earnings - which stemmed from favorable policies, an accelerated M&A activity, unfettered drug pricing environment, and the ability of companies to gain access to untapped markets due to the expanding coverage of public health insurance.

The sector has a robust earnings outlook; street analysts are expecting profits to jump by 7.89% on a per-share basis over the next three years. We expect the dividend growth to stay positive with Pharma, Biotechnology, and Managed Healthcare projected to have a YoY growth rate of around 15%, 14%, and 16%, respectively. Our forecasted growth in dividends is premised on high demand for healthcare products and services coupled with the inelastic nature of the products and/or services offered.

Covid-19 impact will be wide but varied across healthcare sub-sectors

The outbreak of Covid-19 has put an enormous pressure on dividends worldwide. While the primary impact of the virus is to human health, the outbreak has negatively affected every industry. The United States remains the epicenter of the pandemic and has the highest Covid-19 death rates in the world; this has put overwhelming pressure on the healthcare industry. In our view, the spread of the virus will have mixed implications for US-based healthcare companies. Demand for some will be hit-hard in the short term as their businesses are tied to deferable services, while other companies will be less impacted, due to business diversity and solid underlying demand.

Low Exposure - Pharma, Biotech and Managed Healthcare fall under this category as the sustainability of the dividends remain high. Most of these companies reported stable results and benefited from accelerated sales; Johnson & Johnson (JNJ) and UnitedHealth (UNH) have already increased their dividends for FY20.

Medium Exposure - The Healthcare Equipment and Life sciences sub-sectors make up the medium exposure group as their profitability is expected to be impacted significantly. However, companies like Abbott Labs (ABT) and Medtronic Inc (MDT) remain committed to their dividend programs based on the assumption that the latter half of the year will be a recovery period.

High Exposure - Healthcare Facilities and Services remain highly exposed to the clouded impact of Covid-19 on the economic outlook with companies like HCA Healthcare Inc (HCA) suspending their dividends to preserve cash as patient volumes declined sharply during H1 2020.

Pharmaceuticals and Biotechnology

With respect to the total expected industry dividends, the Pharma sector alone accounts for nearly 51% making it the largest payer. The major growth drivers for the pharma companies are effective R&D expenditure and inorganic growth. In FY'19, companies resorted to multi-billion acquisition activities at a robust speed to take advantage of the potential cost synergies over the long-term and to strengthen their hand as it pertains to drug pricing powers. However, as a result of Covid-19, H1 2020 has seen the quietest M&A period in the history of pharma companies.

Dividends can follow an upward trajectory in the H2 2020 if earnings register an uptick in growth - driven by factors such as realized synergies, successful drug launches, and returns to be materialized from the promising pipeline with which pharma entered 2020. Nonetheless, we do not rule out the possibility of a downside risk reflecting the uncertainty surrounding Covid-19 due to reduced demand in some drug categories. However, the impact likely remains subtle as the demand for prescription and Over the Counter (OTC) drugs remains sturdy.

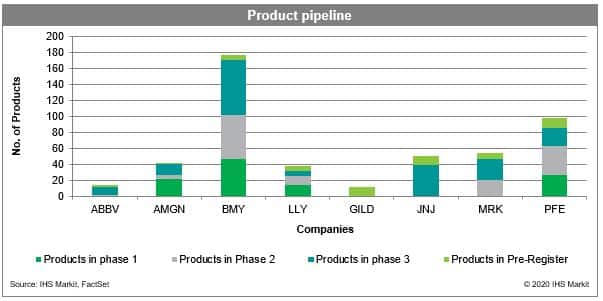

Robust product pipeline

The branded drug industry's late-stage pipeline remains of good quality. However, the pandemic is slowing some clinical trials across numerous therapeutic categories, delaying the timelines for bringing new drugs to the market.

Products in phase 3 and pre-register levels entail the new revenue-generating opportunities that the companies hold for the upcoming years. Products in phase 2, and especially phase 1, will act as an offset to the expected lost revenues due to the patent expirations and arising bio-similar threats in the long-term. Currently, BMY holds the largest number of products (177) in its portfolio, justifying the R&D level of the company; however, GILD's count of a mere 11 products reflects the amount of R&D spent on each drug coupled with company's high stakes on Remdesivir.

Lastly, we believe that the industry's continuous urge for innovation, consolidation, and convergence techniques along with a strong drug pipeline will help the companies to strive through the crisis without having to compromise on the capital deployment mix, in which dividends remain a crucial part.

Contacts:

Amira Abdulkadir, Product Analysis & Design Director

Akshit Gupta, Research Analyst

Email: dividendsupport@ihsmarkit.com

To access the report, please contact dividendsamer@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhealthcare-dividends-to-remain-resilient.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhealthcare-dividends-to-remain-resilient.html&text=Healthcare+dividends+to+remain+resilient+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhealthcare-dividends-to-remain-resilient.html","enabled":true},{"name":"email","url":"?subject=Healthcare dividends to remain resilient | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhealthcare-dividends-to-remain-resilient.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Healthcare+dividends+to+remain+resilient+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhealthcare-dividends-to-remain-resilient.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}