Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 16, 2026

Key PMI survey business insights from 2025 and lessons for 2026

The Purchasing Managers' Index (PMI) is widely seen as an accurate and timely indicator of business conditions that helps analysts and economists to correctly anticipate changing economic trends in official data. This was especially true in 2025, a year marked by unexpected events, including changing US trade policies and a government shutdown in the world's largest economy.

Beyond the headline PMI, which is designed as an overall barometer of business conditions, the PMI survey sub-indices provide valuable insights into trends in output, employment, inflation, inventory, and business sentiment, and can be predictive in nature. These insights can be dissected not only through the commonly reported country lens, but also - uniquely - examined by sector using the PMI.

In this article, we look at three key business insights gathered from the PMI data in 2025 and examine what they might tell us about 2026.

Output vs. sentiment

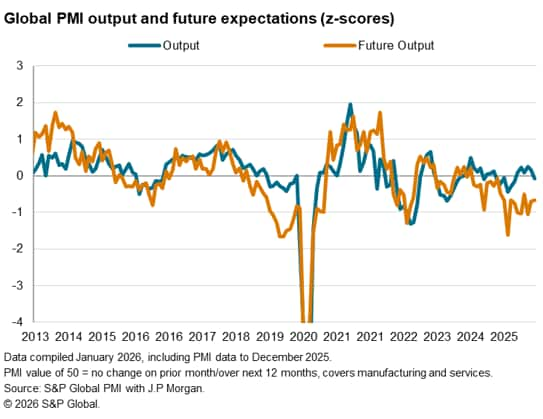

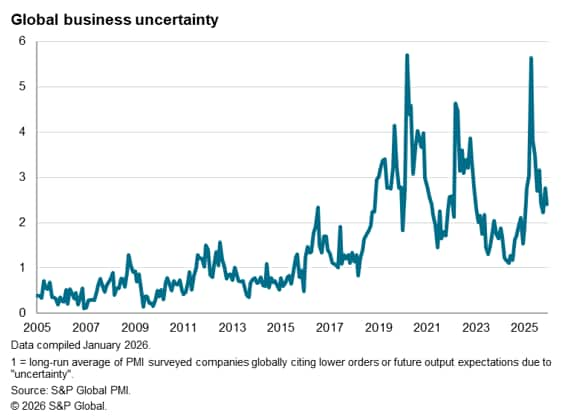

2025 may be characterised as the year when widespread US tariffs induced heightened uncertainty for global businesses. The degree of business uncertainty, as measured by the PMI comment tracker, at one point surged to match that seen at the peak of the COVID-19 pandemic. However, economic growth, as measured by the PMI's gauge of current output as well as official GDP data, has largely proven surprisingly resilient despite this uncertainty.

This divergence between sentiment and actual output had become a prominent trend to monitor going into 2026.

On one hand, the data reminded us that actual output could differ from business sentiment, even when both measures come from the same survey. PMI survey respondents indicated that this reflected idiosyncratic factors, including the front-loading of goods orders through 2025 ahead of the implementation of higher US tariffs on imports, and investments related to artificial intelligence (AI) developments, sometimes designed to cut costs. This meant output grew despite the lack of confidence.

On the other hand, the divergence sounds the alarm in relation to employment and future growth. The lack of business confidence translated to more cautious purchasing and hiring among global businesses into the end of 2025, and may also be hinting at structural shifts that one would have missed from just looking at the actual output trend.

Late 2025 also brought signs that the lack of confidence may now also be starting to act as a drag in economic activity, with some of the idiosyncratic factors from earlier in the year now fading.

US government shutdown

In addition to the implementation of widespread US tariffs, 2025 saw the longest US government shutdown in history. The 43-day shutdown meant a loss of key economic data at a crucial period for policymaking, as widespread US tariffs kicked in just as the Fed contemplated additional rate cuts in the face of concerns over jobs growth. Even as these economic data were eventually reported, doubts regarding their accuracy lingered.

As such, private surveys helped to plug the gap during the period of official data absence. The PMI, already well-followed by policymakers around the world, may be regarded as the best "real-time" economic indicator, offering insights into economic conditions even before the month has ended for major economies (including the US, UK, Eurozone and Japan) via the flash PMI releases - typically released around the 22nd each month. This is followed by monthly worldwide PMI data for over 40 economies at the start of the following month, providing powerful tools for equity investing.

