Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 12, 2026

Global PMI ends 2025 at six-month low amid subdued business confidence

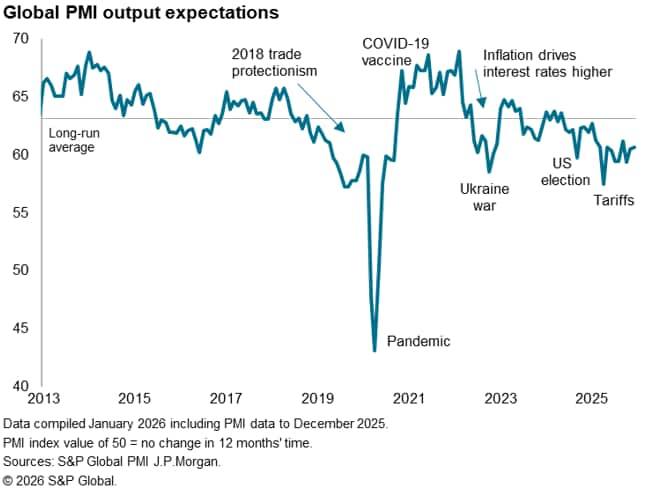

Global PMI surveys signalled a sustained upturn of worldwide business activity at the end of 2025, but December's growth was the weakest for six months. Business expectations relating to future output meanwhile remained low by historical standards, reflecting elevated levels of economic and political uncertainty and dampening business spending.

While the US continued to lead the major developed economies, and India led the major emerging markets, their leads narrowed as growth rates slowed in both cases.

Global PMI at six-month low

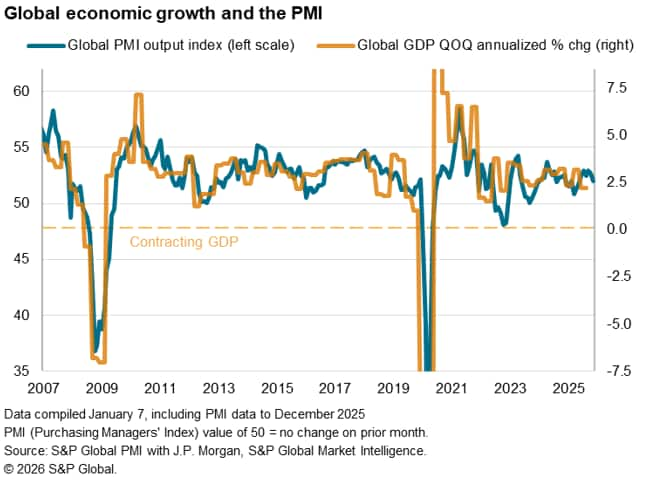

A further expansion of the global economy was indicated by S&P Global Market Intelligence's PMI surveys in December, albeit with the rate of growth slowing to the weakest since June.

The J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, fell for a second successive month, dropping from 52.7 in November to 52.0.

Historical comparisons indicate that the latest PMI is broadly consistent with global GDP growing at an annualized rate of 2.4% in December, with a 2.8% expansion signalled for the fourth quarter as a whole. This compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic.

The survey data therefore suggest that global economic growth has been resilient over the closing months of 2025, recovering from the near one-and-a-half-year low seen back in April, when activity slowed in response to US tariff uncertainty, but has since dropped below its long-term trend rate.

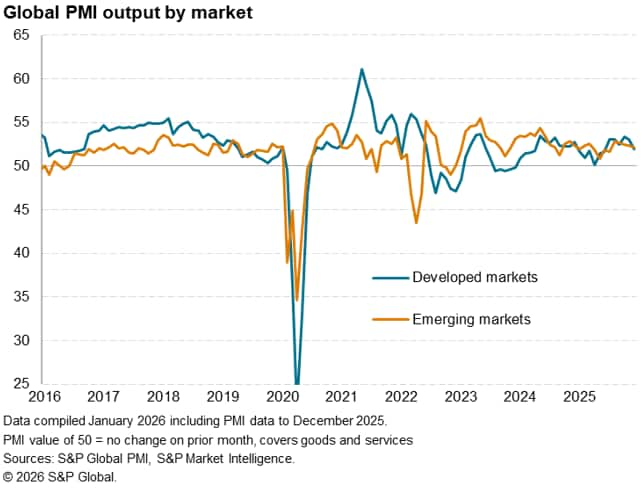

Output continued to rise across both the developed and emerging markets, albeit slowing in both cases for a second successive month.

US lead over developed world narrows amid broad-based slowdown

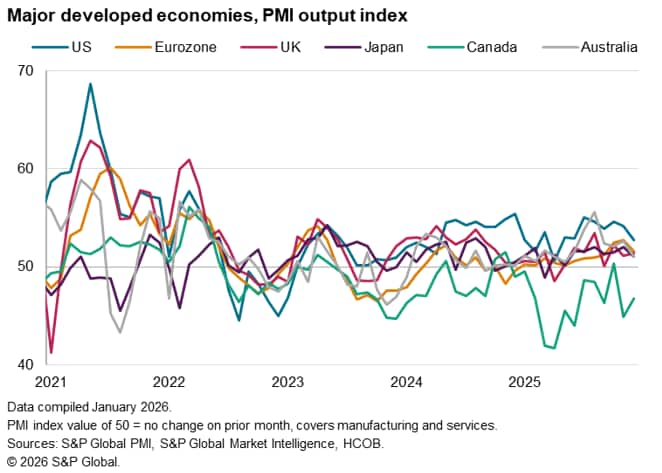

Growth across the developed economies as a whole slowed at the end of 2025 to the weakest since last June. While the US continued to report the fastest growth of the major developed markets, as has been the case throughout much of the past two years, its growth was the slowest recorded since April, reflecting slowdowns in both manufacturing and services. This narrowed the US's outperformance against the developed world average to the lowest since April.

