Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2025

Week Ahead Economic Preview: Week of 12 May 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US inflation, retail sales and industrial production will provide important insights into economic trends in April, alongside updates consumer sentiment data for May. UK GDP and labour market statistics will also be under scrutiny, alongside Japan's GDP update.

After the Federal Open Market Committee held interest rates steady in the US, some key economic releases will be updated in the coming week to provide some additional insights into how policymaking might be affected by tariffs. FOMC members voted unanimously to hold the federal funds rate at 4.25-4.5% at their May meeting despite GDP falling in the first quarter, citing concerns over the potential for tariffs to push inflation higher in the coming months.

Given the changing tariff backdrop, it seems unlikely that any rate change would come at least before the 90-day pause on additional tariffs announced on 2nd April expires on 8th July. That said, updates to CPI data for April will be important to monitor for any immediate post-tariff inflaiotn impact, and US industrial production and retail sales numbers for April will be eyed for early indications of whether GDP could fall again in the second quarter, which would constitute a technical recession. Preliminary University of Michigan consumer sentiment data will also be eagerly assessed for readings after household confidence and inflation expectations slumped and spiked respectively in recent surveys.

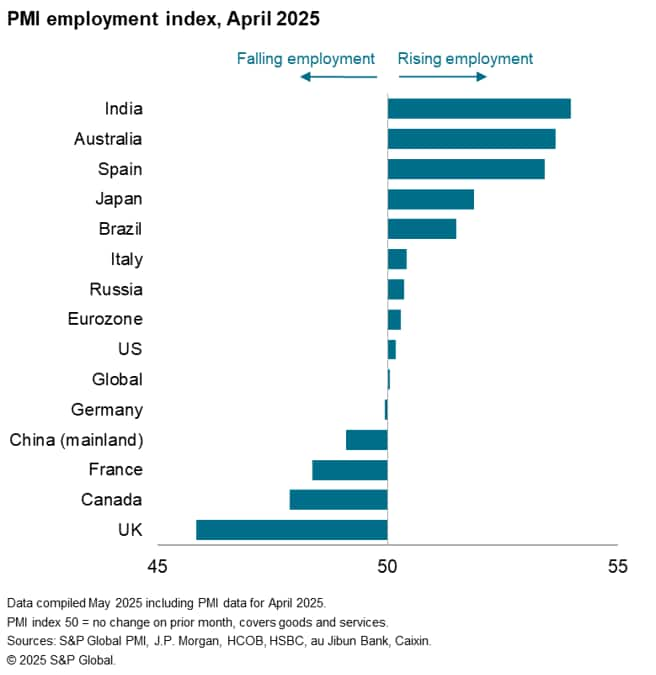

The Bank of England meanwhile reduced interest rates to 4.25% as concerns over slowing economic growth outweighed any concerns over inflation. Growth worries stemmed from the potential impact of tariffs, though recent survey data have also indicated a growing drag from tax changes in the UK, with higher National Insurance contributions in particular cited as a cause of falling staffing levels. PMI data in fact showed UK employment falling at a faster rate than all other major economies in April. Updates to the monthly KPMG/REC recruitment industry survey and official labour market statistics will be eagerly awaited for any further signs of job market weakness or wage persistence, while updated GDP numbers for the first quarter will provide some perspective on the UK's economic performance. Eurozone GDP is likewise updated.

In Asia, Japan also sees its initial estimate of GDP in the first quarter, preceded by inflation data for mainland China, which is released over the weekend.