To illustrate, the US PMI data from S&P Global showed that the economic expansion slowed towards the end of 2025 with manufacturers reporting the first drop in new orders for a year. Below-average confidence levels and a near-stalling of employment, as shown by the PMI, adds to downsides economic risks into the start of 2026.

PMI inflation insights

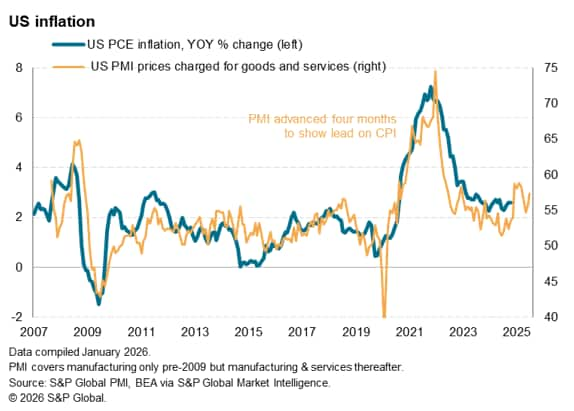

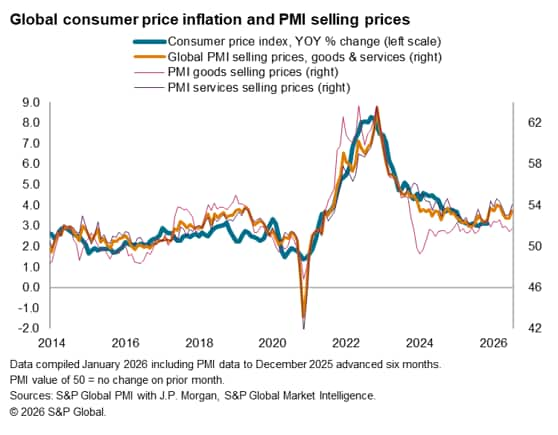

Meanwhile, inflation insights could also be sought from the PMI Input Prices Index, which tracks changes in expenses for firms, and the PMI Output Prices Index, the latter assessing changes in selling prices among firms. As the PMI survey is based on questionnaires send to companies, the insights derived on prices usually serve as a good gauge of consumer price inflation (CPI) many months in advance.

As such, US PMI output prices, or the prices charged, index continued to provide useful insights into inflation trends through the government shutdown period and well in advance of official data. The latest figure from December pointed to a slight increase in price pressures, attributed to the impact of higher tariffs, according to companies surveyed, and is indicative of US personal consumption expenditure (PCE) price index - the US Federal Reserve's preferred inflation gauge - rising to around 3.0% in the coming months. While more subdued employment and slower growth conditions continue to pave the way for the Fed to lower rates in 2026, the latest inflation indications from the PMI provide a reason for greater caution in the immediate term.

The usefulness of the PMI prices data in tracking upcoming inflation trends is not limited to the US with similar comparisons applicable to other economies and on a global scale.

PMI offerings

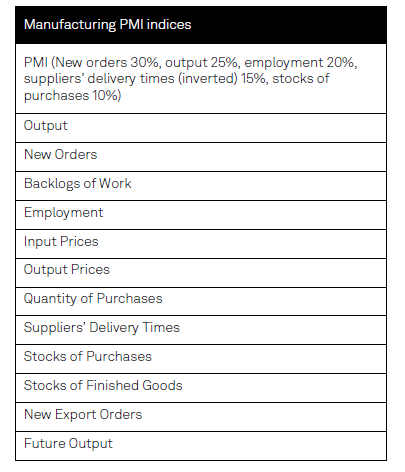

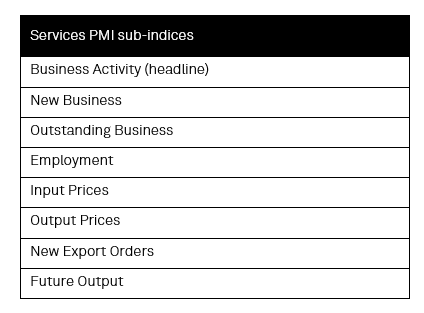

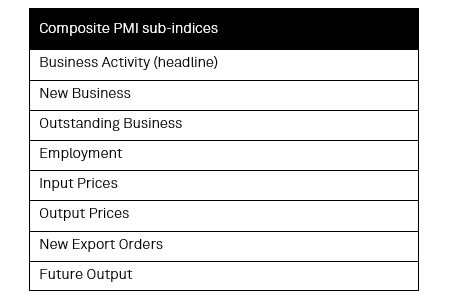

Beyond the headline and inflation gauges highlighted here, S&P Global's PMI also cover all the following sub-indices for relevant economies and sectors.

