Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 13, 2026

Global economic upturn subdued at year end by financial services slowdown

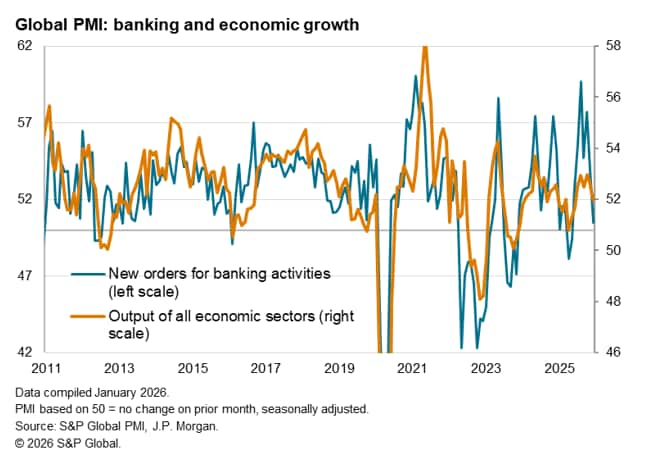

The global economic upturn lost a key ingredient of its recent strength in December, as growth of financial services activity weakened to register one of slowest expansions recorded over the past three years. Demand for banking services has slowed especially sharply, which is often a harbinger of weaker global economic growth.

Growth slows across manufacturing and services

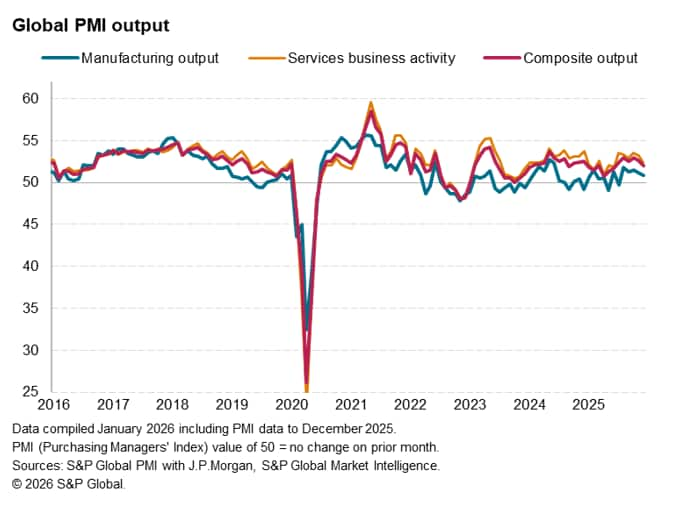

The worldwide PMI surveys produced by S&P Global in association with ISM and IFPSM for J.P.Morgan signalled further growth of business activity in December, but the rate of expansion moderated to the lowest since June. This reflected a slowing of growth across both manufacturing and services.

As has been the case almost continually since the early months of the pandemic (prior to the vaccines), the global expansion continued to be led by the service sector in December. Although the rate of services activity growth cooled to a six-month low, manufacturing output growth also slowed globally, down to its weakest since the brief drop in production recorded back in July.