Key diary events

<span/>Monday 12 May

Indonesia, Singapore, Thailand Market Holiday

Japan Current Account (Mar)

Philippines General Elections

Mexico Industrial Production (Mar)

United States Monthly Budget Statement (Apr)

United Kingdom KPMG / REC Report on Jobs* (Apr)

Tuesday 13 May

Indonesia Market Holiday

Japan BoJ Summary of Opinions (Apr)

Australia NAB Business Confidence (Apr)

United Kingdom Labour Market Report (Mar)

Germany ZEW Economic Sentiment (May)

South Africa Unemployment Rate (Q1)

India Inflation (Apr)

United States CPI (Apr)

United States S&P Global Investment Manager Index* (Apr)

Global GEP Supply Chain Volatility Index* (Apr)

Wednesday 14 May

Australia Home Loans (Q1)

Global Monthly OPEC Report

Thursday 15 May

<span/>South Korea Unemployment Rate (Apr)

Australia Employment Change (Apr)

Indonesia Trade (Apr)

Germany Wholesale Prices (Apr)

United Kingdom GDP (Q1, prelim)

United Kingdom monthly GDP, incl. Manufacturing, Services and Construction Output (Apr)

France IEA Oil Market Report

Eurozone Employment Change (Q1, prelim)

Eurozone Industrial Production (Mar)

Eurozone GDP (Q1, 2nd est.)

Brazil Retail Sales (Mar)

Canada Housing Starts (Apr)

United States PPI (Apr)

United States Retail Sales (Apr)

United States Industrial Production (Apr)

United States Business Inventories (Mar)

United States NAHB Housing market Index (May)

Mexico Banxico Interest Rate Decision

Friday 16 May

Japan GDP (Q1, prelim)

Singapore Non-Oil Domestic Exports (Apr)

Malaysia GDP (Q1)

Japan Industrial Production (Mar, final)

France Unemployment Rate (Q1)

Switzerland Industrial Production (Q1)

Hong Kong SAR GDP (Q1, final)

Eurozone Balance of Trade (Mar)

United States Building Permits (Apr, prelim)

United States UoM Sentiment (May, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US inflation, retail sales and industrial production, housing starts and UoM sentiment data

The key economic release in the new week will be US inflation data for the month of May. According to the latest S&P Global US PMI output price data, which precedes the trend for US CPI, inflationary pressures intensified at the start of the second quarter. The rate of output price inflation was the highest in seven months, attributed partly to rising US tariffs according to panellists. Official data will be closely watched for confirmation of the rising inflation trend.

Additionally, weak US manufacturing survey data in April points to subdued industrial production performance when official data are updated in the week, though the PMI figures did outline some substitution of imports with domestic production amid higher tariffs. Likewise, slowing services activity growth hints at some potential weakness in the upcoming retail sales data.

EMEA: UK output and labour data; Germany ZEW economic sentiment

The UK updates March output data alongside the preliminary print of first quarter GDP. According to PMI releases, UK output expanded at the fastest pace in five months in March as faster services activity expansion helped to offset a sharper downturn in the goods producing sector. That brought the first quarter average close to that in Q4 2024, pointing to a continued mild expansion. Employment data will meanwhile be eyed closely amid concerns over the impact of rising payroll taxes in the UK, with official labour market data preceded by the REC/KPMG recruitment industry survey.

APAC: Japan GDP; Australia employment; India inflation; Hong Kong SAR, Malaysia Q1 GDP; Singapore and Indonesia trade data

In addition to inflation data to be released from mainland China over the weekend, the new week welcomes Japan's first quarter GDP reading and Australia's employment figures. Japan's Q1 GDP is not expected to stray far from Q4 2024 as a reduction in private sector output at the end of the first quarter brings the first quarter average close to the previous quarter, according to PMI data. A solid set of employment figures is meanwhile expected for Australia according to the PMI indications.

Investment Manager and Supply Chain Volatility Indices

May's S&P Global Investment Manager Index will provide a check on risk sentiment, expected returns and sector preference among money managers. This is after the April survey showed the US political and macroeconomic environment to be the biggest drags on equity performance. The GEP Supply Chain Volatility Index will also be watched for insights following the April 2nd US tariffs announcements

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-may-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-may-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+May+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-may-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 May 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-may-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+May+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-may-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}