Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 16, 2026

Week Ahead Economic Preview: Week of 19 January 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs updated alongside US inflation and GDP for mainland China

In addition to flash PMI updates (see box), GDP data for mainland China are accompanied by inflation numbers for the US and UK, the latter also seeing new job market statistics. The Bank of Japan meets to set interest rates.

China will release its mainland GDP data for the fourth quarter, which we anticipate will show a 4.5% annual increase. This would be the lowest rate since the start of 2023, although it concludes a year in which the Chinese economy grew by 5%, matching the forecast for 2024. While growth is expected to slow to 4.6% in 2026, it is likely to become better balanced. In particular, sustained stimulus measures—including further interest rate cuts, fiscal spending, and industrial policies—are anticipated to help drive stronger growth contributions from domestic demand in the coming year. Updates to industrial production, retail sales, and investment data will provide insights into how this economic rebalancing is unfolding.

Meanwhile, the Bank of Japan meets to set interest rates, having previously raised its policy rate to 0.75% in December. Although this marked a 30-year high, the rate remains low by international standards, keeping the currency under pressure. With signs of strengthening growth and inflation, as indicated by PMI surveys, the BOJ appears poised for further tightening but will likely adopt a cautious approach, weighing risks from geopolitics and trade. As a result, many economists expect no change in policy at the January meeting but will be watching for future guidance.

In the US, a further estimate of third-quarter GDP growth is likely to be overshadowed by PCE inflation numbers for November. After the consumer price index indicated inflation remained subdued at 2.7% (with core inflation unchanged at 2.6%) despite tariffs, analysts will be eager to get a check on these figures. The latest available PCE inflation rate (core and headline) for September was 2.8%.

In Europe, the main economic news comes from the UK, with updates to labour market, retail sales, and inflation statistics. These data follow a stronger-than-expected GDP reading for November, which aligned with the sluggish growth trend signalled by the PMI late last year, and a marked slowdown in inflation to 3.2% in November. A further drop in inflation will increase calls for further rate cuts from the Bank of England, especially if labour market data continue to disappoint. Recent months have seen sharp job losses, which survey data indicate persisted through to the year-end.

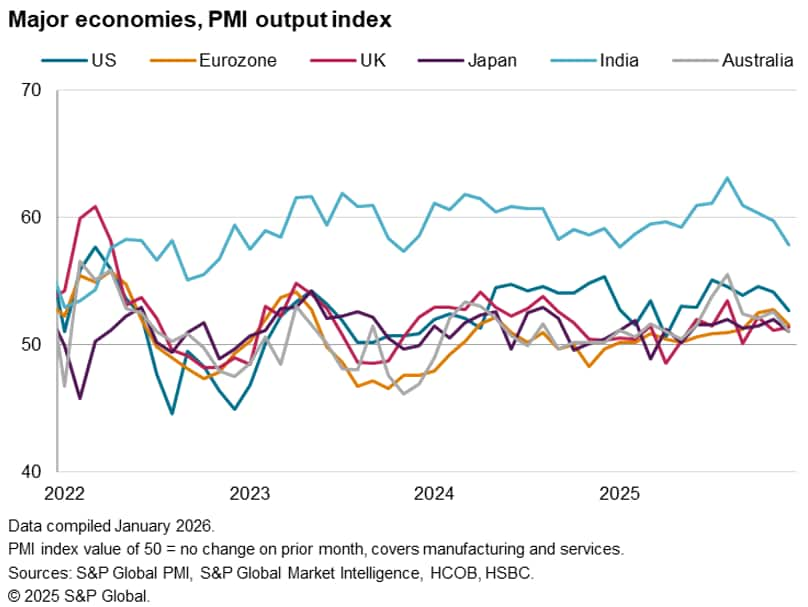

Flash PMI data for the US, eurozone, Japan, UK, India, and Australia will be updated on Friday, 23 January. The surveys will provide the first internationally comparable insights into economic growth, inflation, and labour market trends for January.

The January flash PMI data will be closely analysed to determine whether the generally slower growth trends observed in December—linked to subdued business confidence—have persisted at the start of 2026, particularly given heightened geopolitical tensions in the opening weeks of the year.

Selling price and input cost data will also provide key insights into inflation trends, notably regarding the US tariff pass-through, but also in the UK, eurozone, and Japan, where inflation will play a crucial role in policymaking in the coming months.

Job markets have disappointed in recent months, reflecting subdued business confidence, although Japan has bucked this trend. Read more here.

Key diary events

Monday 19 Jan

Americas

US Market Holiday

- Canada Inflation (Dec)

- Canada BoC Business Outlook Survey

EMEA

- Eurozone Inflation (Dec, final)

APAC

- China (Mainland) GDP (Q4)

- China (Mainland) Industrial Production, Retail Sales, Fixed Asset

Investment (Dec)

- China (Mainland) Unemployment Rate (Dec)

- Japan Industrial Production (Nov, final)

Tuesday 20 Jan

Americas

- US ADP Weekly Employment Change

EMEA

- Germany PPI (Dec)

- UK Labour Market Report (Dec)

- Eurozone Current Account (Nov)

- Eurozone ZEW Economic Sentiment Index (Jan)

- Germany ZEW Economic Sentiment Index (Jan)

APAC

- China (Mainland) Loan Prime Rate (Jan)

- Malaysia Inflation (Dec)

- Malaysia Trade (Dec)

- Taiwan Export Orders (Dec)

- Hong Kong SAR Unemployment Rate (Dec)

Wednesday 21 Jan

Americas

- Canada PPI (Dec)

- US Pending Home Sales (Dec)

EMEA

- UK Inflation (Dec)

- UK CBI Business Optimism Index (Q1)

- South Africa Inflation (Dec)

APAC

- Indonesia BI Interest Rate Decision

- Indonesia Loan Growth (Dec)

Thursday 22 Jan

Americas

- Canada New Housing Price Index (Dec)

- US GDP (Q3, final)

- US core PCE (Nov)

- US Personal Income and Spending (Nov

EMEA

- Norway Norges Bank Interest Rate Decision

- Türkiye TCMB Interest Rate Decision

- Eurozone ECB Monetary Policy Meeting Accounts

- Eurozone Consumer Confidence (Jan, flash)

APAC

- South Korea GDP (Q4, adv)

- Japan Trade (Dec)

- Australia Employment Change (Dec)

- Malaysia BNM Interest Rate Decision

- Taiwan Unemployment Rate (Dec)

- Hong Kong SAR Inflation (Dec)

Friday 23 Jan

Australia S&P Global Flash PMI, Manufacturing & Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Americas

- Canada Retail Sales (Dec, prelim)

- US UoM Sentiment (Jan, final)

EMEA

- UK Retail Sales (Dec)

APAC

- South Korea Consumer Confidence (Jan)

- New Zealand Inflation (Q4)

- Japan Inflation (Dec)

- Japan BoJ Interest Rate Decision

- Thailand Trade (Dec)

- Singapore Inflation (Dec)

- Taiwan Industrial Production (Dec)

*Access press releases of indices produced by S&P Global and relevant sponsors here.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-january-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-january-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+January+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-january-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 January 2026 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-january-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+January+2026+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-19-january-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}