Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 08, 2025

Goods producers in Asia signal sharp loss of export momentum

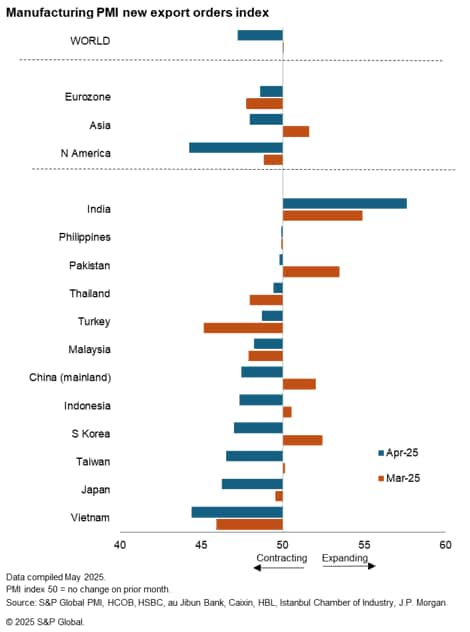

Worldwide manufacturing business conditions deteriorated in April for the first time since the end of 2024, according to PMI survey data. Within this, new export orders were down notably sharply, contracting at the fastest rate since August 2023. Although North America saw the steepest export downturn in nearly two years, Asian export orders fell at the strongest rate in 21 months as producers reported a detrimental impact from US tariff policy.

Only India sees rise in export sales

Of the 12 economies monitored by PMI surveys across Asia, only India saw an expansion in foreign demand. Five economies (Indonesia, Mainland China, Pakistan, South Korea and Taiwan) fell into contraction from growth at the start of the second quarter.

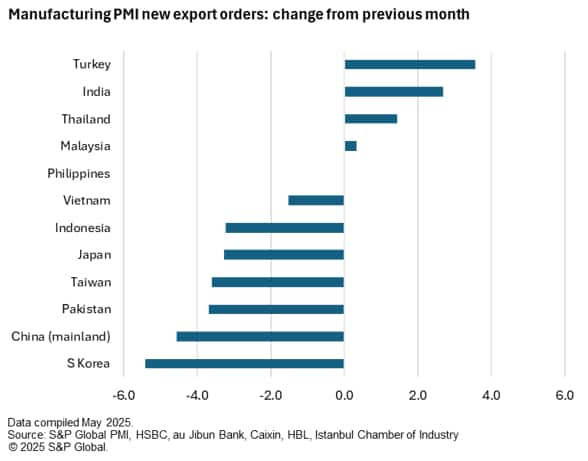

The sharpest falls in new export orders in Asia were seen in Vietnam, where the rate of reduction was the quickest in 22 months, and Japan, where manufacturers reported the steepest decline since October 2024.

Across the monitored Asian economies, the steepest reversal in fortune was seen for exports of South Korean manufactured goods, where the respective index fell 5.4 points on the month. The resulting overall reduction in foreign demand here was the most pronounced since mid-2023 and the first instance of falling exports in the country for six months. Similarly solid reductions were recorded in Mainland China, Indonesia and Taiwan, with orders for Chinese manufactured goods falling at the sharpest rate since July 2023.

By comparison, only marginal drops in export sales were reported in the Philippines, Pakistan and Thailand, though it should be noted that the decline signalled in Pakistan was the first in the 12-month history of the survey.

India, on the other hand, continued to buck the wider Asia trend to record a sustained expansion in new export orders, with the rate of growth accelerating during April to reach the second-highest in over 14 years, behind only that seen at the start of the year. Moreover, India was the sole economy in the region to record an expansion in new export sales.

Tariffs reportedly the main reason for falling exports

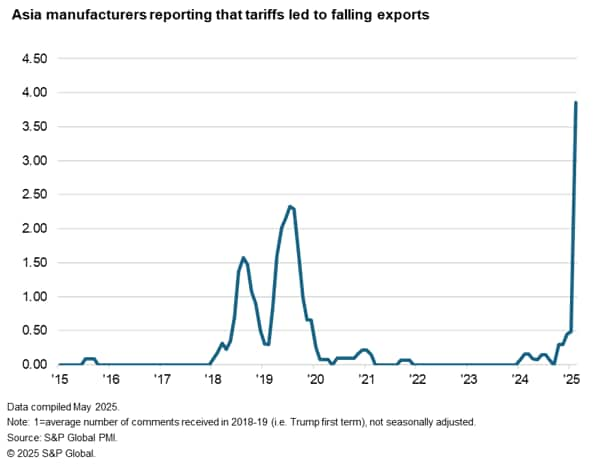

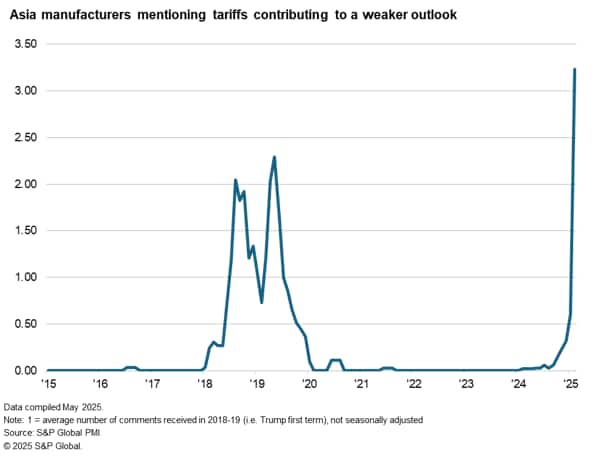

Anecdotal evidence provided by manufacturing firms across Asia often indicated that tariffs were a key factor behind the fall in new export orders in April.

