Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 11, 2025

Global trade contraction eases at the start of 2025

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that the recent contraction of global trade was sustained into the start of 2025, albeit with the degree of decline easing to a marginal level.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, rose to 49.6 in January from 48.7 in December. Posting below the 50.0 neutral mark for the eighth successive month, the latest reading signalled that trade conditions deteriorated again. That said, the reduction in export orders was only fractional, indicating a near-stabilisation of global conditions just ahead of US tariffs announcements.

Goods trade contraction eases while services exchange growth further softens

The downturn in manufacturing new export orders continued into the start of the new year according to the latest PMI data. However, the pace at which manufacturing export orders declined eased to the softest in the eight-month sequence and was only marginal, thereby hinting at a near-steadying of trade flows. The latest easing of export orders decline took place amidst improvements in overall demand for manufactured goods. Global goods new orders returned to growth in January, rising at the fastest pace in eight months.

The main contributor to the uptick in goods orders at the start of the year was renewed new orders growth in the US, though mainland China and India were among the economies that saw new orders expand at a quicker pace while demand eased at softer rates across the UK and the eurozone. Likewise for export orders, a near-stabilisation was observed in the US and mainland China, while India's export orders rose at the fastest pace since early 2011.

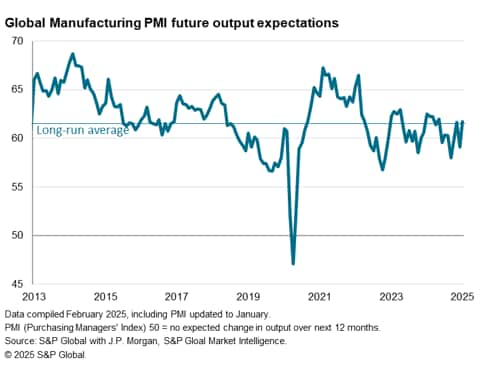

The latest January PMI data were notably collected just ahead of US tariffs announcements for Canada, Mexico and mainland China, though uncertainties regarding implementation persist at the time of writing. As such, it is unclear to what extent that the January figures reflected the front-running of mooted tariffs, though we will be keeping a close eye on the February numbers, especially pertaining to the trend for sentiment about future output. According to January's data, manufacturing year-ahead business confidence rose back above the long-run average, with comments from the manufacturing PMI survey contributors citing 'uncertainty' globally having moderated since December, though again we stress that this was just prior to the announcement of new US tariffs

Meanwhile services export business continued to expand globally at the start of 2025. The pace of growth remained only marginal, however, having softened slightly since December to the slowest in the current 13-month growth sequence. Sector PMI data revealed that, while services export business remained buoyed by consumer services (and particularly rising cross-border demand for tourism and recreation), the downturn in export business for financial services deepened to the sharpest in eight months.

Overall, detailed sector PMI showed that the fastest growth in export business was recorded for tourism & recreation, insurance and transportation sectors. On the other hand, real estate, banks and technology equipment recorded the slowest export demand growth among the sectors tracked. The general outperformance of services export conditions when compared with manufacturing continued to outline both a robust service sector and trade uncertainty-implicated goods producing sector.

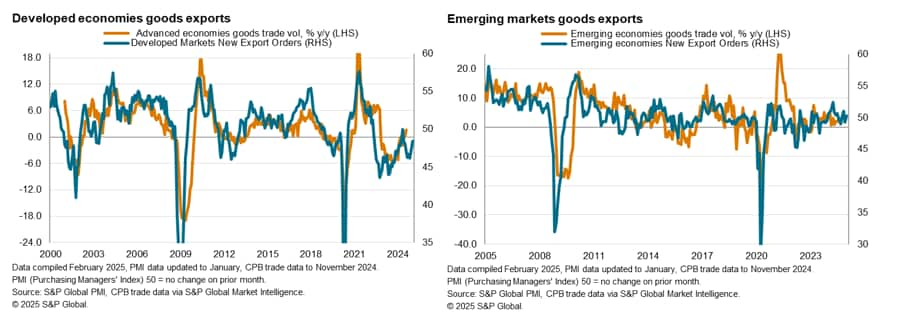

Downturn in developed economy export orders contrasts with improving emerging market trade

By region, the reduction in export orders was concentrated in the developed world again in January. Developed economies' services export orders declined after expanding over the prior two months, albeit only marginally, joining manufacturing new orders in contraction. However, an easing of the reduction in the latter meant that overall developed market export orders fell to the smallest extent in eight months. The latest data is indicative of advanced economies trade near-stabilising at the start of 2025.

In contrast, emerging market export orders expanded in January after declining briefly in December. Although marginal, growth in emerging market exports was supported by broad-based improvements across both manufacturing and services in January. Emerging market goods new orders notably rose only marginally, however, indicating mild improvements just ahead of tariff implementation on mainland China.

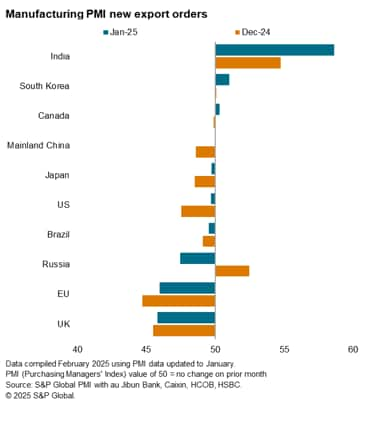

India widens the lead in export growth at the start of 2025

There remained only three of the top ten trading economies recording higher goods exports at the start of 2025, which is among the lowest number seen in the past year. India again led growth with the fastest expansion of goods export orders in just under 14 years as overall manufacturing conditions improved at the start of the year. Furthermore, the latest acceleration in exports growth meant that India had greatly widened the lead, with South Korea in second place (despite the latter also seeing an improved growth pace). Canada replaced Russia as the final of the three recording higher goods exports, reporting higher exports for the first time since August 2023. The latest data outlined that some of the front-loading of goods orders were present amid looming US tariffs.

Meanwhile, marginal reductions in export orders were observed in mainland China, Japan, the US and Brazil, though all with the rates of reduction easing since the end of 2024. In contrast, Russia reported a renewed and steep contraction despite a strengthening of overall manufacturing sector performance. Finally, especially deep reductions in manufacturing export business were seen for the UK and EU, embodying the wider manufacturing malaise in Europe.

Access the PMI press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-at-the-start-of-2025-feb25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-at-the-start-of-2025-feb25.html&text=Global+trade+contraction+eases+at+the+start+of+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-at-the-start-of-2025-feb25.html","enabled":true},{"name":"email","url":"?subject=Global trade contraction eases at the start of 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-at-the-start-of-2025-feb25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+contraction+eases+at+the+start+of+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-contraction-eases-at-the-start-of-2025-feb25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}