Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 28, 2025

Australasian Materials Feel the Heat from Short Sellers.

Recent trends indicate a growing skepticism among investors regarding the outlook for Australian mineral companies amidst growing market volatility.

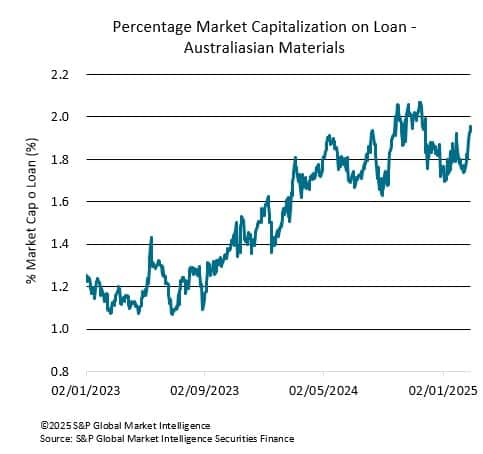

In recent months, Australasian material companies have witnessed a notable increase in the percentage of their market capitalization on loan, reflecting a rising trend in short interest. This surge indicates a growing apprehension among investors about the future performance of these companies, as market dynamics shift in response to fluctuating commodity prices, operational challenges, and broader economic uncertainties.

Recently, a notable increase in short interest has been observed among Australian mineral companies, especially in the battery metals sector. This trend stems from several interconnected factors, such as shifting market sentiment, sector-specific volatility, operational challenges, and the absence of effective hedging mechanisms.

In the lithium market, certain companies have emerged as significant players, with their stocks often serving as proxies for lithium prices due to their scale and liquidity. However, some of these companies have recently reported substantial financial losses, which included declines in revenue and significant drops in underlying EBITDA. Such poor financial results can lead investors to bet against their stocks, contributing to increased short interest.

Additionally, many companies in the sector have been affected by weaker prices for key commodities like iron ore and lithium, which are crucial to their revenue streams. The volatility of these commodity prices can impact investor confidence, prompting many to engage in short selling as a hedge against potential further declines.

Operational challenges have further exacerbated the situation for companies in this space. Many have faced significant issues, such as transitioning operations into care and maintenance due to a weak price environment. These setbacks can raise concerns about their ability to meet production targets, manage costs, and maintain profitability. When investors perceive operational risks, they may resort to short selling as a means of protecting their investments or profiting from anticipated declines in stock prices.

The operational landscape for Australian mineral companies is fraught with challenges, from environmental regulations to labor shortages. These factors can contribute to a sense of uncertainty, prompting investors to hedge their bets through short positions.

Another significant factor contributing to the rise in short interest among Australian mineral companies is the lack of effective hedging mechanisms, particularly in the lithium sector. Unlike more established commodities, the lithium market does not yet have robust financial instruments that allow investors to hedge against price fluctuations effectively. This gap in the market has led some investors to adopt short selling as a strategy to mitigate risks associated with price volatility.

The increasing short interest in Australian mineral companies can thus be attributed to a confluence of factors, including market sentiment, sector-specific volatility, operational challenges, and the absence of effective hedging mechanisms. The interplay of these factors will likely shape the future of short selling in the Australian mineral sector, as investors seek to balance risk and opportunity in a rapidly evolving market.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralasian-materials-feel-the-heat-from-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralasian-materials-feel-the-heat-from-short-sellers.html&text=Australasian+Materials+Feel+the+Heat+from+Short+Sellers.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralasian-materials-feel-the-heat-from-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Australasian Materials Feel the Heat from Short Sellers. | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralasian-materials-feel-the-heat-from-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australasian+Materials+Feel+the+Heat+from+Short+Sellers.+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faustralasian-materials-feel-the-heat-from-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}