Where export sales were reportedly lower, comments from the PMI survey panel suggested that the number of reasons given by goods producers which mentioned "tariffs" were around four times higher than the average seen during the initial round of tariffs introduced during President Trump's first term in 2018-9.

South Korea leads downturn in global exports

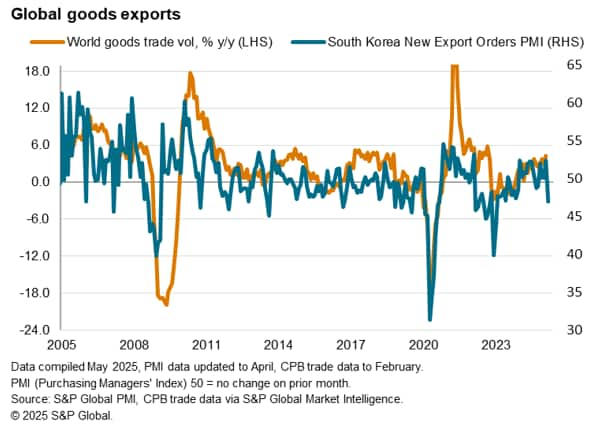

Diving deeper, South Korea holds a key position in the Asian and wider global economy. The South Korean economy is heavily export-driven, with exports making up approximately 40% of GDP, thus a slowdown in exports can indicate a cooling global economy. Moreover, the South Korean manufacturing economy is deeply integrated in the global supply chain, notably on the technology side, meaning a dip in export sales could foreshadow weakening industrial output worldwide. As a result, and due to its positioning, the economy is particularly sensitive to geopolitical risks and trade tensions.

April PMI data pointed to the South Korean manufacturing economy seeing the most pronounced impact on new export orders of all surveyed Asia economies when compared to the previous month. At the time of writing, the current rate of duty applied by the US on imports is the blanket rate of 10%. By contrast, mainland China saw the next largest change, though the current tariff applied is 145%.

The chart above plots new orders from abroad in South Korea against global goods trade volumes (up to February), with the five-month period of PMI data prior to April 2025 pointing to a consistent increase in South Korean export orders. In fact, PMI data pointed to increasing exports in all but three months since January 2024, while trade volumes data have indicated consistent growth throughout this same period. It can be inferred from the chart that the South Korea PMI New Export Orders Index has an average lead on global trade data of approximately six months.

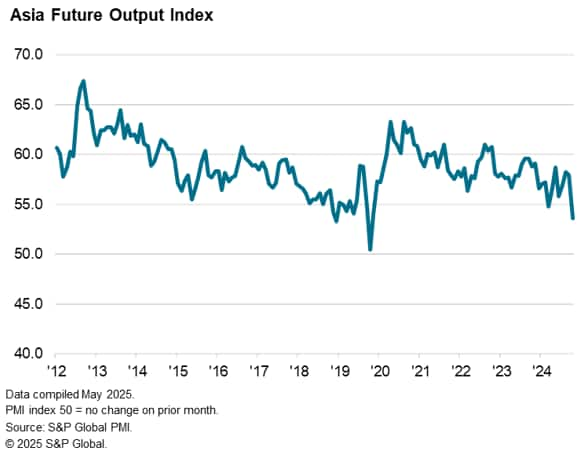

Expectations deteriorate across Asia

Looking at Asian manufacturers' expectations regarding the outlook for output over the coming year, the overall degree of positive sentiment fell sharply during April. The degree of optimism was the lowest since April 2020, the peak of the initial wave of the COVID-19 pandemic.

Of those monitored economies in Asia, manufacturers often mentioned that tariffs were a key source of uncertainty and a headwind to the outlook for production. Comment analysis suggested that mentions of tariffs as a factor behind a weaker outlook were much higher than seen during President Trump's first term.

Usamah Bhatti, Economist, S&P Global Market Intelligence

Tel: +44 1344 328 370

usamah.bhatti@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoods-producers-in-asia-signal-sharp-loss-of-export-momentum-may25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoods-producers-in-asia-signal-sharp-loss-of-export-momentum-may25.html&text=Goods+producers+in+Asia+signal+sharp+loss+of+export+momentum+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoods-producers-in-asia-signal-sharp-loss-of-export-momentum-may25.html","enabled":true},{"name":"email","url":"?subject=Goods producers in Asia signal sharp loss of export momentum | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoods-producers-in-asia-signal-sharp-loss-of-export-momentum-may25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Goods+producers+in+Asia+signal+sharp+loss+of+export+momentum+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgoods-producers-in-asia-signal-sharp-loss-of-export-momentum-may25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}