Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 14, 2025

Week Ahead Economic Preview: Week of 17 February 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI surveys to highlight changing business environment

Flash PMI data will provide the first insights into how business conditions have fared around the world in response to recent tariff announcements. UK inflation also comes under the spotlight. Minutes from the recent FOMC meeting will also help guide markets on future Fed policy changes after rates were held steady. Policy announcements are meanwhile awaited from central bank meetings in Australia and New Zealand, where cuts are widely anticipated.

A lot has happened since January's PMI data were collected, driving greater than usual interest on the February surveys. President Trump has since announced tariffs on US imports on goods from Canada, Mexico and China (the former two subsequently postponed for 30 days), new US levies on metals have also been notified, and economies have started to respond. Notably, mainland China has reacted with a targeted response, including tariffs on selected US imports, and the EU is also weighing up measures.

Markets have meanwhile shown signs of being unsettled by the rising geopolitical uncertainty resulting from various policy approaches instigated by the new US administration. S&P Global Investment Manager Index (IMI) survey, for example, showed risk appetite slumping among US equity investors, contrasting markedly with the ebullient mood seen late last year. Investors report growing concerns over the political environment, the US macro economy and the monetary policy outlook compared to the broad-based optimism surrounding these factors in the immediate aftermath of the Presidential Election. Gold has rallied and the US dollar has weakened.

Non-farm payrolls data have also since disappointed and US inflation has come in higher than forecast, alongside the FOMC holding rates, seeing no rush to loosen policy further.

More positively, at least in Europe, both the Bank of England and the European Central Bank have recently cut rates and remain open to more cuts in the coming months. Trump's approval rating also remains high. Talk of an end to the Ukraine war has meanwhile the potential to alter sentiment in Europe, though the details of any ceasefire will be important here.

Hence, there will be several aspects of the upcoming flash PMIs to scrutinise as businesses around the world react to this changing environment.

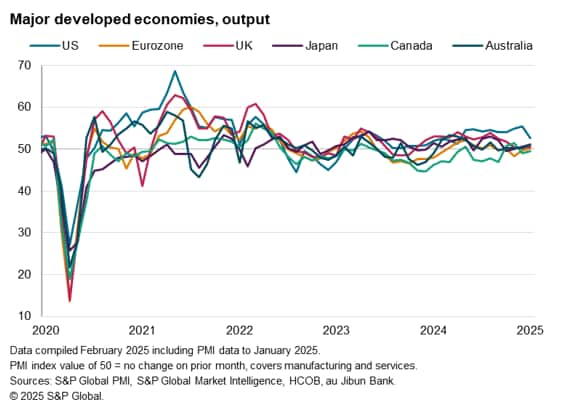

First, recent PMI data have shown the US outperforming other major developed economies in terms of output growth, albeit with the gap narrowing in January. While the US enjoyed something of a revival in manufacturing output growth, activity slowed in its service sector. Insight into whether these reflected temporary factors, such as tariff front-loading and adverse weather respectively, will be gleaned from the February updates.

Second, the degree to which US outperformance continues to be driven by recent elevated levels of business confidence relative to other economies will also be important to assess via the PMI's Future Output Expectations Index.

Third, the effect on staff hiring will be revealed via the PMI's Employment Index, which had risen especially sharply in the US in January. A contrasting steep fall in jobs growth in the UK, linked to domestic policy changes, will meanwhile provide an especially worrying signal if sustained.

Fourth, signs of any impact of tariff announcements on prices will be eagerly awaited, especially in terms of input costs and selling price gauges, as well as likely future trends via anecdotal evidence on inventories and supply chains.

You can read more about which PMI indicators to monitor in terms of trade developments here.

