Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 26, 2025

Gold Rush: Investors Flock to ETFs Amid Soaring Prices and Global Uncertainty.

DOWNLOAD PDF VERSION HERE

Amid escalating geopolitical tensions and economic uncertainties, gold ETFs experienced record inflows as investors sought refuge in the precious metal, driving prices to new all-time highs.

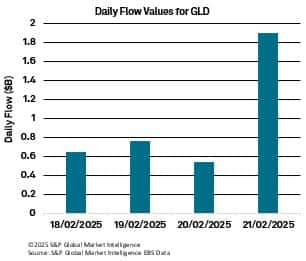

During the period of February 18 to February 21, 2025, the exchange-traded fund (ETF) market witnessed a significant surge in inflows into precious metal ETFs, as investors sought refuge amidst escalating geopolitical tensions and economic uncertainties. The week was marked by a notable influx of $5.2B into precious metal ETFs, driven by a combination of factors that heightened the appeal of gold as a safe-haven asset.

Gold prices recently soared to unprecedented levels, reaching new record highs above $2,900 per ounce. This surge was fuelled by renewed fears surrounding the US-China trade war, a weakening US Dollar, and broader geopolitical instability. The precious metal's allure was further amplified by concerns over inflation and economic stability, as the Federal Reserve's potential easing measures continued to exert pressure on the US Dollar.

The SPDR Gold Trust ETF (GLD), one of the largest and most popular gold ETFs, experienced substantial inflows amounting to $3.9B. This significant investment reflects investors' growing inclination towards gold as a hedge against economic uncertainty and inflation. Similarly, the iShares Gold Trust (IAU) attracted $426.4M in inflows, while the SPDR Gold MiniShares Trust ETF (GLDM) saw an addition of $203.4M. These inflows underscore the heightened demand for gold-backed securities as investors sought to mitigate risks associated with volatile market conditions.

The surge in gold prices and corresponding ETF inflows can be attributed to several key factors. Firstly, the ongoing US-China trade tensions have created an environment of uncertainty, prompting investors to seek safe-haven assets like gold. The potential for further escalation in trade disputes has fuelled speculation about a revaluation of US gold stocks, which could significantly impact the US Treasury's financial strategies. Additionally, the weakening US Dollar has played a crucial role in driving gold prices higher. As the dollar depreciates, gold becomes more attractive to investors as a store of value, further boosting demand for the precious metal. The Federal Reserve's potential easing measures have also contributed to the dollar's decline, reinforcing the appeal of gold as a hedge against currency devaluation.

Moreover, the broader economic landscape has been characterized by inflationary pressures, exacerbated by rising commodity prices and supply chain disruptions. The increase in egg prices, driven by avian influenza in the United States, is just one example of how inflationary concerns are permeating various sectors of the economy. As a result, investors are turning to gold as a means of preserving purchasing power and safeguarding against potential economic downturns.

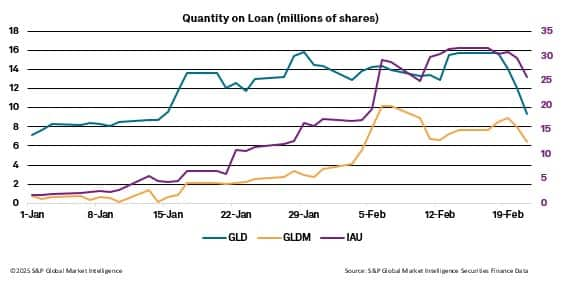

The recent decline in on-loan quantities in Gold ETFs in the securities lending market also signifies a notable shift in market sentiment towards the commodity, indicating increasing confidence among investors. As the on-loan figures decrease, it suggests that fewer investors are engaging in short selling, which typically reflects a bearish outlook. Instead, this trend points to a growing belief in gold's potential as a safe-haven asset, especially in light of macroeconomic instability and inflation concerns.

The significant inflows into gold ETFs and the decline in quantity on loan during this period highlight the growing investor sentiment towards precious metals as a reliable hedge in times of uncertainty. With gold prices rallying almost 45 percent over the past year and up nearly 10 percent since January, the metal's status as a safe-haven asset remains firmly intact. As geopolitical tensions and economic uncertainties persist, the demand for gold-backed ETFs is likely to continue, providing investors with a strategic avenue for risk mitigation and portfolio diversification.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgold-rush-investors-flock-to-etfs-amid-soaring-prices-and-glob.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgold-rush-investors-flock-to-etfs-amid-soaring-prices-and-glob.html&text=Gold+Rush%3a+Investors+Flock+to+ETFs+Amid+Soaring+Prices+and+Global+Uncertainty.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgold-rush-investors-flock-to-etfs-amid-soaring-prices-and-glob.html","enabled":true},{"name":"email","url":"?subject=Gold Rush: Investors Flock to ETFs Amid Soaring Prices and Global Uncertainty. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgold-rush-investors-flock-to-etfs-amid-soaring-prices-and-glob.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Gold+Rush%3a+Investors+Flock+to+ETFs+Amid+Soaring+Prices+and+Global+Uncertainty.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgold-rush-investors-flock-to-etfs-amid-soaring-prices-and-glob.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}