Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2025

Using PMI data to better understand monetary policy decisions

The following is an extract from S&P Global Market Intelligence's latest PMI Special Report. For the full report, please click on the 'Download Full Report' link.

Introduction

In this paper, we use Purchasing Managers' IndexTM (PMI®) data from S&P Global to calculate the likelihood of changes in monetary policy at the world's major central banks. PMI data are advantageous as a tool for central banks, providing timely sets of macroeconomic information that are released monthly and not revised. This contrasts with official data, such as GDP, employment or the Consumer Price Index (CPI), which have a longer publication lead times and are often subject to revision. In fact, PMI data are frequently referred to in central banks' reports and meeting minutes, highlighting their importance in monetary policy debates. This paper explores how likely monetary policymakers are to loosen or tighten at certain PMI thresholds based on historical data from 1999 to 2025. The findings of this research may be used to better understand how a central bank sets interest rates, evaluate the appropriateness of monetary policy decisions and even aid in its forecasting.

Previous research showed how the timely, high-frequency and unrevised publication of PMI survey data provides central banks with a valuable tool for monetary policy decisions. We have revisited this research in an environment where interest rates are no longer at the zero lower bound and no longer principally driven by the demand side to retest the relationship between monetary policy and the business cycle. Using a multinominal logistic regression model, we calculate probabilities of interest rates being either cut, hiked or left unchanged by the European Central Bank (ECB), the Bank of England (BOE) and the Federal Reserve at certain PMI values.

We use prices, activity (output) and employment PMI data to model probabilities of interest rate changes.

Our PMI-powered models find that the ECB, BOE and the Fed have turned more inflation-averse since the pandemic and have become more likely to increase interest rates if inflation is running too high, even if the economy is running weak in terms of output or employment.

The models also illustrate differences in monetary policy setting between the three major central banks. For example, the BOE show a greater reluctance than the ECB and the Fed to tighten monetary policy when economic activity is weak. Our research also clearly shows variations in behavior owing to differences between central banks' policy objectives. For example, the Fed's "dual mandate" of targeting price stability and maximum employment means that labor market conditions are an explicit factor in monetary policy decisions, which the PMI-powered model captures.

PMI's role in monetary policy discussions

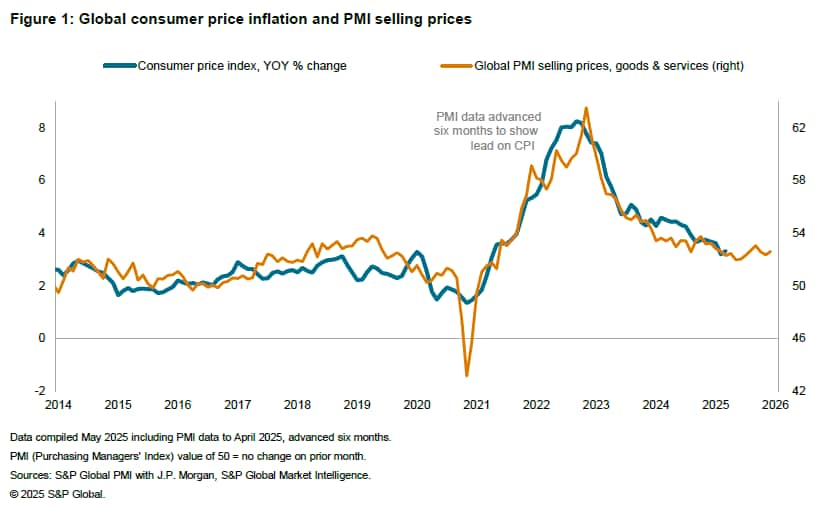

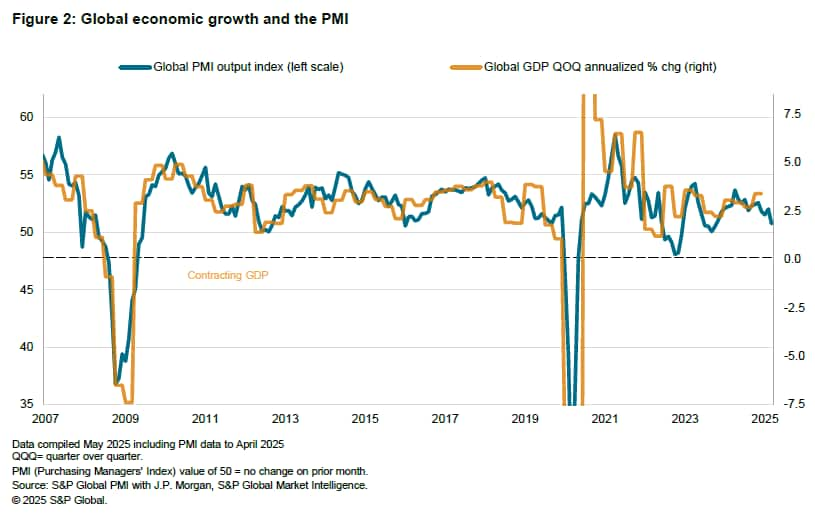

The PMI has earned a strong reputation as a leading indicator of the business cycle, particularly when compared to less timely official statistics relating to popular economic measures such as GDP, employment and inflation. This is because it has a proven track record of accurately reporting changes in economic conditions (see Figures 1 and 2) with a considerably shorter lead time (a matter of days between data collection and publication) and without the need for multiple revisions. As such, monetary policymakers can use the data to support real-time decisions.

This suggests PMI data should be used by "central bank watchers," such as portfolio managers, lenders and borrowers, as changes in PMI data can give advanced signals of changes in monetary policy, which will have ramifications for asset allocation decisions, corporate profit margins and business investment plans. The PMI can be used to assess the extent to which a central bank's decision is corroborated by the most up-to-date information on firms' price-setting behavior and business conditions - an exercise that cannot be achieved with official data.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-data-to-better-understand-monetary-policy-decisions-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-data-to-better-understand-monetary-policy-decisions-May25.html&text=Using+PMI+data+to+better+understand+monetary+policy+decisions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-data-to-better-understand-monetary-policy-decisions-May25.html","enabled":true},{"name":"email","url":"?subject=Using PMI data to better understand monetary policy decisions | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-data-to-better-understand-monetary-policy-decisions-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Using+PMI+data+to+better+understand+monetary+policy+decisions+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fusing-pmi-data-to-better-understand-monetary-policy-decisions-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}