Financial services and consumer-spending boost fades

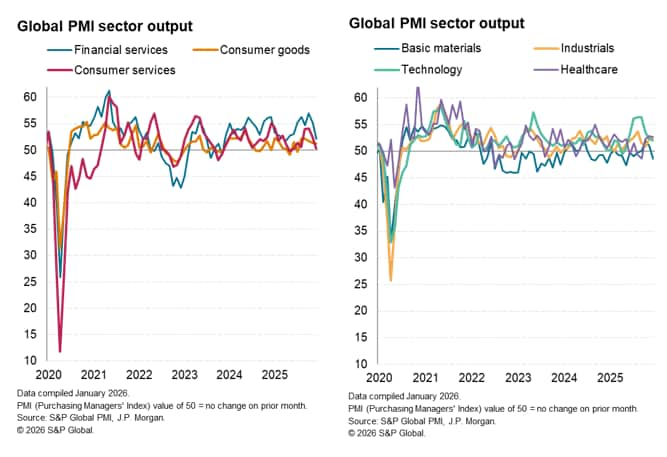

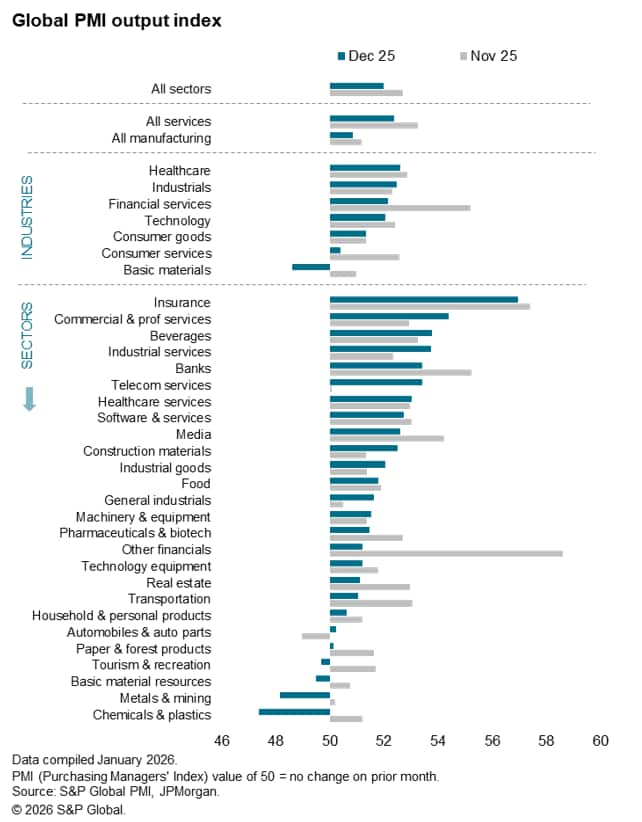

By industry, global growth was broad-based bar basic materials, where output fell after three months of expansion. Chemicals & plastics, metals & mining and basic material resource sectors all reported falling output, with only a very modest increase for paper & forestry products reported.

The only other sub-sector reporting falling output in December was tourism & recreation services, where business activity fell for the first time in six months, albeit dropping only marginally. The decline was nevertheless accompanied by a slowing of growth in the media sector, dragging overall consumer services growth to the weakest since last June. Consumer goods output meanwhile rose only modestly, reflecting a near-stalling of global order book growth for consumer goods.

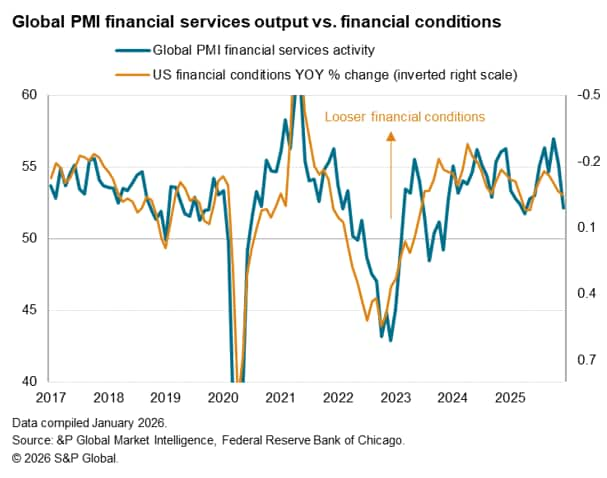

An especially marked slowdown was also recorded in financial services, where growth of activity sank to the lowest since April, registering one of the weakest gains seen over the past three years.

December's marked drop in financial services growth deprives the global economy of one of the key props to growth seen over recent months: financial services reported the strongest growth of all industries in three of the prior four months.

The slowing in financial services activity in part reflects a reduced rate of improvement in underlying financial conditions, as illustrated by measures such as the Federal Reserve Bank of Chicago's Financial Conditions Index.

Near stalled demand for banking services

Growth of new orders for banking services slowed especially sharply in December, rising only marginally to signal the smallest increase since last May. A deteriorating trend for banking services is often an indicator of a broader slowdown in the global economy, hinting that global growth could weaken further in the coming months unless banking activity revives.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-upturn-subdued-at-year-end-by-financial-services-slowdown-Jan26.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-upturn-subdued-at-year-end-by-financial-services-slowdown-Jan26.html&text=Global+economic+upturn+subdued+at+year+end+by+financial+services+slowdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-upturn-subdued-at-year-end-by-financial-services-slowdown-Jan26.html","enabled":true},{"name":"email","url":"?subject=Global economic upturn subdued at year end by financial services slowdown | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-upturn-subdued-at-year-end-by-financial-services-slowdown-Jan26.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+upturn+subdued+at+year+end+by+financial+services+slowdown+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-economic-upturn-subdued-at-year-end-by-financial-services-slowdown-Jan26.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}