Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 13, 2025

Monthly PMI Bulletin: February 2025

The following is an extract from S&P Global Market Intelligence's latest Monthly PMI Bulletin. For the full report, please click on the 'Download Full Report' link.

Global growth slows while inflation intensifies at the start of 2025

The global economic expansion decelerated to the slowest for a year at the start of 2025. That said, growth became more broad-based in January and was accompanied by rising business confidence and employment. This was while inflationary pressures intensified.

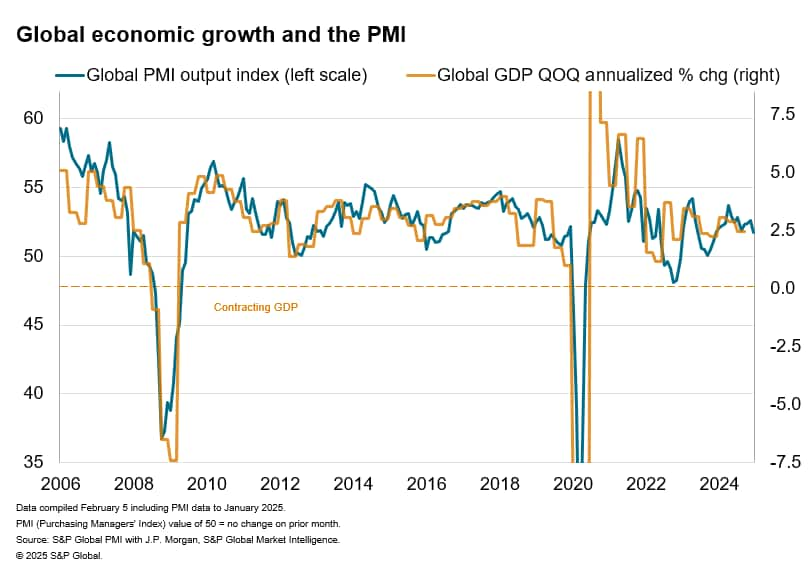

The J.P.Morgan Global PMI Composite Output Index - produced by S&P Global - registered 51.8 in January, down from 52.6 in December 2024. While the latest print represented an extension of the global economic expansion to two years, it also marked the first slowdown in growth in four months. Moreover, the latest reading was the lowest recorded since January 2024 and is broadly consistent with the global economy expanding at an annualized rate of 2.4%, which is down from a 2.7% expansion signalled for the fourth quarter of last year.

The softening of the global growth pace was mainly attributed to slowing services activity expansion in the opening month of 2025. Positive signs were meanwhile observed for manufacturing, as goods production returned to expansion after declining at the end of last year. Furthermore, business confidence among manufacturers rose, improving to a level just below the long-run average in the latest survey. The caveat, however, is that the latest survey results are collected just ahead of US tariffs announcements in early February, and therefore do not capture the potential impact of these developments. As such, the recovery in manufacturing may be tentative and had again partially reflected front-loading ahead of potential tariffs.

Additionally, inflationary pressures were observed to have intensified at the start of 2025. Average selling price inflation across goods and services reached an eight-month high globally, while input prices also rose at a quicker rate, buoyed by higher cost inflation across both the manufacturing and service sectors. As such, we will be closely watching the upcoming flash PMI releases on February 21st for new insights into business conditions, especially pertaining to prices and any US tariff-induced changes to output and sentiment.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-february-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-february-2025.html&text=Monthly+PMI+Bulletin%3a+February+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-february-2025.html","enabled":true},{"name":"email","url":"?subject=Monthly PMI Bulletin: February 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-february-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Monthly+PMI+Bulletin%3a+February+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmonthly-pmi-bulletin-february-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}