Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 13, 2026

Employment intentions diverge among eurozone member states

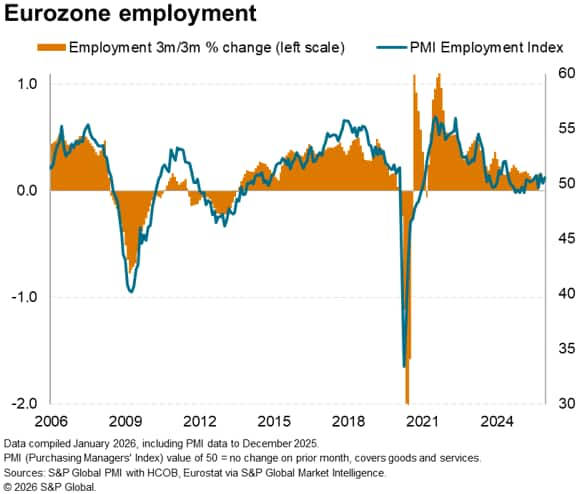

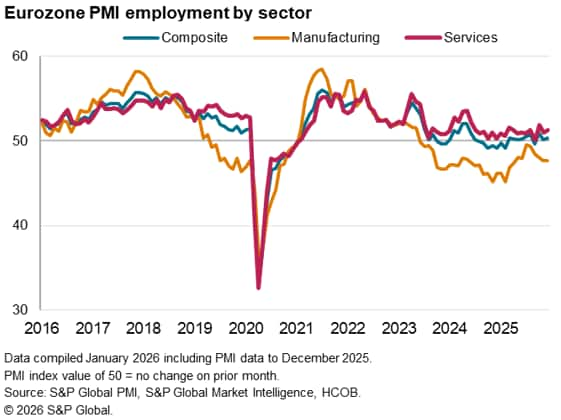

The HCOB Eurozone Composite Employment PMI® Index - a weighted average of the HCOB Manufacturing PMI Employment Index and the HCOB Services PMI Employment Index- showed a slight increase in workforce numbers across the euro area during December. Employment has now risen in nine of the last ten months. That said, despite solid output growth in the final quarter of 2025, job creation has remained relatively sluggish and centred on service firms, with data showing an ongoing downturn in employment at goods producers.

Labour market trends have continued to vary by country within the euro area, according to the latest PMI data, with robust growth in payroll numbers in Spain contrasting with a period of job losses in Germany.

The latest business outlook survey, which was conducted last October and tracks firms' expectations for hiring in the year ahead, suggested a continuing divergence between solid jobs growth in Spain and, to a lesser extent, Italy on the one hand, and more caution towards hiring in Germany and France on the other in 2026. These divergences in part reflected differing views on the impact of Artificial Intelligence (AI).

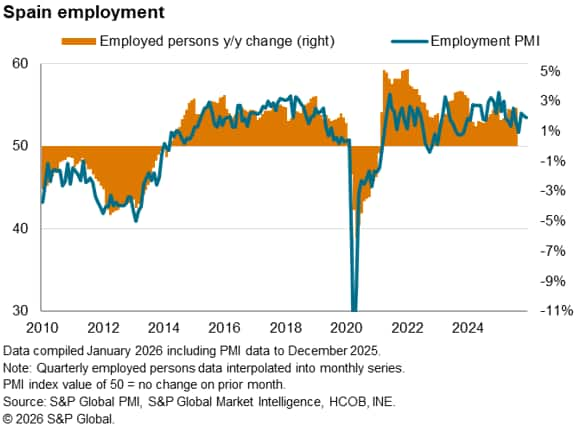

Spain shows strong employment gains

Driving the latest uptick in eurozone employment was another strong round of job creation across Spain. The pace of hiring in December was marked, with the seasonally adjusted index registering well above its long-run average. Employment growth has been recorded in the country in each month since November 2022. The latest increase was again driven solely by the service sector, where rising workloads and positive growth forecasts prompted firms to take on additional staff. In contrast, the downturn in manufacturing employment deepened as factory workforce numbers contracted to the greatest extent for two years.

Elsewhere in southern Europe, Italy saw employment stagnate in December, thereby bringing an end to the previous ten-month sequence of growth. The underlying data indicated a slight uptick in staffing levels within the service sector, but this was offset by a steeper decline in headcounts among manufacturers.

Across 2025 as a whole, Italy's private sector saw modest growth in headcounts on average, with the pace of expansion generally lagging behind that recorded in 2024. Nevertheless, the economy performed positively relative to the eurozone as a whole during 2025, recording stronger average growth in both output and employment.

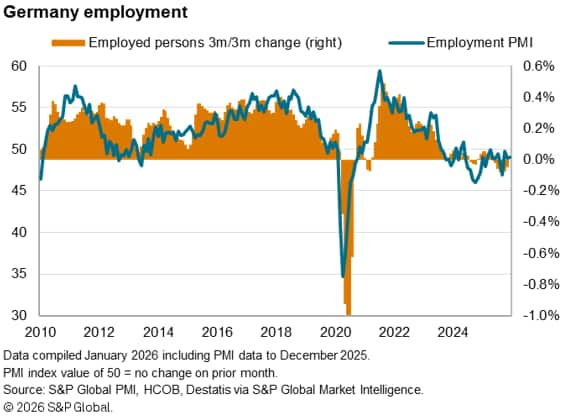

Germany remains a drag on eurozone employment

In Germany, further job losses in the manufacturing sector offset a slight rise in services workforce numbers in the final month of 2025, to leave the HCOB Germany Composite PMI Employment Index below the neutral 50.0 threshold for a nineteenth straight month. Despite a deeper contraction in staffing levels at goods producers, the index ticked up slightly on the month due to a pick-up in service sector job creation.

