Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 16, 2026

Global PMI signals stalled worldwide employment amid low business confidence

In recent months, the PMI surveys have shown encouragingly resilient global economic growth, despite the heightened geopolitical uncertainty seen over 2025. However, December's data showed signs of cracks appearing, leading to a stalling of the job market.

Global PMI at six-month low

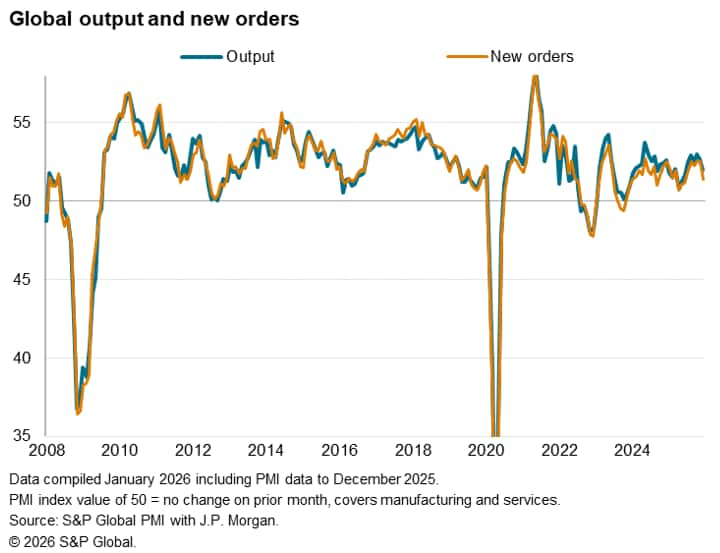

Although the J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, signalled a sustained upturn of worldwide business activity at the end of the year, December's growth was the weakest for six months. In fact, a second successive monthly drop in the PMI took it down to a level indicative of world GDP growing at an annual rate of just 2.4%, which is well below the long-run trend rate of just over 3%.

With new orders growth also weakening in December, also down to the lowest since June, hints at further downside risks to the near-term growth outlook.

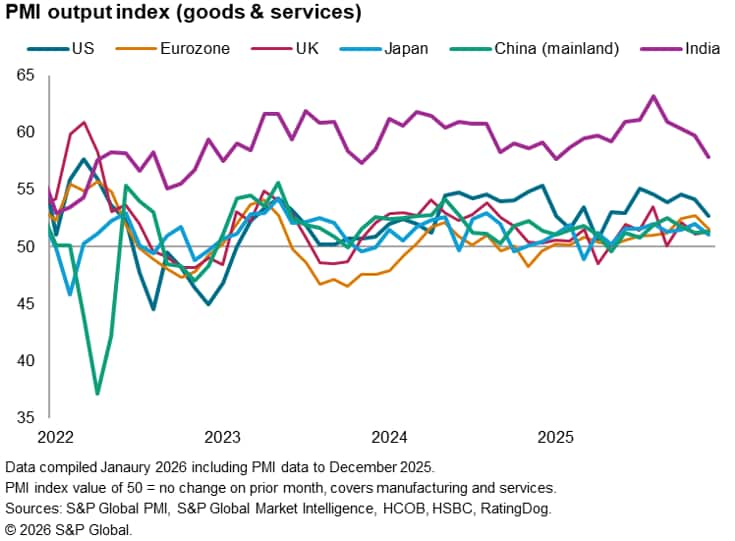

Lost growth drivers

Regionally, the slowdown reflected notably weaker trends in two important growth drivers. The US and India, which had led the global expansion in prior months, both lost considerable momentum at the end of 2025. With growth elsewhere throughout much of the world remaining stubbornly subdued - notably in the eurozone and UK, Japan and mainland China. The slowdowns in the US and India mean the principal growth engines of the developed and emerging markets seem to no longer be firing on all cylinders.