Only modest growth at best was recorded among the other major developed economies, though Canada reported a contraction, with output now having fallen in 12 of the past 13 months. Reduced output was recorded across both Canadian manufacturing and services in December.

Growth meanwhile slowed to seven-month lows in both Japan and Australia, reflecting weakened service sector expansions and near-stalled manufacturing economies.

Eurozone growth also slipped down to a three-month low, as a slowdown in services was joined by the first fall in manufacturing output for ten months. The overall expansion was nonetheless still one of the best seen in the euro area over the past two-and-a-half years, with especially solid growth reported in Spain.

The UK was consequently the only major developed economy to report faster growth, but the improvement was only marginal to hence signal still-sluggish growth, in line with that seen in the eurozone, Japan and Australia.

Indian slowdown drags emerging market growth to lowest since July

Growth across the emerging markets edged lower for a fourth successive month in December, slipping to the lowest since July (yet remaining in line with the average for the year).

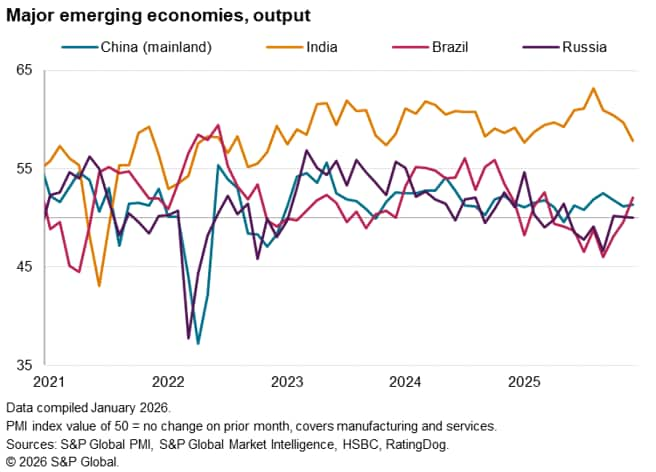

While India again led the four 'BRIC' economies in terms of growth, its rate of expansion was the slowest since last January. Manufacturing output rose at the slowest rate for over three years while services activity growth slipped to an 11-month low.

In contrast, growth revived in Brazil, where output rose for the first time since March, having been hit in prior months due principally to US policy worries. The upturn was driven by the largest expansion of service sector activity since October 2024, but the manufacturing downturn deepened amid a further fall in exports.

Mainland China's upturn extended into its thirty-sixth successive month barring only the one-month decline in output seen in May 2025 in the immediate aftermath of US tariff announcements. However, growth was again only modest, reflecting a near-stalled manufacturing sector and relatively sluggish services growth.

Business activity growth in Russia meanwhile stalled, having risen marginally in the prior two months. The marginal growth seen over the fourth quarter as a whole nevertheless represented an improvement on the declines seen in the second and third quarters.

Global business growth expectations end 2025 firmly in the doldrums

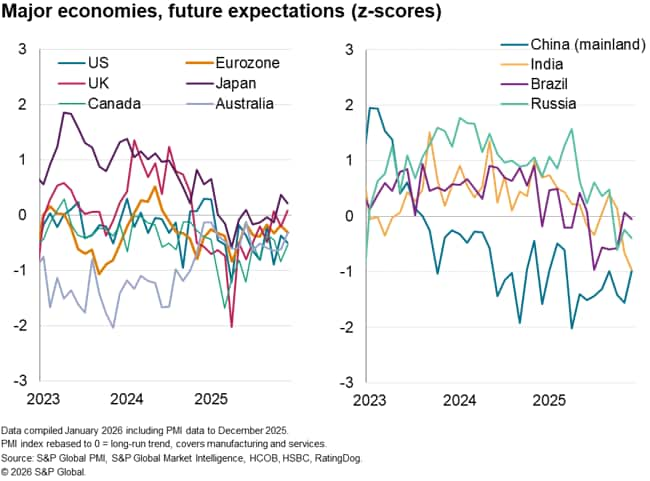

Business expectations about output in the year ahead ticked higher globally in December, up from lows seen during 2025 but well below the average seen in 2024 and even lower than seen during 2023.

A key theme among survey responses is heightened geopolitical uncertainty, with a focus on US trade policy changes, albeit by no means restricted to manufacturing. Similarly muted levels of sentiment were again recorded across both services and manufacturing globally in December, running below long-run averages in both cases.

Output expectations remained especially low relative to the survey long-run average in mainland China, despite picking up in December, and also fell further below their long-run averages in India and Russia, while slipping back to the long-run mean in Brazil.

In the major developed markets, the highest degree of positive sentiment continued to be seen in Japan, though UK survey respondents also registered growing optimism. However, confidence fell further below long-run averages in both the eurozone and the US, the latter remaining especially weak.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-ends-2025-at-sixmonth-low-amid-subdued-business-confidence-jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-ends-2025-at-sixmonth-low-amid-subdued-business-confidence-jan26.html&text=Global+PMI+ends+2025+at+six-month+low+amid+subdued+business+confidence+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-ends-2025-at-sixmonth-low-amid-subdued-business-confidence-jan26.html","enabled":true},{"name":"email","url":"?subject=Global PMI ends 2025 at six-month low amid subdued business confidence | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-ends-2025-at-sixmonth-low-amid-subdued-business-confidence-jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+ends+2025+at+six-month+low+amid+subdued+business+confidence+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-ends-2025-at-sixmonth-low-amid-subdued-business-confidence-jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}