In France, December saw a renewed rise in private sector employment. Workforce numbers had returned to contraction in November, following a three-month sequence of job creation. However, the latest increase was only fractional as companies continued to report a decline in backlogs of work in December, hinting at reduced capacity requirements to meet demand. Unlike at the eurozone level, job creation across France was centred at manufacturing firms, with employment broadly stable across service providers.

Outlook: two-speed jobs market to continue?

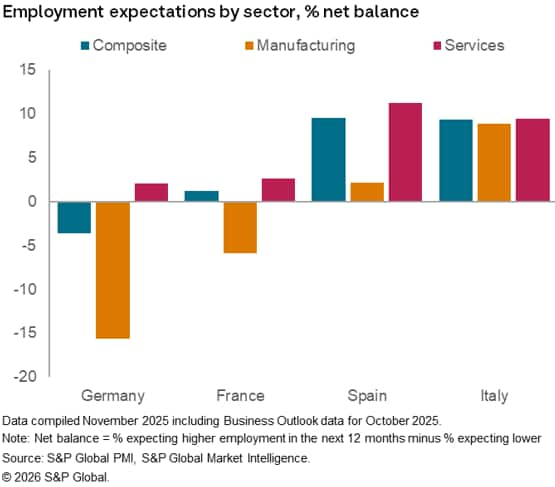

Looking ahead, the latest business outlook survey data collected in October provided insights into firms' expectations for employment in the next 12 months. At +3%, the net balance of companies in the eurozone anticipating a rise in workforce numbers was down from +7% in June and pointed to the continuation of only sluggish workforce growth across the euro area in the near term. The result did, however, mask varying hiring intentions across the countries monitored.

Firms in Germany predicted a slight decrease in workforce numbers in the year ahead (net balance at -4%), while their counterparts in France forecast little change in employment from current levels (+1%).

Companies in Italy and Spain, on the other hand, were more bullish about future hiring. At +9% and +10%, respectively, the net balances for the eurozone's third- and fourth-largest economies were just above their historic trends, albeit down somewhat from the levels seen earlier in the year.

In Germany, the pessimistic employment outlook owed exclusively to the manufacturing sector, where the net balance fell from -1% in June to -16% in October - its lowest level for a year. Alongside threats to the outlook from tariffs and an unsettled geopolitical environment, the goods producers surveyed often remarked on concerns over high costs and competition from abroad.

French manufacturers likewise expected a reduction in payroll numbers in the next 12 months (net balance at -6%), whereas those in Italy and Spain reported plans to increase employment (+9% and +2%, respectively).

The tri-annual business outlook data also indicated that Italian and Spanish companies were in fact more optimistic than their German and French counterparts across several other key indicators, including business activity prospects, profits, capital expenditure, and research and development spending.

New opportunities and efficiency gains via AI

A set of special questions asking about investment in Artificial Intelligence (AI) and its impact on revenues, productivity and employment was added to October's business outlook survey. The results showed generally positive effects on both revenues and productivity, in terms of both realised improvements as a result of past investment and firms' expectations for future improvements in these areas.

The results suggested a broadly neutral impact on employment across the eurozone in the year ahead. Around 15% of survey participants expected to see higher employment at their companies in the next 12 months as a result of AI investment, while roughly the same percentage anticipated an AI-related reduction in employment.

With concerns over competitiveness perhaps providing an added motivation to improve efficiency, German manufacturers were the most likely to predict lower net employment as a result of future AI investment of the businesses surveyed in the eurozone. Their service sector counterparts, by contrast, were optimistic about there being a net positive impact on workforce numbers from AI investment. Sentiment among French private sector firms was broadly neutral, while in both Italy and Spain there was net optimism about investment in AI leading to the creation of more jobs.

Italian companies were the most upbeat about their employment growth expectations as a result of AI investment, the net balance1 coming in at +13%. Slightly behind were Spanish firms, with a net balance of +11%.

The business outlook data point to a two-speed jobs market between Germany and France on one hand and Italy and Spain on the other over the next 12 months. This divergence is driven by differing economic conditions and sentiments; while Italian and Spanish firms display optimism regarding jobs growth, their German and French counterparts remain cautious about hiring. As these regional dynamics unfold, the labour market may continue to reflect contrasting trajectories, shaping the broader economic landscape across the eurozone.

1 Net balance figures were calculated by deducting the percentage of survey respondents reporting lower and slightly lower from the percentage of survey respondents reporting higher and slightly higher.

Access the Eurozone PMI press release here.

Phil Smith | Economics Associate Director | S&P Global Market Intelligence

Tel: +44 149 1461 009

phil.smith@spglobal.com

Maryam Baluch | Economist | S&P Global Market Intelligence

Tel: +44 1344 327 213

maryam.baluch@spglobal.com

© 2026, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-intentions-diverge-among-eurozone-member-states.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-intentions-diverge-among-eurozone-member-states.html&text=Employment+intentions+diverge+among+eurozone+member+states+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-intentions-diverge-among-eurozone-member-states.html","enabled":true},{"name":"email","url":"?subject=Employment intentions diverge among eurozone member states | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-intentions-diverge-among-eurozone-member-states.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Employment+intentions+diverge+among+eurozone+member+states+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-intentions-diverge-among-eurozone-member-states.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}