Confidence sapped by uncertainty

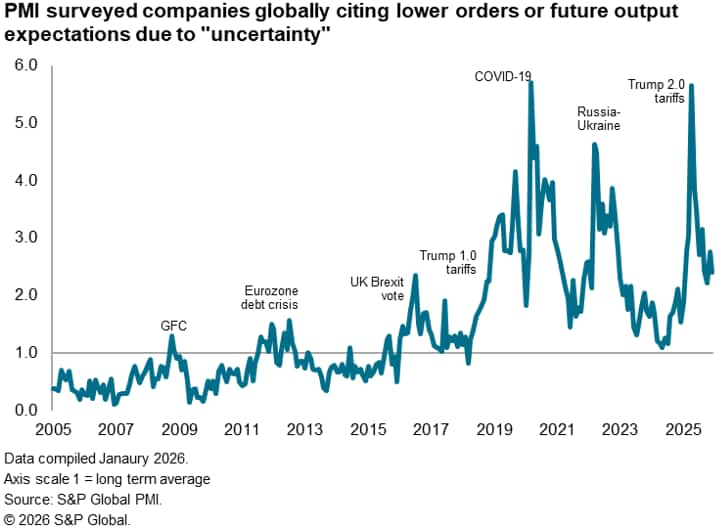

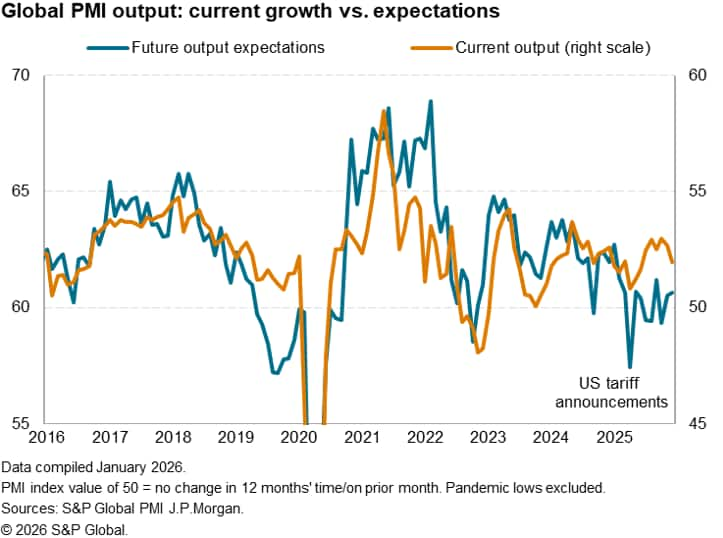

Underlying this softer growth picture has been a persistent weakness in firms' expectations of their output in the coming year, especially since the April tariff announcements from the US.

Company reports of "uncertainty" having dampened order books or subdued growth expectations are down from the spike seen in the immediate aftermath of US tariff announcements back in April 2025, but remain elevated, especially by pre-pandemic standards. The PMI's measure of global uncertainty fell back to a near-normal level in early 2024 (defined as approaching the long-run average of 1.0), but remained nearly 2.5 times above normal in December.

While economic growth had proved surprisingly resilient in the face of this weak business confidence over much of 2025, December's drop in the PMI suggests that this may now be changing as the persistent lack of confidence and uncertainty drags on business spending, investment and employment.

Employment stalls

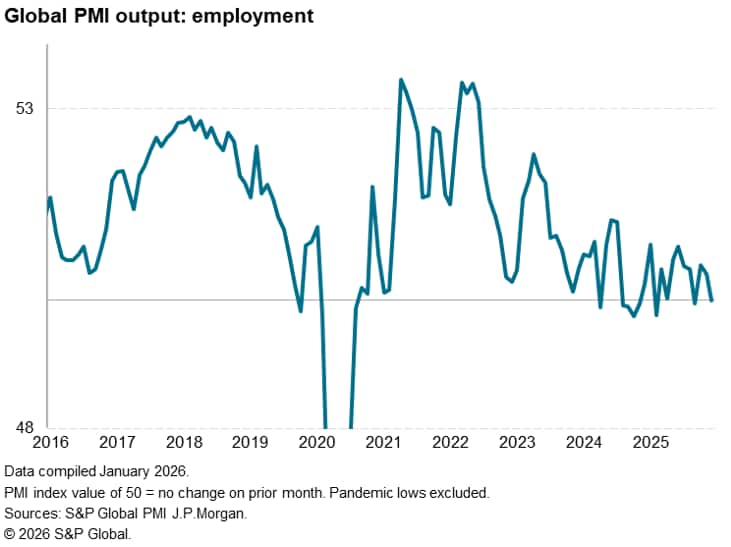

Worldwide employment consequently stagnated in December, according to the PMI, as has demand for machinery and equipment, with both blamed by companies on the uncertain economic outlook and associated demand environments.