Key diary events

Monday 17 Feb

US, Canada Market Holiday

Japan GDP (Q4)

Singapore Non-oil Domestic Exports (Jan)

Thailand GDP (Q4)

Indonesia Trade (Jan)

Japan Industrial Production (Dec, final)

Eurozone Balance of Trade (Dec)

Canada Housing Starts (Jan)

Tuesday 18 Feb

Australia RBA Interest Rate Decision

United Kingdom Labour Market Report (Dec)

Switzerland Industrial Production (Q4)

France Inflation (Jan, final)

South Africa Unemployment (Q4)

Eurozone ZEW Economic Sentiment (Feb)

Germany ZEW Economic Sentiment (Feb)

Canada Inflation (Jan)

Wednesday 19 Feb

Japan Trade (Jan)

Japan Machinery Orders (Dec)

New Zealand RBNZ Interest Rate Decision

China (Mainland) House Price Index (Jan)

United Kingdom Inflation (Jan)

Indonesia BI Interest Rate Decision

South Africa Inflation (Jan)

United States Building Permits and Housing Starts (Jan)

United States FOMC Minutes (Jan)

Thursday 20 Feb

Australia Employment (Jan)

China (Mainland) Loan Prime Rate (Feb)

Malaysia Trade (Jan)

Germany PPI (Jan)

Turkey Consumer Confidence (Feb)

Taiwan Export Orders (Jan)

Canada New Housing Price Index (Jan)

Eurozone Consumer Confidence (Feb, flash)

Friday 21 Feb

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Trade (Jan)

Japan Inflation (Jan)

United Kingdom Gfk Consumer Confidence (Feb)

Malaysia Inflation (Jan)

United Kingdom Retail Sales (Jan)

Mexico GDP (Q4, final)

Canada Retail Sales (Jan)

United States Existing Home Sales (Jan)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI for February

February's flash PMI data, released for major economies including the US, UK, eurozone, Japan, Australia, and India, will be published Friday. While January global PMI data indicated softening growth but rising optimism at the start of 2025, this was prior to recent tariff announcements. As such, changes in output, prices and sentiment data will be closely watched, especially for the US but also in other regions where risks of trade friction have risen.

Americas: Fed minutes, US existing home sales, housing starts, building permits; Canada inflation

Meeting minutes from the January 28-29 Federal Open Market Committee (FOMC) meeting will be released in the new week and tracked for insights into the Fed rate path alongside Fed comments through the week. This comes after Fed chair Jerome Powell indicated that the Fed is in no rush to lower rates while recent S&P Global US PMI prices data showed inflationary pressures rising at the start of 2025, followed by higher than anticipated CPI readings.

Meanwhile Canada updates inflation data on Tuesday. January's PMI prices data, which tend to prelude the trend for inflation, showed a slight cooling of inflationary pressures, driven by falling services charges.

EMEA: UK inflation, labour market report, retail sales; Germany ZEW survey; Eurozone consumer confidence

Besides February flash PMI data, the UK releases a series of economic data in the new week including inflation, labour market statistics and retail sales figures. January UK PMI data previewed a rising inflation trend, coupled with an acceleration in job cuts amid falling new orders across both the manufacturing and service sectors. As such, we will be seeking official confirmation of these economic trends for January. Caution with tracking the labour market updates will need to be administered due to data quality concerns. However, the latest KPMG/REC report on jobs has so far indicated a falling employment trend at the start of 2025.

APAC: RBA, RBNZ meetings; Australia employment; Japan GDP, inflation and trade data

The Reserve Bank of Australia (RBA) and Reserve Bank of New Zealand (RBNZ) are both set to convene for their February monetary policy meeting with rate cuts on the table according to consensus. While the market is contemplating the likelihood of a 25 basis points (bps) cut for the RBA, the size of an RBNZ cut is in question between 25 and 50 bps.

On the data front, Australia's employment figures, Japan's preliminary Q4 GDP and January inflation numbers are among the highlights in APAC. A more subdued growth picture was painted of Japan into the end of 2024 ahead of slight improvements at the start of the new year, according to the au Jibun Bank PMI.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-february-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-february-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+17+February+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-february-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 17 February 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-february-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+17+February+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-17-february-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}