To find out more about the PMI methodology, click here.

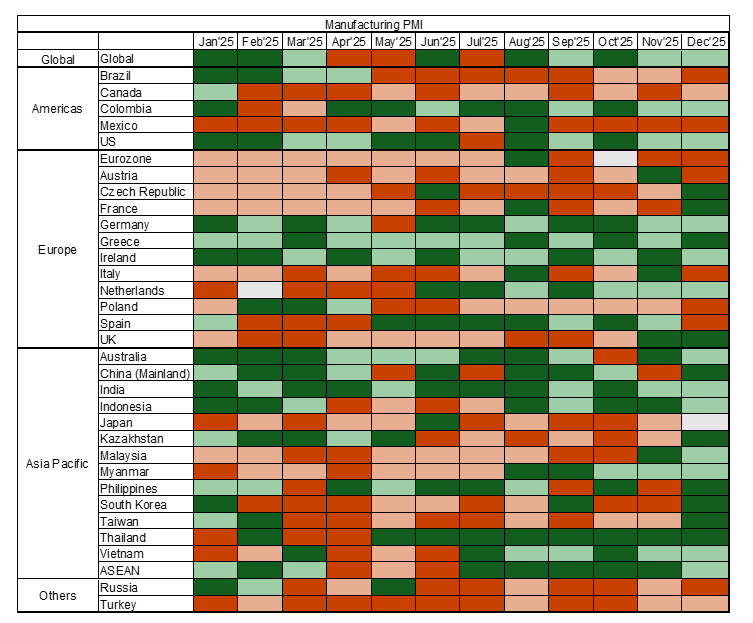

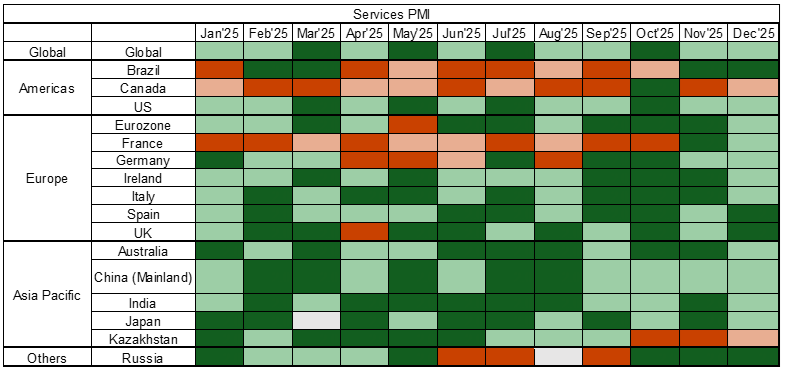

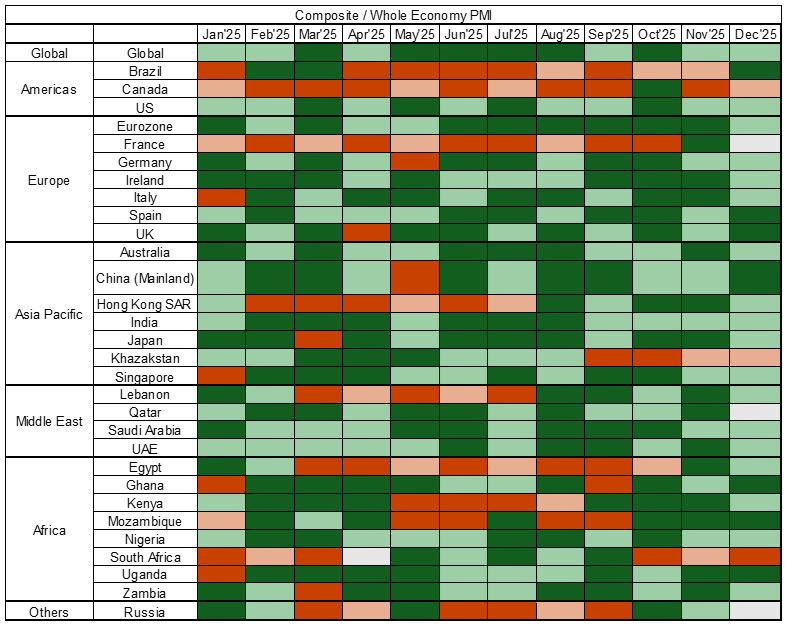

Latest country PMI data heatmap

In addition to the abovementioned manufacturing and service sectors, there also exist construction PMI data for selected countries for an ever-growing list of coverage by economies.

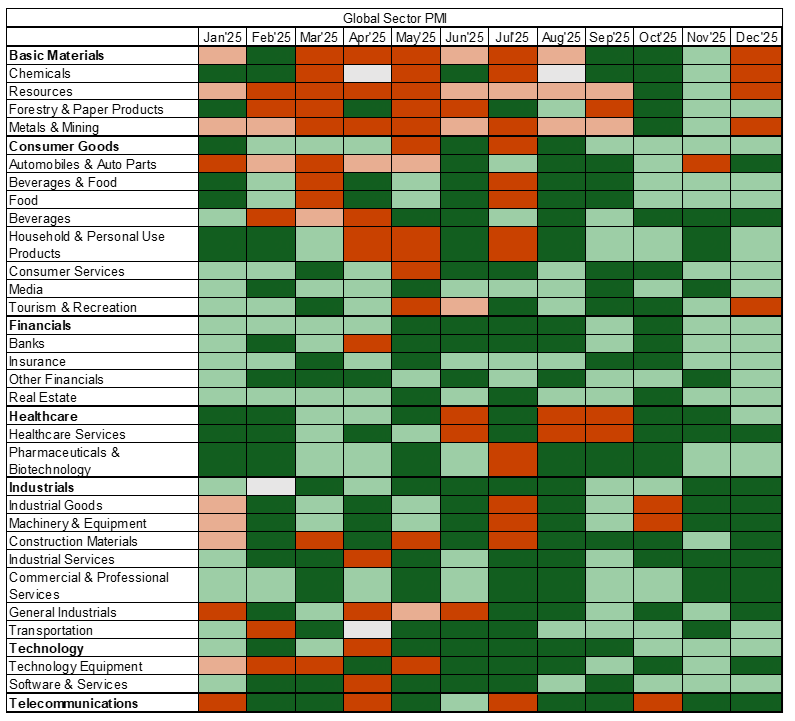

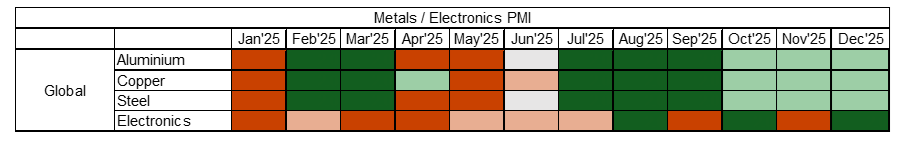

Sector PMI data

For a detailed list of all sector PMI data, click here.

Other PMI data

S&P Global Market Intelligence also offer unique Metal Users PMI data, and a Global Electronics PMI data.

Other unique PMI offerings include the PMI Commodity Price and Supply Indicators, and the abovementioned PMI Comment Tracker.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkey-pmi-survey-business-insights-from-2025-and-lessons-for-2026-Jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkey-pmi-survey-business-insights-from-2025-and-lessons-for-2026-Jan26.html&text=Key+PMI+survey+business+insights+from+2025+and+lessons+for+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkey-pmi-survey-business-insights-from-2025-and-lessons-for-2026-Jan26.html","enabled":true},{"name":"email","url":"?subject=Key PMI survey business insights from 2025 and lessons for 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkey-pmi-survey-business-insights-from-2025-and-lessons-for-2026-Jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Key+PMI+survey+business+insights+from+2025+and+lessons+for+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fkey-pmi-survey-business-insights-from-2025-and-lessons-for-2026-Jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}