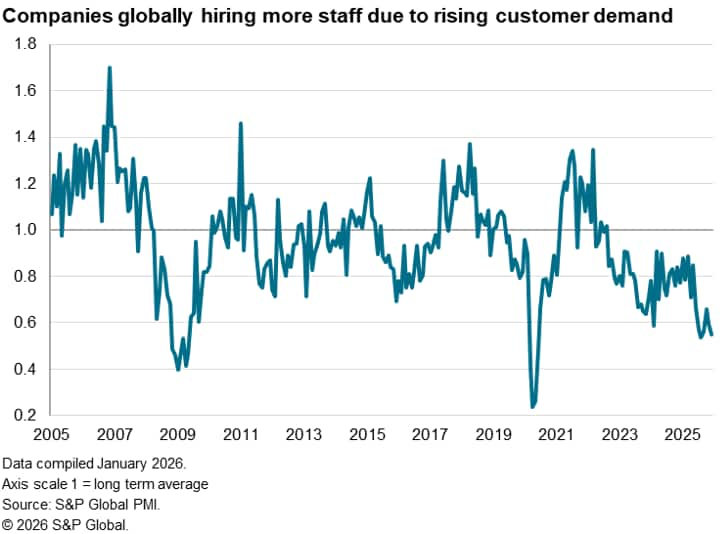

Insights into hiring trends can be gleaned by analyzing the anecdotal evidence provided by PMI survey respondents. Measured globally, the proportion of all firms boosting employment in response to rising customer demand is running at one of the lowest levels recorded since data were first available two decades ago. Only the global financial crisis and height of the pandemic have seen times when the demand environment has been more negative for hiring.

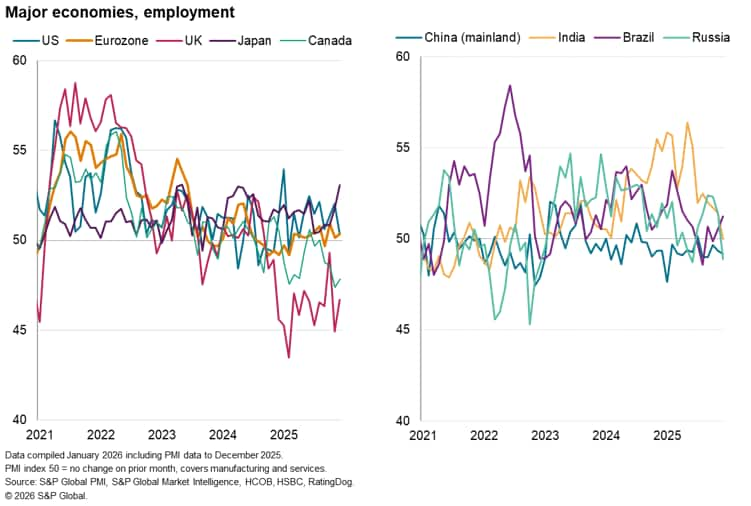

Especially steep rates of job losses were again reported in the UK and Canada, albeit easing in both cases, and a further jobs decline was reported in mainland China for a fifth straight month. Employment stalled in India and came close to stagnating in the US, pointing to the worst month of hiring since February, albeit merely bringing US jobs growth in line with the eurozone.

Bucking this trend of sluggish hiring was Japan, where jobs growth surged in December to a pace not beaten since early 2019, and to a lesser extent Brazil. Both economies have also seen business confidence lift higher in recent months, and hence clearly stand out as exceptions in an otherwise gloomy global corporate hiring picture.

As for the outlook, one should not read too much into one month's data of course. But the lack of business confidence which dogged 2025 principally reflected concerns over geopolitics, which the opening weeks of 2026 suggests may have intensified. If so, this adds to downside risks to output, employment and investment in 2026.

To gain more insights, watch out for the January flash PMI numbers published on 23rd January.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-stalled-worldwide-employment-amid-low-business-confidence-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-stalled-worldwide-employment-amid-low-business-confidence-jan26.html&text=Global+PMI+signals+stalled+worldwide+employment+amid+low+business+confidence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-stalled-worldwide-employment-amid-low-business-confidence-jan26.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals stalled worldwide employment amid low business confidence | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-stalled-worldwide-employment-amid-low-business-confidence-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+stalled+worldwide+employment+amid+low+business+confidence+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-stalled-worldwide-employment-amid-low-business-confidence-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}